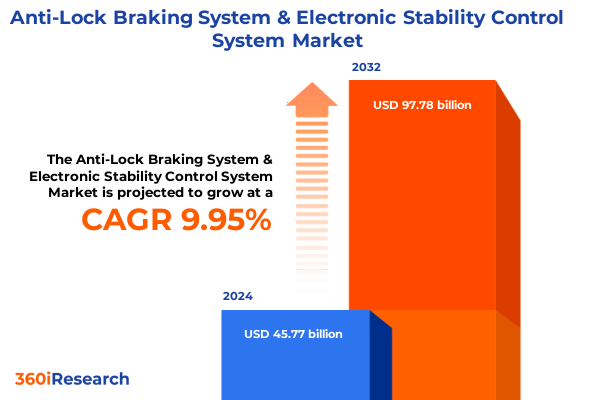

The Anti-Lock Braking System & Electronic Stability Control System Market size was estimated at USD 49.88 billion in 2025 and expected to reach USD 54.36 billion in 2026, at a CAGR of 10.09% to reach USD 97.78 billion by 2032.

Exploring the evolution of Anti-Lock Braking and Electronic Stability Control systems as foundational pillars in modern vehicle safety technology

Over the past four decades, braking technology in passenger vehicles has undergone a dramatic transformation. Initially developed to modulate hydraulic pressure and prevent wheel lockup during panic stops, ABS systems evolved into integrated electronic safety solutions. According to a comprehensive NHTSA analysis, ABS has reduced nonfatal crash involvement by 6 percent in passenger cars and 8 percent in light trucks, underscoring its role in improving vehicle control in adverse conditions. Complementing ABS, ESC technology automates individual wheel braking to correct understeer and oversteer, with research indicating that ESC could prevent up to one-third of fatal accidents when combined with traction control and braking interventions.

Regulatory momentum has further accelerated the adoption of these systems. The U.S. National Highway Traffic Safety Administration mandated ESC on all light vehicles through FMVSS No. 126, requiring operational stability control capable of applying brake torques individually to maintain directional control under skidding conditions. Simultaneously, an emerging rule to equip all new passenger cars and light trucks with automatic emergency braking, including pedestrian detection capabilities, is projected to reduce up to 362 fatalities annually by 2029. These regulatory interventions, combined with consumer demand for enhanced safety, have established ABS and ESC as foundational elements of modern vehicle design.

Amid these developments, OEMs are integrating stability and braking functions with advanced driver assistance systems and connected vehicle platforms. Predictive algorithms now work in concert with GPS and camera inputs to preemptively optimize brake force distribution ahead of critical maneuvers. As the industry shifts toward software-defined vehicles, over-the-air updates for brake control and stability algorithms are becoming commonplace, enabling continuous performance improvements without major hardware changes.

Unpacking transformative shifts driven by technological innovation, regulatory mandates, and consumer expectations in vehicle stability and braking systems

Advances in sensor miniaturization and control algorithms have enabled next-generation stability and braking systems to become more adaptive and predictive. Scalable control units now sample vehicle dynamics data-yaw rate, lateral acceleration, and wheel speed-upwards of 25 times per second, enabling stability interventions in milliseconds. Furthermore, collaborations between tyre manufacturers and electronics suppliers have given rise to intelligent tyre technologies, where embedded sensors feed real-time grip data into ESC modules to optimize braking force distribution across varying surfaces.

Regulatory frameworks continue to evolve alongside technology. In heavy commercial vehicles, FMVSS No. 136 established ESC requirements to mitigate untripped rollovers and loss-of-control crashes, with NHTSA estimating this rule will prevent 40 to 56 percent of rollover incidents and 14 percent of control-related crashes in large trucks and buses. At the same time, consumer expectations for seamless integration of safety systems with advanced driver assistance features have raised the bar for OEMs, driving investments in multi-channel braking architectures and ECU consolidation for improved reliability and reduced system weight.

Meanwhile, digital transformation is reshaping the user interface and calibration of ABS and ESC. Touchscreen and voice-controlled interfaces now allow drivers to select terrain-specific modes, while adaptive learning algorithms adjust intervention thresholds based on driving habits. As vehicles become increasingly connected, cybersecurity measures are also being embedded into braking ECUs to safeguard against unauthorized access and ensure system integrity over the vehicle’s lifecycle.

Analyzing the compounding effects of recently imposed United States tariffs on the supply chain, pricing, and adoption of advanced braking and stability systems

Implementing a sweeping 25 percent Section 232 tariff on imported passenger vehicles and key automobile parts, the U.S. government has imposed a new cost layer on braking and stability system manufacturers, with the tariff on vehicles effective April 2, 2025 followed by levies on engines, transmissions, and electrical components on May 3, 2025. Although U.S.-Mexico-Canada Agreement manufacturers may certify domestic content to temporarily defer tariffs on compliant vehicles and parts, this exemption is transitional, meaning even USMCA-compliant products will eventually face the full tariff burden.

OEMs and tier-one suppliers have primarily absorbed these import duties to avoid immediate consumer price hikes, yet second-quarter financial reports reveal significant margin erosion, exemplified by General Motors’ $1.1 billion tariff-related cost and Stellantis’ projection of €300 million in direct tariff expenses during the first half of 2025. In response, leading automakers are accelerating capital investments in domestic manufacturing facilities and re-evaluating supply chain configurations to localize critical component production, though these initiatives are not expected to offset the tariffs’ impact until later in 2026.

These tariffs also reverberate throughout the aftermarket supply chain, where imported replacement modules and sensor assemblies now carry elevated duties. Repair networks face longer lead times and higher costs, prompting a shift toward domestic remanufacturing and potential changes in warranty structures. As parts availability becomes more constrained, service providers are reevaluating inventory strategies and exploring alternative sourcing to maintain uptime for commercial fleets and passenger vehicles alike.

Revealing segmentation insights showing how sales channels, vehicle categories, system types, propulsion methods, and channel counts drive performance patterns

The market performance across sales channels reveals distinct dynamics between aftermarket and OEM segments. Aftermarket providers are capitalizing on retrofit opportunities for legacy vehicles lacking factory-installed stability controls, offering customizable ABS modules and ESC calibration services through independent repair shops. Conversely, original equipment manufacturers maintain proprietary development roadmaps that integrate braking and stability functions directly into vehicle platforms, enabling seamless communication with onboard networks and broader vehicle safety ecosystems.

Vehicle type segmentation highlights divergent requirements for heavy commercial vehicles, light commercial vehicles, and passenger cars. Heavy-duty applications demand robust ESC configurations capable of managing high center-of-gravity dynamics and large brake caliper assemblies, while light commercial vehicles benefit from modular ABS designs that balance payload performance with cost efficiency. In the passenger car sector, compact models prioritize space-efficient ABS-ESC units, midsize segments focus on refined intervention algorithms for mixed driving environments, and luxury vehicles deploy advanced calibration features such as selectable drive modes and predictive braking to enhance driver experience.

System type distinctions between ABS and ESC underscore how each technology addresses specific safety objectives. Anti-lock braking systems primarily prevent wheel lockup under hard braking scenarios, improving steering control, whereas electronic stability control builds upon ABS and traction control to mitigate skidding events and directional instability. Within ESC, specialized functions such as rollover mitigation actively reduce tipping risks by modulating individual wheel braking and engine torque, while traction control optimizes acceleration on low-grip surfaces by preventing wheel spin.

Propulsion-based segmentation reflects the influence of powertrain architecture on system design. Internal combustion engine vehicles rely on hydraulic actuators tuned for rapid pressure modulation, hybrids integrate energy recuperation strategies with regenerative braking and ESC coordination, and electric vehicles require high-channel-count controllers to manage distributed motor braking. Among electric platforms, battery electric vehicles use high-voltage braking energy conversion, while fuel cell electric vehicles balance hydraulic assistance with electric braking to suit fuel cell response characteristics.

Channel count variations-from two-channel to eight-channel systems-dictate the granularity of wheel-level control. Two-channel ABS systems offer basic front–rear modulation suitable for cost-sensitive applications, four-channel designs provide individual wheel control for mainstream safety compliance, and eight-channel architectures deliver ultimate precision for performance and off-road applications by independently modulating brake pressure at each wheel end.

This comprehensive research report categorizes the Anti-Lock Braking System & Electronic Stability Control System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- System Type

- Propulsion

- Channel Count

- Sales Channel

Uncovering the distinct regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific influencing adoption and system preferences

North America continues to lead global ESC adoption, with the U.S. mandating stability control on all light vehicles since the 2012 model year and achieving near-universal integration across all major OEMs. Market dynamics benefit from stringent federal and state-level safety standards, while consumer awareness campaigns have further reinforced demand for vehicles equipped with advanced braking and stability functions. These factors converge to support ongoing innovation in braking control modules and sensor fusion technologies within the region.

In Europe, Middle East, and Africa, regional regulations under UN/ECE Regulation No. 140 have required ESC systems on M1 category passenger cars since November 2011, with full compliance extended to heavier vehicle classes by 2014. This cohesive regulatory framework complements EU directives on vehicle safety, resulting in high penetration rates for both ABS and ESC across key markets such as Germany, the United Kingdom, and South Africa. Moreover, partnerships between OEMs and local suppliers have fostered competitive supply chains, balancing cost pressures with technological sophistication.

Across Asia-Pacific, diverse regulatory environments shape the adoption of braking and stability technologies. In markets like Japan and Australia, ESC mandates align closely with international UN/ECE standards, whereas rapidly growing markets in India and China have accelerated adoption through a combination of consumer safety advocacy and incremental policy measures. Tier-one suppliers in the region are responding with localized R&D centers and assembly facilities, aiming to optimize cost-performance ratios in markets where price sensitivity remains a critical consideration.

Cross-regional supply chain integration is becoming increasingly vital as OEMs and suppliers seek to harmonize component specifications and certification processes. Collaborative initiatives between North American, European, and Asia-Pacific regulatory bodies are streamlining homologation requirements, reducing redundancy for global part programs and enabling economies of scale that support sustainable innovation across all major regions.

This comprehensive research report examines key regions that drive the evolution of the Anti-Lock Braking System & Electronic Stability Control System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining strategic initiatives, technological innovations, and competitive positioning of braking and stability system manufacturers shaping the industry

Robert Bosch GmbH continues to set industry benchmarks through its ESP platform, having delivered over 250 million units globally and enabling up to 80 percent prevention of skidding incidents through its high-frequency sensor fusion and braking algorithms. Strategic collaborations, such as the intelligent tyre initiative with Pirelli, demonstrate Bosch’s commitment to integrating real-time traction data into stability control modules to enhance performance under variable conditions.

Continental AG builds on its traction control heritage by advancing modular brake control units that support seamless integration with electronic braking systems in electric vehicles, while ZF Friedrichshafen has expanded its ESC portfolio to include brake-by-wire actuators and predictive modulation features that respond to terrain sensing inputs. Japanese suppliers such as Denso and Aisin Seiki leverage OEM synergies to develop compact, ECU-integrated ABS-ESC units optimized for hybrid and fuel cell platforms, underscoring the sector’s shift toward multi-modal efficiency and miniaturization.

Emerging technology companies are also making inroads with software-centric brake control solutions. Start-ups focusing on machine learning–driven stability algorithms and cybersecure ECU platforms are collaborating with traditional suppliers to inject agility into R&D cycles, while also addressing evolving regulatory requirements for functional safety and software update management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Lock Braking System & Electronic Stability Control System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Aptiv PLC

- Continental AG

- DENSO Corporation

- Hitachi Astemo, Ltd.

- Hyundai Mobis Co., Ltd.

- Knorr-Bremse AG

- Mando Corporation

- Nissin Kogyo Co., Ltd.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

Delivering strategic recommendations to automotive stakeholders for optimizing integration and innovation in braking and stability systems

Automotive stakeholders should prioritize modular braking architectures that accommodate evolving propulsion platforms, enabling scalable integration across internal combustion, hybrid, and pure electric drivetrains. By adopting standardized ECU interfaces and harness topologies, manufacturers can streamline system validation and reduce time-to-market for new variants, while also facilitating rapid updates to software-driven stability control features.

Furthermore, leaders must deepen collaborations with tier-two suppliers and technology partners to leverage intelligent sensor networks and machine learning algorithms capable of predicting traction loss before it occurs. Aligning product roadmaps with emerging regulatory timelines and investing in localized manufacturing capabilities will not only mitigate tariff exposure but also cement competitive positioning in key regional markets.

Additionally, industry participants should invest in cybersecurity and over-the-air update infrastructures to maintain system integrity throughout the vehicle lifecycle. Establishing cross-functional teams that unite engineering, IT security, and regulatory compliance will ensure that stability control systems remain resilient against evolving threats and can be optimized continuously without compromising safety.

Outlining the rigorous research methodology combining primary data collection, expert validation, and secondary source analysis for this study

Our research methodology combined structured interviews with OEM safety engineers, tier-one supplier executives, and regulatory officials to validate core findings on system performance and market drivers. These insights were augmented by an extensive review of Federal Register documents, NHTSA regulatory filings, and UN/ECE technical regulations to ensure comprehensive coverage of both light and heavy vehicle safety standards.

Complementary secondary research encompassed analysis of peer-reviewed technical papers, credible industry magazines, and leading mobility technology press releases. Data triangulation across multiple sources, including legislative documents, multinational case studies, and supplier white papers, ensured the robustness of our segmentation and regional insights, while continuous quality checks by subject-matter experts fortified the reliability of our conclusions.

Quantitative data points were cross-verified with official government databases and independent academic studies, while qualitative inputs underwent rigorous peer review by senior analysts specializing in automotive safety systems. This multi-tiered approach provides confidence in the accuracy and relevance of the strategic imperatives and market observations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Lock Braking System & Electronic Stability Control System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Lock Braking System & Electronic Stability Control System Market, by Vehicle Type

- Anti-Lock Braking System & Electronic Stability Control System Market, by System Type

- Anti-Lock Braking System & Electronic Stability Control System Market, by Propulsion

- Anti-Lock Braking System & Electronic Stability Control System Market, by Channel Count

- Anti-Lock Braking System & Electronic Stability Control System Market, by Sales Channel

- Anti-Lock Braking System & Electronic Stability Control System Market, by Region

- Anti-Lock Braking System & Electronic Stability Control System Market, by Group

- Anti-Lock Braking System & Electronic Stability Control System Market, by Country

- United States Anti-Lock Braking System & Electronic Stability Control System Market

- China Anti-Lock Braking System & Electronic Stability Control System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing key insights to emphasize the strategic importance of advanced braking and stability technologies in enhancing vehicle safety and performance

As vehicle safety systems enter a new era of connectivity and electrification, the enduring relevance of ABS and ESC cannot be overstated. These technologies form the bedrock of modern active safety strategies, reducing crash risk through precise brake modulation and stability interventions that respond to real-time dynamic inputs.

Looking ahead, stakeholders who embrace modular architectures, invest in intelligent sensor networks, and align with evolving regulatory frameworks will be best positioned to drive the next wave of safety innovations, delivering enhanced protection and performance across the global automotive landscape.

The convergence of digital, regulatory, and tariff-driven forces underscores the need for agility in product development and supply chain management. By leveraging the insights from this report, industry leaders can anticipate disruptions and transform challenges into strategic opportunities that reinforce their market leadership and deliver value to end users.

Take the next step by engaging with Ketan Rohom to access comprehensive market research that empowers your strategic decision-making and competitive edge

To gain comprehensive access to the full market research report, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to unlock tailored insights that will empower your strategic initiatives and strengthen your competitive advantage in the rapidly evolving braking and stability systems sector.

Engaging directly with Ketan Rohom will provide you with detailed guidance on how to apply our findings to your product roadmap, partnership strategies, and investment planning. Discover how these proprietary insights into regulatory impacts, segmentation performance, and technology trends can help you navigate market complexities and drive sustainable growth.

- How big is the Anti-Lock Braking System & Electronic Stability Control System Market?

- What is the Anti-Lock Braking System & Electronic Stability Control System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?