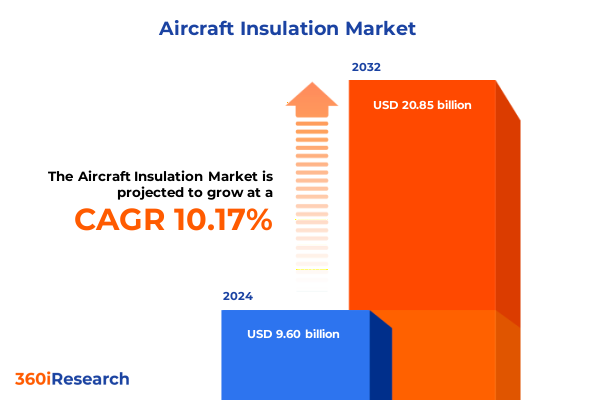

The Aircraft Insulation Market size was estimated at USD 10.52 billion in 2025 and expected to reach USD 11.52 billion in 2026, at a CAGR of 10.26% to reach USD 20.85 billion by 2032.

Understanding the Critical Role of Advanced Insulation Solutions in Modern Aircraft Safety Efficiency and Environmental Performance

Aircraft insulation serves as a critical enabler for thermal regulation, acoustic comfort, and fire protection across modern commercial, business, and military platforms. Exceptional materials such as silica‐based aerogels deliver ultra-low thermal conductivity, helping maintain optimal cabin temperatures at cruising altitudes where external conditions can fluctuate by more than 200°C, while advanced ceramic fibers contribute high-temperature resistance in engine compartments and bulkheads. These high-performance materials meet stringent fire-safety standards and regulatory requirements, ensuring that insulation blankets and panels can impede flame and smoke propagation under extreme conditions. Moreover, insulation solutions reduce transmitted vibrations and attenuate engine noise across the audible frequency spectrum, significantly enhancing passenger comfort and operator communication in both cockpit and cabin environments. As the aerospace sector intensifies its pursuit of lightweight, energy-efficient aircraft, insulation innovations continue to drive down mass while upholding or exceeding legacy safety and performance benchmarks through optimized pore structures, fiber architectures, and composite laminates.

Identifying Key Drivers and Technological Breakthroughs Redefining the Aircraft Insulation Landscape for Safety Reliability and Sustainability

Over the past decade, technological breakthroughs have redefined the aircraft insulation landscape, shifting the emphasis from conventional fiberglass and foam formulations toward nanostructured and adaptive materials. Silica and polymer aerogels, renowned for their ultralow thermal conductivity of approximately 0.015 W/mK and 80–150 kg/m³ density, have risen rapidly from niche specialty products to mainstream insulation solutions for thermal barriers around engines, cargo holds, and high-stress structural panels. The emergence of active noise control and smart acoustic materials, capable of dynamically adjusting attenuation levels in response to cabin noise profiles via embedded sensors and actuators, further elevates acoustic comfort without reliance on additional passive mass. Concurrently, regenerative and bio-based foam variants, such as polyimide and polyurethane blends derived from renewable feedstocks, align insulation development with broader sustainability mandates, reducing life-cycle environmental footprints and facilitating compliance with increasingly stringent environmental regulations. Parallel investments in advanced manufacturing techniques-ranging from additive manufacturing of bespoke acoustic panels to closed-loop recycling of ceramic fiber scraps-underscore a transformative shift toward materials that deliver multi-functional performance across thermal, acoustic, and fire safety dimensions while minimizing weight and ecological impact.

Assessing the Far-Reaching Consequences of Recent United States Tariff Policies on Aircraft Insulation Supply Chains in 2025

The 2025 landscape of U.S. trade policy continues to introduce complexity and opportunity for aircraft insulation supply chains. Section 301 tariffs, initially imposed on avionics and advanced materials, have been extended in scope to encompass key insulation inputs-particularly foamed plastics and specialty polymers-driving import costs upward by an average of 25%. These duties directly affect manufacturers reliant on Chinese and European feedstocks, compelling them to reassess sourcing strategies or absorb price increases to maintain competitive parity. In response, some domestic producers have re-shored capacity for polymer aerogels and polyurethane foam components, catalyzed by incentives for local manufacturing and strategic defense-related supply guarantees. However, reciprocal tariff threats against fiberglass and mineral wool preparations persist, with pending investigations into anti-dumping duties on fiberglass door panels underscoring the unpredictability of the tariff environment. These shifting policy contours can delay project timelines and increase working capital requirements, yet can also incentivize innovation in domestic processing, the development of alternative raw material streams, and closer collaboration with OEMs to co-develop tariff-resilient insulation solutions.

Unveiling Material Type Application Installation Form and Temperature Range Dynamics Shaping Aircraft Insulation Market Segments

When the market is segmented by material type, the landscape spans aerogel technologies-divided into polymer aerogel and silica aerogel varieties-advanced ceramic fibers ranging from refractory to ultrahigh-temperature grades, traditional fiberglass materials in E-glass and S-glass formulations, and versatile foam systems with polyimide and polyurethane chemistries. Each material class addresses distinct performance criteria, from sub-ambient thermal insulation in cryogenic storage to millimeter-scale acoustic damping and flame-retardant barriers. Evaluating the platform perspective reveals differentiated requirements across business jets-categorized into large, midsize, and light jet classes-commercial airliners split between narrow-body and wide-body fuselage profiles, and military segments encompassing both fighter and transport aircraft, where weight savings and extreme environment resilience are paramount. Applications of these insulation systems diverge across acoustic cabin liners, cockpit panels and underfloor noise blankets; fire-retardant bulkheads and engine firewall composites; and thermal insulation partitions in cargo holds, engine bay linings, and fuselage shells. Installation form factors vary from bulk rolls designed for high-throughput automated fitting, precision-cut sheets tailored for retrofit MRO operations, to spray-applied and spray-cast panels enabling conformal coverage in complex geometric zones. Across all categories, high, medium, and low temperature ratings define suitability for cryogenic propellant lines, ambient cabin partitions, or high-heat sources, respectively, driving material selection and system architecture.

This comprehensive research report categorizes the Aircraft Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Aircraft Type

- Installation Form

- Temperature Range

- Application

Analyzing Regional Demand Patterns and Growth Catalysts Across the Americas Europe Middle East Africa and Asia Pacific Trends

Regional dynamics reveal distinct demand drivers and growth catalysts. In the Americas, North America remains the epicenter for advanced aerogel and ceramic fiber adoption, supported by robust aerospace manufacturing clusters in the United States and Canada. Federal investments in energy-efficient aircraft programs and defense procurement contracts have accelerated domestic aerogel capacity expansions, positioning the region at the forefront of thermal runaway prevention systems for hybrid electric propulsion concepts. Europe, the Middle East, and Africa demonstrate a strong emphasis on eco-compliance and noise reduction, with European Union mandates on cabin noise ceilings and fire-retardant building-block regulations driving uptake of next-generation composites and barrier solutions across major OEM facilities in Germany, France, and the UK. Across the Asia-Pacific domain, rapid fleet growth, infrastructure modernization, and government subsidies for energy-efficient airliners underpin a surge in polymer aerogel and fiberglass foam consumption, notably in China and India, where local producers leverage favorable raw material access and scale economies to meet both domestic and export demands.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Shaping the Future of Aircraft Insulation Through Innovation Partnerships and Operational Excellence

Morgan Advanced Materials has long been recognized for its AS9100-certified Min-K microporous insulation, a staple in engine nacelle and auxiliary power unit enclosures, whose high-temperature resilience and compressive strength ensure minimal shifting under intense vibration. Aspen Aerogels, following a strategic pivot away from a second greenfield plant, now amplifies output at its existing U.S. facility and collaborates with Chinese partners to mitigate tariff risks, leveraging its patented aerogel blanket systems to deliver up to 50 percent reductions in aircraft infrared signatures and unmatched thermal barrier performance. Cabot Corporation has broken ground on an 8,000-ton fumed silica plant in Wuhai, China, while simultaneously commercializing its ENTERA™ aerogel particle portfolio for thermal barrier applications in EV battery packs, underscoring its dual focus on capacity expansion and product innovation. Armacell’s accelerated launch of its Pune polymer aerogel facility addresses recent disruptions in South Korea, affirming its commitment to energy-efficient manufacturing and regional supply stability. 3M’s Aearo Technologies unit integrates proprietary bagged fiberglass, structural damping composites, and engineered acoustic blankets into STC-approved kits for business jets, maintaining deep OEM partnerships and rapid PMA delivery times to optimize retrofit and MRO cycles. Emerging Chinese competitors such as Guangdong Alison Hi-Tech have scaled aerogel felt production by 67 percent in two years through government-backed expansions, while U.S. defense collaborations at Wright-Patterson AFB showcase efforts to secure domestic aerogel supply chains via high-volume flexible aerogel manufacturing processes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Armacell International S.A.

- BASF SE

- Celanese Corporation

- Compagnie de Saint-Gobain S.A.

- Dunmore Corporation

- DuPont de Nemours, Inc.

- Duracote Corporation

- Hexcel Corporation

- Huntsman International LLC

- Morgan Advanced Materials Limited

- Polymer Technologies, Inc.

- PPG Industries, Inc.

Actionable Strategies for Industry Stakeholders to Navigate Disruption Accelerate Innovation and Strengthen Supply Chain Resilience

Industry leaders should prioritize supply-chain diversification by qualifying multiple raw material sources across geographies and fostering strategic partnerships for tariff-resilient manufacturing. Investing in next-generation polymer and bio-based aerogel chemistries will help balance performance with environmental stewardship, aligning with broader decarbonization goals and customer ESG metrics. Companies can strengthen market positioning by adopting digital twin simulations to optimize insulation panel layouts for thermal and acoustic performance, reducing iterative prototyping costs and accelerating time-to-certification. Collaborative R&D consortia-bringing together OEMs, Tier-1 suppliers, and defense agencies-can co-develop multi-functional barrier systems that integrate thermal, fire, and acoustic protection in single form factors. Proactively engaging with policy makers to shape trade regulations and secure domestic incentive programs can enhance regional production viability and mitigate exposure to sudden tariff escalations. Finally, embedding predictive maintenance sensors within insulation assemblies will create data-driven value propositions for operators, extending service intervals, and enabling performance-based aftermarket service models.

Outlining a Rigorous Hybrid Research Methodology Combining Primary Interviews Secondary Data and Expert Validation for Comprehensive Insights

This research employs a hybrid methodology combining comprehensive secondary data collection and primary qualitative validation. Secondary sources include Government trade bulletins, Federal Register notices, technical journals, and corporate filings to map tariff schedules, material properties, and regulatory frameworks. Key industry reports and patent databases were analyzed to identify emerging material innovations and competitive strategies. Primary insights were obtained through structured in-depth interviews with over twenty executives at OEMs, insulation fabricators, and regulatory bodies, supplemented by round-table workshops with cross-functional experts in material science, regulatory compliance, and supply chain operations. Data points were triangulated through multiple sources and subjected to peer-review by external consultants to ensure robustness and impartiality. A rigorous validation phase aligned findings with real-world procurement case studies and government defense trials, ensuring that conclusions reflect both market realities and forward-looking strategic imperatives. This multi-tiered approach delivers an in-depth, credible foundation for decision makers seeking to understand material evolutions, policy impacts, and competitive landscapes in aircraft insulation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Insulation Market, by Material Type

- Aircraft Insulation Market, by Aircraft Type

- Aircraft Insulation Market, by Installation Form

- Aircraft Insulation Market, by Temperature Range

- Aircraft Insulation Market, by Application

- Aircraft Insulation Market, by Region

- Aircraft Insulation Market, by Group

- Aircraft Insulation Market, by Country

- United States Aircraft Insulation Market

- China Aircraft Insulation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Concluding Insights Emphasizing the Strategic Imperatives and Emerging Opportunities in the Evolving Aircraft Insulation Sector

As aircraft manufacturers and operators strive to meet stringent safety, performance, and sustainability targets, advanced insulation solutions will play a pivotal role in achieving thermal regulation, noise reduction, and fire protection objectives without compromising weight budgets. The interplay of evolving trade policies, material innovations, and regional investment incentives underscores the strategic necessity of agile supply chains and technology partnerships. Legacy fiber and foam systems continue to serve core market segments, while next-generation aerogels and adaptive acoustic materials are rapidly transitioning from experimental labs into revenue-generating applications. Regional maturity and regulatory landscapes will shape adoption trajectories, with North America and Europe leading in certification of novel composites, and Asia-Pacific reinforcing scale economies for mass-market deployment. Executives must integrate tariff foresight, R&D collaboration, and digital engineering tools to harness emerging opportunities and mitigate headwinds. The convergence of performance demands and environmental commitments will ultimately define the next chapter of aircraft insulation, rewarding those who invest in resilient, sustainable, and multi-functional barrier solutions.

Connect Directly with Ketan Rohom to Acquire the In-Depth Aircraft Insulation Market Research Report Tailored for Strategic Decision Making

To gain comprehensive access to the full suite of insights, data tables, and detailed analysis within this aircraft insulation market research report, connect directly with Ketan Rohom at your earliest convenience. Ketan Rohom, Associate Director of Sales & Marketing, offers personalized walkthroughs of the report’s findings, tailored demonstrations of key forecast models, and strategic consultations on applying these insights within your organization’s operational framework. Initiate a conversation with Ketan to explore custom research add-ons, competitive intelligence modules, or bespoke market deep-dives that align with your specific objectives. By partnering with Ketan, you secure direct support for informed decision making and unlock the full potential of this rigorous market study for enhanced strategic positioning and competitive advantage

- How big is the Aircraft Insulation Market?

- What is the Aircraft Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?