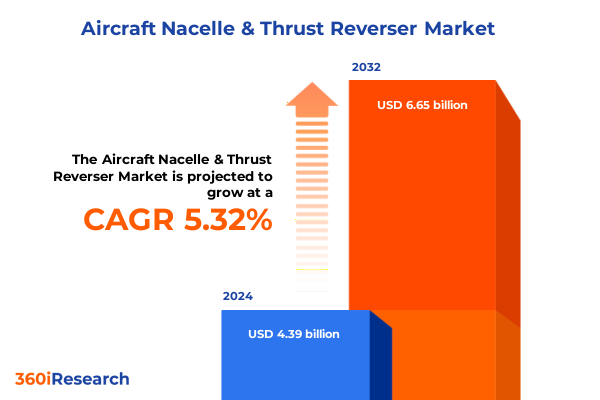

The Aircraft Nacelle & Thrust Reverser Market size was estimated at USD 4.58 billion in 2025 and expected to reach USD 4.78 billion in 2026, at a CAGR of 5.46% to reach USD 6.65 billion by 2032.

Unveiling the Strategic Imperatives and Industry Dynamics Shaping the Aircraft Nacelle and Thrust Reverser Market at the Forefront of Aviation Innovation

The aircraft nacelle and thrust reverser market continuously evolves, propelled by advances in materials science, aerodynamics, and manufacturing efficiency. Over recent years, rising demands for fuel efficiency, noise reduction, and structural resilience have triggered an unprecedented wave of innovation. As global travel resumes robustly, stakeholders across the aerospace supply chain are under pressure to optimize design, reduce weight, and enhance reliability, all while adhering to stricter environmental and safety regulations. This introduction sets the stage for a deep dive into the market’s key drivers, emerging challenges, and strategic opportunities.

Clarity of vision and foresight are indispensable for decision-makers seeking to navigate this complex environment. By examining the interplay between technological breakthroughs, regulatory shifts, and shifting customer preferences, this section lays a solid foundation for understanding how future trends will reshape production processes, supplier relationships, and competitive positioning. Through this lens, executives can align their innovation roadmaps with market imperatives and craft strategies tailored to both near-term gains and long-term resilience.

Identifying the Transformative Technological and Operational Shifts Redefining the Aircraft Nacelle and Thrust Reverser Supply Chain Dynamics

Recent years have witnessed transformative shifts driven by digitalization, sustainability mandates, and the pursuit of performance. Additive manufacturing and digital twin technologies now underpin design validation and rapid prototyping cycles, allowing engineers to simulate aerodynamic stresses and thermal loads more accurately than ever before. This convergence of virtual testing and advanced fabrication techniques accelerates time to market and reduces costly rework. Concurrently, airlines and regulators are placing heightened emphasis on carbon emissions and noise pollution, prompting the adoption of lightweight composite materials and acoustic liners that balance structural integrity with environmental compliance.

Operationally, strategic partnerships between OEMs and Tier-1 suppliers are evolving to foster co-development models rather than traditional buyer-seller relationships. Such collaborations integrate supply chain resilience into early-stage design discussions, mitigating risks associated with component scarcity and geo-political disruptions. Additionally, maintenance-repair-overhaul service providers are embedding predictive analytics into their offerings, enabling condition-based maintenance schedules that reduce unscheduled downtime and enhance fleet availability. Together, these dynamics are redefining how the industry approaches product development, procurement, and lifecycle support, signaling a paradigm shift toward more integrated, data-driven ecosystems.

Assessing the Extended Ramifications of 2025 United States Tariffs on Aircraft Nacelle and Thrust Reverser Production and Global Trade Flows

The imposition of new United States tariffs in 2025 has introduced a layer of complexity that ripples through design, sourcing, and aftersales service models. Components previously imported under favorable terms now face elevated duties, compelling OEMs and MRO providers to reassess supplier networks and explore nearshoring options. The cost inflation triggered by tariffs on raw materials and sub-assemblies exerts upward pressure on manufacturing budgets and maintenance contracts. In response, some industry players are negotiating long-term supply agreements with domestic fabricators to secure stable pricing and delivery schedules.

Beyond direct cost increases, tariffs influence strategic sourcing decisions by altering the relative competitiveness of foreign versus domestic producers. Companies emphasizing vertical integration have accelerated investments in in-country production facilities, aiming to circumvent tariff burdens and fortify supply chain resilience. At the same time, end users are scrutinizing total lifecycle costs more closely, recognizing that higher upfront expenses may be offset by improved operational reliability and reduced exposure to trade policy fluctuations. This recalibration underscores the critical importance of adaptive procurement strategies and comprehensive scenario planning at the executive level.

Extracting Critical Segmentation Insights to Illuminate Product Variances, Material Preferences, Distribution Channels, and End User Demands

An in-depth evaluation of segmentation reveals that product type differentiation drives distinct design and commercialization pathways. The market bifurcates into two primary categories: nacelles and thrust reversers. Within nacelles, demands vary significantly between engine build-ups, pylons, fan cowls, and landing gear doors, each presenting unique aerodynamic and structural requirements. Conversely, thrust reverser solutions split into cascade and clamshell configurations, with each architecture optimized for specific aircraft classes and performance criteria. Understanding these nuances is vital for suppliers crafting bespoke solutions that align with aircraft OEM specifications and performance benchmarks.

Material selection emerges as a pivotal factor influencing cost, weight, and durability. Aluminum alloys continue to dominate certain applications due to their favorable strength-to-weight ratio and cost effectiveness, while advanced composites are gaining traction for their corrosion resistance and weight reduction advantages. Titanium, with its exceptional heat tolerance and fatigue strength, remains indispensable for high-stress components. Distribution channels further nuance the landscape; OEM partnerships drive product innovation through collaborative development, while aftermarket networks focus on service life extension and component refurbishment. End users encompass business aviation operators prioritizing customization, commercial airlines seeking operational efficiency, and defense customers requiring stringent performance standards. Each segment’s unique priorities shape procurement criteria and partner selection frameworks.

This comprehensive research report categorizes the Aircraft Nacelle & Thrust Reverser market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- End User

- Distribution Channel

Highlighting Regional Divergences and Growth Drivers across the Americas, Europe Middle East Africa, and Asia-Pacific Aviation Markets

Regional dynamics underscore how diverse economic and regulatory environments influence market trajectories. In the Americas, robust defense spending and the presence of major commercial aircraft OEMs anchor demand for both new builds and aftermarket services. Regional MRO hubs leverage existing infrastructure to support fleet expansions and retrofit programs, particularly for narrow-body aircraft. Moving eastward, the Europe Middle East and Africa region exhibits a complex tapestry of mature markets and high-growth corridors. Airlines operating across these geographies demand solutions that balance environmental compliance with cost containment, driving interest in noise-reducing nacelle liners and lightweight thrust reverser mechanisms.

Asia-Pacific stands out as a prolific growth engine, fueled by rising passenger volumes, governmental investments in airport infrastructure, and emerging national carriers. The proliferation of newer aircraft fleets in the region prompts significant aftermarket activity, while local content requirements and growing manufacturing capabilities encourage partnerships between global suppliers and regional fabricators. This evolving landscape highlights the need for region-specific strategies that account for regulatory frameworks, labor cost variances, and localized supply chain networks, thereby enabling stakeholders to capitalize on differentiated growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Aircraft Nacelle & Thrust Reverser market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategies and Competitive Positioning of Leading Original Equipment Manufacturers and Tier-1 Suppliers in the Sector

Leading stakeholders in the nacelle and thrust reverser segment are refining their portfolios to balance innovation with operational reliability. Original equipment manufacturers are integrating advanced aerodynamic modeling and high-precision machining into their development processes, enabling customized solutions for diverse aircraft platforms. Tier-1 suppliers are expanding their capabilities through selective acquisitions and strategic alliances, broadening their material sciences expertise and additive manufacturing capacities. Collaborative ecosystems are emerging in which OEMs, material innovators, and digital platform providers co-create next-generation systems that reduce lead times and enhance component traceability.

Competitive differentiation increasingly hinges on the ability to deliver value-added services alongside core components. Several top players are embedding predictive analytics within their service offerings to anticipate maintenance requirements and optimize turnaround times. Others are investing in sustainable production lines powered by renewable energy, aligning with corporate decarbonization targets and customer expectations. As competition intensifies, companies that demonstrate agility in responding to regulatory shifts, material innovation cycles, and evolving airline procurement mandates will secure leading positions in both new aircraft programs and aftermarket contracts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aircraft Nacelle & Thrust Reverser market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aernnova Aerospace S.A.

- Barnes Group Inc.

- Collins Aerospace

- FACC AG

- GKN Aerospace Limited

- Honeywell International Inc.

- IHI Corporation

- Kawasaki Heavy Industries, Ltd.

- Leonardo S.p.A.

- Magellan Aerospace Corporation

- Safran S.A.

- Spirit AeroSystems, Inc.

- The NORDAM Group LLC

- Triumph Group, Inc.

- Woodward, Inc.

Formulating Actionable Strategic Recommendations to Fortify Supply Chains, Optimize Material Choices, and Mitigate Trade Disruptions

To navigate this dynamic environment, executives must prioritize strategic agility, beginning with diversification of raw material sources to mitigate the impact of tariff fluctuations and supply constraints. Establishing flexible contracts with multiple qualified suppliers will reduce single-source dependencies and strengthen negotiating leverage. Leaders should also accelerate digital transformation initiatives by integrating advanced simulation and real-time monitoring tools, thereby optimizing design cycles and streamlining quality assurance processes.

In parallel, forging cross-industry partnerships can unlock new avenues for innovation, particularly in material sciences and sustainable manufacturing. Collaborations with composites specialists and additive manufacturing experts will yield lightweight, high-performance structures that meet stringent environmental mandates. Finally, embedding risk management frameworks into every tier of the supply chain will enhance visibility and responsiveness; scenario planning for geopolitical developments and trade policy shifts will safeguard continuity of operations and maintain competitive cost structures.

Detailing a Comprehensive Research Framework Incorporating Rigorous Primary and Secondary Methodologies for Data Integrity

This study employs a robust research framework combining primary insights from in-depth interviews with senior executives at OEMs, Tier-1 suppliers, MRO service providers, and regulatory bodies. These qualitative inputs are augmented by extensive secondary research, including technical papers, aerospace trade publications, patent filings, and public filings, to ensure that every analysis layer is grounded in verifiable data. Rigorous data triangulation techniques reconcile disparate sources, while expert validation workshops test emerging hypotheses against real-world operational scenarios.

Quantitative rigor is maintained through meticulous data collection on component specifications, material cost trends, and tariff schedules. Advanced analytics tools facilitate trend mapping and correlation analysis, enabling the identification of causal relationships between regulatory shifts and market responses. Throughout the process, continuous quality checks and peer reviews uphold data integrity, ensuring that conclusions reflect both current realities and plausible near-term developments within the aircraft nacelle and thrust reverser ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aircraft Nacelle & Thrust Reverser market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aircraft Nacelle & Thrust Reverser Market, by Product Type

- Aircraft Nacelle & Thrust Reverser Market, by Material

- Aircraft Nacelle & Thrust Reverser Market, by End User

- Aircraft Nacelle & Thrust Reverser Market, by Distribution Channel

- Aircraft Nacelle & Thrust Reverser Market, by Region

- Aircraft Nacelle & Thrust Reverser Market, by Group

- Aircraft Nacelle & Thrust Reverser Market, by Country

- United States Aircraft Nacelle & Thrust Reverser Market

- China Aircraft Nacelle & Thrust Reverser Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Deliver a Cohesive Understanding of Market Trajectories and Strategic Imperatives for Stakeholders

The convergence of material innovation, digital integration, and geopolitical dynamics delineates the future contours of the nacelle and thrust reverser market. Stakeholders that embrace diversified sourcing strategies, invest in advanced manufacturing techniques, and cultivate collaborative ecosystems will gain a decisive competitive edge. Regional variances underscore the need for tailored approaches, and the evolving tariff environment reinforces the value of proactive risk management. Ultimately, success hinges on the ability to anticipate disruptions, harness technological breakthroughs, and align product development with emerging customer and regulatory imperatives.

This executive summary has outlined the most significant trends, challenges, and opportunities shaping the sector. By synthesizing segmentation and regional analyses with strategic recommendations, it equips decision-makers with a holistic perspective for informed action. Organizations that integrate these insights into their planning processes will not only navigate present complexities but also chart a course for sustained growth and innovation.

Driving Market Engagement through Direct Collaboration with Ketan Rohom for Access to the Full Aircraft Nacelle and Thrust Reverser Report

To secure an in-depth understanding of the evolving aircraft nacelle and thrust reverser landscape, we invite you to contact Ketan Rohom, Associate Director of Sales & Marketing, to obtain the full research report. His expertise and personalized guidance will ensure that your organization gains comprehensive insights tailored to strategic decision-making. Engage with Ketan to explore the report’s full breadth of data and analysis, enabling your team to leverage actionable intelligence and stay ahead of market disruptions.

- How big is the Aircraft Nacelle & Thrust Reverser Market?

- What is the Aircraft Nacelle & Thrust Reverser Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?