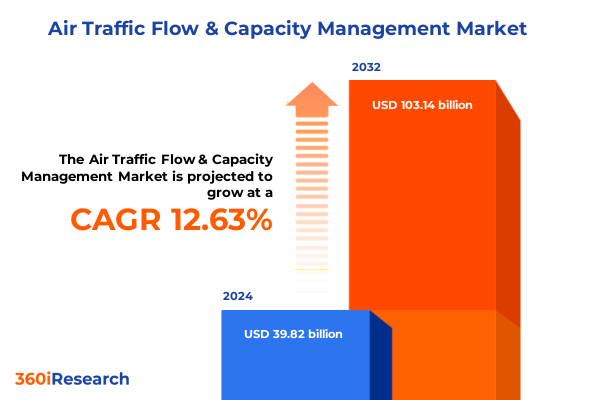

The Air Traffic Flow & Capacity Management Market size was estimated at USD 44.91 billion in 2025 and expected to reach USD 50.16 billion in 2026, at a CAGR of 12.60% to reach USD 103.14 billion by 2032.

Understanding the Strategic Imperative and Core Principles Underpinning Next-Generation Air Traffic Flow and Capacity Management

The airspace is a dynamic ecosystem where demand surges, evolving aircraft technologies, and ever-stringent safety regulations converge to shape the imperative for robust flow and capacity management. As global passenger volumes rebound and cargo operations intensify, regulatory bodies and service providers face mounting pressure to orchestrate seamless traffic flow across congested air corridors. Amid these complexities, a holistic understanding of air traffic flow and capacity management emerges as a critical enabler for operational resilience and strategic planning.

Against this backdrop, it becomes essential to frame the core tenets of capacity optimization, demand balancing, and stakeholder collaboration. Capacity management transcends runway throughput or sector allocation; it integrates predictive forecasting, real-time data exchange, and advanced decision support tools to preempt disruptions. By contextualizing these dimensions within an overarching aviation ecosystem, this introduction sets the stage for examining how transformative innovations and policy shifts are redefining the way airspace is governed and leveraged.

Exploring the Convergence of Digital Innovation and Sustainability Imperatives That Are Reshaping Airspace Traffic Orchestration

Over recent years, the air traffic management landscape has undergone a paradigm shift driven by rapid digitization and the emergence of artificial intelligence. Predictive analytics now anticipate congestion points before they materialize, enabling controllers to deploy flow measures that minimize delays and reduce fuel burn. In parallel, the adoption of digital collaborative platforms has reinvigorated stakeholder engagement, ensuring that airlines, airports, and navigation service providers operate from a unified situational picture.

Moreover, the pursuit of environmental sustainability has prompted regulators to embed carbon-efficient trajectories and continuous descent approaches into capacity planning protocols. The integration of unmanned aerial systems and urban air mobility concepts introduces new variables, necessitating adaptive architectures capable of scaling with diverse operational profiles. These transformative shifts underscore a transition from reactive traffic management to proactive orchestration of complex airspace activities, setting the stage for enhanced safety, efficiency, and environmental stewardship.

Analyzing the Financial and Operational Ripple Effects of 2025 United States Import Tariffs on Avionics and Radar Infrastructure

In 2025, heightened tariff measures imposed by the United States on imported avionics components and ground-based radar systems have reverberated throughout the air traffic flow management supply chain. Equipment integrators have experienced increased procurement costs, prompting program managers to recalibrate budget allocations to accommodate the augmented duties. Consequently, modernization initiatives are being reprioritized, with a growing emphasis on modular upgrades and phased rollouts that mitigate capital exposure.

These tariff-driven cost pressures have also catalyzed a strategic pivot among system developers towards domestic partnerships. By leveraging local manufacturing capabilities, firms aim to shield critical program timelines from international trade frictions. At the same time, leading service providers are intensifying investments in software-centric solutions, where intellectual property dominates value creation and hardware dependencies diminish. This cumulative tariff impact underscores the need for flexible procurement strategies and underscores the resilience benefits of a diversified supply ecosystem.

Unveiling a Comprehensive Segmentation Blueprint That Maps Out Diverse Service, Solution, Functional, and End-User Pathways

A nuanced segmentation framework illuminates the distinct trajectories within the air traffic flow and capacity management market. When categorizing by type, service offerings span consulting and implementation, integration and testing, as well as support and maintenance, while solution portfolios bifurcate into hardware and software. These delineations reveal that the consulting and implementation segment is rapidly aligning with digital transformation goals, whereas software solutions are capitalizing on cloud-based scalability and advanced analytics.

Shifting focus to functional distinctions, strategic flow management tools are gaining prominence as air navigation service providers seek to optimize network-level trajectories, while tactical flow management remains indispensable for real-time conflict resolution and controller workload alleviation. Application-based segmentation further differentiates collaborative decision-making frameworks, demand capacity balancing modules, core flow management suites, network planner platforms, and safety net applications, each addressing specific operational pain points.

Finally, end-user segmentation highlights that air navigation service providers prioritize system interoperability and regulatory compliance, airlines emphasize cost containment and fuel-efficiency benefits, and airports demand integrated workflows that synchronize surface and airborne operations. Understanding these intersecting lenses is critical for stakeholders to tailor their investments and align solution roadmaps with market dynamics.

This comprehensive research report categorizes the Air Traffic Flow & Capacity Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Function

- Application

- End User

Examining the Distinct Regulatory, Technological, and Operational Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics shape the adoption pace and technology preferences within the air traffic flow and capacity management domain. In the Americas, legacy modernization programs championed by regulatory agencies have accelerated the implementation of performance-based navigation and network collaborative environments, producing measurable reductions in en-route delays and CO₂ emissions.

Across Europe, the Middle East & Africa, pan-continental initiatives have harmonized cross-border procedures, underpinned by a unified digital data exchange standard that enhances situational awareness and shared accountability. Gulf states, in particular, are spearheading investments in remote tower operations to extend capacity in challenging climatic conditions, while European Union directives continue to mandate stringent interoperability frameworks.

In the Asia-Pacific region, explosive traffic growth in China and India is driving rapid deployment of satellite-based augmentation systems and multilayered flow management protocols. Authorities are also integrating machine-learning algorithms into demand capacity balancing tools to anticipate seasonal surges and accommodate the region’s burgeoning low-cost carrier networks. These regional insights illustrate how geographic imperatives and regulatory ecosystems converge to influence the trajectory of capacity management solutions.

This comprehensive research report examines key regions that drive the evolution of the Air Traffic Flow & Capacity Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Market Leaders Are Driving Innovation Through Strategic Alliances, Advanced Analytics, and Sustainability Commitments

Leading organizations in the air traffic flow and capacity management arena are forging innovative partnerships and broadening their portfolios to capture emerging opportunities. Established defense-contracting firms are leveraging their deep systems integration expertise to deliver end-to-end digital tower and radar modernization projects. Concurrently, specialist technology vendors are enhancing their analytics platforms with aviation-specific machine-learning models to forecast traffic patterns with unprecedented granularity.

Collaborative alliances between software developers and air navigation service providers are yielding co-created solutions that align closely with user workflows, reducing the time from concept validation to operational deployment. Moreover, several forward-thinking corporations are dedicating R&D resources to sustainability-centric capabilities, embedding metrics that track carbon emissions and fuel consumption directly within traffic flow visualization tools. This proactive approach by key market participants underscores a broader trend towards user-driven innovation and environmental accountability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Traffic Flow & Capacity Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adacel Technologies Limited

- ADB SAFEGATE AB

- Air Traffic Solutions

- Airbus SE

- Airservices Australia

- Avinor

- BAE Systems plc

- DFS Deutsche Flugsicherung GmbH

- ENAV S.p.A.

- EUROCONTROL

- Frequentis AG

- Honeywell International Inc.

- Indra Sistemas S.A.

- Intelcan Technosystems Inc.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Leidos Holdings, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- NATS Limited

- NAV CANADA

- NAVBLUE SAS

- Northrop Grumman Corporation

- RTX Corporation

- Saab AB

- Safran S.A.

- Searidge Technologies Inc.

- SITA N.V.

- Thales Group

- Unisys Corporation

Strategic Roadmap for Implementing Predictive Analytics, Modular Architectures, and Enhanced Collaboration to Fortify Capacity Management

To capitalize on the evolving air traffic flow and capacity management landscape, industry leaders should prioritize the integration of artificial intelligence–driven predictive analytics into existing control systems, enabling preemptive congestion mitigation and optimized route planning. Furthermore, cultivating seamless collaboration across airlines, airports, and navigation service providers through unified platforms will be critical to harmonizing operational objectives and reducing decision latency.

Leaders must also diversify their supplier base to inoculate projects against trade-related disruptions and adopt modular architectures that facilitate incremental enhancements. Emphasis should be placed on embedding sustainability metrics at the core of solution design, ensuring that environmental impact is quantified and optimized alongside throughput. Lastly, reinforcing cybersecurity postures through regular penetration testing and real-time threat monitoring will safeguard critical infrastructure against emerging digital risks. Collectively, these actionable measures will empower organizations to achieve resilient, efficient, and future-proofed capacity management.

Outlining a Rigorous Multi-Layered Research Framework Combining Qualitative Interviews, Secondary Analysis, and Statistical Validation

This research employs a multi-layered methodology combining qualitative and quantitative approaches to ensure comprehensive insights. Primary data were collected through structured interviews with industry executives, air navigation service providers, and technology integrators, enabling direct validation of emerging trends and pain points. Secondary research incorporated peer-reviewed journals, white papers, regulatory filings, and conference proceedings to ground the analysis in established scholarship and regulatory contexts.

Data triangulation was conducted by cross-referencing interview findings with market intelligence sources to reinforce reliability. The segmentation framework was validated through workshops with domain experts, ensuring that service, solution, functional, application, and end-user categories accurately reflect current industry structures. Statistical techniques, including scenario modeling and sensitivity analysis, were applied to interpret the relative impact of variables such as tariff changes and regional regulatory shifts. This rigorous methodology underpins the credibility and actionability of the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Traffic Flow & Capacity Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Traffic Flow & Capacity Management Market, by Type

- Air Traffic Flow & Capacity Management Market, by Function

- Air Traffic Flow & Capacity Management Market, by Application

- Air Traffic Flow & Capacity Management Market, by End User

- Air Traffic Flow & Capacity Management Market, by Region

- Air Traffic Flow & Capacity Management Market, by Group

- Air Traffic Flow & Capacity Management Market, by Country

- United States Air Traffic Flow & Capacity Management Market

- China Air Traffic Flow & Capacity Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing How Technological, Policy, and Collaborative Dynamics Converge to Define the Future of Airspace Management

The convergence of digital innovation, regulatory evolution, and sustainability imperatives is redefining the architecture of air traffic flow and capacity management. As airspace becomes more contested and complex, stakeholders must adopt proactive orchestration strategies that leverage predictive analytics and collaborative platforms. The cumulative effects of trade policies, such as the 2025 United States tariffs, reinforce the importance of a flexible supply chain and domestic partnerships to ensure continuity of modernization programs.

By integrating a nuanced segmentation perspective and regional considerations, decision-makers can tailor their investments to specific operational contexts and end-user needs. The competitive landscape, marked by dynamic alliances and technology commitments, highlights the value of deep domain expertise and environmental stewardship. Ultimately, leaders who embrace modular solution designs, robust cybersecurity measures, and cross-stakeholder collaboration will be best positioned to navigate the evolving skies with resilience and efficiency.

Secure Direct Access to Tailored Air Traffic Flow and Capacity Management Intelligence by Connecting with Our Sales & Marketing Leader

To explore this comprehensive analysis and gain unparalleled insights into the air traffic flow and capacity management landscape, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise in guiding aviation stakeholders through nuanced data interpretations ensures you will receive tailored support in leveraging this report to inform your strategic decisions. By engaging with Ketan, you will secure access to in-depth market intelligence, customized consultancy recommendations, and priority briefings on emerging trends. Take the next step towards optimizing your operational efficiency and competitive positioning by connecting with Ketan Rohom for your exclusive copy of the market research deliverable.

- How big is the Air Traffic Flow & Capacity Management Market?

- What is the Air Traffic Flow & Capacity Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?