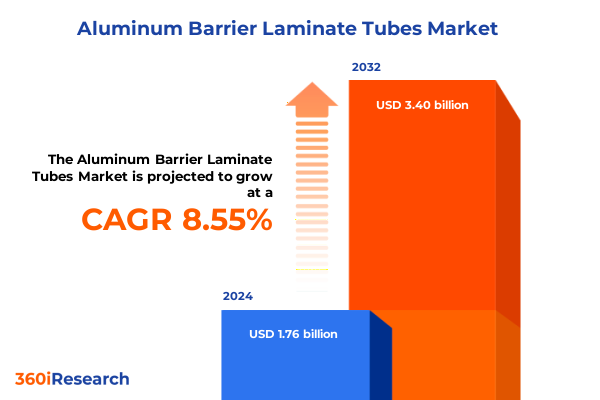

The Aluminum Barrier Laminate Tubes Market size was estimated at USD 1.90 billion in 2025 and expected to reach USD 2.05 billion in 2026, at a CAGR of 8.65% to reach USD 3.40 billion by 2032.

Exploring the Rise of Aluminum Barrier Laminate Tubes as a Sustainable Packaging Solution Driving Innovation and Efficiency Across Multiple End-Use Sectors

In recent years, the aluminum barrier laminate tube sector has emerged as a critical nexus of innovation, sustainability, and performance within the packaging industry. These multi-layered tubes combine thin-gauge aluminum foil with polymer films and specialized adhesives to deliver exceptional barrier properties against moisture, oxygen, and light. Such advanced structures extend product shelf life, preserve flavor and active compounds, and prevent microbial ingress-attributes that resonate strongly with manufacturers across adhesives, cosmetics, food and beverage, and pharmaceutical end-uses. As consumer demand intensifies for packaging that ensures both product integrity and environmental responsibility, aluminum barrier laminate tubes have risen to prominence as a premium alternative to conventionally extruded plastic and metal options.

This report delves into the dynamic confluence of drivers reshaping the landscape for aluminum barrier laminate tubes. It explores the forces of regulatory frameworks limiting single-use plastics, advances in high-impact digital decoration techniques, and the mounting imperative for lightweight, recyclable formats. Furthermore, it outlines how key players are navigating supply chain complexities, raw material volatility, and evolving brand expectations. By framing these trends, this introduction establishes the foundation for a nuanced understanding of market transformation, supply chain realignment, and strategic imperatives that will define the industry’s near- to mid-term trajectory.

Identifying Key Disruptive Forces Shaping Aluminum Barrier Laminate Tubes with Sustainability, Regulatory Mandates, and Technological Advances at the Forefront

Against a backdrop of tightening environmental regulations and shifting consumer preferences, the aluminum barrier laminate tube market is experiencing several transformative shifts. Sustainability mandates are compelling both brand owners and converters to prioritize recyclable formats that reduce reliance on virgin plastic. These regulatory pressures, coupled with voluntary corporate commitments to circular economy principles, have accelerated the adoption of multi-layer laminates featuring high aluminum content for robust barrier performance without excess weight.

Simultaneously, advancements in digital printing and on-line decoration methods are elevating the aesthetic and functional appeal of tubes. Enhanced resolution, movable imaging, and variable data capabilities now allow brands to execute targeted campaigns, limited-edition releases, and personalized packaging at scale. This synergy of sustainable materials with bespoke design is fostering deeper consumer engagement, particularly within the cosmetics and premium food segments.

Moreover, supply chain agility has taken center stage as raw material price fluctuations and logistical disruptions demand flexible sourcing strategies. Firms are exploring regional laminator partnerships, dual-sourcing arrangements, and strategic inventory buffers to mitigate the impact of rare-earth volatility and freight cost inflation. Together, these shifts underscore a market that is not only expanding in volume but also evolving in sophistication, responsiveness, and value creation.

Examining the Growing Financial and Operational Consequences of Ongoing US Aluminum Tariffs on Barrier Laminate Tube Supply Chains and Profitability Dynamics

Since the United States imposed a 10% tariff on imported aluminum under Section 232 in early 2018, the cumulative effect on aluminum barrier laminate tube manufacturers and converters has been significant and ongoing. Five years into these measures, suppliers continue to absorb elevated raw material costs that have led to higher base prices for intermediate foil stocks. These cost pressures cascade through value chains, prompting brand owners to reassess formulation requirements, negotiate longer-term supply contracts, or explore material substitutions where feasible.

In addition to direct input cost increases, the tariff environment has catalyzed a wave of domestic capacity investments. Several North American laminators have accelerated expansion plans, leveraging incentives and tooling grants to reduce reliance on imported foil. While this reshoring trend enhances supply security, it also requires substantial capital outlays and longer lead times, which converters must strategically manage to avoid production bottlenecks.

Furthermore, the ongoing tariff regime has altered global trade flow patterns. Producers in Asia have redirected shipments toward non-US markets, intensifying competition in Asia-Pacific and EMEA regions. Meanwhile, US-based converters are negotiating differentiated pricing structures and time-lagged pass-through clauses to protect margins. Collectively, these dynamics have reshaped the cost, capacity, and competitive landscape for aluminum barrier laminate tubes through 2025.

Unveiling Deep Insights Into Critical Segmentation Variables That Define Application, Layer Count, Tube Diameter, Decoration, and Closure Type Trends

A nuanced understanding of how segmentation dimensions influence demand and product design is essential for market participants aiming to outperform competitors. When considering application needs, adhesives and sealants firms increasingly favor tubes with robust barrier layers to prevent solvent evaporation, whereas cosmetics brands require packaging that balances barrier integrity with premium aesthetics and tactile appeal. Food and beverage manufacturers, while prioritizing barrier performance for sauces and condiments, also emphasize ease of dispensing and recyclability credentials. Pharmaceutical companies demand the highest purity standards, mandating specialized adhesives and foil grades to comply with stringent regulatory guidelines.

Layer count represents another critical variable shaping product development decisions. Five-ply configurations remain the industry workhorse, offering a balanced trade-off between performance and cost. Seven-ply laminates provide an extra aluminum foil layer for enhanced barrier protection in high-value segments, though they command higher production expenses. Three-ply structures, conversely, serve applications where cost efficiency and lighter weight take precedence over ultimate barrier depth.

Tube diameter selections reflect both application volume goals and end-user ergonomics. Smaller formats, up to 30 millimeters, dominate personal care lines seeking portability and precise dosage. Mid-range tubes from 31 to 50 millimeters strike a balance for cosmetics and pharmaceutical creams where shelf presence matters. Larger diameters exceeding 50 millimeters accommodate industrial adhesives and specialty compounds that require higher throughput.

Decoration techniques further diversify the offering set, ranging from plain tubes for highly regulated products to printed and sleeved formats that enable brand storytelling and vibrant color fidelity. Labelled tubes offer a commodity option for basic identification needs, whereas printed and sleeved designs drive premium shelf appeal.

Closure types complete the segmentation matrix, as disc top caps deliver controlled dispensing for viscous adhesives, flip top caps ensure hygienic application in personal care, and screw caps provide universal compatibility preferred by pharmaceutical and food producers alike.

This comprehensive research report categorizes the Aluminum Barrier Laminate Tubes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Layer Count

- Tube Diameter

- Decoration

- Closure Type

- Application

Revealing Strategic Regional Patterns and Growth Trajectories Across the Americas, Europe Middle East and Africa, and Asia-Pacific Packaging Markets

Across the Americas, aluminum barrier laminate tubes have matured from a niche offering into a mainstream packaging solution. The United States market, in particular, has witnessed a surge in domestic lamination capacity as converters seek to circumvent tariff impacts while meeting brand commitments to local sourcing. Mexico has also emerged as a focal point for cross-border supply relationships, leveraging its integrated logistics corridors to serve both North American and Latin American brand owners.

In Europe, Middle East & Africa, the convergence of plastic reduction regulations and extended producer responsibility schemes has amplified the appeal of aluminum-based cartridges. Manufacturers in Western Europe have rapidly adopted high-barrier multi-layer laminates to comply with sustainability directives, while converters across the Gulf region are scaling capabilities to support growing cosmetic exports. Regulatory alignment and shared trade agreements have further facilitated deployment of standardized tube formats across the EMEA zone.

Asia-Pacific remains the fastest-growing region for aluminum barrier laminate tubes, driven by burgeoning middle-class demand for premium personal care and high-volume food processing in China, India, and Southeast Asia. Local lamination houses are increasingly investing in digital decoration assets to cater to leading regional brands seeking differentiated packaging in crowded retail channels. As supply chains expand, Asia-Pacific converters are also exploring hybrid material blends that integrate bio-based polymers with aluminum foil, anticipating future environmental mandates.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Barrier Laminate Tubes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies, Innovation Portfolios, Partnership Dynamics of Leading Companies Propelling Change in Barrier Laminate Tube Manufacturing

Leading suppliers in the aluminum barrier laminate tube arena are actively refining their portfolios to maintain distinct competitive advantages. Amcor, for instance, has prioritized the integration of high-speed digital decoration lines within its global lamination network, enabling rapid-turn product launches and bespoke design services for premium cosmetic and pharmaceutical clients. CCL Industries has expanded its partnership ecosystem, collaborating with specialty foil producers to co-develop foil grades that optimize barrier-to-weight ratios.

RPC Group has zeroed in on sustainability credentials, launching an eco-design initiative that leverages post-industrial recycled content in adhesive layers, thereby reducing the carbon footprint of its tubes. Constantia Flexibles has differentiated through service excellence by offering in-market prototyping and local packaging support hubs in key European centers. Huhtamaki has doubled down on supply chain resilience, establishing dual-sourcing models across foil conversion and resin extrusion to mitigate regional disruptions.

Collectively, these strategies illustrate how top-tier companies are converging innovation, sustainability, and operational flexibility to safeguard market share and address evolving brand expectations. Each player’s focus areas-whether digital printing, eco-friendly materials, or strategic partnerships-underscore the multiplicity of pathways to leadership within this dynamic market segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Barrier Laminate Tubes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albéa S.A.

- Alltub Group

- Ambertube International

- Amcor Limited

- Antilla Propack

- CCL Industries Inc.

- Essel Propack Limited

- Hoffmann Neopac AG

- Huhtamaki Oyj

- Impact International Pty. Limited

- IntraPac International Corporation

- Lajovic Tuba D.O.O.

- Linhardt GmbH & Co. KG

- Montebello Packaging Inc.

- Perfektüp Ambalaj Sanayi ve Ticaret A.S.

- Pirlo GmbH & Co. KG

- Plastube (India) Pvt Ltd.

- The Berry Global Group, Inc.

- Tubapack a.s.

- Tuboplast International

Delivering Practical Guidance on Supply Chain Optimization, Sustainability Initiatives, and Market Positioning to Drive Growth in Tube Packaging

Industry stakeholders seeking to excel in the aluminum barrier laminate tube market should embrace a multi-faceted approach that harmonizes sustainability objectives with operational agility. First, investing in next-generation decoration technologies will enable brands to deliver personalized, limited-edition offerings without incurring prohibitive tooling costs. These capabilities can unlock new channels for targeted promotions and rapid adaptation to emerging consumer trends.

Second, deepening supplier relationships and diversifying foil sourcing across multiple geographies can cushion the impact of tariff volatility and raw material price swings. Establishing long-term partnerships that incorporate collaborative cost-optimization programs ensures stability in supply continuity and more predictable input costs.

Third, firms should prioritize eco-design principles in laminate construction, exploring bio-based adhesives, recyclable polymer layers, and reduced aluminum thickness configurations. By aligning product development with circular economy frameworks, companies can preempt future regulatory shifts and reinforce brand narratives around environmental stewardship.

Finally, agile inventory management and regional production footprints will empower converters to respond swiftly to localized demand surges and mitigate transportation bottlenecks. Coupled with data-driven forecasting tools, these measures will enhance service levels, reduce lead times, and bolster overall competitiveness in a rapidly evolving packaging ecosystem.

Detailing Robust Research Techniques Including Primary Engagements, Secondary Data Integration, and Analytical Frameworks That Ensure Rigorous Market Insights

This analysis synthesizes insights derived from a rigorous research methodology combining primary and secondary sources to ensure comprehensive market coverage. Primary research encompassed in-depth interviews with executives, product developers, and procurement leads across major aluminum foil mills, lamination converters, and end-use brand owners, yielding firsthand perspectives on operational challenges, innovation priorities, and procurement strategies.

Secondary data collection involved reviewing industry publications, regulatory filings, and trade statistics to validate volumetric trends, tariff impacts, and regional trade flows. These data points were triangulated through cross-comparison of customs records, industry association reports, and public filings to mitigate biases and enhance data integrity.

Analytical frameworks applied in this report include segmentation matrices aligned with key product attributes, Porter’s Five Forces assessments to gauge competitive intensity, and value chain mapping to identify potential leverage points for cost reduction and innovation infusion. An independent advisory panel of packaging engineers, supply chain specialists, and sustainability experts provided peer review at critical milestones, ensuring that findings are robust, actionable, and aligned with the latest industry developments.

Together, these research practices underpin the credibility and depth of the insights presented herein, equipping stakeholders with the intelligence needed to navigate complex market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Barrier Laminate Tubes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Barrier Laminate Tubes Market, by Layer Count

- Aluminum Barrier Laminate Tubes Market, by Tube Diameter

- Aluminum Barrier Laminate Tubes Market, by Decoration

- Aluminum Barrier Laminate Tubes Market, by Closure Type

- Aluminum Barrier Laminate Tubes Market, by Application

- Aluminum Barrier Laminate Tubes Market, by Region

- Aluminum Barrier Laminate Tubes Market, by Group

- Aluminum Barrier Laminate Tubes Market, by Country

- United States Aluminum Barrier Laminate Tubes Market

- China Aluminum Barrier Laminate Tubes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Findings to Illuminate the Future Trajectory of Aluminum Barrier Laminate Tubes Amid Industry Evolution and Emerging Market Demands

The collective examination of technological advancements, regulatory influences, and tariff-driven cost dynamics reveals an aluminum barrier laminate tube market in the midst of sophisticated transformation. Sustainable packaging imperatives are steering material innovation toward ever-thinner yet more effective laminate structures, while digital decoration capabilities are redefining how brands engage consumers at the point of sale.

Tariff regimes have prompted localized capacity expansions and strategic supplier partnerships, underlining the critical importance of supply chain resilience. Segmentation nuances-from application-specific barrier requirements and layer count preferences to decorative formats and closure mechanisms-highlight the need for targeted product offerings and agile production processes.

Regionally, growth vectors vary from the Americas’ focus on domestic lamination expansion to EMEA’s regulatory-driven adoption and Asia-Pacific’s explosive demand for premium personal care packaging. Top industry players are carving out distinct leadership positions through investments in digital printing, eco-design, and flexible sourcing models, illustrating multiple pathways to sustainable competitive advantage.

Ultimately, stakeholders equipped with these integrated insights can better anticipate emerging shifts, optimize resource allocations, and reinforce their market positioning. As the aluminum barrier laminate tube sector continues to evolve, proactive adaptation and strategic foresight will be the hallmarks of industry leaders.

Encouraging Immediate Engagement with Associate Director Sales & Marketing to Secure Comprehensive Market Intelligence for Packaging Innovation

For organizations seeking to transform market intelligence into strategic action, direct engagement with Ketan Rohom, Associate Director of Sales & Marketing, offers a seamless path to accessing the full depth of this comprehensive report. By connecting with Ketan, decision-makers can secure tailored briefings, bespoke data extracts, and interactive consultations that align precisely with their unique objectives. His expertise ensures prompt guidance on leveraging the insights presented in this analysis to optimize product portfolios, refine distribution channels, and accelerate go-to-market initiatives. Reach out today to unlock privileged glimpses into proprietary datasets, gain early visibility into emerging shifts, and develop targeted strategies that will fortify your position in the evolving aluminum barrier laminate tube landscape

Act now to benefit from personalized support, exclusive offers, and priority delivery of the complete market research. Partnering with Ketan Rohom guarantees that your organization will harness the latest understanding of material developments, tariff impacts, segmentation nuances, and regional dynamics-all delivered with the precision required for decisive leadership. Contact Ketan directly to initiate your access to this indispensable resource and take the definitive step toward driving innovation, operational excellence, and sustained competitive advantage.

- How big is the Aluminum Barrier Laminate Tubes Market?

- What is the Aluminum Barrier Laminate Tubes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?