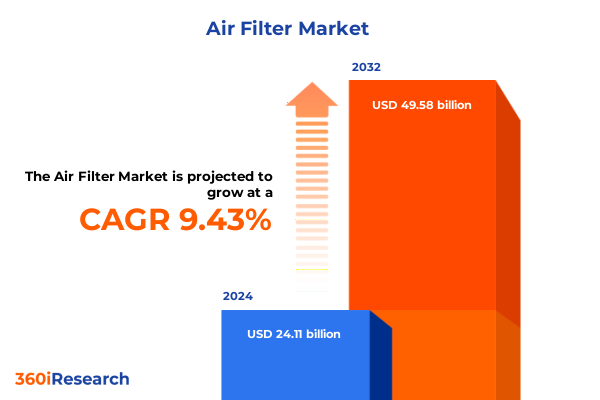

The Air Filter Market size was estimated at USD 26.06 billion in 2025 and expected to reach USD 28.17 billion in 2026, at a CAGR of 9.62% to reach USD 49.58 billion by 2032.

Unlocking the Air Filter Market’s Core Drivers and Mechanisms Defining Industry Evolution and Growth Opportunities for Stakeholders Worldwide

Air quality has emerged as a pivotal determinant of public health and industrial resilience, driven by the escalating burden of respiratory and cardiovascular diseases linked to airborne pollutants. New evidence underscores that fine particulate matter, NO₂, and soot substantially elevate health risks, contributing to an estimated 8.1 million annual deaths worldwide and marking air pollution as the second leading risk factor for mortality globally of 2021, including a disproportionate impact on children under five. Moreover, recent research correlates each 10-microgram increase in PM2.5 with a 17% rise in dementia risk, highlighting the urgent necessity for more effective filtration solutions to safeguard human health and cognitive function.

Concurrently, industrial and environmental regulations are tightening across major markets, propelling organizations to integrate advanced filtration systems to comply with emission targets and enhance operational efficiency. Driven by urbanization and the proliferation of smart infrastructure, demand for filtration technologies extends beyond traditional HVAC applications to encompass critical settings such as healthcare facilities, laboratories, automotive manufacturing, and residential air purification. The convergence of health imperatives, regulatory mandates, and sustainability objectives is catalyzing a new era of innovation in filtration materials, design architectures, and performance mechanisms geared toward capturing nanoscale contaminants while minimizing energy consumption.

Transformational Forces Reshaping the Air Filter Industry Through Technological Advancements Regulatory Changes and Consumer Expectations

The air filtration sector is undergoing a profound transformation fueled by technological breakthroughs in sensor integration, data analytics, and material science. Artificial intelligence and machine learning algorithms now leverage real-time data from embedded IoT sensors to anticipate maintenance needs before performance degradation occurs, marking a shift from reactive to predictive maintenance in critical filtration systems. Edge computing capabilities further streamline this process, enabling localized data processing and rapid anomaly detection that reduce downtime and optimize lifecycle management of high-efficiency particulate filters.

Simultaneously, innovations in filter media materials-ranging from electrostatic fabrics and activated carbon composites to nanofiber-enhanced pleated papers-are elevating capture efficiencies and extending service intervals. These advancements enable more compact modular designs that integrate UV and ionization modules, offering multi-mechanism contaminant neutralization in a single unit. Additionally, sustainable manufacturing practices, such as recyclable pleated paper and biodegradable foam cores, are gaining traction as manufacturers align product portfolios with circular economy principles. As a result, the industry is witnessing an unprecedented amalgamation of digital and material innovations, redefining performance benchmarks and unlocking new value propositions for end users seeking cleaner air and operational sustainability.

Evaluating the Layered Consequences of 2025 U.S. Tariffs on Air Filter Production Supply Chains and Market Viability in North America

Beginning in early 2025, the United States implemented sweeping tariff measures that have introduced layered cost pressures and supply chain complexities for air filter manufacturers. Steel and aluminum inputs, foundational to filter frames and housings, have been subjected to 50% tariffs, while a universal 10% reciprocal levy has been applied to all imported components, including specialized membranes from Asia-Pacific sources. Collectively, these duties have contributed to a 2.3% short-term increase in input costs for consumer and capital goods, squeezing margins across both OEM and aftermarket channels and prompting manufacturers to reassess sourcing strategies.

In response, key industry players have accelerated regional diversification of production, with partial relocation of membrane and metal sheet fabrication to Mexico and Southeast Asia to mitigate tariff exposure. This realignment has been accompanied by a strategic push toward domestic fabrication for critical components, supported by federal incentives under recent infrastructure legislation. While these measures buffer some cost escalations, companies report ongoing volatility in freight costs and customs clearance, intensifying the premium on supply chain resilience. Consequently, navigating the cumulative impact of 2025 U.S. tariff policies has become a central strategic imperative for sustaining competitiveness in the North American air filtration market.

Dissecting Core Market Segments by Technology Material Distribution Channels and Application Profiles to Illuminate Strategic Growth Levers

The air filter market landscape is delineated through a multifaceted segmentation framework that illuminates diverse demand pockets and performance requirements. By product type, the industry spans from activated carbon air filters to UV air filters, encompassing cabin, engine, HEPA, HVAC, ULPA, exhaust, diesel particulate, baghouse, air compressor, ionizer, and other specialized variants, each optimized for unique applications and contaminant profiles. An additional dimension emerges from the distinction between pleated and non-pleated air filters, which affects both aerodynamic resistance and particulate capture efficiency.

Material composition further differentiates offerings, with activated carbon/charcoal, electrostatic fabric, fiberglass, foam, metal mesh, pleated paper/cotton, and polyester serving as primary media substrates. Filtration mechanisms such as diffusion, electrostatic attraction, interception, inertial impaction, and straining underpin performance across these media, influencing particle retention rates and service life. Distribution models bifurcate into offline retailers-spanning specialty stores and supermarket chains-and online channels via branded websites and third-party eCommerce platforms, reflecting shifting procurement preferences. Market participants also segment by user type, with OEMs and aftermarket suppliers tailoring portfolios to installers and end users. Finally, end-use contexts range from residential and commercial environments, including healthcare facilities, hospitality, laboratories, offices, retail shops, and educational institutions, to industrial sectors such as automotive, construction, food & beverage, and manufacturing.

This comprehensive research report categorizes the Air Filter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Filter Media Type

- Material

- Filtration Mechanism

- Distribution Channel

- User Type

- End-use

Contrasting Regional Air Filtration Market Dynamics Across the Americas Europe Middle East Africa and Asia-Pacific to Guide Targeted Strategies

Regionally, the Americas market is characterized by mature automotive and HVAC applications, underpinned by stringent EPA standards and growing demand for electric vehicle cabin filtration systems. In the United States, manufacturer investments in domestic capacity and compliance-driven upgrades have fostered stability, even as tariff-induced cost pressures persist. Latin American markets, notably Brazil and Mexico, are experiencing accelerated adoption of pleated paper and activated carbon filters in both industrial and residential contexts, guided by improving air quality regulations and urbanization trends.

Within Europe, Middle East, and Africa, the emphasis on sustainability and circular economy models drives uptake of recyclable filter media and end-of-life management programs. The European Union’s upcoming EcoDesign regulations are spurring suppliers to innovate low-energy-loss filter units, while Gulf Cooperation Council nations are investing in HVAC filtration for critical infrastructure. In Africa, nascent urban air quality standards are catalyzing demand for cost-effective non-pleated filters in residential and small commercial segments.

Asia-Pacific remains the fastest-growing region, led by China and India where accelerated industrialization and heightened air pollution concerns have created robust markets for HEPA, activated carbon, and UV-based solutions. Government-sponsored retrofit initiatives in high-pollution cities and the expansion of semiconductor manufacturing hubs in Southeast Asia are significantly elevating requirements for ULPA and molecular contamination control filter applications.

This comprehensive research report examines key regions that drive the evolution of the Air Filter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Air Filter Manufacturers’ Competitive Strategies Innovations and Market Positioning Across Global Filtration Segments

Within the competitive arena, a handful of global players exert substantial influence through integrated portfolios and expansive service networks. Camfil, headquartered in Sweden, leads with a diversified suite spanning air pollution control, molecular contamination, and power systems, supported by R&D centers across the Americas, Europe, and Asia-Pacific, and annual sales surpassing $1 billion. German-based MANN+HUMMEL has emerged as a powerhouse in both liquid and air filter systems, leveraging acquisitions such as Purolator and Clarcor to deepen its presence in OEM cabin and engine air filters, with a workforce exceeding 21,000 employees globally.

In the United States, Donaldson Company sustains leadership in engine and industrial filtration through innovation in RadialSeal and AxialSeal technologies that deliver high-efficiency particulate removal and vibration resistance across heavy-duty applications. Parker-Hannifin, although renowned for motion control, is a major contender in the filtration segment, offering hydraulic, pneumatic, and HVAC filters within its diversified industrial solutions portfolio and exceeding $29 billion in total assets. Finally, 3M’s filtration division capitalizes on its material science expertise to supply cleanroom, industrial, and residential air filters, employing advanced electrostatic media and nanofiber designs to optimize performance across variable contamination environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Filter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- A.L. Group

- Ahlstrom-Munksjö Oyj

- Air Filter Industries Pvt Ltd.

- Alen Corporation

- Blueair Inc. by Unilever PLC

- Camfil AB

- Compagnie de Saint-Gobain S.A.

- Coway Co., Ltd.

- Cummins Inc.

- Daikin Industries, Ltd.

- Denso Corporation

- Donaldson Company Inc.

- Duraflow Industries Inc.

- Dyson Technology Ltd.

- ElectroMaze Air Filters

- Elofic Industries Limited

- Filtration Group Corporation

- First Brands Group, LLC

- Freudenberg Filtration Technologies GmbH & Co. KG

- General Motors Company

- Graver Technologies LLC

- Hengst SE

- Hollingsworth & Vose Co. Inc.

- Honeywell International Inc.

- K&N Engineering Inc.

- Koninklijke Philips N.V.

- Lydall Inc.

- MANN+HUMMEL International GmbH & Co. KG

- Molekule Group, Inc.

- Parker-Hannifin Corporation

- Pliotron Company of America, LLC

- Rensa Filtration

- Robert Bosch GmbH

- Samsung Electronics

- Sharp Corporation

- United Filter Industries Pvt. Ltd.

- Whirlpool Corporation

Strategic Imperatives for Air Filter Industry Leaders to Enhance Innovation Diversify Supply Chains and Capitalize on Emerging Market Opportunities

To navigate the evolving market landscape, industry leaders should adopt a multipronged strategy that emphasizes supply chain resilience, technology integration, and sustainability. First, establishing dual-sourcing partnerships in North America and Southeast Asia can mitigate tariff volatility and ensure continuity of critical membrane and metal components. Concurrently, investing in onshore fabrication of frames and housings reduces exposure to escalating tariffs while aligning with domestic content incentives under infrastructure funding programs.

Second, integrating smart sensor networks and AI-driven analytics into filter management platforms enhances predictive maintenance capabilities, enabling real-time performance monitoring and automated replacement alerts to maximize uptime and reduce lifecycle costs. Third, advancing sustainable product portfolios through recyclable or bio-based media, and disclosing lifecycle environmental impacts, positions manufacturers to meet increasingly stringent EcoDesign regulations and corporate ESG commitments. Finally, engaging in strategic alliances with HVAC OEMs, building management system vendors, and digital service providers can unlock new revenue streams through performance-based service contracts and data-driven air quality solutions.

Transparent Explanation of Research Approach Data Sources and Analytical Frameworks Employed to Deliver Rigorous Air Filter Market Insights

This report synthesizes quantitative and qualitative insights through a structured research methodology combining extensive secondary and primary data collection. Secondary research encompassed industry publications, regulatory filings, and academic studies to establish the macroenvironmental context and tariff frameworks. Publicly available company reports, patent databases, and whitepapers informed the competitive landscape and technology trends.

Primary research consisted of in-depth interviews with key stakeholders across the value chain, including OEM product managers, distribution executives, and end-use facility operators, ensuring validation of data points and market behaviors. A bottom-up approach was employed to triangulate input costs, capacity utilizations, and regional consumption patterns, supplemented by proprietary modeling to assess the impact of 2025 tariff scenarios on supply chain configurations.

Data integrity was maintained through cross-verification of multiple sources and iterative feedback loops with industry participants. The segmentation framework was defined by product type, filter media, material composition, filtration mechanism, distribution channel, user type, and end-use, enabling granular analysis of demand drivers. Regional analysis was conducted to reflect localized regulatory landscapes, infrastructure developments, and demographic trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Filter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Filter Market, by Type

- Air Filter Market, by Filter Media Type

- Air Filter Market, by Material

- Air Filter Market, by Filtration Mechanism

- Air Filter Market, by Distribution Channel

- Air Filter Market, by User Type

- Air Filter Market, by End-use

- Air Filter Market, by Region

- Air Filter Market, by Group

- Air Filter Market, by Country

- United States Air Filter Market

- China Air Filter Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesis of Critical Insights and Strategic Implications to Empower Decision Makers in Navigating the Evolving Air Filtration Market Landscape

The convergence of heightened health awareness, stringent environmental regulations, and rapid technological innovation is redefining the global air filter market. As the cumulative effects of U.S. tariff policies reshape supply chains, and advancements in digital and material sciences unlock new performance thresholds, manufacturers and stakeholders must adapt strategy to thrive. Segmentation analysis underscores the imperative to align product portfolios with application-specific requirements, while regional insights guide targeted investments and market entry approaches.

Key players that combine sustainable media innovations with digital service offerings are best positioned to capitalize on the growing demand for smart filtration solutions. Industry leaders who proactively diversify sourcing, optimize predictive maintenance capabilities, and commit to circular economy principles will secure long-term resilience in an increasingly competitive landscape. The synthesis of these findings affirms that strategic agility and technology-driven differentiation are instrumental for success in the evolving air filtration ecosystem.

Engage with Ketan Rohom to Unlock Exclusive Access to Comprehensive Air Filter Market Research Insights and Strategic Data

For tailored insights and to secure exclusive access to the full air filter market research report, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through the diverse findings, strategic analyses, and detailed data sets essential for informed decision-making and competitive advantage in the evolving air filtration landscape. Engage today to translate these comprehensive market perspectives into actionable business outcomes.

- How big is the Air Filter Market?

- What is the Air Filter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?