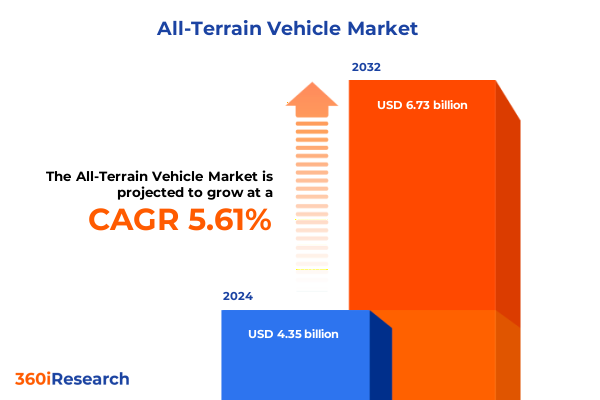

The All-Terrain Vehicle Market size was estimated at USD 4.57 billion in 2025 and expected to reach USD 4.82 billion in 2026, at a CAGR of 5.68% to reach USD 6.73 billion by 2032.

Driving Towards New Horizons in All-Terrain Vehicles with Comprehensive Understanding of Market Dynamics and Strategic Imperatives for Stakeholders

All-terrain vehicles (ATVs) have transcended their traditional recreational roots, emerging as versatile platforms that address a diverse array of applications from agriculture to defense. In recent years, the convergence of consumer demand for high-performance off-road solutions and the drive for sustainability has accelerated innovation across powertrain technologies, materials science, and digital connectivity. Against this backdrop, stakeholders ranging from original equipment manufacturers to aftermarket suppliers are seeking a consolidated perspective that illuminates emerging opportunities and potential disruptions in the market.

This executive summary synthesizes the critical developments shaping the current ATV landscape. It provides a succinct yet comprehensive foundation for understanding how evolving consumer preferences, environmental regulations, and global trade policies intersect to redefine market priorities. By distilling complex data into strategic insights, this overview equips decision-makers with the context needed to align product roadmaps, investment decisions, and operational strategies with broader industry dynamics. As the ATV sector navigates a period of rapid transformation, this introduction lays the groundwork for a deeper exploration of the forces driving change and the imperatives for success.

Embracing Technological Innovations and Sustainability Drivers Reshaping the All-Terrain Vehicle Market Ecosystem for the Next Generation of Mobility Solutions

Over the past few years, the all-terrain vehicle sector has undergone transformative shifts propelled by breakthroughs in electric propulsion, lightweight composite materials, and advanced telematics integration. The rise of battery-electric drivetrains has reduced reliance on traditional internal combustion systems, unlocking new design freedoms and lowering lifecycle emissions. Concurrently, manufacturers are integrating sophisticated connectivity modules that enable real-time performance analytics, predictive maintenance, and seamless navigation in remote environments.

Sustainability has emerged as a pivotal driver, influencing everything from supply chain sourcing to end-of-life vehicle recycling programs. Bio-based polymers and high-strength aluminum alloys are increasingly replacing steel components, resulting in weight reduction and improved fuel economy. In parallel, regulatory frameworks in major markets are tightening emissions targets, encouraging OEMs to accelerate the rollout of hybrid and pure-electric ATV models. These environmental imperatives are catalyzing collaborative partnerships between traditional vehicle manufacturers and technology startups, fuelling a convergence of expertise that reshapes the competitive landscape. As a result, industry participants must continuously adapt product portfolios and invest in new capabilities to maintain relevance in an increasingly eco-conscious market.

Assessing the Far-Reaching Consequences of United States Tariff Measures Implemented in 2025 on Production Supply Chains and Global Trade Dynamics

In 2025, a suite of tariff measures introduced by the United States government has substantially influenced the economics of ATV manufacturing and distribution. By imposing elevated duties on both finished vehicles and critical component imports, the measures have introduced cost pressures that reverberate across supply chains. Original equipment manufacturers have responded by seeking alternative sourcing arrangements, shifting a larger share of component production to tariff-exempt regions in North America to mitigate duty expenditures.

These tariff-driven adjustments have reshaped channel dynamics, with distributors absorbing incremental costs or renegotiating contractual terms to preserve margin structures. Concurrently, aftermarket parts suppliers have experienced heightened demand for domestically produced replacement components, as service providers look to avoid the complexity and delays associated with cross-border shipments. In the medium term, some smaller manufacturers are exploring joint ventures with Canadian and Mexican partners to establish regional assembly facilities that benefit from preferential trade provisions. Collectively, these developments underscore the importance of agile supply chain strategies and proactive regulatory monitoring in maintaining operational resilience amid evolving trade policies.

Unlocking Actionable Insights from Comprehensive Segmentation of All-Terrain Vehicle Demand by Type Engine Capacity End Use Fuel Channel and Application

A nuanced examination of market segmentation reveals critical demand differentials that can inform product development and go-to-market strategies. Based on vehicle type, the landscape is dominated by side-by-side models that combine passenger comfort with cargo flexibility, while sport variants capture the thrill-seeking segment, utility configurations serve work-intensive applications, and youth models introduce early brand engagement. When viewed through the lens of engine capacity, consumer preferences bifurcate between mid-range powertrains in the 300–500Cc band for entry-level affordability, the robust torque and acceleration of 500–800Cc units favored by both recreational users and professional operators, compact sub-300Cc engines for ultralight applications, and high-performance offerings above 800Cc for specialized uses.

End users span personal enthusiasts who prioritize customization and brand loyalty, commercial buyers focused on cost efficiency and durability, and government and defense agencies that demand specialized configurations with stringent reliability requirements. Fuel type segmentation underscores the ascendancy of gas-powered models for legacy use cases, diesel variants for heavy-duty operations, the emergence of electric platforms driven by zero-emissions mandates, and hybrid architectures that bridge transitional gaps. Distribution channels bifurcate into the aftermarket, where online retail channels cater to convenience seekers and traditional retail outlets serve established service networks, and original equipment pathways encompassing dealership networks that provide hands-on customer experiences alongside direct sales channels that support fleet procurement. Finally, an analysis by application highlights the multifaceted roles of ATVs across agriculture and farming environments where ground disturbance minimization is paramount, forestry and landscaping projects that require nimble maneuverability, mining and construction operations emphasizing load-bearing capacity, and recreational activities where comfort and off-road prowess are key.

This comprehensive research report categorizes the All-Terrain Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Drive Type

- Power Source

- Engine Capacity

- Seating Capacity

- Transmission Type

- Sales Channel

- Application

Revealing Strategic Regional Perspectives on All-Terrain Vehicle Trends and Opportunities across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional analysis uncovers divergent growth trajectories and strategic imperatives across key geographies. In the Americas, strong consumer affinity for outdoor recreation and established distribution infrastructures continue to drive uptake of both legacy petrol models and emerging electric variants. Proximity to manufacturing hubs in North America enables streamlined logistics for domestic operators, while favorable financing schemes and incentive programs accelerate electrification efforts in select states.

Within the Europe, Middle East & Africa context, regulatory harmonization around emissions and safety standards has prompted OEMs to localize production and tailor offerings to diverse market requirements. Demand in Western Europe is heavily influenced by stringent environmental policies and premiumization trends, whereas price-sensitive markets in Eastern Europe, the Middle East, and Africa prioritize durable, low-maintenance platforms. Collaborative pilot projects in off-grid electrification and solar-charging infrastructure further underscore the region’s experimental approach to sustainable mobility.

Asia-Pacific dynamics reflect a dual emphasis on cost-competitive production and rapid urbanization. Southeast Asian markets embrace small-displacement ATVs for agrarian applications, supported by government programs targeting rural mechanization. In contrast, Australia and Japan exhibit growing interest in recreational and specialized utility segments, driven by tourism initiatives and a cultural appreciation for outdoor sports. Regional supply chains in the Asia-Pacific are increasingly integrated, with manufacturers optimizing cross-border component flows to reduce lead times and production costs.

This comprehensive research report examines key regions that drive the evolution of the All-Terrain Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying and Evaluating Leading Industry Players Driving Innovation Market Positioning and Competitive Strategies in the Dynamic All-Terrain Vehicle Sector

Key industry players are actively redefining competitive parameters through differentiated product portfolios, strategic partnerships, and targeted acquisitions. Leading OEMs are investing in modular platform architectures that support rapid powertrain swaps between gas, electric, and hybrid configurations, reducing time to market and enhancing customer choice. At the same time, specialized component suppliers are leveraging additive manufacturing techniques to deliver lightweight, high-strength parts with shorter lead times and reduced tooling expenses.

Strategic alliances between established vehicle manufacturers and technology startups are becoming commonplace. These collaborations enable the rapid integration of advanced driver assistance systems, telematics suites, and predictive maintenance algorithms into newer ATV models. Additionally, post-sales service providers are differentiating based on end-to-end support offerings, combining digital diagnostics platforms with on-site field service teams to minimize downtime and optimize fleet availability for commercial operators. Collectively, these moves illustrate a shift from traditional incremental innovation toward ecosystem-based value creation, where providers compete not just on vehicle attributes but on the breadth and quality of ancillary services.

This comprehensive research report delivers an in-depth overview of the principal market players in the All-Terrain Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeon Motor Co., Ltd.

- American LandMaster

- Apollo Motor

- Arctic Cat Inc. by Textron Inc.

- AUTO RENNEN MOTORSPORTS INDIA PVT LTD

- Bennche, Inc.

- BMS Motorsports Inc.

- BRP Inc.

- Deere & Company

- DRR USA Inc.

- HISUN Motors Corp.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- KTM Sportmotorcycle GmbH

- Kubota Corporation

- Kwang Yang Motor Co., Ltd.

- Linhai Group

- Massimo Motor Sports, LLC

- Nebula Automotive Private Limited

- Polaris Inc.

- Powerland Agro Tractor Vehicles Pvt. Ltd.

- Sherp ATV

- Suzuki Motor Corporation

- Yamaha Motor Co., Ltd.

- Zhejiang Chunfeng Power Co., Ltd.

Empowering Industry Stakeholders with Action Plans to Enhance Operational Efficiency Market Responsiveness and Long-Term Resilience in All-Terrain Vehicles

Industry leaders should prioritize the deployment of versatile platform strategies that allow rapid adaptation to evolving fuel and powertrain regulations. By designing chassis and body architectures with modular integration points, manufacturers can offer tailored configurations without incurring prohibitive retooling costs. Simultaneously, establishing strategic joint ventures with regional partners can mitigate tariff exposure and accelerate market entry, ensuring that production footprints remain aligned with localized demand conditions.

Investing in advanced data analytics capabilities will enable organizations to monitor asset utilization and maintenance cycles in real time, unlocking opportunities for predictive service models and recurring revenue streams. Beyond product-centric initiatives, cultivating direct engagement channels through digital storefronts and virtual showrooms can complement traditional dealership networks, enhancing brand reach and customer loyalty. Finally, embedding sustainability targets into corporate governance frameworks will not only bolster regulatory compliance but also resonate with an increasingly eco-conscious consumer base, positioning adopters as leaders in next-generation mobility.

Ensuring Rigor and Transparency through Mixed-Method Research Design Data Collection and Analytical Framework Tailored to the All-Terrain Vehicle Industry

This research methodology harnesses a mixed-method approach that integrates quantitative data analysis with qualitative expert insights. Secondary research drew upon public filings, industry white papers, and regulatory databases to map out baseline market structures and identify key policy inflection points. Concurrently, primary interviews were conducted with senior executives, product engineers, and procurement specialists across OEM, distribution, and end-user segments to validate hypotheses and uncover emerging sentiment.

Data integrity was ensured through cross-verification of multiple data sources and triangulation techniques, while a standardized coding framework allowed for the consolidation of diverse input streams into coherent themes. Econometric modeling and scenario analyses provided robustness checks for observed trends, and sensitivity analyses tested the resilience of conclusions against potential policy shifts and macroeconomic fluctuations. The combined methodology underpins a comprehensive understanding of market dynamics, ensuring that strategic recommendations are grounded in empirical evidence and reflective of real-world operational conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our All-Terrain Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- All-Terrain Vehicle Market, by Type

- All-Terrain Vehicle Market, by Drive Type

- All-Terrain Vehicle Market, by Power Source

- All-Terrain Vehicle Market, by Engine Capacity

- All-Terrain Vehicle Market, by Seating Capacity

- All-Terrain Vehicle Market, by Transmission Type

- All-Terrain Vehicle Market, by Sales Channel

- All-Terrain Vehicle Market, by Application

- All-Terrain Vehicle Market, by Region

- All-Terrain Vehicle Market, by Group

- All-Terrain Vehicle Market, by Country

- United States All-Terrain Vehicle Market

- China All-Terrain Vehicle Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1590 ]

Concluding Synthesis of Key Insights Underscoring Strategic Imperatives and Market Momentum Shaping the Future Trajectory of All-Terrain Vehicles

This executive summary distills the multifaceted forces redefining the all-terrain vehicle market, from technological breakthroughs and sustainability mandates to trade policy shifts and regional market nuances. By synthesizing segmentation-driven demand patterns, competitive dynamics, and actionable strategic imperatives, stakeholders are equipped with a holistic understanding of where to focus innovation, partnership, and investment efforts. The cumulative insights underscore the importance of adaptability, data-driven decision-making, and collaborative ecosystems in securing future growth.

As the sector continues its rapid evolution, the ability to anticipate regulatory developments, respond to shifting customer priorities, and leverage emerging technologies will determine market leadership. This conclusive synthesis provides a strategic compass, guiding industry participants toward initiatives that balance short-term performance with long-term resilience in an increasingly complex environment.

Contact the Associate Director of Sales and Marketing to Unlock Comprehensive All-Terrain Vehicle Market Research Insights

For readers seeking to delve deeper into the nuances of all-terrain vehicle dynamics and obtain an exhaustive analysis, engaging directly with Ketan Rohom (Associate Director, Sales & Marketing) offers a streamlined path to acquiring the full market research report. His expertise in aligning comprehensive data insights with stakeholder needs ensures that potential buyers receive personalized guidance on how to leverage the report’s findings for strategic planning. By initiating a conversation with him, organizations can clarify specific chapters of interest, discuss supplemental custom research options, and expedite access to actionable intelligence that underpins competitive advantage. Contacting Ketan today will transform broad market overviews into tailored strategic roadmaps, enabling decision-makers to navigate evolving regulatory landscapes, optimize product development timelines, and capitalize on emerging technological trends with confidence.

- How big is the All-Terrain Vehicle Market?

- What is the All-Terrain Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?