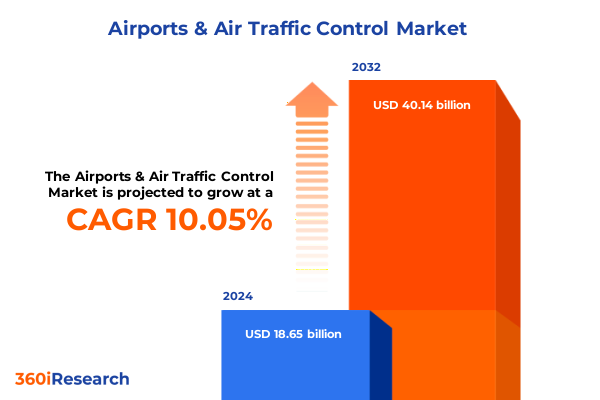

The Airports & Air Traffic Control Market size was estimated at USD 20.49 billion in 2025 and expected to reach USD 22.36 billion in 2026, at a CAGR of 10.08% to reach USD 40.14 billion by 2032.

Envisioning the Future of Air Traffic Control Through Technological Innovation and Policy Evolution to Address Emerging Operational and Safety Demands

The air traffic control landscape is undergoing a profound transformation shaped by rapid technological advancements and evolving regulatory frameworks. As global air traffic steadily rebounds to pre-pandemic levels, there is an accelerating demand for systems that can manage increased flight volumes while maintaining the highest safety and efficiency standards. This resurgence is accompanied by a renewed focus on digital integration, where traditional radar-based monitoring converges with satellite-based surveillance and advanced data analytics to create a more resilient and adaptive airspace infrastructure.

Industry stakeholders are responding to these challenges by investing in next-generation communication, navigation, and surveillance systems designed to support seamless information exchange between pilots, controllers, and automated decision-support platforms. Regulatory bodies have also introduced initiatives to harmonize air traffic management protocols, paving the way for collaborative decision-making models that enhance situational awareness and resource optimization. In parallel, there is a growing emphasis on sustainability, driving efforts to reduce fuel consumption and minimize environmental impact through optimized routing and continuous descent approaches.

Against this backdrop, organizations must navigate a complex interplay of operational pressures, technological innovation cycles, and policy mandates. This report provides an in-depth analysis of the key drivers, obstacles, and opportunities shaping the future of air traffic control, offering a strategic roadmap to guide decision-makers toward resilient growth and operational excellence.

Navigating the Transformative Shifts Redefining Air Traffic Control Operations Driven by Digital Integration, Automation, and Collaborative Airspace Management

The air traffic control domain is witnessing an unprecedented wave of transformative shifts driven by automation, connectivity, and data-driven decision-making. The convergence of Internet of Things (IoT) sensors, artificial intelligence, and machine learning algorithms is enabling predictive maintenance of critical hardware components and enhancing threat detection capabilities. These technologies are not only improving the reliability of amplifiers, antennas, sensors, and radar installations but are also streamlining operational workflows by reducing manual interventions and minimizing human error.

Simultaneously, the evolution from ground-based radar to satellite-based surveillance systems is redefining how airspace is monitored, offering greater coverage, especially in remote oceanic and polar regions. This shift supports continuous tracking of aircraft trajectories and reduces reliance on legacy infrastructures that are susceptible to outages and maintenance challenges. Moreover, collaborative decision-making platforms are fostering interoperability among air navigation service providers, airlines, and airport operators, resulting in more agile responses to weather disruptions, airspace congestion, and emergency scenarios.

These shifts underscore a broader trend toward integrated, cloud-enabled ecosystems that facilitate real-time data sharing across stakeholders. As a result, communication systems are being upgraded to support higher bandwidth and lower latency, while database management and incident management software are becoming central to centralized command centers that orchestrate complex traffic flows. By embracing these transformative trends, industry participants are positioning themselves to meet the demands of a dynamic ecosystem where safety, efficiency, and environmental stewardship coalesce.

Assessing the Cumulative Impact of 2025 Tariff Measures on the United States Air Traffic Control Ecosystem and Key Supply Chain Dynamics

Recent tariff measures implemented by the United States in early 2025 have introduced additional duties on a range of communications, surveillance, and radar components imported from certain key suppliers. These levies have had a cascading effect on the cost structures for hardware modules such as amplifiers, antennas, cameras, displays, modulators, demodulators, radar units, and sensors. As OEMs and system integrators face elevated input costs, there is a growing pressure to pass these expenses onto end users or absorb them through margin compression.

Moreover, the cumulative impact of these tariffs extends into the software domain, where database management systems and incident management platforms rely on hardware capable of supporting higher data throughput and secure connectivity. System type categories including communication systems, navigation systems, and surveillance systems have experienced price adjustments to account for increased procurement costs, prompting stakeholders to reevaluate sourcing strategies and inventory planning. Applications encompassing approach control, en route control, terminal control, and tower control have had to budget for upgraded hardware with tariff-adjusted premiums, fueling demand for alternative suppliers or domestic manufacturing partnerships.

This tariff environment has also influenced technology adoption curves. While radar-based systems continue to be impacted by import duties, emerging satellite-based alternatives have gained traction, driven by relatively lower tariff exposure and potential for indigenous satellite solutions. End users across civil aviation, general aviation, and military sectors are reassessing long-term procurement roadmaps to mitigate the financial impact, balancing the need for operational modernization against cost containment imperatives.

Illuminating Key Segmentation Insights into Components, Systems, Applications, Technologies, and End Users Shaping Air Traffic Control Market Strategies Worldwide

Examining the market through the lens of component segmentation reveals distinct growth trajectories and investment priorities across hardware, services, and software offerings. Within hardware, the focus on amplifiers, antennas, cameras, displays, encoders and decoders, modulators and demodulators, radar, and sensors underscores a continued appetite for high-performance transmission and detection platforms. Service portfolios, ranging from installation and maintenance to training and consultancy, are increasingly valued for their role in ensuring system uptime and regulatory compliance. Software platforms, particularly those centered on database management systems and incident management, are gaining prominence as control centers seek to leverage real-time data flows and analytics to enhance decision support.

By system type, communication systems are evolving to support next-generation datalink protocols and secure voice channels, while navigation systems are integrating advanced positioning and timing technologies to facilitate precise approach and departure procedures. Surveillance systems are migrating toward hybrid models that combine ground-based radar and satellite-derived ADS-B data, enabling comprehensive coverage and redundancy. In application contexts, approach control solutions are optimized for trajectory-based operations, en route control is adopting performance-based navigation frameworks, terminal control is focusing on surface movement guidance, and tower control is leveraging digital towers and remote tower services to improve smaller airport operations.

From a technological perspective, radar-based systems continue to underpin the bulk of airspace monitoring infrastructures, but satellite-based systems are rapidly scaling up, offering flexible deployment models and enhanced situational awareness. Finally, end users spanning civil aviation, general aviation, and military segments each demonstrate unique procurement drivers-ranging from commercial capacity expansion and fleet modernization to mission-critical interoperability and national defense mandates-shaping tailored solution roadmaps that align with their operational risk profiles and strategic objectives.

This comprehensive research report categorizes the Airports & Air Traffic Control market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Technology

- End User

- Application

Unveiling Key Regional Insights That Highlight Distinct Operational Trends, Investment Priorities, and Regulatory Landscapes Across Major Global Markets

Regional analysis uncovers divergent patterns in investment, regulatory evolution, and technology adoption across the Americas, Europe Middle East & Africa, and Asia-Pacific markets. In the Americas, the United States remains at the forefront of NextGen modernization efforts, underpinned by robust federal funding for radar upgrades, ADS-B implementation, and cybersecurity enhancements. Both civil and general aviation operators are leveraging performance-based navigation and trajectory management to reduce fuel burn and emissions, while the military continues to prioritize integrated air defense solutions.

Within Europe Middle East & Africa, regulatory harmonization under the Single European Sky initiative is driving cross-border interoperability and data exchange. Several Middle Eastern hubs are investing heavily in satellite-based surveillance to support their expanding international air traffic networks, whereas African nations are undertaking incremental ground-based system rollouts, often in collaboration with international development agencies, to bolster aviation safety and compliance.

The Asia-Pacific region exhibits some of the fastest growth in air traffic volumes, propelled by burgeoning domestic markets in China and India and ambitious infrastructure projects throughout Southeast Asia. Civil aviation authorities are accelerating the adoption of next-generation communication systems and remote tower services to address capacity constraints, while general aviation markets seek cost-effective solutions for regional connectivity. Across all regions, a common thread emerges: the imperative to balance modernization goals with fiscal discipline, regulatory compliance, and environmental sustainability.

This comprehensive research report examines key regions that drive the evolution of the Airports & Air Traffic Control market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Innovators and Established Players Driving Technological Advancements and Strategic Partnerships in Air Traffic Control Solutions Globally

Leading technology providers and system integrators are shaping the competitive landscape through strategic partnerships, targeted acquisitions, and continuous innovation. Established defense and aerospace companies are extending their portfolios beyond core radar and surveillance systems to include comprehensive digital solutions encompassing advanced data analytics, cybersecurity frameworks, and cloud-native command and control platforms. These ecosystem plays are further strengthened by joint ventures with satellite operators and telecommunications firms to deliver integrated surveillance-as-a-service offerings.

At the same time, specialist software developers are gaining traction by offering modular database management and incident management tools that can be rapidly configured to local regulatory requirements. These solutions enable air navigation service providers to implement agile, incremental enhancements without the need for large capital outlays. Hardware vendors are responding to the shift by introducing compact, energy-efficient amplifiers, antennas, and sensor arrays designed for modular installations and ease of maintenance, thereby reducing total cost of ownership.

Across civil aviation, general aviation, and military segments, the focus on interoperability, cybersecurity, and scalability is driving suppliers to offer end-to-end managed services, from initial system design and procurement to lifecycle maintenance and training. This trend underscores the importance of collaborative innovation and customer-centric service models, which together are setting new benchmarks for performance, reliability, and compliance in the air traffic control market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Airports & Air Traffic Control market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Frequentis AG

- HENSOLDT AG

- Honeywell International Inc.

- Indra Sistemas, S.A.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Saab AB

- Thales SA

Empowering Leaders with Actionable Recommendations to Navigate Regulatory Complexities, Leverage Emerging Technologies, and Optimize Operational Efficiency

Industry leaders must prioritize a strategic action plan that addresses regulatory shifts, supply chain resilience, and technology adoption. To mitigate tariff-related cost pressures, organizations should diversify supplier portfolios by engaging with domestic manufacturers and exploring alternative sourcing from allied markets. Concurrently, investing in research and development of satellite-based surveillance and open-architecture software platforms will reduce reliance on legacy systems and unlock operational agility.

Navigating an increasingly complex regulatory environment requires proactive engagement with policymakers and participation in standards bodies. By collaborating on performance-based navigation and cybersecurity guidelines, stakeholders can influence rule-making processes while ensuring early alignment with evolving compliance requirements. Operational resilience is further enhanced by adopting predictive maintenance frameworks driven by real-time sensor data and AI-based analytics, which can significantly reduce unplanned downtime and extend system life cycles.

Finally, cultivating strategic partnerships across the value chain-from satellite operators to telecommunications providers-will enable the development of integrated service offerings that meet end-user demands for flexible, scalable, and secure air traffic management solutions. This holistic approach to innovation, risk management, and ecosystem collaboration is essential for maintaining competitive advantage and driving sustainable growth in the dynamic air traffic control sector.

Detailing a Rigorous Methodology Integrating Primary Stakeholder Interviews, Secondary Data Analysis, and Data Triangulation to Deliver Actionable Insights

The research methodology underpinning this report combines primary stakeholder insights, rigorous secondary data analysis, and robust triangulation to deliver credible, actionable findings. The primary research phase included in-depth interviews with senior executives from air navigation service providers, hardware vendors, software developers, and regulatory authorities. These discussions provided nuanced perspectives on operational priorities, investment criteria, and emerging risks that are shaping market dynamics.

Secondary research incorporated a comprehensive review of industry publications, government policy announcements, technical standards, and patent filings to map technology trends and competitive positioning. Relevant regulatory documents and tariff schedules were analyzed to quantify the impact of trade measures on component costs and procurement strategies. Data triangulation was achieved by cross-validating quantitative cost models with qualitative interview feedback, ensuring that both macroeconomic factors and operational realities are accurately reflected.

This multi-layered methodology ensures that the report’s conclusions are grounded in a balanced synthesis of empirical evidence and expert judgment, offering decision-makers an authoritative foundation for strategic planning and investment prioritization in the air traffic control domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Airports & Air Traffic Control market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Airports & Air Traffic Control Market, by Component

- Airports & Air Traffic Control Market, by System Type

- Airports & Air Traffic Control Market, by Technology

- Airports & Air Traffic Control Market, by End User

- Airports & Air Traffic Control Market, by Application

- Airports & Air Traffic Control Market, by Region

- Airports & Air Traffic Control Market, by Group

- Airports & Air Traffic Control Market, by Country

- United States Airports & Air Traffic Control Market

- China Airports & Air Traffic Control Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Strategic Insights That Illuminate Key Findings and Industry Implications to Guide Stakeholders and Foster Innovation in Air Traffic Control Ecosystem

The analysis highlights several pivotal trends that are redefining air traffic control: the acceleration of digital transformation, the strategic shift toward satellite-based surveillance, the operational implications of recent tariff measures, and the critical role of modular, service-centric business models. Collectively, these forces are driving a more interconnected, resilient, and adaptable air traffic management ecosystem that can effectively accommodate growing flight volumes while upholding stringent safety and environmental standards.

Key findings underscore the necessity for stakeholders to embrace open architectures, invest in AI-driven analytics, and engage proactively with regulatory frameworks to secure early mover advantages. The segmentation insights reveal that hardware vendors must innovate around energy efficiency and modularity, while software providers focus on customizable incident management and database solutions. Regional distinctions emphasize that the Americas lead in modernization funding, Europe Middle East & Africa prioritize interoperability, and Asia-Pacific pursues rapid capacity expansion.

Ultimately, the convergence of technology innovation, policy evolution, and collaborative partnerships will determine which organizations emerge as leaders in the next generation of air traffic control. By synthesizing these insights, decision-makers can craft strategies that balance risk, cost, and performance, securing a path to sustainable growth and operational excellence.

Take Action Today to Obtain Comprehensive Air Traffic Control Market Insights and Collaborate with Ketan Rohom to Drive Your Strategic Growth Through Research

Engaging with Ketan Rohom offers an unparalleled opportunity to transform how your organization leverages market intelligence and actionable strategic insights. With a blend of deep industry expertise and a forward-looking perspective, Ketan’s consultative approach ensures each engagement is tailored to your specific challenges and growth objectives. By collaborating directly with Ketan, you gain access to the latest analytical frameworks, proprietary data interpretation methods, and bespoke advisory services that align with your operational priorities.

Seize the moment to equip your team with comprehensive research methodologies and nuanced market perspectives that empower decisive action. Whether you aim to refine product roadmaps, optimize supply chain strategies, or prioritize R&D investments, this collaboration will catalyze impactful outcomes. This report offers a foundational blueprint for navigating the evolving air traffic control landscape, and a direct partnership with Ketan Rohom amplifies its value by aligning insights to your organizational context.

Secure your copy today and schedule a strategic consultation with Ketan Rohom to chart the course for sustained competitive advantage and operational excellence in the dynamic world of air traffic control.

- How big is the Airports & Air Traffic Control Market?

- What is the Airports & Air Traffic Control Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?