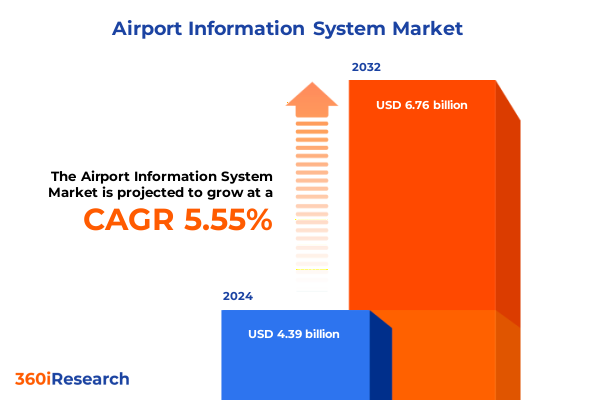

The Airport Information System Market size was estimated at USD 4.62 billion in 2025 and expected to reach USD 4.86 billion in 2026, at a CAGR of 5.59% to reach USD 6.76 billion by 2032.

Establishing the Foundation of Modern Airport Information Systems with In-Depth Overview of Operational Needs, Emerging Technologies, and Strategic Priorities

In an era defined by rapid technological convergence and rising passenger expectations, modern airport information systems serve as the nerve center for seamless operational coordination and superior traveler experiences. These systems synthesize complex data streams-from flight schedules and baggage handling statuses to security alerts and passenger wayfinding-ensuring that every touchpoint within the airport ecosystem remains synchronized and responsive.

The convergence of cloud computing, artificial intelligence, and Internet of Things (IoT) technologies has elevated airport information systems from mere data repositories to dynamic, intelligence-driven platforms. This evolution enables real-time analytics, predictive maintenance, and proactive passenger engagement strategies, positioning airports to adapt rapidly to fluctuating demand patterns and emerging security threats.

As global air travel rebounds from recent disruptions and embraces growth trajectories, airport operators and technology integrators face mounting pressure to deploy scalable, resilient, and interoperable solutions. Understanding the foundational elements-ranging from hardware components such as interaction kiosks and sensors to the software architectures that drive system intelligence-provides the strategic context necessary for informed decision-making.

This introduction sets the stage for an in-depth exploration of the airport information systems landscape, highlighting the critical interplay between operational needs, emergent technologies, and strategic priorities that will define future investment and deployment strategies.

Illuminating Transformative Shifts Shaping Airport Information Systems by Examining Digitalization, Data Intelligence, Self-Service, and Resilient Operational Models

The airport information systems landscape is undergoing transformative shifts as stakeholders prioritize digitalization, operational resilience, and passenger centricity. The proliferation of self-service solutions, such as interactive kiosks and mobile check-in platforms, reflects a broader move toward contactless interactions that enhance throughput while reducing touchpoints. These self-service channels are underpinned by advanced sensor networks and edge computing frameworks that deliver precise, low-latency data to central analytics engines.

Simultaneously, the adoption of biometric authentication and AI-driven surveillance tools is reshaping airport security paradigms. Machine learning models now enable real-time threat detection and risk assessment across sprawling terminal complexes, streamlining security checkpoints without compromising vigilance. Concurrently, cloud-native architectures facilitate rapid scaling of compute resources, allowing operators to accommodate peak traffic surges and streamline software updates with minimal disruption.

Another pivotal shift involves the integration of open APIs and standards, which foster interoperability among disparate systems-ranging from flight information displays to baggage handling networks. This standardization accelerates deployment cycles for new services while lowering total cost of ownership by reducing vendor lock-in. Moreover, the growing emphasis on data analytics and predictive maintenance ensures that hardware components such as sensors and servers remain operationally efficient, thereby maximizing uptime and reducing lifecycle costs.

Together, these transformative changes herald a new era of adaptive, intelligence-driven airport operations where information flows seamlessly across security, passenger services, and back-end maintenance workflows, driving both efficiency and elevated traveler satisfaction.

Assessing the Cumulative Impact of United States Tariffs in 2025 on Airport Information System Supply Chains, Component Costs, and Strategic Sourcing Dynamics

As United States tariffs implemented in 2025 continue to reverberate across global supply chains, airport information systems-particularly hardware-dependent segments-have experienced pronounced cost pressures. Interaction kiosks, sensors, and servers, often sourced from key manufacturing hubs abroad, have seen unit prices escalate, compelling procurement teams to reassess vendor contracts and total cost implications.

These import tariffs have also accelerated the shift toward domestic and nearshore suppliers capable of meeting stringent quality and compliance requirements without the unpredictability of tariff-induced price fluctuations. In response, leading system integrators have expanded partnerships with local manufacturers, investing in localized assembly lines and joint innovation centers to mitigate supply chain disruptions. This strategic pivot has not only fostered greater agility in component sourcing but also stimulated domestic job growth within the airport infrastructure sector.

Service-based segments have felt the impact as well, with consulting, installation, and maintenance contracts being restructured to account for higher hardware costs. Providers are increasingly offering bundled service agreements that bundle hardware lifecycle management with remote diagnostics and predictive maintenance analytics, thereby optimizing total cost of ownership in a high-tariff environment.

Looking ahead, organizations that proactively diversify supply networks and leverage modular, cloud-compatible architectures will be best positioned to absorb tariff shocks and sustain continuous innovation. By embedding flexibility into both hardware procurement and service delivery models, airport operators and technology partners can maintain forward momentum despite evolving trade policies.

Revealing Key Segmentation Insights for Airport Information Systems across Component Layers, System Types, Airport Sizes, Deployment Modes, and End-User Profiles

Insight into the airport information systems market emerges when dissecting multiple segmentation dimensions concurrently. By component, the interdependence of hardware offerings such as interaction kiosks, advanced sensors, and high-availability servers with the complementary layers of software and professional services becomes evident. Consulting expertise guides system architecture decisions, while installation teams ensure seamless integration of hardware components and maintenance services sustain operational continuity through proactive diagnostics.

Shifting focus to system type reveals the nuanced demands of airport operational databases, security solution suites, baggage handling architectures, flight information display networks, passenger information systems, and public announcement frameworks. Within baggage handling systems specifically, the interplay between conveyor mechanisms and explosive detection technologies underscores the critical requirement for synchronization across safety and throughput objectives, driving integrators to harmonize mechanical engineering with smart analytics.

Size of airport introduces another layer of complexity, as large hub airports demand scalable, high-throughput configurations capable of supporting millions of annual passengers, whereas medium and small hubs prioritize cost-effective, modular deployments that align with budget constraints and phased growth strategies. This divergence influences architectural decisions across hardware, software, and service commitments, compelling solution providers to tailor offerings accordingly.

Deployment mode further refines the market landscape, contrasting on-cloud solutions that offer rapid scalability, centralized management, and frequent updates with on-premises architectures prized for localized control, data sovereignty, and offline resilience. Finally, the diverse portfolio of end-users-including airline operators, airport authorities, government agencies, and ground handling service providers-imbues each deployment with distinct compliance, performance, and usability requirements. Together, these segmentation insights illuminate a market characterized by layered complexity and the need for highly customizable, interoperable solutions.

This comprehensive research report categorizes the Airport Information System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Size of Airport

- System Type

- Technology

- Deployment Mode

- Application

- End-User

Unpacking Regional Dynamics Influencing Global Airport Information Systems through Comparative Analysis of the Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional market dynamics exhibit stark contrasts shaped by regulatory frameworks, passenger volumes, and infrastructure investment cycles. In the Americas, particularly North America, high levels of digital maturity and rigorous security mandates have spurred rapid adoption of biometrics and advanced analytics within major carrier hubs. Investment priorities center on modernizing legacy baggage handling and flight information display systems to support next-generation passenger experiences and operational resilience in the face of labor constraints.

Across Europe, the Middle East, and Africa, interoperability and standardization initiatives-driven by cross-border travel corridors and regulatory bodies-dominate the agenda. European airports emphasize alignment with EU cybersecurity directives and sustainability targets, integrating energy-efficient hardware and carbon-monitoring dashboards into the information system stack. Meanwhile, emerging hubs in the Middle East leverage state funding to deploy large-scale, technologically advanced terminals that showcase AI-enabled passenger flow management and multilingual wayfinding solutions.

Within the Asia-Pacific region, surging passenger growth and government-led infrastructure expansions underpin significant demand for scalable, cloud-native airport information systems. High-traffic airports in China and India prioritize automated baggage handling enhancements and multilingual passenger information displays, while Southeast Asian hubs focus on cost-effective security screening upgrades and mobile-first check-in experiences. These regional patterns underscore the imperative for solution providers to calibrate offerings to distinct regulatory, economic, and cultural contexts across global markets.

This comprehensive research report examines key regions that drive the evolution of the Airport Information System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting Competitive Dynamics and Strategic Positioning of Leading Airport Information System Providers Driving Innovation, Partnerships, and Market Differentiation

Competitive dynamics within the airport information systems sector illustrate a blend of established technology vendors, specialized security integrators, and emerging software innovators. Leading incumbents differentiate through end-to-end portfolios that span consulting, hardware deployment, and managed services, leveraging global delivery networks to support large hub airport rollouts. Meanwhile, security-focused firms capitalize on proprietary algorithms and sensor fusion techniques to capture market share in biometric authentication and advanced threat detection.

A growing cohort of software-centric entrants is challenging traditional players by introducing cloud-native platforms that emphasize rapid feature releases and modular integration via open APIs. These disruptors often partner with hardware specialists to deliver turnkey solutions that combine best-in-class sensor arrays with real-time analytics dashboards. Such collaborative models have accelerated time-to-market for advanced passenger information systems and automated public announcement frameworks.

Strategic alliances between airlines, airport authorities, and systems integrators are also reshaping competition. Joint innovation labs focus on co-developed applications-such as AI-driven passenger sentiment analysis and predictive baggage routing-while revenue-sharing arrangements align incentives across stakeholders. These shifting alliances underscore the importance of agile collaboration models and reinforce the value of a multi-partner ecosystem to drive continued innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airport Information System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADB SAFEGATE

- Airport Information Systems Ltd

- Amadeus IT Group, S.A.

- Atos SE

- CGI Inc

- Damarel Systems International Ltd

- Eaton Corporation plc

- Frequentis AG

- Fujitsu Limited

- Honeywell International Inc.

- Indra Sistemas, S.A.

- International Business Machines Corporation

- L3Harris Technologies, Inc.

- Leidos Holdings, Inc.

- Leonardo S.p.A.

- NEC Corporation

- Northrop Grumman Corporation

- RESA Airport Data Systems

- Saab AB

- Siemens AG

- SITA NV

- Tata Consultancy Services Limited

- TAV Technologies

- Thales S.A.

- Wipro Limited

Defining Actionable Recommendations for Industry Leaders to Enhance Airport Information Systems through Strategic Investment, Technological Partnerships, and Operational Excellence

Industry leaders should prioritize the adoption of modular, scalable architectures that decouple core operational functions from emerging passenger engagement features. By investing in microservices and containerized deployments, airport operators can accelerate the rollout of new capabilities-such as biometric checkpoints and context-aware wayfinding-while minimizing disruption to existing workflows.

To mitigate supply chain volatility, organizations are advised to cultivate relationships with diversified hardware suppliers and explore nearshore manufacturing options. This approach enhances resilience against future trade policy shifts and ensures steady access to critical components like sensors and interaction kiosks. Complementing this, embedding predictive maintenance analytics within service contracts can optimize lifecycle costs for servers, conveyors, and explosive detection systems.

Developing a clear roadmap for migrating to cloud-native platforms is essential for unlocking advanced data analytics and AI-driven insights. Industry leaders should conduct pilot programs to evaluate hybrid deployments that balance centralized data management with on-premises control for mission-critical workloads. Training and change-management initiatives must accompany technological transitions to equip operations teams and security personnel with the skills needed to maximize system uptime and passenger satisfaction.

Finally, forging collaborative partnerships across airlines, ground handlers, and government bodies can accelerate co-innovation. Shared data lakes and joint analytics projects unlock efficiencies in flight information management, baggage reconciliation, and security screening, creating a unified, data-driven ecosystem that benefits all stakeholders.

Outlining Robust Research Methodology Employed to Derive Insights on Airport Information Systems including Data Collection, Analysis Frameworks, and Validation Processes

The research underpinning this analysis integrates a dual approach combining quantitative data aggregation with qualitative expert interviews. Secondary data sources include regulatory filings, industry white papers, and technical standards documentation, ensuring a comprehensive understanding of evolving compliance requirements and technology roadmaps.

Primary research consisted of structured consultations with senior executives from airlines, airport authorities, ground handling service providers, and leading systems integrators. These conversations provided nuanced perspectives on deployment challenges, investment priorities, and emerging use cases for advanced analytics and security solutions.

Data triangulation techniques were applied to validate findings across disparate sources, reconciling vendor-reported capabilities with firsthand operational feedback. An analysis framework assessing technological maturity, deployment complexity, and user adoption informed the segmentation insights, while scenario modeling captured the potential impacts of policy changes and tariff adjustments.

Throughout the research process, methodological rigor was maintained via peer reviews and advisory committee validations, ensuring that the insights presented reflect the latest industry dynamics and strategic best practices relevant to airport information systems stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airport Information System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airport Information System Market, by Component

- Airport Information System Market, by Size of Airport

- Airport Information System Market, by System Type

- Airport Information System Market, by Technology

- Airport Information System Market, by Deployment Mode

- Airport Information System Market, by Application

- Airport Information System Market, by End-User

- Airport Information System Market, by Region

- Airport Information System Market, by Group

- Airport Information System Market, by Country

- United States Airport Information System Market

- China Airport Information System Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Concluding Strategic Takeaways on Airport Information Systems Emphasizing Critical Insights, Unresolved Challenges, and Paths Forward for Stakeholder Decision-Making

The evolving landscape of airport information systems underscores the critical need for adaptive, intelligence-driven platforms that harmonize operational efficiency with passenger experience excellence. Key transformative shifts-ranging from cloud-native deployments and open ecosystem integrations to AI-enabled security screening and predictive maintenance-have set new benchmarks for resilience and scalability.

Tariff-induced cost pressures in 2025 have catalyzed a strategic reorientation toward domestic sourcing and modular architectures, reinforcing the importance of supply chain agility. Meanwhile, segmentation insights highlight that one-size-fits-all approaches are no longer viable; bespoke, context-sensitive solutions tailored to component layers, system types, airport sizes, deployment modes, and end-user requirements are paramount.

Regional dynamics further illustrate that regulatory, economic, and cultural factors exert significant influence over technology adoption patterns across the Americas, EMEA, and Asia-Pacific. Providers seeking to succeed globally must navigate this mosaic through flexible offerings and region-specific partnerships.

As competitive pressures intensify, collaboration among airlines, authorities, and integrators will drive co-innovation and unlock new pathways for efficiency. By embracing the recommended strategies-modular architectures, diversified supply chains, cloud migration roadmaps, and stakeholder alliances-organizations can chart a path toward sustained operational excellence and passenger satisfaction.

Empowering Stakeholder Engagement with Ketan Rohom for Comprehensive Airport Information Systems Report Acquisition and Tailored Strategic Consultation Opportunities

To secure comprehensive insights tailored to your strategic needs and operational objectives, engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore customized licensing options and exclusive advisory services that will equip your organization with the critical intelligence required to navigate the evolving airport information systems landscape. By collaborating with Ketan Rohom, you gain privileged access to in-depth data, expert interpretation of emerging trends, and guided frameworks for translating research findings into high-impact initiatives. Accelerate your decision-making process and unlock the full value of our flagship airport information systems market report by initiating a conversation with Ketan today.

- How big is the Airport Information System Market?

- What is the Airport Information System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?