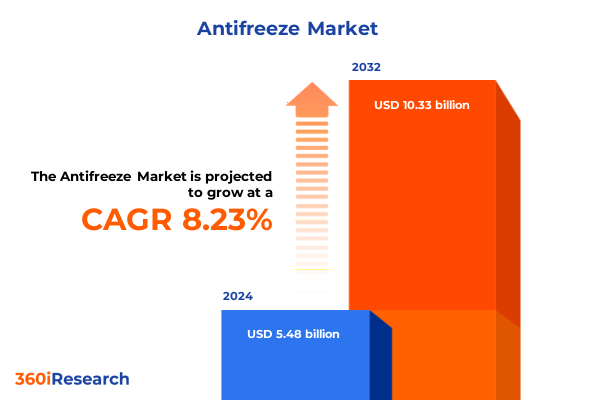

The Antifreeze Market size was estimated at USD 5.89 billion in 2025 and expected to reach USD 6.34 billion in 2026, at a CAGR of 8.34% to reach USD 10.33 billion by 2032.

An authoritative overview for decision-makers on the fundamental drivers shaping technological evolution and market dynamics in the global antifreeze industry

The global antifreeze market plays a critical role as both a protective agent against freezing and overheating in internal combustion engines and as an efficient heat transfer medium in diverse industrial processes. Antifreeze formulations prevent engine block damage, inhibit corrosion in cooling systems, and maintain thermal stability across applications ranging from light-duty automotive vehicles to heavy-duty industrial machinery. Their performance under extreme temperature conditions underpins the reliability of transportation fleets, power generation facilities, and manufacturing operations.

Complex value chains characterize the antifreeze sector, linking raw material suppliers, chemical producers, distributors, and end-use customers. Raw materials such as ethylene glycol and propylene glycol serve as the chemical backbone of most coolant formulations, while manufacturers add corrosion inhibitors, antifoaming agents, and pH stabilizers to meet specific performance requirements. Distribution networks encompass original equipment manufacturers, automotive service centers, distributors, e-commerce platforms, and retail outlets, ensuring that coolant products reach a broad base of consumers and industrial clients.

Against this backdrop, stakeholders must navigate a rapidly evolving landscape defined by sustainability mandates, electrification trends, digitalization initiatives, and shifting trade policies. Strategic decisions hinge on understanding how environmental regulations are prompting formulation innovation, how electric vehicles are reshaping thermal management requirements, and how reciprocal tariffs and supply chain realignments are affecting raw material costs. This executive summary distills key insights across these dimensions to inform investment choices, R&D priorities, and market entry strategies.

Examining pivotal technological, regulatory, and consumer-driven shifts transforming antifreeze formulations and supply chain practices worldwide

Technological innovation is driving a profound transformation of antifreeze formulations and thermal management solutions. The rising adoption of organic acid technology (OAT) concentrates, which combine corrosion protection with extended service life, underscores a shift away from traditional inorganic silicate inhibitors. These OAT products now represent a significant portion of new coolant offerings as original equipment manufacturers and fleet operators seek longer maintenance intervals and reduced lifecycle costs. Simultaneously, the surge in electric and hybrid vehicle production has stimulated the development of specialty coolants engineered for battery pack thermal regulation. Unlike conventional engine coolants, these fluids require enhanced dielectric properties and precise heat dissipation capabilities to maintain battery performance and longevity, reflecting an industry pivot toward multifunctional thermal fluids.

Environmental requirements and circular economy principles are also redefining antifreeze supply chains. Stringent regulations under frameworks such as the European Union’s REACH directive have classified ethylene glycol as a substance of very high concern when discharged into aquatic environments, prompting manufacturers to increase R&D investments in bio-based and biodegradable alternatives. Concurrently, pilot programs in closed-loop recycling of used coolants are emerging, leveraging advanced distillation and purification processes to reclaim glycols and reintegrate them into production. This practice not only mitigates environmental impact but also hedges against raw material volatility, enabling more sustainable and cost-efficient operations.

Unpacking the cumulative effects of recent U.S. tariff measures on antifreeze raw materials and supply chain economics in 2025

In early 2025, the United States initiated a comprehensive tariff regime under the International Emergency Economic Powers Act (IEEPA), imposing a baseline 10% duty on nearly all imported goods, including critical chemical inputs for antifreeze production. Country-specific reciprocal tariffs further elevated rates for select trading partners, with China facing a 20% surcharge on chemical imports from March 4, 2025, up from the previous 10%. These duties aim to incentivize domestic manufacturing but have simultaneously introduced significant cost pressures for producers reliant on integrated global supply chains.

Although major bulk chemicals such as ethylene, polyethylene, and polypropylene were initially exempted from the highest reciprocal tariffs, the specter of future expansions and maritime fees threatens to increase freight expenses by as much as 228% for products like monoethylene glycol. This dynamic has compelled companies to reassess sourcing strategies and explore alternative suppliers within North America or under preferential trade agreements. Compliance with USMCA rules of origin has become paramount for border-adjacent operations, as non-compliant imports risk a 25% tariff, versus de minimis entry exemptions available only through precise documentation and procedural adherence.

The cumulative impact of these measures has reverberated through the cost structure of antifreeze manufacturers. Heightened input prices for glycols, coupled with escalating logistics charges, have compressed margins and triggered a wave of downstream pricing adjustments. In response, several producers are accelerating investments in localized glycol synthesis facilities, while others are pursuing strategic partnerships to secure feedstock access. These realignments underscore the importance of agility in procurement and the need for robust scenario planning in a landscape where trade policy can shift rapidly.

Illuminating critical segmentation dimensions across application, end-use sectors, chemical composition, and distribution channels in the antifreeze domain

Application segmentation in the antifreeze market delineates two principal fluid types: engine coolant, formulated to maintain optimal thermal conditions in internal combustion engines, and heat transfer fluid, engineered for industrial systems requiring precise temperature regulation. Engine coolant formulations are further differentiated into concentrate variants, which enable on-site mixing to desired freezing or boiling point depressions, and pre-mixed solutions delivering convenience and consistent performance across varying climates and service intervals. This nuanced approach to product design reflects the need to balance customer preferences for ease of use against the operational flexibility afforded by concentrated blends.

End-use segmentation reveals the automotive sector, encompassing both heavy-duty and light-duty vehicles, as a dominant consumer of antifreeze products. In parallel, the industrial domain subdivides into HVAC applications, where fluids remove excess heat from large-scale systems; metalworking and machinery, which leverage coolant fluids to manage temperatures in cutting, grinding, and forming processes; and power generation, where thermal stability safeguards turbines and auxiliary equipment. Within these end-use channels, chemical type segmentation distinguishes ethylene glycol-based formulations, prized for their superior heat transfer efficiency, from propylene glycol variants, favored for lower toxicity and environmental compliance. Distribution pathways further bifurcate into aftermarket channels, where distributors, e-commerce platforms, and retail outlets serve maintenance and replacement demands, and original equipment manufacturers, which integrate coolants directly into new vehicle and machine assemblies.

This comprehensive research report categorizes the Antifreeze market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Chemical Type

- Technology

- Application

- End Use

- Distribution

Revealing nuanced regional variances and growth catalysts in antifreeze adoption across the Americas, EMEA, and Asia-Pacific territories

In the Americas, mature automotive manufacturing and well-established aftermarket networks underpin steady antifreeze demand. The United States remains a key hub for both glycol production and formulation innovation, while Canada and Mexico leverage USMCA provisions to facilitate cross-border trade in coolant chemicals. Within South America, growing fleet sizes coupled with increasing industrialization support incremental market expansion, particularly in regions investing in infrastructure and power generation capacity.

Europe, the Middle East & Africa present a regulatory environment driving product evolution. The European Union’s stringent environmental directives and national recycling mandates have spurred widespread adoption of bio-based and low-toxicity antifreeze formulations. Concurrently, Middle East oil economies are diversifying industrial portfolios, investing in petrochemical capacity and driving demand for heat transfer fluids. In Africa, infrastructural growth and the electrification of commercial transport fleets are gradually amplifying coolant consumption, albeit from a lower base.

In Asia-Pacific, rapid automotive production growth in China and India fuels substantial volume requirements for engine coolants, while Southeast Asian nations are emerging as manufacturing nodes for electric vehicle components. Additionally, Australia’s mining and power sectors rely heavily on heat transfer fluids for processing and generation. Across the region, policy incentives encouraging electric mobility and renewable energy deployments are reshaping thermal management needs, with specialized EV battery coolants and solar thermal fluids gaining traction.

This comprehensive research report examines key regions that drive the evolution of the Antifreeze market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling strategic initiatives and competitive positioning of leading antifreeze manufacturers and innovators in a disruptive market environment

Major chemical conglomerates are executing diverse strategies to solidify their positions in the antifreeze market. BASF, for instance, has invested significantly in waterless coolant technologies leveraging ionic liquids, aimed at reducing water dependency and enhancing thermal efficiency in electric vehicle applications. Dow continues to monitor cost implications of U.S. trade measures, exploring partnerships with alternative glycol producers to mitigate tariff exposure while advancing research in bio-based corrosion inhibitors and smart additive packages. Evonik has expanded its organic acid technology portfolio, offering hybrid organic acid inhibitors (HOAT) calibrated for mixed-metal cooling systems, and has deepened collaborations with OEMs to embed proprietary formulations directly into assembly processes.

Specialty players and service providers are also shaping competitive dynamics. Valvoline and Prestone have strengthened aftermarket distribution networks through exclusive alliances with automotive dealerships and e-commerce platforms, optimizing inventory management and rapid replenishment. Shell and ExxonMobil are partnering on next-generation coolant sensor integrations, combining lubricant expertise with IoT-enabled monitoring technologies to deliver predictive maintenance solutions. Meanwhile, nimble firms like PPG Industries are capitalizing on regional regulatory mandates by supplying localized, biodegradable antifreeze blends in European and North American markets, reinforcing agility as a differentiator in a market defined by shifting environmental and trade requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antifreeze market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- BP p.l.c.

- CCI Corporation

- Chevron Corporation

- Clariant AG

- Exxon Mobil Corporation

- Gulf Oil International Limited

- Motul S.A.

- Old World Industries, Inc.

- Prestone Products Corporation

- Recochem Inc.

- Royal Dutch Shell plc

- TotalEnergies SE

- Valvoline, Inc.

Actionable strategic imperatives for antifreeze industry leaders to capitalize on emerging trends, navigate risks, and secure growth trajectories

Industry leaders should prioritize investment in research and development of eco-friendly glycol alternatives and advanced additive systems. By accelerating the commercialization of bio-based and nanotechnology-enhanced fluids, organizations can address both regulatory compliance and customer demand for sustainable performance. Collaborations with academic institutions and participation in pilot recycling programs will bolster circular economy credentials and shield against raw material volatility.

Moreover, supply chain resilience must be fortified through diversified sourcing strategies. Executives are advised to establish dual-sourcing partnerships within North America to navigate tariff uncertainties and mitigate logistics disruptions. Simultaneously, forming strategic alliances with OEMs and technology providers for integrated thermal management and monitoring solutions will differentiate product portfolios. Finally, proactive engagement with policymakers to shape trade and environmental regulations, coupled with continued digital transformation of distribution networks, will ensure that companies remain agile and responsive to emerging market dynamics.

Detailing the rigorous, multi-source research methodology underpinning this antifreeze market analysis for integrity and insight

This analysis employs a mixed-methods approach, combining primary research with extensive secondary data collection. Interviews with senior executives, R&D managers, supply chain specialists, and procurement officers across chemical producers, OEMs, and distribution partners provided qualitative insights into strategic priorities, technological innovation, and operational challenges. These interviews were augmented by quantitative surveys targeting purchasing decision-makers within key end-use industries.

Secondary sources comprised industry journals, regulatory filings, patent databases, and trade association publications. Empirical data were triangulated to reconcile discrepancies and validate market observations. A rigorous vetting process ensured that only credible, up-to-date information informed the analysis. The segmentation framework was applied across four core dimensions, enabling granular cross-analysis of performance indicators by application, end use, chemical type, and distribution channel.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antifreeze market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antifreeze Market, by Chemical Type

- Antifreeze Market, by Technology

- Antifreeze Market, by Application

- Antifreeze Market, by End Use

- Antifreeze Market, by Distribution

- Antifreeze Market, by Region

- Antifreeze Market, by Group

- Antifreeze Market, by Country

- United States Antifreeze Market

- China Antifreeze Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing core insights and strategic conclusions to guide stakeholders in the evolving antifreeze chemical and coolant industry

As the antifreeze market navigates concurrent pressures from electrification, environmental regulation, digitalization, and tariff realignments, stakeholders equipped with nuanced, actionable intelligence will outpace competitors. The convergence of technological advancement and sustainability demands creates a fertile environment for innovation, particularly in bio-based coolants and digital monitoring solutions. However, success will hinge on the ability to adapt procurement strategies and forge cross-sector collaborations.

Ultimately, antifreeze market participants must balance near-term margin pressures from elevated input costs against long-term opportunities in electric vehicle thermal management and circular economy practices. Those who align product portfolios with evolving regulatory expectations, invest in proprietary additive technologies, and maintain resilient supply networks will emerge as the leaders in a market defined by rapid transformation and strategic complexity.

Connect with Ketan Rohom to access the comprehensive antifreeze market research report and empower your strategic decisions

We invite industry stakeholders, strategic planners, and decision-makers to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss how comprehensive insights from this report can fortify competitive positioning and drive sustainable growth. By arranging a personalized consultation, you will gain privileged access to in-depth analyses of supply chain vulnerabilities, emerging technological innovations, and regulatory developments shaping the antifreeze landscape. Connect with Ketan Rohom today to secure your organization’s advantage and ensure that your next strategic move is guided by actionable intelligence and unparalleled expertise

- How big is the Antifreeze Market?

- What is the Antifreeze Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?