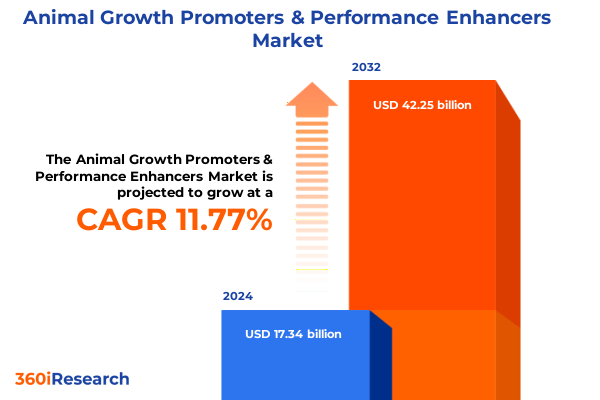

The Animal Growth Promoters & Performance Enhancers Market size was estimated at USD 19.08 billion in 2025 and expected to reach USD 21.01 billion in 2026, at a CAGR of 12.02% to reach USD 42.25 billion by 2032.

Unveiling the Critical Role of Animal Growth Promoters and Performance Enhancers in Meeting Global Food Security and Sustainable Livestock Production

The increasing global population coupled with dietary shifts has placed unprecedented demand on livestock producers to deliver safe, cost-effective animal protein. The rising per capita consumption of animal-source foods is set to climb by six percent by 2034, led by middle-income regions where protein intake may surge by nearly twenty-four percent, underscoring the vital importance of growth promoters and performance enhancers in closing nutritional gaps and supporting food security initiatives worldwide.

At the same time, environmental pressures have spurred a shift toward more efficient livestock systems. According to the FAO, ambitious mitigation pathways leveraging best practices in animal health management can reduce greenhouse gas emissions from livestock while meeting rising demand, highlighting the strategic role of targeted feed additives, acidifiers, enzymes, and probiotics in optimizing feed conversion and reducing the sector’s carbon footprint.

Charting a New Era in Animal Health with Regulatory Overhauls, Technological Breakthroughs, and Sustainable Growth Promoters Reshaping Industry Dynamics

A wave of regulatory overhauls is reshaping the animal health industry, with the US FDA introducing Guidance for Industry 213 to phase out medically important antimicrobials for growth promotion under veterinary oversight, while the EU’s Regulations 2019/4 and 2019/6 enforce strict bans on antimicrobial use for growth or prophylaxis. The World Organization for Animal Health has called for a global phase-out of antimicrobial growth promoters, accelerating the industry’s pivot toward acidifiers, beta agonists, enzymes, probiotics, and prebiotics as sustainable performance enhancers.

Concurrently, technological breakthroughs in precision nutrition and digital farming are enabling unprecedented control over feed formulation and animal health monitoring. Advanced data analytics, real-time environmental sensors, and genomic selection tools are driving customized enzyme blends that boost nutrient uptake, while novel probiotic and prebiotic formulations are enhancing gut health and immune resilience. These innovations are ushering in a new era of performance-driven, sustainability-focused livestock production.

Analyzing the Multi-Faceted Economic and Strategic Consequences of 2025 United States Tariff Policies on Animal Health Ingredient Supply Chains

The United States’ 2025 tariff policies have introduced a baseline ten-percent duty on imports from Canada, Mexico, and the European Union, while China faces an elevated rate of 145 percent, significantly inflating costs for active pharmaceutical ingredients, feed-grade antibiotics, and essential feed additives. These measures have squeezed margins across the animal health supply chain, driving companies to reassess sourcing strategies and supply-chain resilience.

Industry associations such as FEFAC have warned of the disruptive impact of US-EU tariff disputes on feed security and cost structures, even as selective exemptions for swine health vitamins have highlighted the nuanced interplay between trade policy and animal health priorities. The cumulative effect of reciprocal tariffs and import duties has accelerated the shift toward domestically produced compounds and dual-sourcing frameworks to mitigate future trade volatility.

Unlocking Market Dynamics through Comprehensive Segmentation of Product Types, Livestock Applications, Formulations, Uses, and Distribution Channels

The market’s segmentation by product type highlights distinct research and regulatory pathways for Acidifiers like Butyric, Formic, and Propionic Acid, Antibiotics including Ionophores, Macrolides, Penicillins, and Tetracyclines, Beta Agonists such as Ractopamine and Zilpaterol, Enzymes spanning Amylase, Cellulase, Phytase, and Protease, Hormones comprising Androgens, Estrogens, and Progestins, Prebiotics like Fructooligosaccharides and Mannan Oligosaccharides, and Probiotics based on Bifidobacterium, Lactobacillus, and Saccharomyces, each offering tailored mechanisms to support animal health and performance. In turn, the segmentation across livestock types from Aquaculture and Poultry to Ruminants and Swine necessitates product optimization to species-specific metabolic and immune profiles, while the choice of formulation-whether Feed Additives, Injectables, or Water-soluble delivery systems-drives bioavailability and ease of administration. Further, applications spanning Disease Prevention, Feed Efficiency, Growth Promotion, and Reproductive Performance demand distinct efficacy benchmarks and safety profiles, and the distribution channels of Direct Sales, Distributors, and E-Commerce shape go-to-market strategies that balance reach, regulatory compliance, and cost efficiency.

This comprehensive research report categorizes the Animal Growth Promoters & Performance Enhancers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Livestock Type

- Formulation

- Application

- Distribution Channel

Delineating Regional Nuances Influencing the Adoption, Regulation, and Commercial Pathways of Animal Performance Enhancers across Key Global Markets

In the Americas, regulatory landscapes and trade policies have driven a resurgence of domestic production with stakeholders leveraging reshoring incentives to mitigate tariff-exposed imports, while exemptions for critical vitamins in swine health and conditional approvals for mRNA and traditional vaccines underscore an industry balancing affordability with innovation.

Across Europe, the Middle East and Africa, stringent directives including EU Regulation 2019/4 and EU Regulation 2019/6 have enforced a comprehensive ban on antimicrobial growth promoters and mandated prescription-only access, fostering rapid growth in alternative acidifiers, enzymes, and probiotics, supported by robust analytics to detect antibiotic residues and ensure compliance, even as local market heterogeneity demands adaptive distribution frameworks.

Meanwhile, the Asia-Pacific region’s surging protein consumption-driven by China, India, and Southeast Asia’s projected share of nearly forty-nine percent of global animal-sourced food growth-has accelerated the adoption of cost-efficient feed additives and performance enhancers in both aquaculture and poultry sectors, even as variable regulatory standards across nations underscore the importance of tailored formulations and strategic partnerships to secure market entry and scale.

This comprehensive research report examines key regions that drive the evolution of the Animal Growth Promoters & Performance Enhancers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Imperatives and Innovation Trajectories of Leading Animal Health Companies Driving Growth Promoter Solutions and Portfolio Diversification

Zoetis has strategically refocused its livestock health franchise by divesting its medicated feed additive portfolio to emphasize high-growth vaccine and biotherapeutic segments, while capturing approvals for advanced performance claims on Synovex implants in beef production, signaling a shift toward precision-driven, value-added solutions.

Elanco’s integration of Bayer Animal Health assets has broadened its product suite across parasiticides, bio-protection, and feed efficiency agents, underpinned by robust animalytix data analytics and landmark product launches such as Credelio Quattro that demonstrate cross-species efficacy, reinforcing its ambition for mid-single-digit organic growth.

Boehringer Ingelheim continues to invest heavily in state-of-the-art R&D facilities in the United States, while forging strategic collaborations in probiotics with Novozymes to pioneer non-antibiotic gut health solutions for poultry hatcheries, reflecting its commitment to holistic immunity management and sustainable productivity enhancements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Animal Growth Promoters & Performance Enhancers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alltech, Inc.

- Archer Daniels Midland Company

- BASF SE

- Boehringer Ingelheim International GmbH

- Cargill, Incorporated

- Elanco Animal Health Incorporated

- Evonik Industries AG

- Koninklijke DSM N.V.

- Merck & Co., Inc.

- Nutreco N.V.

- Zoetis Inc.

Implementing Strategies and Robust Operational Frameworks to Capitalize on Evolving Trends in Animal Growth Promoters and Enhance Competitive Positioning

Industry leaders should double down on research and development for non-antibiotic alternatives, accelerating investments in acidifiers, enzymes, probiotics, and beta agonists while leveraging public-private collaborations to share risk and drive regulatory acceptance. Early engagement with policy makers and industry bodies can smooth pathways for novel performance enhancers and ensure clarity around evolving standards. Concurrently, companies must fortify supply chain resilience through dual-sourcing strategies and regional manufacturing hubs, mitigating the impact of tariff fluctuations and logistics volatility.

Moreover, embedding sustainability into core operations by aligning with FAO-recommended GHG mitigation practices and integrating digital agriculture tools will be critical. Precision feeding technologies, advanced data analytics, and remote monitoring systems can optimize nutrient utilization and welfare outcomes while delivering measurable ESG benefits. Finally, upskilling technical and sales teams on emerging scientific insights and regulatory shifts will position organizations to capture growth opportunities and build lasting competitive advantage.

Structuring Rigorous Mixed-Method Research Approaches Combining Primary Engagement and Secondary Analysis to Ensure Comprehensive Market Intelligence

The research methodology combined extensive secondary analysis of regulatory documents, industry publications, and corporate financial reports with primary qualitative interviews among senior executives, veterinarians, feed formulators, and key opinion leaders. Data triangulation ensured consistency and credibility by cross-verifying insights across diverse sources. Quantitative modeling was applied to identify segmentation dynamics and supply chain impacts, while thematic analysis distilled emerging trends and strategic imperatives. Peer review by veterinary scientists and industry consultants further validated findings, ensuring the report’s recommendations are grounded in rigorous, multidimensional evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Animal Growth Promoters & Performance Enhancers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Animal Growth Promoters & Performance Enhancers Market, by Product Type

- Animal Growth Promoters & Performance Enhancers Market, by Livestock Type

- Animal Growth Promoters & Performance Enhancers Market, by Formulation

- Animal Growth Promoters & Performance Enhancers Market, by Application

- Animal Growth Promoters & Performance Enhancers Market, by Distribution Channel

- Animal Growth Promoters & Performance Enhancers Market, by Region

- Animal Growth Promoters & Performance Enhancers Market, by Group

- Animal Growth Promoters & Performance Enhancers Market, by Country

- United States Animal Growth Promoters & Performance Enhancers Market

- China Animal Growth Promoters & Performance Enhancers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Illuminate the Strategic Imperatives and Future Outlook for Animal Growth Promoter and Performance Enhancer Markets

This analysis underscores the critical role of targeted animal growth promoters and performance enhancers in meeting rising protein demand, maintaining cost-effectiveness, and advancing environmental sustainability. Regulatory transformations have accelerated innovation, steering the industry away from antibiotic dependency and toward precision-driven, non-antibiotic solutions. Tariff uncertainties and regional nuances will continue to shape supply chain strategies, demanding agility and localized capabilities. As leading companies refine their portfolios and operational excellence, the convergence of data analytics, genomics, and digital agriculture will define the next frontier for performance optimization. Collaborative partnerships across the value chain will be essential in navigating complex regulatory and trade environments while driving long-term resilience and growth.

Engage with Associate Director Ketan Rohom to Access Expert-Curated Comprehensive Market Research Reports on Animal Growth Promoters and Performance Enhancers

For detailed, actionable insights and an in-depth analysis of the animal growth promoters and performance enhancers landscape, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through how our expert-curated market research report can inform your strategic initiatives, support your decision-making, and provide the clarity needed to navigate regulatory complexities, tariff impacts, and emerging technological trends. Engage directly with Ketan to access custom data segments, executive interviews, and tailored recommendations that align with your organization’s priorities and growth objectives.

- How big is the Animal Growth Promoters & Performance Enhancers Market?

- What is the Animal Growth Promoters & Performance Enhancers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?