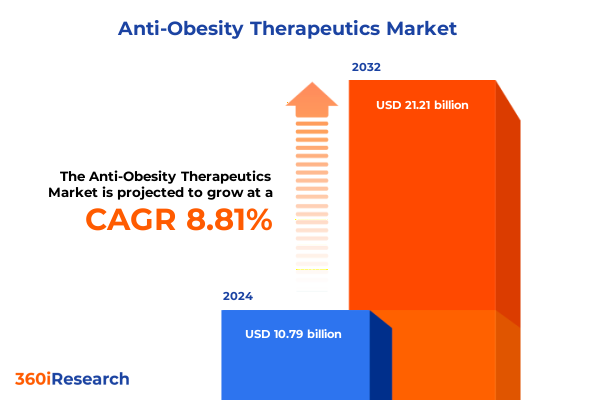

The Anti-Obesity Therapeutics Market size was estimated at USD 11.69 billion in 2025 and expected to reach USD 12.67 billion in 2026, at a CAGR of 8.87% to reach USD 21.21 billion by 2032.

Pioneering Pathways to Combat Obesity Through Groundbreaking Therapeutic Innovations and Collaborative Healthcare Strategies for Enhanced Patient Outcomes

Obesity represents one of the most pressing public health challenges of our time, imposing substantial clinical and economic burdens on patients, healthcare systems, and societies at large. Over the past decade, the scientific community has made remarkable strides in understanding the complex pathophysiology driving excess weight gain, leading to breakthroughs in drug design, patient monitoring, and multidisciplinary care. These advancements have catalyzed a rapidly expanding therapeutic pipeline that seeks to offer safer, more effective, and better-tolerated treatment options.

Against this backdrop of innovation, the anti-obesity therapeutic landscape is characterized by heightened collaboration between pharmaceutical developers, medical device manufacturers, digital health enterprises, and regulatory authorities. Coordinated efforts have shifted the focus from symptomatic weight management to precision targeting of metabolic pathways, appetite regulation, and energy homeostasis. Meanwhile, payers and patient advocacy groups are calling for expanded access, evidence of long-term outcomes, and integrated care models that bridge pharmacotherapy with behavioral support. By distilling these multifaceted developments into a cohesive narrative, this report lays the foundation for an in-depth exploration of emerging opportunities, strategic risks, and best practices shaping the future of obesity treatment.

Revolutionizing the Anti-Obesity Arena with Next Generation Biologics Personalized Medicine Digital Therapeutic Synergies and Expanded Access Models

The anti-obesity space is undergoing a fundamental transformation driven by the advent of next-generation biologics, combination therapies, and digital interventions that deliver unprecedented efficacy and patient engagement. At the forefront are glucagon-like peptide-1 receptor agonists and dual agonists, which have redefined weight loss benchmarks and opened doors to novel mechanism-based regimens. Concurrently, non-invasive endoscopic procedures and refined surgical techniques are complementing pharmacological approaches to address patient populations with severe or refractory obesity.

In tandem with therapeutic evolution, the integration of digital health platforms, telemedicine, and real-world data analytics is facilitating personalized treatment journeys. Physicians are leveraging remote monitoring to track patient progress in real time, while AI-driven algorithms optimize dosing and adherence support. These transformative shifts extend to payer frameworks, where value-based agreements and outcomes-oriented contracting are replacing traditional volume-driven reimbursement models. As a result, stakeholders across the pharmaceutical, medtech, and payer spectrum are coalescing around strategies that reward demonstrable health benefits, driving sustainable differentiation and unlocking new pathways to market expansion.

Unraveling the Comprehensive Impact of Newly Instituted United States Tariffs on Therapeutic Ingredients and Supply Chain Dynamics in 2025

In 2025, newly instituted United States tariffs have introduced additional complexity to sourcing active pharmaceutical ingredients and deploying global supply strategies. By targeting specific chemical intermediates and imported raw materials commonly originating from key manufacturing hubs, these measures have exerted upward pricing pressure on both upstream and downstream segments of the anti-obesity value chain. Manufacturers dependent on offshore suppliers have faced the challenge of recalibrating cost structures while preserving competitive pricing for end-market stakeholders.

The cumulative impact of these levies has accelerated the drive toward supply chain diversification, prompting organizations to explore nearshoring and domestic API production. This shift has spurred public–private collaboration on incentivizing local capacity, including grants for advanced manufacturing technologies and streamlined regulatory pathways for facilities meeting domestic content thresholds. While the immediate effect has raised input costs, medium to long-term benefits include enhanced resilience against geopolitical disruptions, improved traceability, and reduced lead times. Consequently, decision-makers are realigning sourcing strategies and capital investment plans to mitigate tariff-induced volatility and secure uninterrupted patient access.

Illuminating Critical Segmentation Insights That Inform Therapeutic Development Market Positioning And Commercialization Strategies

A nuanced examination of treatment type categorization underscores the dual pillars of anti-obesity intervention. On one hand, medications span a spectrum of mechanisms ranging from appetite suppression through neurohormonal modulation-represented by bupropion-naltrexone and semaglutide-to metabolic enhancement via incretin dual agonists such as tirzepatide and cardiovascular-focused agents like phentermine-topiramate. On the other hand, interventional treatments offer mechanical or anatomical modifications, evidenced by adjustable gastric banding, gastric bypass surgery, and cutting-edge endoscopic sleeve gastroplasty techniques that deliver sustained weight loss in clinically appropriate cohorts.

Beyond treatment modalities, drug classification trends reveal a growing dichotomy between over-the-counter and prescription products. Oral formulations dominate early adoption phases due to patient familiarity and ease of administration, whether provided as capsules, tablets, or liquid dosage forms. In parallel, parenteral delivery-encompassing both intravenous infusion and subcutaneous injection-has become the preferred route for high-potency biologics that necessitate stringent bioavailability control. Formulation strategies further diversify the market with semi-solid and solid dosage variations tailored to patient adherence and stability profiles.

Distribution channels are undergoing transformation as traditional hospitals and clinics remain key access points while online pharmacies and retail counterparts expand digital fulfillment capabilities. This multi-channel landscape demands agility in supply logistics, regulatory compliance, and patient support services to ensure seamless integration across touchpoints. Together, these segmentation lenses provide a comprehensive framework for evaluating opportunity windows and crafting differentiated positioning within an increasingly competitive anti-obesity marketplace.

This comprehensive research report categorizes the Anti-Obesity Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Drug Type

- Route Of Administration

- Drug Formulation

- Distribution Channel

Revealing Key Regional Dynamics Across Americas Europe Middle East Africa And Asia Pacific that Shape Therapeutic Accessibility and Adoption Patterns

Regional heterogeneity shapes both the adoption curves and strategic priorities of anti-obesity therapeutics. In the Americas, particularly within the United States, accelerated uptake of GLP-1 receptor agonists has been facilitated by robust reimbursement environments, widespread clinical guidelines endorsement, and high patient awareness. Access programs and manufacturer co-pay assistance initiatives have further reduced financial barriers, fostering mainstream acceptance of novel therapies.

In Europe, the Middle East, and Africa, fragmented regulatory frameworks and varying payer thresholds complicate market entry strategies. Nevertheless, centralized processes within the European Union have streamlined approval timelines for breakthrough designations, while emerging markets across the Middle East and Africa are witnessing growing interest in combination regimens that balance efficacy with cost considerations. Public health campaigns and digital education platforms are critical to driving physician and patient engagement in regions where obesity stigma and resource constraints intersect.

Asia-Pacific markets display pronounced diversity in both epidemiological profiles and healthcare infrastructure. Japan and Australia have advanced clinical pathways for injectable biologics, supported by national health insurance systems that incorporate outcomes-based reevaluation. Conversely, Southeast Asian economies are prioritizing scalable, cost-effective interventions to address rising obesity rates, creating fertile ground for generic and biosimilar entrants. Telehealth and mobile health solutions are especially prominent in remote geographies, bridging gaps in specialist access and facilitating ongoing therapeutic monitoring.

This comprehensive research report examines key regions that drive the evolution of the Anti-Obesity Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing Leading Biopharmaceutical Innovators and Strategic Partnerships Driving Breakthroughs in Anti-Obesity Therapeutic Development and Market Expansion

The competitive landscape of anti-obesity therapeutics is defined by a cadre of established innovators and agile challengers. Leading biopharmaceutical organizations have leveraged deep pipelines of peptide-based agents and strategic partnerships to secure first-mover advantages. Concurrently, niche developers with expertise in metabolic modulation and gut-microbiome interplay have attracted significant investment, driving rapid progress from research stages to late-phase clinical trials.

Strategic alliances between pharmaceutical titans and technology providers are accelerating the commercialization of digital companion tools that enhance adherence and patient support. In parallel, mergers and acquisitions are reshaping the value chain, enabling vertical integration of manufacturing capabilities and distribution networks. This consolidation is complemented by co-promotion agreements and joint ventures that expand geographic reach and diversify portfolios.

Key players are also forging cross-industry collaborations with weight-management clinics, payers, and academic research centers to generate robust real-world evidence. Such initiatives are pivotal for securing reimbursement for novel therapy classes and demonstrating long-term health economic benefits. As the competitive arena intensifies, the ability to combine clinical innovation with scalable commercial execution will distinguish the leaders from the followers in this rapidly evolving domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Obesity Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alizyme PLC

- Amgen Inc.

- Arena Pharmaceuticals Inc.

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Currax Pharmaceuticals LLC

- Eisai Co. Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- FlaxoSithKline plc.

- GlaxoSmithKline PLC

- Johnson & Johnson Services Inc.

- Merck & Co. Inc.

- Nalpropion Pharmaceuticals Inc.

- Norgine B.V.

- Novartis AG

- Novo Nordisk A/S

- Orexigen Therapeutics Inc.

- Pfizer Inc.

- Rhythm Pharmaceuticals, Inc.

- Sanofi S.A.

- SHIONOGI & Co., Ltd.

- Takeda Pharmaceutical Company Limited

- Vivus Inc.

- Zydus Lifesciences Limited

Translating Strategic Insights into Actionable Recommendations for Industry Leaders to Accelerate Adoption and Optimize Obesity Treatment Outcomes

To capitalize on emerging opportunities and mitigate sector-specific risks, industry leaders should pursue a multifaceted strategy. First, diversifying supply chains by integrating advanced manufacturing and nearshoring initiatives will reduce exposure to tariff volatility while enhancing production agility. Concurrently, establishing collaborative frameworks with contract manufacturing organizations can allow for responsive scaling in line with variable demand.

Second, investing in digital health integration-including telemedicine platforms and AI-driven patient engagement tools-will support adherence, enable personalized dosing adjustments, and gather real-world insights for continuous product optimization. These capabilities not only improve patient outcomes but also strengthen value-based contracting propositions with payers. Third, fostering cross-stakeholder partnerships across clinical, regulatory, and payer communities will accelerate evidence generation for novel mechanisms and streamline market access pathways.

Finally, embedding patient-centric support services-such as nutritional counseling, behavioral coaching, and community networks-into therapeutic programs will reinforce adherence and broaden long-term retention. By coupling clinical innovation with robust patient engagement and commercial agility, organizations can position themselves as preferred partners in the evolving anti-obesity ecosystem and ensure sustainable growth.

Detailing Comprehensive Research Methodology Emphasizing Rigorous Data Collection Analysis and Validation Processes Underpinning the Study Findings

This study synthesizes a rigorous blend of qualitative and quantitative research approaches to deliver a robust analytical framework. Secondary data sources-including peer-reviewed literature, regulatory filings, patent databases, and industry publications-were systematically reviewed to map the current therapeutic landscape and emerging pipeline assets. Concurrently, primary research involved structured interviews with key opinion leaders, clinical investigators, payers, patient advocacy group representatives, and manufacturing specialists to capture nuanced perspectives across the value chain.

Data triangulation techniques ensured consistency and validation across multiple inputs, while a dedicated advisory board of obesity experts provided oversight on methodological design and interpretation of findings. Geographic coverage spanned major markets in the Americas, Europe, Middle East, Africa, and Asia-Pacific, with attention to region-specific regulatory nuances and commercial considerations. Quality control measures, including inter-research cross-checks, data reconciliation protocols, and standardized reporting templates, were employed throughout the process to maintain accuracy and transparency.

The resulting insights reflect a balanced integration of strategic intelligence and operational realities, offering stakeholders a clear line of sight into development trends, market dynamics, and actionable imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Obesity Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Obesity Therapeutics Market, by Treatment Type

- Anti-Obesity Therapeutics Market, by Drug Type

- Anti-Obesity Therapeutics Market, by Route Of Administration

- Anti-Obesity Therapeutics Market, by Drug Formulation

- Anti-Obesity Therapeutics Market, by Distribution Channel

- Anti-Obesity Therapeutics Market, by Region

- Anti-Obesity Therapeutics Market, by Group

- Anti-Obesity Therapeutics Market, by Country

- United States Anti-Obesity Therapeutics Market

- China Anti-Obesity Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Evolving Anti-Obesity Therapeutic Ecosystem Highlighting Strategic Imperatives and Future Pathways for Stakeholder Success

The anti-obesity therapeutic ecosystem stands at a pivotal juncture, where the convergence of groundbreaking pharmacological innovations, digital health integration, and evolving reimbursement models is reshaping treatment paradigms. Stakeholders who embrace supply chain resilience, leverage real-world evidence, and foster collaborative partnerships will be best positioned to navigate tariff challenges and capture value from the expanding pipeline.

Moreover, the deepening segmentation of treatment modalities, administration routes, and distribution channels underscores the importance of nuanced go-to-market strategies tailored to patient subgroups and regional market conditions. As leading biopharmaceutical innovators and dynamic niche players vie for leadership, the ability to execute on strategic recommendations-ranging from domestic API sourcing to patient engagement programs-will serve as a critical differentiator.

Ultimately, organizations that align clinical excellence with commercial agility and patient-centric approaches will drive sustainable growth and meaningful health outcomes. This report highlights the strategic imperatives and future pathways that industry participants must consider to achieve long-term success in the rapidly evolving anti-obesity landscape.

Engage with Associate Director for Customized Insights and Secure the Comprehensive Report on Anti-Obesity Therapeutics to Drive Your Strategic Vision

To gain a competitive edge and harness the full spectrum of insights covered in this report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will collaborate with you to tailor a purchase plan that aligns with your organization’s strategic priorities, ensuring you receive the most relevant and actionable intelligence on anti-obesity therapeutics. By securing this comprehensive research asset, you will equip your team with the critical context needed to navigate shifting market dynamics, leverage emerging therapeutic innovations, and capitalize on forthcoming regulatory and tariff changes. Engage directly with Ketan to explore flexible licensing options, custom deliverables, and exclusive add-ons that support your roadmap for growth. His expertise in bridging analytical rigor with practical commercial applications will help translate report findings into measurable impact within your therapeutic development, market access, and stakeholder engagement strategies. Take the next step toward transforming your obesity treatment portfolio by contacting Ketan today and unlock unparalleled guidance to drive your strategic vision and operational success.

- How big is the Anti-Obesity Therapeutics Market?

- What is the Anti-Obesity Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?