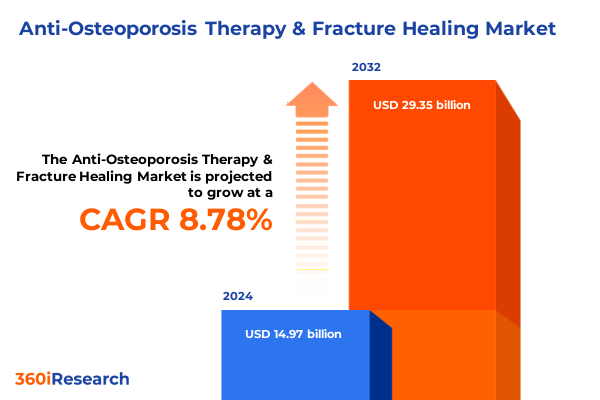

The Anti-Osteoporosis Therapy & Fracture Healing Market size was estimated at USD 16.28 billion in 2025 and expected to reach USD 17.72 billion in 2026, at a CAGR of 8.77% to reach USD 29.35 billion by 2032.

Understanding the Critical Landscape of Anti Osteoporosis Treatments and Fracture Healing Through Innovative Therapeutic Pathways and Evolving Market Dynamics

The rising prevalence of osteoporosis among aging populations has transformed bone health into a pressing global concern. As individuals live longer and remain active well into their later decades, the risk of fragility fractures has surged, imposing significant burdens on healthcare systems and patient quality of life. Hip, spinal, and wrist fractures, in particular, can result in prolonged immobility, diminished independence, and elevated morbidity, driving an urgent need for effective prevention and therapeutic strategies that restore skeletal integrity and expedite healing processes.

Amid this backdrop, the integration of anti-osteoporosis therapies with advanced fracture healing modalities represents a paradigm shift in musculoskeletal care. Beyond merely augmenting bone mineral density, next-generation treatments emphasize tailored biochemical pathways, targeted biologic mechanisms, and personalized patient management protocols. This introduction outlines the multifaceted dynamics of anti-osteoporosis therapy and fracture healing, setting the stage for an exploration of market transformations, tariff influences, segmentation insights, regional differentials, leading industry participants, and strategic imperatives that define the current and future contours of this critical therapeutic domain.

Exploring the Rapid Evolution of Osteoporosis Management and Fracture Healing Driven by Biologic Therapies Digital Technologies and Personalized Care Approaches

In recent years, the landscape of osteoporosis management and fracture healing has been fundamentally reshaped by the advent of biologic agents and precision medicine approaches. Monoclonal antibodies targeting the receptor activator of nuclear factor kappa-B ligand have demonstrated superior efficacy in reducing fracture risk, while parathyroid hormone analogues have pioneered anabolic pathways that actively foster bone formation. Concurrently, selective estrogen receptor modulators and hormone replacement interventions continue to refine risk-benefit profiles for postmenopausal patients, illustrating a nuanced balance between efficacy and safety.

Digital health platforms and telemedicine capabilities have complemented pharmacologic advances by fostering improved patient engagement, adherence monitoring, and remote rehabilitation support. Wearable sensors now enable real-time assessment of mobility and weight-bearing status, allowing clinicians to calibrate fracture healing regimens with unprecedented precision. As regulatory agencies adapt to expedited approval pathways for breakthrough therapies, collaboration between academic centers, biopharma innovators, and specialized clinics has accelerated the translation of laboratory breakthroughs into clinical practice. This confluence of biologics, digital tools, and streamlined regulatory frameworks underpins the transformative trajectory of osteoporosis and fracture care.

Assessing the Compounded Effects of United States Tariff Policies in 2025 on Osteoporosis Treatment Supply Chains Manufacturing Innovation and Cost Structures

The implementation of enhanced tariff measures by the United States in 2025 has exerted compounding pressures on the global supply chain for osteoporosis therapeutics and fracture healing products. Import duties levied on active pharmaceutical ingredients and critical raw materials have translated into elevated manufacturing expenses, prompting several developers to reevaluate sourcing strategies. In response, some manufacturers have regionalized production footprints or pursued vertical integration to mitigate cost escalations, while others have negotiated longer-term contracts with raw material suppliers to secure price stability.

These cost headwinds have further influenced R&D investments, as budget allocations shift to absorb incremental duties without compromising pipeline progression. Companies are increasingly exploring alternative material chemistries, such as synthetic analogues and biosynthetic peptides, to reduce dependence on tariff-affected imports. Combined with inflationary trends in logistics and packaging, the tariff landscape has redefined procurement models and underscored the necessity of supply chain resilience. As a result, strategic collaborations and localized manufacturing hubs are emerging as critical levers to contain expenses, ensure uninterrupted product availability, and sustain innovation amid evolving trade policies.

Unveiling Segmentation Perspectives to Decipher Heterogeneous Patient Populations Treatment Modalities Administration Routes End User Venues and Fracture Types

A comprehensive analysis of the osteoporosis therapy and fracture healing market necessitates a detailed understanding of segment-specific dynamics. By therapy type, the landscape encompasses established bisphosphonates-ranging from oral alendronate, ibandronate and risedronate formulations to intravenous zoledronic acid-alongside hormone replacement solutions, either combined hormone therapy pathways or estrogen-only protocols. The monoclonal antibody cohort features denosumab, differentiated into Prolia for osteoporosis prevention and Xgeva for oncologic bone complications, as well as the newer romosozumab agents that dual-function as both antiresorptive and anabolic facilitators. Parathyroid hormone analogues, consisting of abaloparatide and the teriparatide franchise, continue to establish anabolic bone remodeling as a central therapeutic axis, while selective estrogen receptor modulators such as bazedoxifene and raloxifene offer tailored risk modulation in postmenopausal cohorts.

Complementing these treatment modalities are varying routes of administration, with oral regimens serving as patient-friendly mainstays and injectable options presented in either intravenous infusion or subcutaneous injection formats, each calibrated for dosing frequency and bioavailability. Adoption patterns also vary by end user, as homecare programs integrate self-administered therapies for chronic management, hospitals deliver acute fracture healing interventions in inpatient settings, and specialty clinics orchestrate multidisciplinary programs that bridge diagnostics, pharmacotherapy and rehabilitation. Fracture type further delineates clinical focus, from hip and spinal stabilization protocols to advanced immobilization and bone graft methodologies dedicated to wrist injury recovery. Together, these segmentation layers provide a multifaceted lens for interpreting competitive positioning and unmet clinical needs.

This comprehensive research report categorizes the Anti-Osteoporosis Therapy & Fracture Healing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Route Of Administration

- Fracture Type

- End User

Highlighting Regional Nuances in Osteoporosis Therapeutic Adoption and Fracture Healing Dynamics Across the Americas Europe Middle East Africa and Asia Pacific

Regional disparities in healthcare infrastructure, reimbursement frameworks, and population demographics drive notable variations in osteoporosis therapy adoption and fracture healing approaches. In the Americas, robust access to specialty clinics and homecare infusion services has accelerated uptake of monoclonal antibodies and parathyroid analogues. Well-established hospital networks facilitate comprehensive fracture management, integrating surgical interventions with pharmacologic support. Patient assistance programs and insurance reimbursement policies in this region have historically mitigated out-of-pocket burdens, although recent policy reforms are prompting stakeholders to explore value-based contracting and outcomes-driven agreements.

Across Europe, the Middle East and Africa, divergent regulatory environments and formulary limitations have shaped a more conservative approach to biologic utilization, with many markets emphasizing cost-effective bisphosphonate therapies and selective estrogen receptor modulators. Specialized fracture healing centers in Western Europe have pioneered clinical pathways integrating bone morphogenetic proteins and minimally invasive surgical techniques, while emerging economies in the region are investing in public health initiatives to improve osteoporosis screening and fracture prevention. In Asia-Pacific, aging populations in Japan and China have fueled strong demand for both anabolic agents and innovative digital rehabilitation platforms. Government-backed awareness campaigns and localized manufacturing capacities are poised to enhance regional self-sufficiency and drive future growth in this dynamic territory.

This comprehensive research report examines key regions that drive the evolution of the Anti-Osteoporosis Therapy & Fracture Healing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Pharmaceutical Innovators Shaping the Future of Osteoporosis Treatment and Fracture Healing Through Strategic Pipelines Collaborations and Technology

Several leading pharmaceutical and biotech innovators continue to shape the competitive landscape through differentiated pipelines, strategic collaborations, and technology investments. Amgen retains prominence with its Prolia franchise, leveraging long-term data on denosumab to expand indications and refine patient adherence programs. In partnership with UCB, romosozumab has further underscored the feasibility of dual-action biologics, prompting a wave of second-generation antibody development efforts. Radius Health has secured its presence in the anabolic segment through abaloparatide, while Eli Lilly’s teriparatide offerings benefit from expanded dosing regimens that enhance convenience without sacrificing efficacy.

Traditional bisphosphonate stakeholders, including Pfizer and Teva, continue to optimize generic formulations of alendronate, risedronate and zoledronic acid to maintain affordability in cost-sensitive markets. Concurrently, endocrine specialists are exploring novel hormone replacement formulations, with Bayer and several emerging biotech firms investigating tissue-selective estrogen complexes to minimize systemic risks. Technology collaborations between medtech providers and drug developers have introduced advanced bone healing scaffolds and sensor-enabled implants, illustrating a growing convergence of pharmacologic and device-based innovation. This ecosystem of diversified leaders underscores the importance of cross-functional partnerships and robust intellectual property strategies to sustain long-term differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anti-Osteoporosis Therapy & Fracture Healing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline plc

- Healthy Life Pharma Pvt. Ltd.

- Johnson & Johnson Services, Inc.

- Manus Aktteva Biopharma LLP

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Salvavidas Pharmaceutical Private Limited

- Sanofi S.A.

- Taj Pharmaceuticals

- Taj Pharmaceuticals Limited

- Teva Pharmaceuticals Industries Ltd

Empowering Industry Leadership with Actionable Strategies to Enhance Innovation Success and Patient Outcomes in Osteoporosis Treatment and Fracture Healing

Industry leaders must adopt multifaceted strategies to navigate the evolving osteoporosis and fracture healing environment while delivering sustainable value. Prioritizing investments in biologic manufacturing flexibility can offset tariff-induced cost pressures and mitigate supply disruptions, thereby preserving market access and patient affordability. Organizations should also expand digital engagement platforms that facilitate remote monitoring of adherence, mobility metrics and rehabilitation progress, enabling real-world evidence generation and strengthening payer negotiations through demonstrated outcomes.

Strategic alliances with contract manufacturing organizations and regional centers of excellence can localize production and regulatory filings, reducing exposure to trade policy volatility. Simultaneously, cross-sector partnerships with medtech innovators will unlock integrated therapeutic solutions that combine pharmacologic agents with next-generation bone scaffolds, positioning companies at the forefront of holistic fracture healing care. Finally, cultivating end-user education programs-targeted to homecare nurses, hospital orthopedists and specialty clinic staff-will drive optimized treatment protocols, enhance patient satisfaction, and reinforce the therapeutic value proposition in an increasingly cost-conscious landscape.

Implementing a Robust Research Framework Integrating Primary Expert Interviews Secondary Source Review and Triangulation for Reliable Osteoporosis Insights

This research leverages an integrated framework combining primary expert interviews with orthopedic specialists, endocrinologists, and rehabilitation therapists alongside comprehensive secondary source reviews of peer-reviewed journals, regulatory filings, and proprietary clinical trial databases. Initial stages involved qualitative discussions with key opinion leaders to identify emergent clinical challenges, unmet needs, and adoption barriers across diverse healthcare settings. Insights from these interviews informed the development of structured questionnaires administered to portfolio managers, supply chain executives, and market access professionals.

Secondary analysis encompassed a thorough examination of global and regional policy documents, tariff schedules, and industry white papers to map the influence of trade measures on manufacturing economics and distribution logistics. Quantitative data from public health registries and institutional reports further triangulated prevalence trends and therapeutic penetration rates. Finally, each data stream underwent rigorous validation through cross-referencing and consistency checks, ensuring that reported findings reflect the most reliable and actionable intelligence available for stakeholders in the anti-osteoporosis therapy and fracture healing domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anti-Osteoporosis Therapy & Fracture Healing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anti-Osteoporosis Therapy & Fracture Healing Market, by Therapy Type

- Anti-Osteoporosis Therapy & Fracture Healing Market, by Route Of Administration

- Anti-Osteoporosis Therapy & Fracture Healing Market, by Fracture Type

- Anti-Osteoporosis Therapy & Fracture Healing Market, by End User

- Anti-Osteoporosis Therapy & Fracture Healing Market, by Region

- Anti-Osteoporosis Therapy & Fracture Healing Market, by Group

- Anti-Osteoporosis Therapy & Fracture Healing Market, by Country

- United States Anti-Osteoporosis Therapy & Fracture Healing Market

- China Anti-Osteoporosis Therapy & Fracture Healing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding Synthesis of Therapeutic Innovations Market Dynamics and Strategic Imperatives for Advancing Osteoporosis Care and Fracture Healing Outcomes

The convergence of biologic therapies, digital innovation, and personalized care pathways is redefining the future of osteoporosis management and fracture healing. As tariff policies reshape supply chain dynamics, organizations are compelled to develop adaptive manufacturing and sourcing strategies while maintaining a relentless focus on clinical differentiation. Multi-layered segmentation analysis underscores the necessity of tailoring approaches to specific patient cohorts, administration preferences, care delivery channels and fracture types.

Leading enterprises are demonstrating that strategic collaboration-across pharmaceutical, biotechnology, medtech and digital health sectors-yields the most potent platforms for sustained competitive advantage. By implementing actionable recommendations that emphasize flexibility, integration and patient-centricity, stakeholders can navigate market uncertainties and unlock new avenues for growth. This comprehensive examination illuminates the critical intersections of innovation, policy and patient care that will guide decision-makers in elevating outcomes and driving long-term value in the anti-osteoporosis therapy and fracture healing landscape.

Contact Ketan Rohom Associate Director Sales Marketing to Secure the Anti Osteoporosis Therapy and Fracture Healing Market Research Report Today

I invite you to reach out to Ketan Rohom, Associate Director Sales & Marketing at our organization, to obtain the definitive anti-osteoporosis therapy and fracture healing market research report today. This comprehensive study delivers critical intelligence into emerging therapeutic modalities, supply chain considerations, tariff impacts, and competitive landscapes that will empower your strategic planning.

Ketan Rohom is ready to guide you through the report’s extensive findings, ensuring you gain the insights needed to navigate shifting industry dynamics, optimize product positioning, and seize growth opportunities in 2025 and beyond. Contact him to discuss customized licensing options and to secure your copy of the report at the earliest opportunity.

- How big is the Anti-Osteoporosis Therapy & Fracture Healing Market?

- What is the Anti-Osteoporosis Therapy & Fracture Healing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?