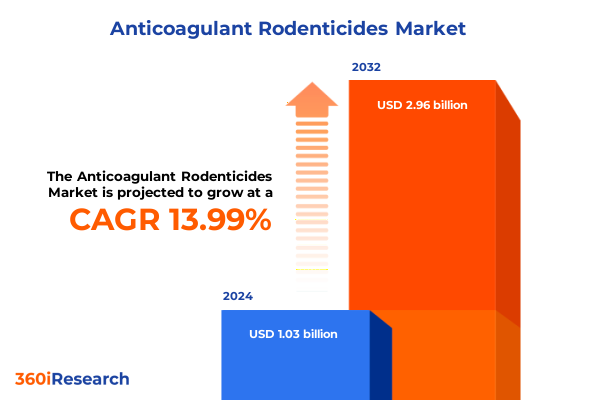

The Anticoagulant Rodenticides Market size was estimated at USD 1.15 billion in 2025 and expected to reach USD 1.29 billion in 2026, at a CAGR of 14.41% to reach USD 2.96 billion by 2032.

Driving Strategic Understanding of the Anticoagulant Rodenticide Market Dynamics and Emerging Opportunities in a Complex Regulatory Environment

The intricate landscape of anticoagulant rodenticides demands a strategic framework to understand the convergence of technological advancements, evolving regulations, and shifting end-user priorities. This executive summary provides a cohesive vantage point from which senior leaders can navigate the complexities inherent in mitigating rodent-related risks while adhering to increasingly stringent environmental and safety requirements. By framing key developments and emerging patterns, it lays the groundwork for informed decision making and targeted investment strategies.

This section introduces the foundational context of anticoagulant rodenticides, illuminating their mechanism of action against enzymatic pathways critical to rodent survival. It outlines the differentiation between first-generation compounds such as Warfarin and Coumatetralyl and second-generation counterparts including Brodifacoum and Difethialone. Moreover, it addresses the interplay between formulation innovations-from solid blocks to liquid concentrates-and the demand for tailored application approaches across agricultural, municipal, and residential settings.

In addition to delineating core chemical and usage dimensions, this introduction highlights the transformative shifts catalyzed by both regulatory scrutiny and sustainability imperatives. It anticipates how modifications in tariff structures, international trade policies, and public perception influence supply chain resilience and product development roadmaps. Ultimately, this opening chapter sets the tone for a thorough exploration of market segmentation, regional variations, corporate strategies, and actionable recommendations for navigating the evolving anticoagulant rodenticide ecosystem.

Exploring Revolutionary Shifts in Rodenticide Development Regulatory Landscapes and Sustainable Pest Control Practices Reshaping Industry Standards

Recent years have witnessed a rapid integration of novel application technologies aimed at enhancing the precision and safety of rodenticidal interventions. From bait stations equipped with sensor-based monitoring to burrow deployment systems that reduce non-target exposure, these technological investments reflect a broader industry commitment to sustainable, data-driven pest control. Transitioning away from purely chemical reliance, practitioners are increasingly adopting integrated pest management paradigms that leverage environmental modifications and biological controls in tandem with anticoagulant baits.

Concurrent regulatory recalibrations have reshaped the availability and permissible concentrations of both first- and second-generation compounds. Heightened scrutiny over persistent residues in non-target species has compelled manufacturers to reformulate active ingredients and explore lower-toxicity analogs. These shifts have prompted a reallocation of R&D budgets toward next-generation molecules designed for rapid metabolism in wildlife and minimal environmental persistence, thereby addressing both regulatory compliance and public concern over biodiversity impacts.

Moreover, there has been a discernible pivot toward collaboration with academic institutions and nonprofit research bodies to develop predictive models for rodent population dynamics. By harnessing ecological data and statistical algorithms, stakeholders can optimize deployment schedules and reduce total chemical usage. This evidences a broader trend of leveraging cross-sector partnerships to balance efficacy with ecological stewardship, ultimately elevating the ethical profile of rodenticide applications.

Lastly, digital workflow integration has enabled remote tracking of bait consumption patterns in real time. By aggregating usage data across multiple end-user sites, suppliers can refine logistical planning, forecast replenishment needs, and customize service offerings. This digitization facilitates a feedback loop between field performance metrics and product refinement, underscoring the pivotal role of data analytics in advancing operational efficiency and efficacy within the anticoagulant rodenticide landscape.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Measures on Anticoagulant Rodenticide Supply Chains and Cost Structures

The introduction of incremental tariffs on imported raw materials and finished products in early 2025 has reverberated across the anticoagulant rodenticide supply chain. Manufacturers that historically sourced active ingredients from global suppliers have encountered escalated input costs, necessitating strategic sourcing pivots. To mitigate tariff-induced price pressures, several producers have forged alliances with domestic chemical manufacturers or diversified their procurement channels to leverage tariff-exempt trading zones.

In parallel, the tariff adjustments have incentivized increased local production of formulation components. A subset of market players has accelerated investments in in-country manufacturing infrastructure to internalize cost volatility and secure uninterrupted supply lines. This shift toward domestic capacity not only addresses immediate financial implications but also bolsters long-term resilience against geopolitical trade fluctuations.

On the distribution front, retailers and pest management service providers have grappled with greater cost pass-through dynamics. In response, many are renegotiating contract terms with end users or offering value-added services such as predictive inventory management to justify premium pricing. The ripple effect has been a tightening of margins for distributors who lack scale or integration capabilities, prompting a consolidation trend among regional suppliers seeking operational synergies.

Ultimately, the cumulative impact of 2025 tariffs extends beyond transient cost adjustments. It has precipitated a strategic reorientation toward supply chain segmentation, where high-value, environmentally benign formulations are prioritized for tariff-vulnerable segments while legacy compounds remain concentrated in lower-cost distribution channels. This bifurcation underscores the necessity for agility and supply chain transparency to navigate ongoing trade policy uncertainties.

Uncovering Critical Insights from Multifaceted Segmentation of Anticoagulant Rodenticides by Type Formulation Mode of Action and Application Channels

A nuanced understanding of market behavior emerges when dissecting the spectrum of active ingredient classes. The earliest anticoagulants, which include chlorophacinone, coumatetralyl, diphacinone, pindone, and warfarin, remain foundational within certain agricultural and residential applications due to their well-established safety profile when used in regulated doses. Conversely, second-generation agents such as brodifacoum, bromadiolone, difenacoum, difethialone, and flocoumafen dominate high-resistance scenarios, delivering single-feed lethality but triggering heightened regulatory scrutiny over potential ecological persistence.

Formulation preferences further delineate user requirements and environmental considerations. Solid block formulations enjoy widespread adoption in urban settings where tamper resistance is paramount, whereas grain and pellet forms are preferred in expansive agricultural fields for cost-effective coverage. Liquid and paste offerings cater to specialized use cases, enabling precise dosing and targeted delivery when non-target species must be safeguarded.

Mode of action segmentation sheds light on strategic selection criteria. Coumarin-based compounds bridge a wide potency range, serving markets that demand either gradual control or rapid eradication, while indanedione derivatives provide alternative biochemical pathways for populations exhibiting coumarin resistance. This mechanistic diversity ensures that both legacy and emerging rodent strains can be managed effectively, particularly when rotation strategies are employed to mitigate resistance buildup.

Target rodent species drive product design and deployment tactics. Mice and rats constitute the bulk of demand, but squirrels and voles represent niche segments within agricultural and forestry contexts. Tailoring bait attractiveness and delivery modalities to species-specific foraging behaviors enhances overall efficacy and minimizes excessive application volumes.

End-user categories reveal divergent purchasing behaviors and service requirements. Agricultural operators prioritize bulk procurement and operational integration with crop protection cycles, while municipal authorities emphasize public safety compliance and environmentally considerate formulations. Commercial, industrial, and residential clientele each exhibit unique preferences regarding service frequency, application sophistication, and post-treatment monitoring, guiding suppliers in customizing product bundles and support structures.

Finally, application methods from bait stations and burrow baiting to liquid and loose bait techniques underscore the importance of situational adaptability. Bait stations provide controlled environments for sensitive sites, burrow baiting leverages rodent tunnel networks, liquid baiting addresses water-soluble formulations, and loose bait remains integral for large open-area deployments. Innovation in each method continues to evolve in response to operational feedback and regulatory mandates.

This comprehensive research report categorizes the Anticoagulant Rodenticides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Formulation

- Mode Of Action

- Target Rodent

- Application Method

- End User

Illuminating Diverse Regional Dynamics Influencing Anticoagulant Rodenticide Demand Regulatory Environments and Innovation Pathways Across Global Markets

Within the Americas, regulatory agencies have balanced agricultural productivity with environmental protection by reinforcing stewardship programs and promoting training for certified applicators. This region benefits from well-established distribution networks and a mature service provider ecosystem, yet faces pressure to adopt next-generation anticoagulants that align with wildlife conservation objectives. Moreover, the North American emphasis on digital tracking and field analytics has spurred early adoption of intelligent bait stations and remote monitoring solutions.

Meanwhile, Europe, the Middle East, and Africa exhibit pronounced regulatory heterogeneity, ranging from stringent European Union directives that limit second-generation poison concentrations to emerging markets in the Middle East exploring increased urban pest control services. Africa presents unique challenges including informal market channels and limited cold chain infrastructure for certain formulations. Nevertheless, rising urbanization and expanding commercial real estate portfolios are elevating demand for standardized, compliant rodenticide solutions across EMEA.

In the Asia-Pacific, growth is driven by rapid urban expansion, agricultural intensification, and heightened awareness of zoonotic disease risks. Countries like China, India, and Southeast Asian nations have instituted more rigorous import regulations and sustainability mandates, prompting multinational suppliers to establish localized manufacturing hubs. Additionally, Asia-Pacific stakeholders are pioneering cost-effective mixed-formulation approaches that integrate granules and liquids, optimizing supply chain efficiency while adhering to increasingly uniform safety standards.

Across all regions, the drive toward harmonization of safety protocols and training initiatives underscores the global imperative for responsible rodenticide usage. Whether through certification programs in the Americas, EU-aligned labeling requirements in EMEA, or government-led extension services in Asia-Pacific, regional frameworks are converging toward a unified ethos centered on environmental stewardship and human health protection.

This comprehensive research report examines key regions that drive the evolution of the Anticoagulant Rodenticides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Strategic Profiles of Leading Global Anticoagulant Rodenticide Manufacturers Their Innovations Alliances and Market Positioning Tactics

The competitive terrain of anticoagulant rodenticides is populated by multinational chemical conglomerates that leverage extensive R&D pipelines and global distribution infrastructures. These firms continuously refine active ingredient portfolios to address emerging resistance patterns and regulatory constraints, often introducing dual-compound formulations to enhance efficacy. Strategic partnerships with specialty chemical producers enable rapid scaling of novel molecules while controlling cost structures.

Mid-tier manufacturers differentiate their offerings through service-oriented models, bundling application training, digital monitoring tools, and on-site consultation. This integrated approach caters to end users seeking turnkey solutions and reduces dependency on third-party service providers. Additionally, these players frequently cultivate regional alliances to access localized expertise and expedite regulatory approvals for specialized formulations.

Innovative start-ups are also reshaping competitive dynamics by pioneering biobased rodenticide alternatives that minimize environmental persistence. While still nascent, these bioactive compounds demonstrate promising efficacy against resistant rodent populations, potentially disrupting the longstanding dominance of synthetic agents. Venture capital interest in these ventures underscores the growing market appetite for sustainable and differentiated pest control modalities.

Lastly, distribution specialists and pest management service providers occupy a critical nexus between manufacturers and end users. By harnessing data analytics and logistics optimization, they streamline supply chain operations and provide tailored application services. Their evolving role as consultative partners reinforces the importance of collaboration across the value chain, ensuring that product innovations translate into quantifiable field outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anticoagulant Rodenticides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. SAJ Agricare Pvt. Ltd

- Adama Agricultural Solutions Ltd.

- Anticimex AB

- Arbuda Agrochemicals Ltd

- BASF SE

- Bayer AG

- De Sangosse Group

- Ecolab Inc.

- FMC Corporation

- Heranba Industries Ltd

- Impex Europa S.L.

- Kalyani Industries Limited

- Killgerm Group Ltd

- Motomco Ltd

- Neogen Corporation

- Orkin LLC

- PelGar International PLC

- POMAIS Agriculture

- Rollins, Inc.

- SenesTech, Inc.

- Sichuan Sunshine Biotech Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- Truly Nolen Group

- UPL Limited

Formulating Actionable Strategies for Industry Leaders to Navigate Regulatory Complexities Elevate Product Innovation and Optimize Supply Chain Resilience

Industry leaders should prioritize the development of next-generation active ingredients that balance rapid rodent mortality with minimal non-target exposure and environmental persistence. By channeling R&D investments into lower-toxicity analogs and synergistic compound blends, companies can preempt both regulatory restrictions and emerging resistance challenges. Furthermore, collaboration with academic research centers can accelerate the validation of novel mechanisms of action while sharing the burden of pre-commercialization risk.

Strengthening supply chain resilience remains a strategic imperative. Diversifying raw material sourcing through regional manufacturing hubs or tariff-exempt zones can buffer against geopolitical disruptions and cost fluctuations. Concurrently, implementing real-time inventory tracking and demand forecasting tools empowers procurement teams to optimize stock levels, reduce lead times, and enhance service reliability for end users.

Expanding value-added service models serves to differentiate offerings beyond commodity-priced formulations. Companies can integrate digital monitoring platforms, remote data analytics, and customized training modules to foster stronger client partnerships and justify premium pricing tiers. These consultative services build long-term customer loyalty and create recurring revenue streams that are less vulnerable to commodity price cycles.

Finally, fostering proactive engagement with regulatory bodies and industry associations ensures timely alignment with evolving compliance mandates. By participating in standard-setting committees and contributing to best-practice guidelines, firms can influence policy direction while demonstrating leadership in responsible stewardship. This collaborative approach not only mitigates regulatory risk but also reinforces corporate reputation in sustainability and public health arenas.

Detailing a Robust Research Methodology Combining Primary Stakeholder Interviews Secondary Data Analysis and Rigorous Validation Processes for Credible Insights

The research underpinning this analysis combines robust primary and secondary methodologies to ensure comprehensive, unbiased insights. Primary data were gathered through in-depth interviews with key stakeholders encompassing senior executives at manufacturing firms, distribution partners, and regulatory agency representatives. These discussions illuminated real-world challenges in product development, compliance, and market access strategies.

Secondary research sources included peer-reviewed journals, government regulatory filings, and industry whitepapers, providing historical context and technical validation for emerging trends. These resources were systematically reviewed to identify shifts in regulatory frameworks, formulation science breakthroughs, and supply chain reconfigurations. Data triangulation was employed to cross-verify critical findings against multiple independent sources.

Quantitative modeling techniques were utilized to validate thematic observations, employing scenario analysis to test the resilience of supply chains under varying tariff regimes and raw material availability. Qualitative thematic analysis of interview transcripts facilitated the extraction of recurring pain points and strategic opportunities. This dual approach ensured that the final recommendations are both empirically grounded and pragmatically relevant to leadership decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anticoagulant Rodenticides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anticoagulant Rodenticides Market, by Type

- Anticoagulant Rodenticides Market, by Formulation

- Anticoagulant Rodenticides Market, by Mode Of Action

- Anticoagulant Rodenticides Market, by Target Rodent

- Anticoagulant Rodenticides Market, by Application Method

- Anticoagulant Rodenticides Market, by End User

- Anticoagulant Rodenticides Market, by Region

- Anticoagulant Rodenticides Market, by Group

- Anticoagulant Rodenticides Market, by Country

- United States Anticoagulant Rodenticides Market

- China Anticoagulant Rodenticides Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Illuminate Future Directions for Anticoagulant Rodenticide Stakeholders and Inform Strategic Decision Making

This executive summary has charted the complex interplay of innovation, regulation, and economics influencing the anticoagulant rodenticide sector. From the strategic segmentation of active ingredients and formulations to the ripple effects of 2025 tariff measures, the analysis underscores the importance of adaptive strategies that prioritize both efficacy and sustainability. Regional insights reveal converging trends toward harmonized safety standards and digital adoption, while competitive intelligence highlights the imperative for service-driven differentiation.

Looking ahead, industry stakeholders who embrace collaborative R&D, fortify supply chain agility, and engage proactively with regulatory bodies will be best positioned to capitalize on emerging opportunities. The convergence of environmental stewardship and technological innovation presents a compelling pathway for sustainable growth, ensuring that anticoagulant rodenticides continue to serve as a vital tool in integrated pest management frameworks worldwide.

Empowering Decision Makers to Secure Comprehensive Intelligence with Ketan Rohom’s Expert Guidance on Advanced Anticoagulant Rodenticide Market Trends

Engaging with a dedicated expert such as Ketan Rohom empowers stakeholders to access unparalleled market intelligence tailored to organizational objectives and operational challenges. His deep understanding of evolving regulatory frameworks, product innovations, and supply chain intricacies ensures that clients receive actionable guidance designed to drive measurable results and competitive differentiation.

To explore the full breadth of insights captured in our comprehensive report on anticoagulant rodenticides, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with him, you will secure customized research deliverables, receive expert consultation on strategic initiatives, and unlock the critical information necessary to guide confident investment, product development, and market entry decisions.

- How big is the Anticoagulant Rodenticides Market?

- What is the Anticoagulant Rodenticides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?