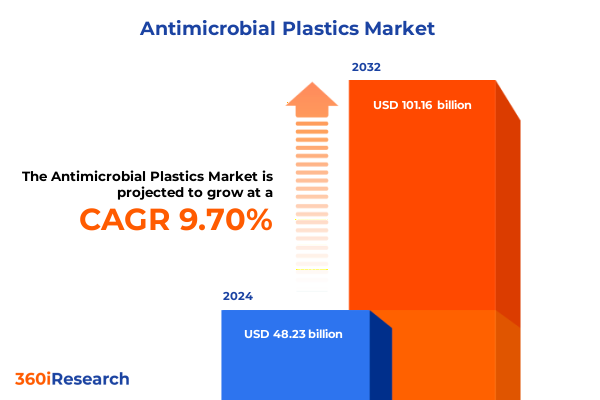

The Antimicrobial Plastics Market size was estimated at USD 52.64 billion in 2025 and expected to reach USD 57.55 billion in 2026, at a CAGR of 9.78% to reach USD 101.16 billion by 2032.

Uncovering the Essential Role of Innovative Antimicrobial Plastics in Shaping Future Material Science Applications and Public Health Safeguards

Antimicrobial plastics have emerged as a pivotal innovation at the intersection of materials science and public health, offering the promise of enhanced surface hygiene and extended product lifecycles. Through the integration of specialized additives into polymer matrices, these materials inhibit microbial growth on contact, addressing critical challenges in high‐traffic environments such as healthcare facilities, food processing plants, and public transportation. As stakeholders across industries increasingly prioritize infection control and consumer safety, the adoption of antimicrobial plastics has transitioned from niche applications to mainstream considerations, underscoring their transformative potential within the broader plastics ecosystem.

Moreover, the evolution of additive technologies-from traditional silver and copper compounds to next‐generation organic biocides-has broadened the functional capabilities of these materials. Recent advancements have improved dispersion techniques, compatibility with diverse polymer types, and long‐term efficacy, thereby elevating performance benchmarks. Consequently, manufacturers and end users are evaluating antimicrobial plastics not only for their hygienic benefits but also for their capacity to enhance mechanical properties, aesthetic durability, and recyclability.

In light of these developments, this executive summary synthesizes the most salient trends, regulatory influences, segmentation dynamics, and strategic imperatives shaping the antimicrobial plastics landscape. By offering a cohesive view of current challenges and growth drivers, the overview equips decision makers with the insights necessary to navigate complex market conditions and align product development with emerging demands.

Transformative Technological and Market Shifts Redefining Antimicrobial Plastic Innovations for Enhanced Durability Safety and Regulatory Compliance Worldwide

The antimicrobial plastics industry is undergoing significant structural and technological reinvention, driven by the convergence of sustainability goals and enhanced safety standards. In recent years, regulatory bodies around the globe have intensified scrutiny of legacy biocidal agents, prompting a shift toward ecofriendly alternatives and transparent disclosure practices. As a result, developers are exploring bio‐based additives and green chemistry pathways, leveraging plant‐derived antimicrobials and enzyme‐based solutions to meet both efficacy and environmental criteria. This trend signals a departure from one‐size‐fits‐all formulations toward tailored innovations that address specific pathogen challenges while minimizing ecological footprints.

Simultaneously, digital manufacturing and advanced processing techniques-such as 3D printing with antimicrobial resins-are redefining production capabilities. These methods enable rapid prototyping of complex geometries, accelerating time to market while ensuring consistent additive distribution within polymer structures. Consequently, original equipment manufacturers (OEMs) can integrate hygiene functionalities directly into design phases, reducing post‐processing requirements and waste generation. This integration of digital workflows and antimicrobial materials supports lean manufacturing objectives and heightens responsiveness to evolving consumer expectations.

Furthermore, the emergence of multi‐modal materials combining antimicrobial properties with other functional enhancements-such as flame retardancy, ultraviolet resistance, or self‐healing capabilities-reflects a broader industry appetite for high‐value polymer solutions. By embedding multiple performance attributes into a single material platform, stakeholders can streamline component inventories, simplify supply chains, and reinforce product differentiation in competitive markets. These transformative shifts underscore the imperative for organizations to adopt agile innovation strategies, anticipate regulatory trajectories, and foster cross‐sector collaborations that accelerate development of next‐generation antimicrobial plastics.

Assessing the Multifaceted Effects of Latest 2025 United States Tariff Measures on Supply Chain Dynamics Cost Structures and Industry Competitiveness

In 2025, revisions to United States import tariffs have reverberated across the antimicrobial plastics supply chain, altering the cost calculus for raw materials and finished products alike. Manufacturers sourcing silver, copper, or specialized polymer resins from international suppliers are confronting heightened duties, prompting reevaluation of procurement strategies. As organizations seek to preserve margin structures, many have accelerated diversification of supplier portfolios, favoring near‐shore partners and domestic producers to mitigate exposure to punitive tariffs. This strategic pivot has underscored the value of regional ecosystems that offer both logistical advantages and policy alignment.

Meanwhile, the imposition of additional duties on select polymer grades has exposed vulnerabilities in long‐standing commodity agreements. Stakeholders dependent on imports for critical feedstocks are now negotiating volume commitments and supply contracts with greater flexibility, incorporating tariff adjustment clauses to hedge against future policy shifts. These adaptations have fostered collaborations between additive innovators and polymer manufacturers to co‐develop formulations optimized for domestically produced resins, thereby reducing reliance on tariff‐impacted sources.

Consequently, the market is witnessing a realignment in cost structures and competitive positioning. End users in healthcare and food packaging-where antimicrobial performance is non‐negotiable-are exploring value‐engineered alternatives that balance efficacy with affordability. This recalibration has spurred investment in processing efficiencies and additive loading optimization, ensuring that antimicrobial functionality can be retained even as base material expenses fluctuate. Ultimately, the cumulative impact of these tariff measures is redefining supply chain resilience and compelling industry participants to cultivate more agile, cost‐effective sourcing models.

Deep Dive into Antimicrobial Plastics Market Segmentation Revealing Strategic Implications across Material Types Additives and Diverse Application Verticals

A nuanced examination of market segmentation reveals critical insights into how antimicrobial plastics are tailored to meet diverse performance requirements. First, segmentation based on polymer type distinguishes between commodity, engineering, and high‐performance plastics. Commodity plastics-including polyethylene, polyethylene terephthalate, polypropylene, polystyrene, and polyvinyl chloride-serve as cost‐effective carriers for antimicrobial additives, finding wide application in packaging and consumer goods. In parallel, engineering plastics such as polyamide, polycarbonate, and polyoxymethylene afford enhanced mechanical strength, chemical resistance, and thermal stability, making them indispensable for medical device housings and automotive components. Beyond these categories, high‐performance polymers cater to extreme environments, delivering superior structural integrity and longevity under rigorous use conditions.

Equally pivotal is the segmentation by additive class, which bifurcates into inorganic and organic antimicrobials. Inorganic additives-most notably copper, silver, and zinc-are celebrated for their broad‐spectrum efficacy and durable surface action against a range of pathogens. Conversely, organic biocides such as isothiazolinones and triclosan offer compatibility with diverse polymer matrices and enable fine‐tuned release rates, although regulatory scrutiny of certain compounds has accelerated the search for next‐generation chemistries. This additive segmentation underscores the intricate balance between regulatory compliance, long‐term performance, and consumer safety considerations.

Finally, application‐based segmentation captures the broadening footprint of antimicrobial plastics across industries. In the automotive and transportation sector, these materials enhance in‐vehicle hygiene; in building and construction they contribute to antimicrobial wall panels and fixtures; and in consumer goods they extend product freshness and durability. Within food and beverage, antimicrobial surfaces help maintain safety standards, while in healthcare and medical contexts they play a vital role in preventing hospital‐acquired infections. Packaging applications leverage antimicrobial functionality to prolong shelf life and reduce waste, illustrating the versatile nature of these materials across end‐use verticals.

This comprehensive research report categorizes the Antimicrobial Plastics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Additive

- Application

Evaluating Regional Dynamics of Antimicrobial Plastics Adoption Spotlighting Growth Drivers in the Americas EMEA and Asia Pacific Markets

Regional dynamics in the antimicrobial plastics sphere are shaped by differing regulatory frameworks, manufacturing capabilities, and end‐user priorities. In the Americas, stringent hygiene standards and robust healthcare infrastructure have catalyzed early adoption, particularly in medical device manufacturing and food packaging. Incentives for reshoring critical supply chains have further reinforced regional capacity, enabling closer alignment between additive developers and polymer producers. This synergy has accelerated pilot projects and commercialization pathways, fostering a cohesive ecosystem that emphasizes quality assurance and technical support.

Across Europe, the Middle East, and Africa, complex regulatory landscapes-anchored by the EU’s Biocidal Products Regulation-have driven innovation toward safer, more transparent antimicrobial chemistries. Companies operating in these markets often collaborate with regulatory bodies to expedite approvals and establish performance benchmarks. Meanwhile, heightened consumer awareness regarding product safety has elevated demand for third‐party certifications, prompting manufacturers to invest in validation protocols that attest to efficacy and environmental stewardship.

In the Asia‐Pacific region, rapid industrial expansion and a growing middle class have amplified demand for antimicrobial solutions in consumer goods, packaging, and public infrastructure. Emerging economies are scaling up polymer production facilities, with domestic additive manufacturers playing an increasingly prominent role. Concurrently, partnerships between global additives suppliers and local processors are bridging knowledge gaps, facilitating technology transfer, and adapting formulations to meet regional climatic and usage conditions. These collaborative models are critical for addressing diverse market requirements and sustaining long‐term growth.

This comprehensive research report examines key regions that drive the evolution of the Antimicrobial Plastics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Leading Corporate Strategies and Collaborative Innovations Driving Competitive Edge in the Evolving Antimicrobial Plastics Ecosystem

Leading players in the antimicrobial plastics domain are distinguished by their strategic investments in research and development, vertical integration efforts, and collaborative partnerships. Major chemical companies leverage extensive poly mer platforms to integrate antimicrobial functionalities at the polymer production stage, enabling streamlined supply chain coordination. Specialty additive firms complement these capabilities through advanced formulation expertise, often co‐innovating with manufacturers to customize surface performance characteristics. This interplay between large polymer producers and nimble additive developers fuels a cycle of continuous product improvement.

Furthermore, corporate alliances with original equipment manufacturers and end‐use brands have become increasingly prevalent. By establishing joint development initiatives and licensing agreements, these partnerships accelerate market entry and validate application‐specific benefits. In parallel, targeted acquisitions of niche biocide manufacturers and intellectual property portfolios enhance competitive positioning, allowing companies to expand their offerings across multiple polymer types and application areas.

Investment in digital platforms for material characterization and performance modelling further differentiates industry leaders. Through simulation tools, companies can predict antimicrobial efficacy under diverse conditions, optimize additive loadings, and reduce experimental timelines. As the competitive landscape intensifies, these digital innovations provide a distinct advantage by enabling data‐driven decision making, improving time to market, and reinforcing value propositions for customers seeking reliable antimicrobial solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antimicrobial Plastics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Addmaster Limited by Polygiene Group AB

- Americhem, Inc.

- Avient Corporation

- BASF SE

- BioCote Limited

- Chroma Color Corporation

- Clariant AG

- Covestro AG

- Emco Industrial Plastics, Inc.

- FiteBac Technology

- Gelest, Inc. by Mitsubishi Chemical Group Corporation

- Kandui Industries Private Limited

- King Plastic Corporation

- Lonza Group AG

- Microban International, Ltd.

- Milliken & Company

- PARX Materials N.V.

- Polychem Alloy, Inc.

- Ray Products Company Inc.

- RTP Company

- Sanitized AG

- Sciessent LLC

- Teknor APEX Company

- Universal Masterbatch LLP

- Valtris Specialty Chemicals Limited

Strategic Roadmap and Practical Initiatives for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Challenges in Antimicrobial Plastics

Industry leaders are advised to prioritize sustainable additive development by exploring bio‐based and enzymatic antimicrobial solutions that align with emerging regulatory and consumer expectations. By initiating cross‐disciplinary research programs, organizations can identify novel chemistries that maintain efficacy while reducing ecological impact. In doing so, companies will not only address compliance requirements but also differentiate their offerings in markets increasingly sensitive to environmental credentials.

Moreover, supply chain diversification remains critical in light of tariff fluctuations and geopolitical uncertainties. Establishing strategic partnerships with regional polymer and additive suppliers will mitigate disruption risks and enhance logistical agility. In addition, negotiating flexible procurement agreements with tariff adjustment clauses can help stabilize input costs and preserve competitive pricing strategies.

Finally, engaging proactively with regulatory authorities and standardization bodies is essential for shaping future guidelines and securing streamlined approvals. Companies should invest in robust validation protocols, including third‐party efficacy testing and long‐term performance studies, to substantiate claims and build trust among end users. By integrating digital performance modelling into development workflows and emphasizing transparent communication of safety data, organizations can set new benchmarks for reliability and effectiveness in antimicrobial plastics.

Comprehensive Overview of Rigorous Research Methodologies and Analytical Frameworks Underpinning the Integrity of Antimicrobial Plastics Market Insights

The research underpinning this analysis combines comprehensive secondary research with targeted primary engagements. Secondary sources include peer‐reviewed journals, technical white papers, and regulatory dossiers to ensure a thorough understanding of chemical efficacy, polymer compatibility, and compliance landscapes. Patent databases and scientific conference proceedings were also reviewed to capture the latest innovations and emerging trends in additive technologies.

Complementing this, primary interviews were conducted with sector experts spanning polymer manufacturers, additive formulators, regulatory consultants, and end users in key application areas. These conversations provided nuanced perspectives on supply chain complexities, performance validation protocols, and commercial adoption barriers. Insights gleaned from these dialogues were cross‐validated against publicly available case studies and product launch announcements to ensure consistency and accuracy.

Finally, an iterative validation process involving an expert panel was employed to refine findings and prioritize strategic imperatives. Feedback loops with industry stakeholders facilitated calibration of analytical frameworks, ensuring that conclusions reflect real‐world challenges and opportunities. This methodological rigor guarantees that the insights presented are grounded in robust data, practical expertise, and a clear understanding of market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antimicrobial Plastics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antimicrobial Plastics Market, by Type

- Antimicrobial Plastics Market, by Additive

- Antimicrobial Plastics Market, by Application

- Antimicrobial Plastics Market, by Region

- Antimicrobial Plastics Market, by Group

- Antimicrobial Plastics Market, by Country

- United States Antimicrobial Plastics Market

- China Antimicrobial Plastics Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Synthesizing Core Insights to Illuminate Future Directions and Strategic Imperatives for Stakeholders in the Antimicrobial Plastics Arena

Drawing together the diverse threads of technological innovation, regulatory evolution, and supply chain realignment, it is evident that antimicrobial plastics stand at a critical juncture. Enhanced additive formulations, driven by sustainability imperatives and advanced manufacturing processes, are reshaping application possibilities across sectors. As regulatory bodies worldwide refine guidelines to balance efficacy and environmental health, stakeholders must remain agile in adapting to new compliance frameworks.

Simultaneously, regional tariff adjustments and geopolitical considerations are recalibrating procurement strategies, compelling companies to invest in localized partnerships and contingency planning. The resulting supply chain diversification not only mitigates risk but also fosters closer collaboration between polymer producers and additive innovators. This synergy is poised to unlock novel material platforms that can meet stringent performance requirements with greater cost efficiency.

Ultimately, organizations that integrate these insights into their strategic roadmaps-prioritizing sustainable chemistries, digital performance modelling, and proactive regulatory engagement-will be best positioned to lead the antimicrobial plastics arena. By embracing these imperatives, stakeholders can accelerate the deployment of next‐generation materials that enhance public health protections, foster environmental stewardship, and drive competitive differentiation.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Antimicrobial Plastics Market Intelligence and Secure Your Competitive Advantage Today

To explore detailed data, advanced analyses, and comprehensive insights tailored to strategic decision making, connect with Associate Director Ketan Rohom. He can guide you through premium offerings that deliver clarity on material innovations, supply chain considerations, and regulatory implications that shape the antimicrobial plastics landscape. Engaging directly will ensure you secure a resource that aligns with your organization’s priorities and deadlines.

Take advantage of this opportunity to partner with a dedicated expert who understands the nuances of antimicrobial additives, regional dynamics, and emerging application areas. By initiating a dialogue today, you’ll gain immediate access to proven methodologies, proprietary intelligence, and actionable perspectives designed to accelerate your competitive positioning and operational efficiency in this rapidly evolving market.

- How big is the Antimicrobial Plastics Market?

- What is the Antimicrobial Plastics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?