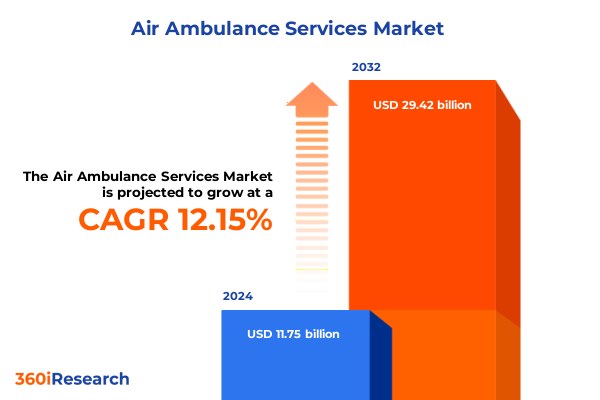

The Air Ambulance Services Market size was estimated at USD 13.12 billion in 2025 and expected to reach USD 14.66 billion in 2026, at a CAGR of 12.22% to reach USD 29.42 billion by 2032.

Illuminating Foundational Trends and Critical Drivers Defining the Modern Air Ambulance Services Landscape Across Emergency, Non-Emergency, and Telemedicine-Enabled Care Pathways

The air ambulance services sector is undergoing a fundamental evolution driven by complex clinical demands, technological advances, and shifting regulatory frameworks. As patient needs become more sophisticated, the imperative for rapid, reliable, and integrated transport solutions has never been greater. In parallel, healthcare systems are placing heightened emphasis on care continuity, cost containment, and outcomes measurement, prompting service providers to refine operational protocols and adopt data-driven decision-making in real time. This introduction sets the stage by examining the critical drivers-from rising incidence of trauma and stroke to demographic shifts toward aging populations-that are propelling demand across emergency, non-emergency, and telemedicine-enabled service types.

Against this backdrop, regulatory bodies and aviation authorities worldwide are redefining safety standards and certification processes to accommodate innovative platforms like drone ambulances and hybrid-electric rotorcraft. Meanwhile, public-private partnerships are emerging as a vital mechanism for extending coverage into rural and underserved regions, ensuring that distance and geography no longer impede lifesaving interventions. By combining insights on policy trajectories, technological adoption curves, and evolving stakeholder expectations, this section frames the overarching context for the deep-dive analysis that follows.

Uncovering Disruptive Technological and Operational Transformations that Are Redefining Service Delivery, Ownership Models, and Patient Experiences in Air Ambulance Operations

As the air ambulance sector matures, transformative shifts in service delivery models and operational strategies are redefining competitive dynamics. Digital health integration, for instance, has accelerated telemedicine-enabled deployments, allowing onboard clinicians to collaborate with remote specialists, improve triage accuracy, and optimize in-flight interventions. Concurrently, unmanned aerial vehicle testbeds in select regions are pioneering drone ambulance use cases for critical organ transport and rapid diagnostics in areas cut off by terrain or infrastructure limitations. These developments are complemented by data-driven scheduling systems that leverage artificial intelligence to reduce response times and enhance fleet utilization across both fixed-wing and rotor-wing platforms.

Operationally, ownership paradigms are diversifying with the rise of public-private partnerships that blend governmental oversight with private-sector agility, thereby extending service reach without compromising financial sustainability. In addition, strategic alliances between air ambulance operators and regional healthcare networks are fostering seamless patient handoffs, accelerating discharge-to-transfer timelines, and delivering integrated continuum-of-care solutions. Taken together, these disruptive technological and operational innovations are not only reshaping how services are delivered but also challenging traditional revenue models and necessitating agile governance structures.

Assessing the Comprehensive Ramifications of 2025 United States Tariff Implications on Supply Chain Costs, Asset Procurement, and Service Accessibility in Air Ambulance Operations

In 2025, a new wave of United States tariffs targeting imported aircraft components-ranging from specialized rotor blades to critical avionics modules and propulsion systems-has introduced notable headwinds for service providers. These trade measures have amplified procurement costs for established operators, reshaping supply chain strategies and prompting a reevaluation of inventory management practices to buffer against price fluctuations. At the same time, OEMs and maintenance, repair, and overhaul providers are realigning production schedules and exploring alternative sourcing partnerships, both domestically and within USMCA member states, to mitigate tariff-related cost pressures.

Beyond direct cost impacts, these tariff interventions exert a compound effect by influencing asset acquisition timelines, lease financing structures, and residual valuations for both fixed-wing and rotor-wing fleets. With capital expenditure budgets tightening, operators are increasingly motivated to embrace platform-agnostic maintenance agreements and assess hybrid procurement models that balance outright purchases with time-based leases. By tracing the cumulative impact of these policy shifts through operational budgets, partnership contracts, and end-user pricing structures, leaders can recalibrate their risk frameworks and identify opportunities to advocate for regulatory recalibrations that support sustainable growth.

Deriving Strategic Insights by Analyzing Market Segmentation through Service Types, Ownership Structures, Platform Technologies, Payment Models, Case Scenarios, End Uses, and Flight Ranges

Analyzing market segmentation reveals nuanced opportunities and risk profiles across service type categories. Emergency operations remain the backbone of the sector, driven by high-acuity trauma responses and time-critical stroke interventions, while non-emergency transports are gaining traction by offering cost-effective interfacility transfers. The telemedicine-enabled segment, although nascent, is rapidly integrating remote diagnostic and decision-support systems to augment critical care en route.

Ownership structure insights highlight that government-operated fleets ensure standardized protocols and broad coverage, yet private entities exhibit greater agility in adopting cutting-edge platforms. Public-private partnership models are emerging as a bridge, combining public sector reach with private sector efficiency to deliver balanced service networks. Platform type analysis indicates that rotor-wing assets dominate urban and suburban corridors, whereas fixed-wing aircraft provide extended-range capabilities essential for cross-border medical evacuations. Meanwhile, drone ambulance initiatives are progressing from pilot studies toward regulatory approval.

Payment mode segmentation underscores that government programs and insurance reimbursements underpin the majority of service revenues, yet out-of-pocket and subscription-based offerings are lowering barriers for elective transfers and membership-driven response guarantees. Case type dissection shows that medical evacuation drives baseline utilization, organ transport mandates stringent regulatory oversight, patient transfer volumes swell with hospital networks optimizing bed capacity, and pediatric transport commands specialized clinical protocols. End-use evaluation reveals corporate entities contracting bespoke services to safeguard C-suite mobility, hospitals integrating bespoke air medical programs, individuals seeking on-demand critical transport solutions, and insurance companies collaborating on bundled care packages. Flight range stratification illustrates that short-haul missions cover dense urban markets, medium-haul flights connect regional medical hubs, long-haul services cater to cross-state emergencies, and ultra long-haul operations serve remote and offshore installations.

This comprehensive research report categorizes the Air Ambulance Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Ownership

- Platform Type

- Payment Mode

- Case Type

- End Use

Contrasting Regional Dynamics and Growth Drivers Shaping Air Ambulance Service Demand Across the Americas, EMEA, and Asia-Pacific Markets with Operational Nuances

Regional dynamics in the Americas display a mature United States market characterized by sophisticated clinical protocols, integrated dispatch systems, and expansive private-sector coverage. Canada’s government-subsidized frameworks ensure nationwide access, while Latin American operators contend with infrastructure limitations and variable regulatory consistency, driving cross-border partnerships and mobile health collaborations.

Within Europe, stringent safety regulations and well-established HEMS (Helicopter Emergency Medical Services) networks underpin high service reliability, whereas Middle Eastern nations are investing heavily in luxury medevac solutions as part of broader healthcare tourism strategies. African markets remain underdeveloped but are attracting pilot programs focused on drone-based point-of-care deliveries and philanthropic PPP initiatives to overcome geographic barriers.

Asia-Pacific emerges as the fastest-growing region, propelled by expanding healthcare budgets in China, India, and Southeast Asia. Japan and Australia demonstrate high platform standardization and interoperability, while emerging markets in the region are catalyzing innovation through domestic manufacturing of fixed-wing and rotor-wing assets, complemented by academic research partnerships exploring hybrid-electric and unmanned solutions.

This comprehensive research report examines key regions that drive the evolution of the Air Ambulance Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Examining Their Strategic Initiatives, Partnerships, and Innovation Trajectories within the Air Ambulance Services Sector

Leading global operators have adopted differentiated strategies to maintain competitive advantage. Air Methods continues to expand its network by forging partnerships with major trauma centers and investing in real-time data analytics for flight optimization. PHI Group differentiates through fixed-wing expertise, leveraging contract agreements with rural hospitals to extend service reach. Babcock International retains European leadership by securing long-term government HEMS contracts while piloting drone ambulance use cases for time-critical diagnostics.

Emerging players such as REVA Inc are capitalizing on Asia-Pacific demand by offering modular telemedicine-enabled pods compatible with existing platforms, thereby reducing capital barriers. Metro Aviation has differentiated through a focus on avionics integration and maintenance services, establishing itself as a preferred MRO partner for both rotor-wing and fixed-wing operators. Collaborative ventures between established insurers and specialized service providers are also proliferating, enabling bundled medical transport offerings that streamline reimbursement processes and improve patient satisfaction.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Ambulance Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acadian Companies

- Air Methods Corporation

- Angel MedFlight Worldwide Air Ambulance Services

- Avincis Aviation Group

- Capital Air Ambulance

- DRF Luftrettung

- European Air Ambulance

- FAI Aviation Group

- Global Medical Response, Inc.

- Gulf Helicopters

- Life Flight Network

- Ornge

- PHI, Inc.

- REVA, Inc.

- Royal Flying Doctor Service

Formulating Pragmatic Strategic Recommendations Enabling Industry Leaders to Capitalize on Emerging Opportunities, Mitigate Risks, and Drive Sustainable Growth in Air Ambulance Services

To thrive amid intensifying competition and policy headwinds, industry leaders must prioritize strategic investments in telemedicine integration and advanced avionics, positioning their fleets for future regulatory requirements while enhancing clinical outcomes. Cultivating diversified supply chain partnerships-with an emphasis on USMCA sourcing and domestic manufacturing-will prove critical for mitigating tariff disruptions and stabilizing procurement costs. Further, exploring pilot programs for drone ambulances in remote and high-density environments can unlock new revenue streams with minimal capital exposure.

Operators should also formalize public-private partnership frameworks to secure government funding, expand geographic coverage, and harmonize protocols across jurisdictions. Standardizing training programs and interoperable communication platforms will drive operational consistency and patient safety. Data analytics must underpin decision-making, from predictive maintenance scheduling to dynamic dispatch algorithms. Finally, establishing alliances with insurance carriers for subscription-based membership models can fortify revenue diversification and foster direct-to-consumer engagement.

Elucidating the Rigorous Multi-Source Research Methodology, Data Validation Protocols, and Analytical Frameworks Underpinning this Comprehensive Air Ambulance Services Study

This study employs a rigorous mixed-methods research design encompassing primary interviews, secondary data analysis, and advanced quantitative modeling to ensure the highest standards of validity and reliability. Primary research involved structured interviews with senior executives at air ambulance operators, regulatory officials at aviation authorities, and clinical directors in major trauma centers to capture firsthand perspectives on operational challenges and market priorities. Complementing this, a detailed survey of fleet managers and procurement specialists provided granular insights into asset management practices and tariff mitigation strategies.

Secondary research leveraged published regulatory guidelines from the Federal Aviation Administration and European Union Aviation Safety Agency, financial statements from public operators, and specialized industry journals. Proprietary databases and trade association reports furnished historical trends, while triangulation methods cross-validated findings. Statistical analysis applied regression models to evaluate the interplay between tariff measures and procurement cycles. Finally, expert validation workshops ensured that synthesized conclusions accurately reflected stakeholder realities and provided actionable strategic intelligence for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Ambulance Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Ambulance Services Market, by Service Type

- Air Ambulance Services Market, by Ownership

- Air Ambulance Services Market, by Platform Type

- Air Ambulance Services Market, by Payment Mode

- Air Ambulance Services Market, by Case Type

- Air Ambulance Services Market, by End Use

- Air Ambulance Services Market, by Region

- Air Ambulance Services Market, by Group

- Air Ambulance Services Market, by Country

- United States Air Ambulance Services Market

- China Air Ambulance Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Highlighting Strategic Imperatives to Navigate Future Challenges and Harness Opportunities within the Evolving Air Ambulance Services Domain

This assessment synthesizes foundational market drivers, disruptive technological trends, and policy-induced cost pressures to deliver a cohesive narrative of the air ambulance services landscape. By examining segmentation intricacies-from telemedicine-enabled care scenarios to subscription-based payment mechanics-and juxtaposing regional nuances across the Americas, EMEA, and Asia-Pacific, this analysis underscores the imperative for agile, data-informed strategies. The examination of leading operators highlights that differentiation hinges on fleet modernization, strategic alliances, and integrated clinical protocols.

Ultimately, the cumulative insights emphasize that stakeholders must navigate tariff landscapes with proactive supply chain planning, leverage public-private partnerships to broaden service accessibility, and accelerate investments in digital health platforms to optimize patient outcomes. As the sector continues to evolve, success will favor those who marry clinical excellence with operational innovation, ensuring that air ambulance services remain at the forefront of rapid response care.

Driving Strategic Decision-Making and Market Intelligence Acquisition Through Personalized Engagement with Ketan Rohom for the Definitive Air Ambulance Services Market Research Report

For organizations seeking to transform strategic planning, operational resilience, and market positioning in the fast-evolving air ambulance services sector, acquiring the full market research report is the definitive next step. Engage directly with Ketan Rohom to explore how this in-depth analysis can tailor insights to your unique objectives, clarify complex tariff implications, and uncover high-impact opportunities across emerging technologies and service models. Leverage personalized consultations to align your investment priorities, validate theory of change scenarios, and harness actionable intelligence spanning regulatory environments, segmentation strategies, and competitive landscapes. Elevate your decision-making by tapping into a comprehensive repository of validated data, stakeholder perspectives, and scenario-based forecasts designed to drive sustainable growth. Reach out to Ketan to schedule an exclusive walk-through of the report’s proprietary findings and ensure your organization is equipped to lead with confidence in a market defined by rapid innovation, shifting ownership structures, and dynamic payment frameworks.

- How big is the Air Ambulance Services Market?

- What is the Air Ambulance Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?