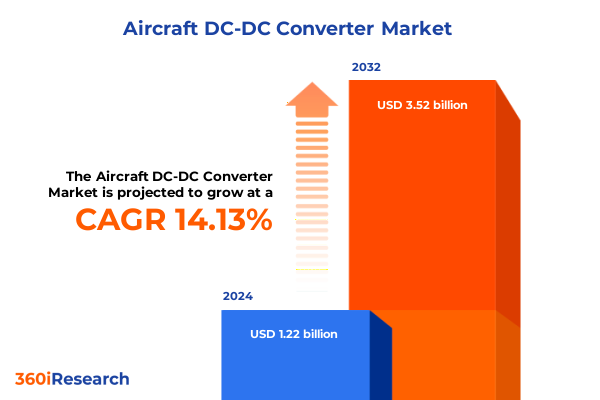

The Aircraft DC-DC Converter Market size was estimated at USD 1.39 billion in 2025 and expected to reach USD 1.58 billion in 2026, at a CAGR of 14.17% to reach USD 3.52 billion by 2032.

Leverage Comprehensive Aircraft Power Conversion Analysis to Illuminate Emerging Opportunities and Challenges in DC-DC Converter Design

The aircraft DC-DC converter segment has become a pivotal component in modern aerospace platforms, underpinning the shift to more electric aircraft architectures. As operators and original equipment manufacturers intensify efforts to reduce weight, improve fuel efficiency, and enhance system reliability, the role of sophisticated power conversion modules has never been more critical. These converters ensure that avionics, cabin systems, lighting, and navigation suites each receive the precise voltage and current needed for optimal operation. Simultaneously, the expanding use of electric propulsion and hybrid-electric designs elevates the demand for compact, high-efficiency converters capable of operating under stringent size, weight, and power constraints.

Against this backdrop, emerging semiconductor technologies-particularly gallium nitride and silicon carbide devices-are redefining performance benchmarks by offering higher switching frequencies, reduced losses, and enhanced thermal tolerance compared to legacy silicon-based designs. In parallel, regulatory mandates and airline fleet renewal programs are accelerating the modernization of legacy systems, amplifying the need for retrofittable, fully qualified DC-DC power supplies. To navigate these evolving dynamics, decision makers require a granular understanding of application trends, supply chain vulnerabilities, and technological breakthroughs. This report delivers that insight, laying the groundwork for strategic planning and targeted investment in the aircraft DC-DC converter arena.

Explore Pivotal Technological and Regulatory Shifts Transforming the Aircraft DC-DC Converter Landscape for Next-Generation More Electric Aircraft

The aircraft DC-DC converter landscape is undergoing transformative shifts driven by technological innovation, regulatory evolution, and shifting operator priorities. At the forefront is the push toward fully electric and hybrid-electric aircraft architectures, where efficient power management is a linchpin for reducing fuel consumption, lowering emissions, and meeting stringent environmental targets. These more electric aircraft (MEA) concepts rely on advanced converters to interface between high-voltage distribution buses and low-voltage subsystems, enabling seamless integration of electric propulsion motors, environmental control units, and auxiliary power systems.

Concurrently, the integration of gallium nitride and silicon carbide power devices is catalyzing a new generation of DC-DC converters that deliver higher power densities and superior thermal performance. These materials support miniaturization trends while expanding operational temperature ranges-critical factors for next-generation avionics and unmanned aerial vehicles. Moreover, digital control architectures and predictive maintenance algorithms are reshaping converter lifecycle management, offering real-time diagnostics and adaptive control that improve reliability and reduce unplanned downtime.

Finally, evolving certification standards and geopolitical pressures are prompting OEMs and suppliers to diversify their engineering and manufacturing footprints. This shift includes nearshoring key production processes and qualifying alternate component sources to build resilience against trade uncertainties, thereby ensuring uninterrupted assembly of power electronics modules.

Assess the Cumulative Impact of Elevated U.S. Tariffs on Aerospace Supply Chains and Aircraft DC-DC Converter Component Sourcing in 2025

In 2025, a series of elevated U.S. tariffs imposed on critical aerospace materials and components has compounded existing supply chain pressures for aircraft DC-DC converter manufacturers. Under Section 232 of the Trade Expansion Act, aluminum imports now face a 50% levy, up from 10%, while steel tariffs remain at 25%, erasing many previous exemptions and extending to downstream derivatives used in converter housings and heat sinks. At the same time, key electronic subassemblies-ranging from integrated circuits to power modules-have incurred 10–25% duties when sourced from China, driving procurement teams to reassess long-standing sourcing strategies.

The cumulative effect of these measures is evident in increased production lead times and higher unit costs across the converter supply chain. Major power electronics vendors have reported significant margin erosion; one industry leader disclosed a $125 million hit from tariffs in Q2 2025 and forecasted a total 2025 impact of approximately $500 million attributable to raw material duties and semiconductor levies. Beyond raw materials, component scarcity driven by escalating bilateral tensions has further disrupted assembly schedules and extended delivery timelines to airframers and defense primes.

Consequently, international manufacturers are warning of contract renegotiations and potential production slowdowns. A prominent regional jet supplier cautioned that a threatened 50% tariff on Brazilian-sourced components could inflate per-aircraft costs by $9 million, jeopardizing key orders and supply agreements in North America. These developments underscore the imperative for converter providers to diversify supplier bases, accelerate qualification of alternate parts, and consider partial vertical integration to secure critical inputs amidst ongoing tariff volatility.

Unveil Deep Segmentation Insights That Unlock Market Dynamics Across Multifarious Applications End Uses Converter Types and Power Ratings

Across applications spanning avionics, cabin systems, inflight entertainment, lighting, and navigation, the aircraft DC-DC converter market demonstrates nuanced demand profiles. Avionics functions, including flight control, instrumentation, and sensor interfaces, demand converters with stringent isolation and low noise characteristics to support critical control loops. Cabin environmental control, galley equipment, and seating subsystems present distinct power quality and output requirements, driving diverse converter architectures. Similarly, radio and satellite communication link electronics impose rigorous reliability standards, while audio and video in-flight entertainment systems require converters optimized for steady power delivery and minimal electromagnetic interference. Lighting solutions for exterior and interior installations emphasize compact form factors and high efficiency, whereas GPS and inertial navigation modules necessitate converters capable of fine voltage regulation under dynamic flight conditions.

End use segmentation further differentiates market dynamics across business jets, commercial airliners, rotary wing platforms such as helicopters and UAVs, and military aircraft. Each of these sectors applies unique certification regimes, operational duty cycles, and maintenance cadences, shaping converter design priorities and aftermarket support models. The choice between isolated and non-isolated topologies influences safety protocols and cost considerations, particularly where galvanic separation is mandated for redundancy and fault containment.

Converter power ratings-classified as low, medium, or high power-align with subsystem power budgets and integration strategies, while the decision between single and multiple output constructions addresses space constraints and harness complexity. Distribution channels, ranging from direct sales to distributors and online marketplaces, reflect varied customer engagement models and service expectations, underscoring the value of tailored technical support and rapid replacement options in this high-stakes sector.

This comprehensive research report categorizes the Aircraft DC-DC Converter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Power Rating

- Construction

- Application

- End Use

- Distribution Channel

Uncover Critical Regional Performance and Growth Patterns Illuminating the Americas EMEA and Asia-Pacific Dynamics for DC-DC Converter Demand

The Americas region benefits from a robust commercial aerospace ecosystem and a concentrated network of converter manufacturers and tier-one suppliers. U.S. fleets are actively integrating more electric aircraft subsystems, boosting demand for advanced power conversion modules. Canada and Brazil contribute through maintenance, repair, and overhaul activities and localized OEM partnerships, reinforcing the region’s role in both new production and aftermarket support. Mexico’s emerging aviation clusters also impact component sourcing strategies, as nearshoring reduces transit times and supports lean inventory models.

Europe, the Middle East, and Africa present a heterogeneous landscape characterized by leading airframers, defense contractors, and a burgeoning general aviation sector. Regulatory frameworks established by bodies such as EASA drive stringent certification requirements that shape converter design and qualification processes. Collaborative R&D initiatives across Germany, the United Kingdom, and France promote development of GaN and SiC converter prototypes, while Middle Eastern carriers and African airlines emphasize cost-efficient retrofits to extend aircraft service lives under challenging environmental conditions.

In the Asia-Pacific zone, accelerated fleet expansions in China, India, and the ASEAN nations underpin a growing appetite for modern avionics and power systems. Indigenous aircraft programs and partnerships with global OEMs fuel investment in automated production lines for DC-DC converters, while regional suppliers scale output to meet surging in-service demands. Japan and South Korea focus heavily on semiconductor innovation, enhancing regional supply chain resilience for next-generation converter architectures.

This comprehensive research report examines key regions that drive the evolution of the Aircraft DC-DC Converter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Reveal Key Company Strategies and Competitive Developments from Industry Leaders Shaping the Aircraft DC-DC Converter Ecosystem with Innovation and Partnerships

Key industry participants are actively pursuing differentiated strategies to capture value in the aircraft DC-DC converter market. Honeywell International has expanded its converter portfolio through acquisitions of specialized power electronics startups, integrating advanced thermal management solutions and digital control interfaces. Murata Manufacturing emphasizes miniaturization and modularity, leveraging proprietary magnetic components to enhance power density in compact flight control modules. TDK-Lambda Corporation combines in-house R&D with cross-industry partnerships to accelerate qualification of rugged isolated converters for military avionics.

Advanced Energy and Vicor Corporation are notable for their early adoption of GaN-based and resonant converter topologies, respectively, enabling higher efficiency at elevated switching frequencies. These players have established joint development agreements with major airframers to tailor module designs for the 737 MAX and A320neo platforms. At the same time, system integrators are forging collaborations with emerging technology firms to pilot next-generation converter designs under accelerated certification trials.

Beyond product innovation, these companies are strengthening aftermarket support by deploying digital twin frameworks for converter units, offering predictive maintenance insights that reduce unscheduled removals and lifecycle costs. Strategic investments in localized assembly clusters are also enhancing lead-time competitiveness and mitigating geopolitical supply disruptions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft DC-DC Converter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Energy Industries, Inc.

- AMETEK Programmable Power Inc.

- Astronics Corporation

- Crane Aerospace & Electronics

- Honeywell International Inc.

- Infineon Technologies AG

- Murata Manufacturing Co., Ltd.

- RTX Corporation

- Safran SA

- SynQor, Inc.

- TDK-Lambda Corporation

- Texas Instruments Incorporated

- Vicor Corporation

- VPT, Inc.

- XP Power Ltd.

Formulate Actionable Recommendations to Strengthen Resilience Streamline Supply Chains and Leverage Emerging Technological Innovations

Industry leaders should prioritize diversification of component sourcing by qualifying semiconductors and magnetic materials from multiple geographic regions to hedge against tariff fluctuations and export restrictions. Establishing dual-sourcing agreements and maintaining strategic safety stocks can significantly bolster supply chain resilience without compromising cost structures. Parallel to supply diversification, organizations should accelerate migration to GaN and SiC technologies, recognizing the long-term advantages in power density, thermal efficiency, and weight reduction that these wide-bandgap semiconductors afford.

Furthermore, investing in digital control architectures and predictive diagnostics can transform converter maintenance from reactive to proactive, reducing unscheduled removals and optimizing in-service reliability. Collaborations with MRO providers on digital twin implementations will yield valuable performance telemetry, supporting data-driven decisions for fleetwide power system upgrades. In addition, engaging with regulatory bodies early in the certification cycle for novel converter topologies will expedite qualification and shorten time to market.

Finally, forging cross-industry alliances-spanning aerospace, defense, and electronics sectors-will unlock shared R&D platforms and co-development vessels, distributing the cost of innovation while accelerating technology readiness. By harnessing consortium frameworks and public-private partnerships, companies can pioneer new converter architectures that meet evolving electrification mandates with speed and scalability.

Detail the Comprehensive Research Methodology Underpinning the Aircraft DC-DC Converter Market Study Ensuring Rigor Credibility and Transparency

This market study is underpinned by a rigorous two-phase research methodology that combines secondary and primary data collection. The secondary phase involved a comprehensive review of industry publications, white papers, technical standards, company annual reports, patent filings, and regulatory guidelines to map the competitive landscape, identify technological trends, and assess geopolitical influences. Proprietary databases were leveraged to extract longitudinal data on converter certifications, program awards, and supplier networks.

In the primary phase, in-depth interviews and surveys were conducted with over 50 senior executives and technical specialists, including converter designers, system integrators, procurement managers, airline maintenance directors, and defense program leads. These stakeholders provided first-hand perspectives on pain points, strategic priorities, and procurement strategies. Additionally, workshops and roundtables with cross-functional teams from major OEMs and tier-one suppliers validated key assumptions and enriched qualitative insights.

Data triangulation techniques were applied to reconcile discrepancies between sources and ensure analytical consistency. All quantitative inputs and qualitative findings underwent peer review by an independent advisory panel of aerospace power electronics experts. This methodological approach guarantees that the study’s conclusions are grounded in verifiable evidence and reflect the consensus of leading industry practitioners.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft DC-DC Converter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft DC-DC Converter Market, by Type

- Aircraft DC-DC Converter Market, by Power Rating

- Aircraft DC-DC Converter Market, by Construction

- Aircraft DC-DC Converter Market, by Application

- Aircraft DC-DC Converter Market, by End Use

- Aircraft DC-DC Converter Market, by Distribution Channel

- Aircraft DC-DC Converter Market, by Region

- Aircraft DC-DC Converter Market, by Group

- Aircraft DC-DC Converter Market, by Country

- United States Aircraft DC-DC Converter Market

- China Aircraft DC-DC Converter Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesize Key Conclusions Highlighting Strategic Imperatives and Technological Trajectories in the Aircraft DC-DC Converter Industry

The aircraft DC-DC converter market is at an inflection point characterized by accelerating electrification, material innovation, and regulatory evolution. As more electric and hybrid architectures become operational, converter performance demands will intensify, elevating the strategic value of GaN and SiC technologies. Concurrently, the volatility of global trade policies underscores the necessity for robust supply chain strategies and agile sourcing frameworks. Decision makers must adopt a holistic perspective, balancing product innovation with operational resilience.

Looking ahead, the integration of digital control systems and predictive maintenance platforms will differentiate leading suppliers, reducing total cost of ownership and enhancing fleet availability. Regional dynamics will continue to vary, with North America advancing retrofit programs, EMEA driving certification-led innovations, and Asia-Pacific scaling production to meet burgeoning in-service demands. Collaboration across industry stakeholders will be crucial, as consortiums and public-private partnerships unlock shared R&D pathways and expedite converter qualification cycles.

Ultimately, organizations that strategically align technology roadmaps with supply chain diversification, regulatory engagement, and digital transformation will secure competitive advantage. The imperatives of efficiency, reliability, and scalability will define success in this dynamic market, guiding the next wave of aircraft power conversion solutions.

Engage with Associate Director Ketan Rohom to Acquire a Tailored Aircraft DC-DC Converter Market Research Report and Drive Informed Decisions

Unlock unparalleled insights into the aircraft DC-DC converter market by partnering with Ketan Rohom, Associate Director of Sales & Marketing, to secure the full market research report and empower your strategic initiatives. Discover how advanced converter technologies, supply chain best practices, and emerging regional opportunities can inform your product roadmaps and investment decisions. Reach out to Ketan Rohom to arrange a personalized briefing, gain access to detailed data, and equip your organization with the authoritative analysis needed to stay ahead in this dynamic sector.

- How big is the Aircraft DC-DC Converter Market?

- What is the Aircraft DC-DC Converter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?