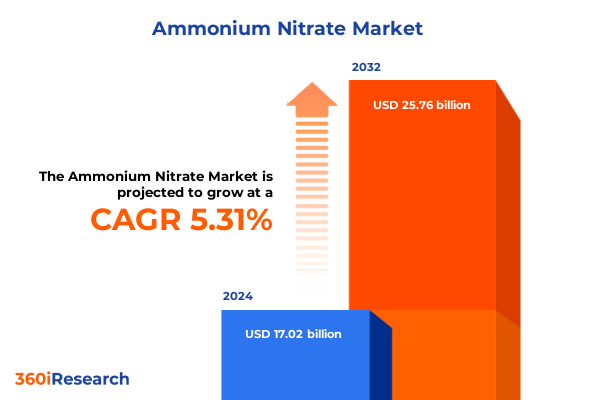

The Ammonium Nitrate Market size was estimated at USD 17.85 billion in 2025 and expected to reach USD 18.73 billion in 2026, at a CAGR of 5.37% to reach USD 25.76 billion by 2032.

Uncovering the Fundamental Drivers Shaping the Global Ammonium Nitrate Market in a Dynamic Industrial and Agricultural Era of Transformation

Ammonium nitrate, a dual-purpose chemical integral to both agricultural productivity and industrial processes, has become a focal point of global supply chain discourse. Its unique nitrogen content underpins its widespread use in fertilizer blends, while its oxidative properties make it a critical component in mining and construction explosives. Against a backdrop of shifting geopolitical dynamics, sustainability imperatives, and evolving safety regulations, decision-makers must navigate a web of complex factors to ensure reliable sourcing and cost efficiency. As global agricultural demand intensifies due to population growth and resource constraints, the importance of understanding the underpinning drivers of supply, logistics, and regulatory compliance has never been greater.

The rising prominence of digital platforms, advanced manufacturing processes, and stringent handling protocols has further elevated the need for a granular understanding of this vital chemical. Stakeholders spanning production, distribution, and end-use sectors now demand actionable insights that synthesize technical innovation and regulatory developments. Through this executive summary, we set the stage for a deep dive into the transformative forces reshaping the ammonium nitrate landscape, evaluate the ramifications of recent policy measures, and distill critical segmentation and regional perspectives. By weaving together these interconnected threads, we aim to provide a clear, authoritative foundation for strategic planning and operational excellence in the ammonium nitrate domain.

Exploring the Pivotal Technological, Regulatory, and Demand-Driven Shifts Redefining the Ammonium Nitrate Landscape Worldwide

Over the past several years, the ammonium nitrate ecosystem has undergone a profound metamorphosis driven by technological breakthroughs, shifting demand patterns, and an intensifying regulatory environment. Innovations in prilling and granulation techniques have improved particle consistency and handling safety, enabling producers to tailor product specifications more precisely to fertilizer formulators and explosive manufacturers. Concurrently, advances in digital supply chain management-such as real-time inventory tracking and predictive logistics optimization-have enhanced resilience against disruptions and reduced lead times across international corridors.

Regulatory authorities around the world have implemented stricter handling standards and traceability requirements in response to safety concerns, prompting producers and distributors to invest in enhanced compliance frameworks and traceable batch management systems. These measures, while introducing new complexities, have elevated overall safety levels and reinforced public trust in ammonium nitrate applications. At the same time, heightened environmental mandates have accelerated the adoption of low-carbon production routes and eco-friendly process optimizations, signaling a clear pathway toward decarbonized chemical manufacturing.

Demand dynamics have also shifted notably. Agricultural end users are increasingly seeking customized nutrient blends that enhance soil health and crop yield, while industrial segments such as mining and construction require formulations optimized for specific blast performance criteria. These evolving end-user preferences are driving producers to collaborate more closely with research institutions and end-use integrators, fostering joint innovations that align product attributes with application requirements. As these transformative shifts converge, stakeholders must adopt a holistic perspective to harness new opportunities and mitigate emerging risks.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Production, Distribution, and Competitive Dynamics for Ammonium Nitrate

In 2025, the United States introduced a series of targeted tariffs on imported ammonium nitrate to bolster domestic manufacturing and address concerns over unfair pricing practices. These measures, applied across multiple entry points, have had a cascading impact on cost structures and supply chain strategies for end users and intermediaries alike. Importers are now grappling with elevated landed costs that have altered procurement calculus, prompting renewed interest in reshoring production capabilities or establishing joint ventures with North American partners to mitigate tariff exposure.

From a distribution standpoint, heightened duties have catalyzed a search for alternative sourcing regions, with some organizations turning to neighboring markets where tariffs are lower or nonexistent. However, this redirection has introduced longer transit times and potential quality variances, compelling firms to strengthen supplier qualification processes and invest in rigorous quality assurance protocols. At the same time, domestic producers have reaped the benefit of improved competitive positioning, enabling them to secure higher utilization rates and justify incremental capacity expansions.

The cumulative effect of these tariffs extends beyond immediate cost impacts. In many cases, midstream distributors have restructured contractual terms, implementing variable pricing clauses tied to duty fluctuations. End users in agriculture and mining have adjusted application plans and budgeting forecasts to accommodate new price floors. As a result, industry participants must continuously monitor policy developments and tariff recalibrations, adapting their supply chain architectures to maintain cost predictability and operational agility in an environment of evolving trade dynamics.

Deriving In-Depth Insights from Formulation, Purity, Production Processes, Distribution Channels, and End-Use Segments of Ammonium Nitrate

A nuanced understanding of the ammonium nitrate market requires careful consideration of multiple segmentation dimensions that capture product attributes, production methods, distribution pathways, and end-user applications. The form of the product-whether delivered as granules, prills, or as a liquid solution-significantly influences handling characteristics, application precision, and storage requirements. Granular ammonium nitrate is often favored for its ease of blending with other solid fertilizers, while prilled variants offer improved flowability in cold conditions. Solutions find their niche in fertigation systems where rapid nutrient uptake is critical.

Beyond form, purity grades delineate product suitability across diverse applications. Feed grade ammonium nitrate, with its specific impurity thresholds, serves specialized uses in animal nutrition when treated appropriately. Fertilizer grade, formulated for agricultural soil enrichment, balances nitrogen content and stability considerations. Technical grade, held to the most exacting specifications, meets the demands of industrial processes such as nitric acid production or as an oxidizer in controlled explosive formulations.

The production process itself creates further differentiation. Neutralization routes enable large-scale continuous output with cost efficiencies, whereas prilling processes-where molten nitrate droplets solidify into spherical beads-yield consistent particle size and improved handling traits. Granulation, which binds dust and fines into durable agglomerates, enhances product robustness and minimizes storage losses. Each process carries unique capital and operational requirements, influencing producers’ site selection and investment decisions.

Distribution channels have likewise evolved, with offline sales through direct distribution networks and agricultural cooperatives remaining the primary conduit for bulk deliveries, while online platforms are gaining traction among smaller end users seeking flexible, on-demand procurement. Meanwhile, end-use segmentation illuminates the diverse demand drivers for this versatile chemical. Explosives applications span construction, mining, and quarrying, with mining further subdivided into surface and underground operations, each demanding tailored performance characteristics. In the fertilizer arena, blending and coating methods, direct soil application techniques, and fertigation approaches define nutrient management strategies. The industrial chemicals segment encompasses both explosive manufacture and the production of nitric acid, underscoring ammonium nitrate’s dual role as both feedstock and functional input.

This comprehensive research report categorizes the Ammonium Nitrate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Purity

- Production Process

- End Use

- Distribution Channel

Unveiling Regional Dynamics and Growth Trajectories Across the Americas, Europe Middle East & Africa, and Asia-Pacific in the Ammonium Nitrate Market

The regional landscape for ammonium nitrate is shaped by distinct economic drivers, regulatory regimes, and logistical challenges across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust agricultural demand in North and South America-driven by staples like corn and soy-fuels consistent fertilizer consumption, while the mining sector in Chile, Peru, and the Canadian oil sands sustains significant explosive usage. Cross-border trade within the NAFTA corridor benefits from streamlined customs protocols, although recent trade policy shifts have injected a degree of uncertainty into long-term supply agreements.

Over in Europe Middle East & Africa, stringent environmental and safety regulations have compelled producers to intensify investments in process safety management and secure distribution frameworks. The EU’s push for greener production methods has given rise to pilot facilities exploring carbon capture integration with nitric acid plants, setting a new benchmark for low-emission ammonium nitrate production. In the Middle East, cost-competitive feedstocks and state-backed infrastructure projects drive large-scale manufacturing, while North African export hubs serve emerging agricultural markets across the region.

Asia-Pacific remains the fastest-growing region, underpinned by rapid industrialization and population growth in countries like China, India, and Southeast Asian economies. Expanding fertilizer application rates, combined with ambitious mining ventures in Australia and Indonesia, have spurred capacity additions and technology partnerships. Infrastructure investments and port expansions in key nodes such as Singapore and Melbourne are reducing logistical bottlenecks, enabling faster turnaround times for both agricultural and industrial shipments. As each region pursues its distinct growth trajectory, multinational stakeholders must adopt flexible strategies that account for local regulations, transportation networks, and end-user needs.

This comprehensive research report examines key regions that drive the evolution of the Ammonium Nitrate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Initiatives Shaping Competitive Advantage in the Ammonium Nitrate Sector

A range of global and regional players are driving innovation, capacity optimization, and strategic partnerships in the ammonium nitrate domain. Leading chemical conglomerates have prioritized advanced production technologies such as heat-integrated granulation and energy-efficient neutralization reactors to reduce operating costs and carbon intensity. These established producers are also leveraging long-standing customer relationships and scale advantages to navigate raw material volatility and logistics disruptions more effectively than smaller competitors.

Meanwhile, niche specialty manufacturers have carved out positions by offering tailored product formulations and value-added services, such as on-site blending, custom particle sizing, and digital application advisory platforms. Several alliances between downstream explosive formulators and upstream suppliers have emerged, creating integrated value chains that reduce time-to-market for new high-performance blasting agents. Joint ventures focused on feedstock integration have also gained traction, enabling consistent ammonia supply streams for large-scale nitrate facilities.

Across the board, key players are intensifying efforts to align with sustainability frameworks and circular economy principles. Initiatives range from pilot projects that use renewable hydrogen for ammonia synthesis to trials of carbon-neutral process heat sources. Companies are also investing in traceability solutions that document each batch’s journey from raw material origin to final application, addressing both regulatory imperatives and end-user demands for transparency. As competitive dynamics continue to evolve, organizations that balance operational excellence with strategic innovation will be best positioned to capture evolving opportunities and maintain resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ammonium Nitrate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abu Qir Fertilizers and Chemical Industries Company

- Austin Powder Company

- CF Industries Holdings, Inc.

- CSBP Limited

- CVR Partners, LP

- Deepak Fertilisers And Petrochemicals Corporation Ltd.

- Enaex S.A.

- Eurochem Group AG

- Fertiberia, SA

- Group DF

- Incitec Pivot Limited

- Koch Industries, Inc.

- KUMPULAN SAINTIFIK F.E. SDN BHD

- MAXAMCORP HOLDING, SL

- Merck KGaA

- Neochim PLC

- Orica Limited

- San Corporation

- Sasol Limited

- Sumitomo Chemical Co., Ltd.

- URALCHEM JSC

- Vale S.A.

- Vijay Gas Industry Pvt. Ltd.

- Yara International ASA

Delivering Actionable Strategies for Industry Leaders to Optimize Supply Chains, Enhance Innovation, and Navigate Regulatory Complexities

To thrive in the evolving ammonium nitrate landscape, industry leaders must adopt a multi-pronged approach that balances operational efficiency, regulatory compliance, and innovation. Enhancing supply chain resilience begins with diversifying sourcing strategies across geographies and production processes, thereby reducing dependency on any single origin or technology. In parallel, deploying digital end-to-end supply chain platforms can provide real-time visibility into inventory, logistics, and quality metrics, enabling proactive risk mitigation and demand responsiveness.

Investment in process innovation is equally critical. Companies should explore modular production units and scalable prilling or granulation modules that can be rapidly deployed to high-growth regions. Collaborating with technology providers on low-carbon ammonia and nitrate synthesis pathways will position organizations to meet tightening environmental standards while improving energy efficiency. In tandem, fostering partnerships with end users-whether fertilizer blenders, mining operators, or chemical intermediates producers-can yield co-development projects that fine-tune product specifications to exact application needs.

Regulatory navigation requires a comprehensive compliance architecture that incorporates automated batch tracking, hazard analysis protocols, and ongoing training for storage and handling personnel. Engaging proactively with policymakers and standard bodies through industry associations can also help shape regulations that balance safety considerations with market access. Finally, embedding sustainability at the core of corporate strategy-measured by science-based targets and circularity initiatives-will not only mitigate regulatory risk but also enhance brand reputation and unlock new funding opportunities.

Outlining the Robust Research Methodology Employed to Deliver Comprehensive and Actionable Intelligence on the Ammonium Nitrate Marketplace

This research is underpinned by a robust methodology that combines extensive secondary analysis with targeted primary engagements. The foundational stage involved exhaustive reviews of trade data, regulatory filings, and technical publications to map the global ammonium nitrate landscape and identify key regulatory milestones. This desk research established the baseline framework for segmentation, regional dynamics, and policy interpretations.

Building on this groundwork, the study incorporated in-depth interviews with senior executives from leading producers, distributors, and end users across agriculture, mining, and industrial chemical sectors. These conversations provided real-world context on operational challenges, technology adoption, and strategic priorities. To validate and enrich these qualitative inputs, the research team conducted a series of case studies examining successful product launches, process upgrades, and trade policy adaptations.

Quantitative data points were triangulated using a multi-source approach, integrating publicly available customs and trade statistics, proprietary process cost models, and anonymized shipment records from logistics providers. Detailed data validation protocols, including cross-referencing against independent industry datasets and expert peer review, ensured accuracy and reliability. The final synthesis was iteratively refined through a peer consensus process, blending analytical rigor with practitioner insights to deliver actionable intelligence suited for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ammonium Nitrate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ammonium Nitrate Market, by Form

- Ammonium Nitrate Market, by Purity

- Ammonium Nitrate Market, by Production Process

- Ammonium Nitrate Market, by End Use

- Ammonium Nitrate Market, by Distribution Channel

- Ammonium Nitrate Market, by Region

- Ammonium Nitrate Market, by Group

- Ammonium Nitrate Market, by Country

- United States Ammonium Nitrate Market

- China Ammonium Nitrate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Conclusive Perspectives on Future Prospects and the Strategic Imperatives Guiding the Ammonium Nitrate Industry Forward

As the ammonium nitrate industry advances into a new era of technological innovation, regulatory sophistication, and shifting demand paradigms, organizations must align their strategic imperatives accordingly. Producers will need to invest in process modernization and sustainability initiatives to maintain cost competitiveness and regulatory compliance. Distributors should leverage digital platforms to streamline operations and enhance transparency across complex logistics networks. End users, spanning agriculture and industrial sectors, stand to benefit from closer collaboration with suppliers to co-create tailored solutions that drive performance and resource efficiency.

Strategic agility will also be paramount in responding to evolving trade policies and tariff landscapes. Companies that can rapidly reconfigure supply chains and negotiate favorable partnerships will reduce exposure to cost volatility and emerging protectionist measures. Moreover, embedding sustainability at the core of corporate strategies will serve not only to mitigate environmental risk but also to unlock access to green financing and premium market segments.

In sum, the convergence of technological advancements, regulatory mandates, and demand-side evolution presents both significant challenges and lucrative opportunities. By synthesizing the insights outlined in this report and translating them into focused action plans, industry stakeholders can secure a competitive edge, foster resilient operations, and contribute to the sustainable growth of the ammonium nitrate ecosystem.

Engage with Ketan Rohom to Unlock In-Depth Insights and Secure Access to the Comprehensive Ammonium Nitrate Market Research Intelligence Today

To gain comprehensive intelligence and strategic clarity on the latest developments in the ammonium nitrate space, we invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s deep expertise and consultative approach will ensure you receive tailored guidance aligned with your organization’s priorities. By securing direct access to our full market research report, you will unlock nuanced analysis, granular segmentation insights, and forward-looking scenarios that empower you to make informed decisions with confidence. Connect today to explore customized research previews, seamless purchase options, and priority client support that will accelerate your strategic planning and execution initiatives.

- How big is the Ammonium Nitrate Market?

- What is the Ammonium Nitrate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?