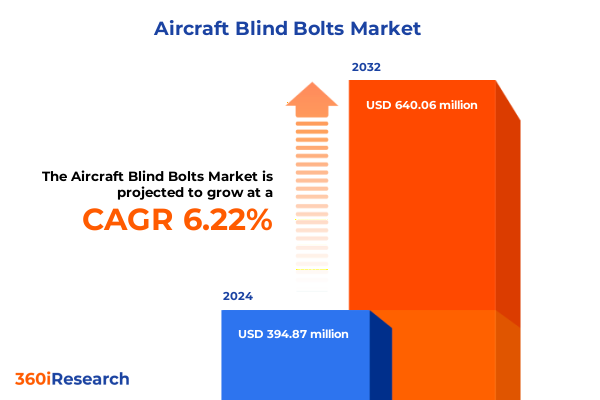

The Aircraft Blind Bolts Market size was estimated at USD 412.03 million in 2025 and expected to reach USD 431.78 million in 2026, at a CAGR of 6.49% to reach USD 640.06 million by 2032.

Understanding the Indispensable Contribution of Blind Bolts to Aircraft Structural Integrity and the Forces Driving Their Expanding Role in Aerospace

Blind bolts are indispensable fasteners engineered to join structural components in hard-to-reach areas of modern aircraft assemblies with precision and reliability. Their unique design allows installation from a single side, addressing accessibility challenges inherent to complex aerospace structures. As aircraft continue to evolve toward lighter, stronger, and more fuel-efficient configurations, blind bolts have emerged as critical enablers of advanced joining techniques. They ensure integrity under extreme vibration, pressure differentials, and temperature fluctuations encountered during flight operations.

The aerospace industry’s relentless pursuit of performance optimization and safety enhancement fuels demand for high-performance fastening solutions. Blind bolts made from diverse materials such as aluminum, nickel alloy, steel, and titanium meet stringent requirements for strength-to-weight ratios, corrosion resistance, and fatigue performance. Simultaneously, adoption of composites and hybrid structures in fuselage, wing, and tail assemblies has driven innovations in blind bolt geometries, coatings, and installation tools. Consequently, stakeholders across the supply chain-from material suppliers to OEMs-are intensifying collaborative efforts to refine blind bolt designs, validate their performance in real-world conditions, and streamline certification protocols.

Within this dynamic landscape, research reveals shifting priorities around cost efficiency, sustainability, and digital traceability. Manufacturers are integrating advanced analytics and real-time quality monitoring during bolting processes to minimize defects and enhance traceability across the lifecycle. Moreover, regulatory bodies are updating standards to align with next-generation fasteners and their application in both commercial and defense platforms. By examining these converging trends, businesses can unlock actionable insights to navigate emerging challenges while capitalizing on growth avenues presented by the rising pace of aircraft modernization.

Examining the Paradigm Shifts Redefining Aircraft Blind Bolt Development Including Material Innovation Supply Chain Resilience and Automation

Over the past decade, transformative shifts have redefined aircraft blind bolt development from incremental design tweaks to disruptive technology integrations. Digital manufacturing techniques, including robotic installation and in-line nondestructive testing, have accelerated production cycles while elevating quality assurance standards. By harnessing data analytics and machine learning, manufacturers can now predict failure modes, optimize installation parameters, and reduce rework rates. These capabilities are proving critical as aerospace OEMs and Tier One suppliers pursue faster time-to-market without compromising on stringent safety requirements.

Simultaneously, light-weighting initiatives have spurred material innovation within the blind bolt realm. The increasing prevalence of composite airframes and hybrid structures demands bolts capable of accommodating differential thermal expansion and mitigating galvanic corrosion risks. Advanced nickel alloys and high-strength titanium grades are being tailored with proprietary surface treatments to address these challenges. This convergence of material science and chemical engineering has ignited a paradigm shift away from traditional steel-based fasteners.

Environmental sustainability and supply chain resilience have emerged as equally compelling drivers of change. In response to tightening emissions regulations and corporate responsibility mandates, businesses are exploring eco-friendly coatings and recyclable alloys. At the same time, recent geopolitical disruptions have underscored the importance of regionalized manufacturing hubs and diversified sourcing strategies for critical components. Industry consortia are fostering collaborative frameworks to secure raw material supply, validate alternative alloy suppliers, and develop standardized qualification protocols, thereby mitigating exposure to future volatility. Through these interconnected transformations, the aircraft blind bolt market is transitioning toward a more agile, data-driven, and sustainable ecosystem.

Analyzing the Complex Effects of New United States Tariffs on Imported Materials for Blind Bolts and Their Implications for Aerospace Supply Chains

In 2025, the United States government enacted a series of tariffs targeting imported aluminum and titanium alloys used extensively in aerospace fastening systems. These measures, aiming to bolster domestic production capacity and address perceived unfair trade practices, have introduced a new layer of complexity for blind bolt manufacturers and end-users alike. The increased levies on foreign-sourced feedstock have driven up procurement costs, compelling OEMs and Tier One suppliers to reevaluate their supply strategies.

As a direct consequence of these tariffs, many domestic and international suppliers have sought to localize production of high-grade alloys to circumvent additional duties. While this trend supports the revitalization of local manufacturing infrastructures, it also raises pressure on raw material availability and processing capabilities within North America. Smaller forging facilities face challenges meeting the escalated demand for specialized alloys, which could lead to extended lead times and higher premiums for custom fasteners.

On the demand side, aerospace OEMs are negotiating longer-term agreements with key domestic metal producers to lock in favorable pricing and secure consistent supply. These partnerships often include co-investment in alloy processing technologies and joint qualification programs to accelerate certification of locally produced materials. Additionally, several manufacturers have accelerated efforts to validate alternative alloys that offer comparable performance at lower duty rates, such as advanced high-strength steels and emerging composite-metal hybrid fasteners. By understanding the unfolding ramifications of U.S. tariff policy, industry stakeholders can better anticipate cost fluctuations and strategically align sourcing decisions to maintain competitiveness.

Unlocking Critical Market Segmentation Insights Across Material Application Type and Installation Tool That Shape the Trajectory of the Blind Bolt Arena

The aircraft blind bolt market exhibits distinct preferences and performance demands when examined through the lens of material segmentation. Aluminum fasteners deliver exceptional weight savings and corrosion resistance favored in secondary structures, while nickel alloys are prized for their strength retention at elevated temperatures in engine and exhaust assemblies. Steel fasteners, subdivided into carbon and stainless variants, strike a balance of toughness and environmental resilience, underpinning their prevalent use across landing gear and fuselage joints. Titanium, with its superior strength-to-weight ratio and fatigue life, has proven indispensable for highly stressed airframe and control surface fittings. Each of these material categories requires unique design considerations around coating application and fatigue testing to ensure long-term reliability under cyclical loading.

Application segmentation further illuminates targeted opportunities and performance challenges in the blind bolt arena. In airframe assemblies, blind bolts secure critical load paths within the fuselage, tail, and wing subcomponents, demanding precise installation torque and axial stiffness. Engine enclosures and electronic housings place a premium on temperature stability and electromagnetic shielding compatibility, prompting specialized bolt designs. Within interiors, fastening solutions must balance aesthetic requirements with vibration damping, while landing gear assemblies necessitate extreme shear strength and damage-tolerance attributes. By dissecting each use case, stakeholders gain clarity on where tailored bolt geometries, head styles, and material alloys can unlock incremental performance gains.

Type segmentation underscores the nuanced distinctions among countersunk head, flush head, multi-grip, and structural blind bolts. Countersunk and flush head variants optimize aerodynamic smoothness on external skin panels, whereas multi-grip designs accommodate variable panel thicknesses in modular cabin interiors. Structural blind bolts offer enhanced shear and tensile capacities, making them the preferred choice for high-load joints in primary airframe structures. Each bolt type must undergo rigorous certification regimes that validate pull-through resistance, hole enlargement tolerances, and fatigue endurance under representative flight profiles.

Installation tool segmentation reveals further stratification of the blind bolt ecosystem. Manual tools remain ubiquitous for on-site repairs and prototyping, but electric and pneumatic solutions dominate high-volume production environments. Electric tools split into battery-powered and corded variants, offering trade-offs between mobility and sustained torque output. Pneumatic tools, whether bench-mounted or handheld, deliver consistent installation force for large assembly lines and maintenance hangars. Hydraulic systems, while less common, are specified for exceptionally high-torque applications. Embracing this multifaceted segmentation framework enables companies to tailor product portfolios and service offerings to distinct end-user requirements, thereby fostering deeper market penetration.

This comprehensive research report categorizes the Aircraft Blind Bolts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Type

- Installation Tool

- Application

Exploring Regional Market Dynamics in the Americas Europe Middle East Africa and Asia Pacific and Their Unique Impacts on Aircraft Blind Bolt Demand

The Americas region continues to lead in blind bolt consumption driven by robust commercial aircraft production in North America and growing defense modernization programs in Canada and Brazil. The presence of major OEM hubs along with extensive MRO infrastructure creates a vibrant aftermarket ecosystem where high-performance fasteners are in constant demand. Mexico’s expanding aerospace manufacturing parks further complement value chains by offering cost-competitive assembly services for both domestic and global players. Across the continent, regulatory initiatives aimed at enhancing supply chain transparency are streamlining material traceability requirements and encouraging suppliers to adopt standardized digital documentation practices.

Europe Middle East and Africa exhibit a nuanced landscape where legacy aerospace clusters in Western Europe coexist with rapidly emerging hubs in the Gulf and South Africa. In Germany and France, stringent certification standards for defense platforms fuel demand for structural blind bolts with proven fatigue life. Meanwhile, investments in passenger helicopter fleets within the Gulf Cooperation Council states have accelerated the need for specialized fastening solutions that meet rotary-wing vibration and load profiles. African nations are gradually bolstering their regulatory frameworks to support local aerospace assembly, opening avenues for partnerships with established European suppliers to develop co-certified bolt variants.

Asia Pacific stands out as the fastest-growing region for blind bolt demand, led by significant aircraft carrier programs in China and India and burgeoning commercial and regional aircraft manufacturing in Southeast Asia. Domestic OEMs are increasingly prioritizing indigenous fastener development to reduce reliance on foreign sources, resulting in co-investment initiatives for alloy processing facilities. In parallel, governments across the region are incentivizing adoption of advanced manufacturing technologies, propelling the integration of robotic installation and digital quality control into blind bolt production lines. This convergence of policy support and industrial investment positions Asia Pacific as a pivotal growth engine for next-generation fastening solutions.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Blind Bolts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering Organizations Driving Innovation in the Aircraft Blind Bolt Space Through Strategic Collaborations and Technological Advancements

Leading players in the aircraft blind bolt sector are differentiating through strategic partnerships, vertical integration, and technology licensing agreements. Several long-standing fastener specialists have expanded their portfolios by acquiring complementary tooling companies, thereby offering end-to-end installation systems. These acquisitions enable seamless compatibility between fastener design and assembly equipment, reducing validation cycles for OEMs. Other incumbents are partnering with aerospace material innovators to co-develop proprietary surface treatments aimed at extending fatigue life and enhancing corrosion resistance under cyclic humidity and salt-spray conditions.

In parallel, a handful of emerging enterprises are carving out niche positions by focusing on digital traceability and blockchain-enabled supply chain solutions. By embedding serialized identifiers and tamper-proof data records directly onto bolt shanks, these firms are addressing stringent audit requirements set forth by both civil aviation authorities and defense regulators. This capability not only strengthens quality assurance but also enables predictive maintenance programs by linking fastener performance data to specific airframe components.

Major multinationals continue to invest in regional production footprints to meet localized content regulations while minimizing logistical lead times. Their global networks of specialized forging and finishing facilities allow for agile scaling of high-volume programs and rapid customization of bolt designs for new airframe platforms. Concurrently, several innovators are piloting additive manufacturing processes for bespoke blind bolt geometries, signaling a potential shift toward on-demand, low-volume production runs that can drastically reduce inventory carrying costs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Blind Bolts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3V Fasteners Company, Inc.

- Allfast Fastening Systems

- ARaymond SAS

- Böllhoff GmbH

- Elco Industries, Inc.

- Howmet Aerospace Inc.

- Kwikbolt Ltd.

- LISI Aerospace

- PennEngineering

- Precision Castparts Corp.

- RTX Corporation

- SFS Group AG

- Stanley Engineered Fastening, Inc.

- The Boeing Company

- Tox Pressotechnik GmbH & Co. KG

- TriMas Corporation

Presenting Actionable Recommendations for Industry Leaders to Enhance Competitiveness Through Supply Chain Diversification Innovation and Sustainability Integration

Industry leaders should prioritize diversification of raw material sourcing to mitigate exposure to geopolitical trade risks and evolving tariff regimes. Establishing alliances with alternative alloy producers and investing in qualification of nontraditional feedstocks can create buffer against supply chain disruptions. At the same time, integrating advanced analytics into installation workflows will unlock proactive quality control, reduce rework rates, and extend service intervals through data-driven maintenance planning.

Collaborative research initiatives between fastener manufacturers, aerospace material scientists, and certification bodies should be accelerated to validate next-generation bolt materials and coatings. Such programs can streamline approval processes, enabling faster adoption of lightweight and corrosion-resilient alloys. Additionally, companies should explore digital traceability solutions that leverage serialization and blockchain technologies to ensure end-to-end transparency and compliance with emerging global regulations.

To stay ahead of competitive pressures, organizations must also evaluate opportunities in emerging regional markets by aligning production footprints with local content requirements and industrial incentives. Strategic investments in flexible manufacturing technologies-such as robotic installation systems and hybrid production lines integrating additive and traditional forging-will enhance responsiveness to bespoke project demands. By aligning these initiatives with robust sustainability targets around recyclable alloys and eco-friendly coatings, industry leaders can not only meet regulatory mandates but also appeal to increasingly environmentally conscious stakeholders.

Outlining the Comprehensive Research Methodology Employed to Deliver Rigorous Analysis and Reliable Insights into the Aircraft Blind Bolt Ecosystem

The research underpinning this analysis was conducted through a rigorous mixed-method approach combining extensive secondary research with targeted primary inputs. Initial desk research involved review of industry journals, regulatory filings, aerospace OEM technical specifications, and trade association reports to map the competitive landscape and emerging trends. Publicly available tariff schedules, trade statistics, and patent databases were analyzed to quantify the impact of 2025 U.S. duty adjustments on alloy supply chains.

Primary research comprised in-depth interviews with key stakeholders across the value chain, including material suppliers, tooling manufacturers, aerospace OEM procurement managers, and certification experts. These conversations provided nuanced perspectives on current bottlenecks, validation timelines, and the operational realities of blind bolt installation in both production and maintenance contexts. Quantitative surveys supplemented qualitative insights, capturing data on average lead times, installation error rates, and regional sourcing preferences.

Data triangulation ensured reliability of findings by cross-referencing interview feedback against published technical standards and real-world case studies. All information was validated through multiple independent sources, and insights were iteratively refined through expert review panels. This comprehensive methodology ensures the report’s conclusions and recommendations provide a robust foundation for strategic decision making in the aircraft blind bolt ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Blind Bolts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Blind Bolts Market, by Material

- Aircraft Blind Bolts Market, by Type

- Aircraft Blind Bolts Market, by Installation Tool

- Aircraft Blind Bolts Market, by Application

- Aircraft Blind Bolts Market, by Region

- Aircraft Blind Bolts Market, by Group

- Aircraft Blind Bolts Market, by Country

- United States Aircraft Blind Bolts Market

- China Aircraft Blind Bolts Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing Key Conclusions on the Future Pathways for Blind Bolts Amid Shifting Regulatory Technological and Economic Landscapes in Aerospace

The convergence of advanced materials, digital manufacturing, and evolving regulatory landscapes is reshaping the aircraft blind bolt market in profound ways. Material diversification toward high-strength nickel alloys and titanium has unlocked new performance thresholds, while automation and data integration across installation workflows have elevated quality assurance to unprecedented levels. At the same time, geopolitical shifts and trade policy reforms are influencing sourcing strategies, fostering regional resilience and collaborative qualification programs.

As the industry navigates these multifaceted changes, segmentation insights reveal that targeted opportunities exist across specific material grades, application zones, bolt types, and installation tools. Regional dynamics further underscore the importance of localized strategies, from near-shoring in the Americas to domestic alloy development in Asia Pacific and co-certification initiatives in EMEA. Leading companies that proactively invest in sustainable materials, digital traceability, and flexible manufacturing will be best positioned to capitalize on growth trajectories and maintain competitive edge.

Ultimately, the aircraft blind bolt market is entering a phase of accelerated evolution where strategic collaboration and agility will dictate leadership. Stakeholders equipped with comprehensive, actionable intelligence can unlock efficiencies, mitigate risk, and drive innovation, ensuring the reliability and performance of tomorrow’s aircraft structures.

Engaging Directly with Ketan Rohom to Acquire In-Depth Market Intelligence on Aircraft Blind Bolts and Accelerate Strategic Decision Making Today

To secure a comprehensive understanding of the evolving aircraft blind bolt market, reach out directly to Ketan Rohom Associate Director of Sales & Marketing at 360iResearch He is ready to guide you through the report’s in-depth analysis and tailor insights to your strategic priorities Engage with Ketan today to explore customized solutions address specific challenges and leverage the latest intelligence for competitive advantage

- How big is the Aircraft Blind Bolts Market?

- What is the Aircraft Blind Bolts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?