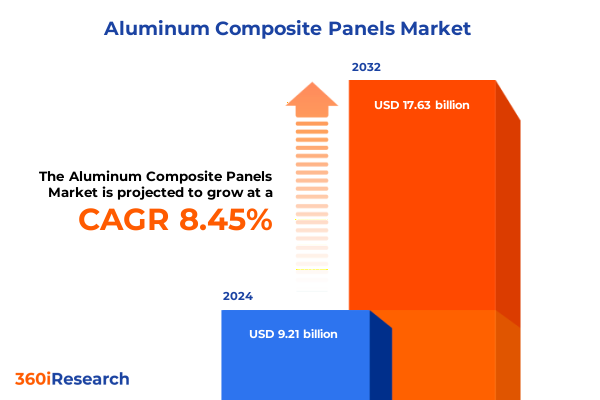

The Aluminum Composite Panels Market size was estimated at USD 10.00 billion in 2025 and expected to reach USD 10.78 billion in 2026, at a CAGR of 8.42% to reach USD 17.63 billion by 2032.

Exploring the Dynamic Core of the Aluminum Composite Panels Market and Its Pivotal Role in Modern Architectural Advancements

The global aluminum composite panel sector has emerged as a cornerstone of contemporary architecture, merging aesthetic versatility with functional performance. As demand intensifies for building materials that offer both durability and design flexibility, these panels have increasingly become the material of choice for architects and developers aiming to realize visionary façades and efficient cladding systems. This evolution is driven not only by the inherent properties of aluminum composite panels-lightweight construction, weather resistance, and high strength-to-weight ratios-but also by their capacity to adapt to stringent safety and environmental mandates.

Over the past year, manufacturers have accelerated the integration of eco-friendly production practices, reflecting a broader industry shift toward sustainable construction. The adoption of recyclable core materials and greener coating technologies has enabled a new generation of composite panels that minimize carbon footprints without compromising quality. Concurrently, rapid advancements in digital printing and custom finish techniques are redefining architectural expression, enabling unique textures and patterns to be applied at scale. Together, these trends underscore a market landscape that is dynamic and innovation-driven, setting the stage for manifold applications beyond traditional exterior cladding and into interiors, transportation, and branded environments.

How Technological Progression and Sustainability Mandates Are Driving Transformative Changes in Aluminum Composite Panel Applications

Recent years have witnessed a profound transformation in the aluminum composite panels domain, where next-generation coatings and smart materials are reshaping product capabilities. High-performance PVDF and FEVE coatings now deliver exceptional UV resistance and self-cleaning properties, extending service life and reducing maintenance demands in harsh climates. Simultaneously, embedded smart functionalities-such as sensor arrays for environmental monitoring or thin-film photovoltaic cells-are transitioning panels from static building components to active elements of intelligent façades. The convergence of these technologies exemplifies how material science innovations are fostering multifunctional building envelopes.

Parallel to these technical strides, regulatory pressures and sustainability imperatives have catalyzed the development of mineral-core fire-rated composites and recycled aluminum cores. The shift to mineral-filled panels that comply with rigorous fire safety standards addresses market needs in high-rise and public infrastructure projects, while recyclable composite cores support circular economy objectives. Moreover, the surge in digital design platforms and visualization tools has empowered architects to iterate and customize panel aesthetics with unprecedented precision and speed. These interconnected shifts-notable for driving performance improvements and design freedom-are collectively elevating market expectations and shaping competitive dynamics.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on the Aluminum Composite Panels Industry

The United States’ evolving tariff landscape in 2025 has introduced significant headwinds for aluminum composite panel importers and end-users. As of March 12, derivative aluminum products became subject to an additional 25 percent ad valorem duty, eliminating prior quotas and exemptions for major trading partners including Canada, the European Union, and the United Kingdom. This tariff adjustment, enacted under Section 232 and codified in Proclamation 9704, intensified cost pressures for distributors and fabricators reliant on imported panel cores and cover sheets. Meanwhile, further tariff escalations announced on June 4 raised duties on steel and aluminum articles from 25 to 50 percent, signaling a broader protectionist stance that reverberates across supply chains and procurement strategies.

These cumulative tariff increases have prompted sourcing shifts toward domestic suppliers and closer scrutiny of material compositions to optimize cost structures. Importers are increasingly evaluating near-sourcing options in North America to mitigate duty exposure, while downstream fabricators are reassessing product mixes between fire-rated and non-fire-rated panels to balance performance with price sensitivities. Although short-term cost inflation has strained project budgets across building and transportation sectors, the policy environment has simultaneously spurred investment in localized production capacity and innovation in alternative composite formulations.

Unveiling Critical Product, End Use and Distribution Channel Perspectives Driving Decision-Making in the Aluminum Composite Panels Market

Product distinctions between fire-rated and non-fire-rated aluminum composite panels are shaping specification trends in high-risk applications. Fire-rated composites with mineral cores are experiencing heightened adoption in public and commercial projects, responding to enhanced safety regulations, whereas non-fire-rated variants maintain strong traction in residential and standard low-rise construction due to competitive cost positioning. End-use segmentation further underscores the material’s versatility: while commercial, industrial, infrastructure, and residential sub-sectors within the building and construction domain continue to absorb the bulk of demand, signage and advertising applications are diversifying digital printing portfolios, and transportation sector specifications emphasize weight reduction and corrosion resistance. Distribution channel dynamics reveal that offline engagements-via direct sales and distributor networks-remain dominant for large orders and custom projects, even as burgeoning e-commerce portals simplify access for smaller buyers and specialty segments. This multi-layered segmentation mosaic provides a strategic lens for stakeholders to align product portfolios and distribution tactics with distinct market requirements.

This comprehensive research report categorizes the Aluminum Composite Panels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- End Use

- Distribution Channel

Delving into Regional Nuances and Demand Patterns Across Americas, EMEA and Asia-Pacific Aluminum Composite Panel Markets

Regional demand patterns reveal differentiated growth trajectories across the Americas, EMEA and Asia-Pacific markets. North America’s retrofit and infrastructure spending continues to support demand for both fire-rated and decorative panels, particularly in urban renewal and commercial property upgrades. Latin American markets demonstrate growing interest in cost-effective non-fire-rated panels for expanding retail and hospitality construction. In EMEA, stringent post-Grenfell fire-safety codes and robust green building certification frameworks are boosting uptake of mineral-core, eco-certified composites, with Germany and the UAE emerging as adoption leaders. Meanwhile, in Asia-Pacific, the confluence of rapid urbanization and large-scale infrastructure initiatives in China, India and Southeast Asia is propelling significant volume growth; domestic manufacturing hubs are capitalizing on supportive government policies to scale production and introduce differentiated product lines. These regional nuances reflect how policy, project pipelines and sustainability agendas converge to influence strategic positioning across global markets.

This comprehensive research report examines key regions that drive the evolution of the Aluminum Composite Panels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Movers Shaping Competitive Dynamics in the Aluminum Composite Panels Sector

Leading players in the aluminum composite panel arena are extending their competitive moats through targeted innovations and strategic alliances. Arconic, following its major acquisition by Apollo Global Management, has concentrated on enhancing its architectural product suite while optimizing supply chain resilience. 3A Composites, buoyed by the success of ALUCOBOND® circular-a high-recycled-content panel introduced in January 2025-continues to champion sustainability through circular economy models, reducing CO₂ emissions by more than half in cover sheet production. Meanwhile, partnerships like 3A Composites USA’s collaboration with TENMAT on an NFPA 285-certified rainscreen fireblock assembly underscore the premium placed on code compliance for high-rise projects. Regional and niche specialists are also carving out value propositions: several Asia-based manufacturers are investing in digital printing capabilities to meet surging demand for dynamic signage applications, and European innovators are accelerating the roll-out of FEVE-coated panels optimized for harsh coastal environments. Collectively, these corporate strategies highlight a market where technology leadership, sustainability credentials and regulatory alignment are pivotal to maintaining and growing market share.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aluminum Composite Panels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3A Composites GmbH

- Alcan Singen GmbH

- Alcoa Inc.

- Alubond U.S.A.

- Alucobond

- Aludecor Lamination Private Limited

- Alumax Industrial Co., Ltd.

- Arconic Inc.

- CCJX Co., Ltd.

- Fairfield Metal

- Fangda Group

- Goodsense ACP Co., Ltd.

- Honghe Building Materials Group Co., Ltd.

- Jyi Shyang Industrial Co., Ltd.

- Kaidi Architectural

- Mitsubishi Chemical Corporation

- Multicolor Steels (India) Private Limited

- Pivot Precision Products

- Shanghai Huayuan New Composite Materials Co., Ltd.

- SILK ALC Pvt. Ltd.

- Yaret Industrial Group

Strategic Imperatives and Best Practices for Industry Leaders to Capitalize on Emerging Trends in Aluminum Composite Panels

Industry leaders should prioritize a tri-pronged approach that marries innovation, supply chain agility and regulatory foresight. First, expanding R&D investments in recyclable and mineral-core composites will address fire-safety and ESG imperatives, positioning companies to capture premium segments and satisfy evolving building codes. Second, diversifying procurement channels through strategic partnerships with domestic alloy producers and regional fabricators can mitigate tariff risks and inventory bottlenecks exposed by changing trade policies. Third, integrating advanced digital printing and sensor technologies into panel offerings will unlock new use cases in signage, smart building systems and adaptive façades, augmenting revenue streams beyond traditional cladding.

Concurrently, stakeholder alignment with green building certification bodies-such as LEED and BREEAM-is critical to securing specification wins in sustainability-driven projects. Organizations should also implement dynamic pricing tools that reflect real-time input cost fluctuations, ensuring competitive yet profitable contract structuring. Finally, reinforcing after-sales service capabilities for maintenance, retrofits and compliance support will cultivate long-term client relationships and differentiate offerings in a commoditized market. By operationalizing these recommendations, market participants can fortify resilience and drive sustainable growth amid a complex and shifting industry landscape.

Comprehensive Research Framework and Methodological Approach Underpinning the Aluminum Composite Panels Market Analysis

This analysis synthesizes insights derived from a rigorous blend of primary and secondary research. In the primary phase, in-depth interviews were conducted with senior executives, technical experts and procurement specialists across leading composite panel manufacturers, fabricators and installation contractors. These discussions provided nuanced perspectives on product innovation pipelines, regulatory compliance challenges, and channel dynamics. Secondary research entailed systematic reviews of trade publications, executive orders, regulatory filings, and sustainability benchmarks published by industry associations, government agencies and specialized technology partners.

Quantitative triangulation was applied by cross-referencing published project data with proxy indicators-such as construction tender volumes and major cladding contracts-while qualitative validation involved iterative feedback loops with research panel members. Segmentation frameworks were vetted through peer review to ensure alignment with real-world procurement processes. All data was normalized via a standardized taxonomy to maintain consistency, and rigorous checks were instituted to eliminate potential bias. This methodological approach ensures the robustness and reliability of the findings, offering stakeholders a transparent foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aluminum Composite Panels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aluminum Composite Panels Market, by Product

- Aluminum Composite Panels Market, by End Use

- Aluminum Composite Panels Market, by Distribution Channel

- Aluminum Composite Panels Market, by Region

- Aluminum Composite Panels Market, by Group

- Aluminum Composite Panels Market, by Country

- United States Aluminum Composite Panels Market

- China Aluminum Composite Panels Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Synthesis of Core Findings and Strategic Outlook Guiding Future Innovations and Market Growth in Aluminum Composite Panels

The aluminum composite panel market is at an inflection point defined by technological innovation, evolving safety mandates and dynamic trade regimes. As manufacturers and fabricators embrace smarter, more sustainable materials, the boundaries of panel functionality are broadening-from passive cladding to integrated energy generation and environmental monitoring. Regulatory shifts in major markets, particularly the United States’ 2025 tariff augmentations, have intensified the focus on localized production and supply chain diversification.

Navigating this landscape demands an agile, forward-looking strategy that anticipates policy trajectories and leverages next-generation coatings, cores and digital capabilities. Companies that align product development with circular economy principles, prioritize code-compliant fire-rated solutions and harness digital design tools will be best positioned to lead. A nuanced understanding of regional market drivers further enables tailored go-to-market approaches. Ultimately, the roadmap for sustained success will hinge on balancing innovation investments with operational resilience, ensuring that value creation endures across the full project lifecycle.

Unlock Exclusive Market Intelligence and Propel Strategic Growth by Partnering with Ketan Rohom to Access the Full Aluminum Composite Panel Report

Ready to empower your strategic planning with the latest insights and expert guidance, connect with Ketan Rohom (Associate Director, Sales & Marketing) to secure a comprehensive and actionable report tailored to your needs and drive your growth in the aluminum composite panel market

- How big is the Aluminum Composite Panels Market?

- What is the Aluminum Composite Panels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?