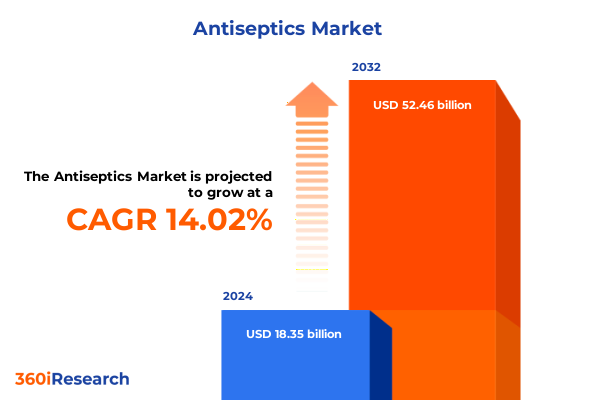

The Antiseptics Market size was estimated at USD 20.58 billion in 2025 and expected to reach USD 23.08 billion in 2026, at a CAGR of 14.29% to reach USD 52.46 billion by 2032.

Navigating a rapidly evolving healthcare focus on infection prevention elevates antiseptic solutions as indispensable for modern medical and consumer safety

As the global healthcare ecosystem continues to prioritize infection prevention and control, the antiseptics market has emerged at the forefront of both clinical protocols and consumer safety initiatives. The intrinsic role of antiseptics in reducing microbial load across a broad range of applications-from preoperative skin preparation to routine hand hygiene-has catalyzed intense interest from institutional purchasers, healthcare professionals, and individual consumers alike. Recent public health emergencies, heightened regulatory scrutiny of disinfectant efficacy, and rising awareness of antimicrobial resistance have collectively reinforced the indispensability of reliable antiseptic solutions. Consequently, this sector is witnessing accelerated innovation in formulation chemistry, novel delivery formats, and adaptable packaging-all driven by the imperative to balance potent microbial eradication with user safety and convenience.

Formulation innovations and sustainability-driven packaging are reshaping efficacy standards and market expectations for antiseptic products

The antiseptics landscape has undergone a transformative evolution fueled by breakthroughs in active chemistries and heightened consumer demand for effective yet skin-friendly formulations. Alcohol-Based solutions have diversified beyond traditional liquids into foam, gel, and spray presentations, enhancing compliance in fast-paced clinical and home environments. Parallel advances in biguanides and quaternary ammonium compounds have expanded the antimicrobial spectrum while minimizing irritation, spurring manufacturers to invest in hybrid formulations that leverage synergistic efficacy. Equally notable is the resurgence of iodine-Based antiseptics in innovative iodine complexes designed for sustained release and deeper tissue penetration, marking a departure from legacy tinctures. Underpinning these shifts is a growing emphasis on sustainability, prompting the introduction of biodegradable wipes and refillable bottles that address escalating concerns about plastic waste. These converging trends signal a new era in which formulation versatility and environmental responsibility coalesce to redefine market expectations.

Tariffs on key antiseptic inputs in 2025 are driving strategic sourcing adaptations, cost management innovations, and industry consolidation dynamics

In 2025, United States tariff policies imposed on a spectrum of imported raw materials and finished antiseptic products have had cascading effects across the value chain. The additional duties levied on bottles, aerosol cans, and select active ingredients such as chlorhexidine precursors have driven up input costs for domestic manufacturers, compelling many to pursue strategic sourcing shifts. Several industry leaders have negotiated direct partnerships with suppliers in duty-exempt free trade zones or accelerated investments in local production capabilities to mitigate cost pressures. The immediate impact has been a modest uptick in end-user prices, particularly in hospital pharmacies and retail channels, which in turn has spurred demand for private label alternatives that offer lower price points. Looking ahead, market participants anticipate that the tariffs will catalyze further vertical integration, as well as expedited innovation in lower-cost chemistries that circumvents tariffed inputs, thereby preserving profitability without compromising on antimicrobial performance.

Diverse product chemistries and delivery formats converge across clinical, personal, and veterinary antiseptic applications in multifaceted market segments

Insights into the antiseptics market’s segmentation underscore distinct performance drivers across product types, forms, applications, end users, distribution channels, and packaging formats. Alcohol-Based formulations manifest significant traction, particularly when delivered in foam or gel varieties that optimize skin contact time and user compliance in hand hygiene applications both within healthcare settings and in personal use contexts. Biguanides and quaternary ammonium compounds hold an important niche in surface disinfection, complementing hydrogen peroxide and phenolic compounds for high-touch clinical instruments and home settings alike. End users such as ambulatory surgical centers and hospitals favor spray and wipe formats for rapid turnover environments, whereas clinics and home care adopt wipes and foil sachets for convenience and portability, with veterinary use emerging as a specialized segment in personal use-oriented packaging. Distribution patterns reveal that pure-play e-commerce channels are rapidly gaining share among retail pharmacies and online platforms, while hospital pharmacies continue to absorb volumes of bulk-solution bottles. Across all segments, aerosol cans, bottles, and wipes dominate packaging preferences, reflecting a blend of dosage accuracy and convenience for both institutional and consumer end users.

This comprehensive research report categorizes the Antiseptics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

- End User

- Distribution Channel

- Packaging Type

Regional market trajectories reflect regulatory rigor, sustainability mandates, and rapid rural commercialization shaping antiseptic demand globally

Regional dynamics reveal divergent growth trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. In the Americas, robust public health initiatives and substantial hospital infrastructure investments have sustained strong demand for traditional alcohol-Based and hydrogen peroxide-based disinfectants, with e-commerce emerging as a crucial channel for urban consumer segments. Meanwhile, Europe, Middle East & Africa markets are characterized by stringent regulatory frameworks and a pronounced shift toward eco-friendly phenolic compounds and refillable packaging solutions, led by sustainability mandates in the European Union. Asia-Pacific stands out for rapid commercialization of iodine-Based antiseptics, driven by domestic manufacturers prioritizing cost-effective production and expansive rural healthcare outreach programs. This regional mosaic underscores the necessity for adaptive strategies that reconcile local regulatory landscapes, distribution ecosystems, and end-user expectations to fully leverage growth opportunities in each geography.

This comprehensive research report examines key regions that drive the evolution of the Antiseptics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic alliances and acquisition-driven portfolio expansion underscore competitive leadership and innovation agility in antiseptic manufacturing

The competitive arena in the antiseptics market is populated by multinational chemical conglomerates, specialized life sciences firms, and agile emerging players. Established corporations have fortified their portfolios with strategic acquisitions of niche brands in foam, gel, and wipe formats, complemented by continuous investment in R&D centers focused on next-generation antimicrobial compounds. Simultaneously, mid-tier innovators are carving out differentiation through proprietary formulations that emphasize skin-friendly excipients and minimal residue profiles. Among pure-play specialty companies, those that offer private label manufacturing have attracted partnerships with large retail chains seeking cost efficiencies and customized packaging. Across the supply chain, collaborative alliances between distributors and raw material suppliers have emerged to streamline logistics and reduce tariff impacts, underscoring an industry-wide push toward integrated value-chain solutions. These competitive dynamics reflect an ecosystem where scale, innovation agility, and strategic partnerships collectively determine market leadership and future growth potential.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antiseptics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Ansell Limited

- B. Braun Melsungen AG

- BASF SE

- Bode Chemie GmbH

- Cardinal Health, Inc.

- Dabur India Ltd.

- Ecolab Inc.

- Getinge AB

- Godrej Consumer Products Ltd.

- GOJO Industries, Inc.

- Henkel AG & Co. KGaA

- Johnson & Johnson Services, Inc.

- Kao Corporation

- Lonza Group AG

- METREX Research LLC

- Mölnlycke Health Care AB

- Novartis AG

- Paul Hartmann AG

- Reckitt Benckiser Group plc

- Solvay S.A.

- STERIS plc

- Unilever PLC

- Whiteley Corporation

Leveraging integrated innovation platforms and local production strategies can safeguard margins and propel market leadership amid evolving antiseptic demand

To capitalize on evolving market dynamics, industry leaders should prioritize integrated innovation platforms that enable rapid development of hybrid antiseptic chemistries while optimizing for user safety, environmental sustainability, and regulatory compliance. Strengthening relationships with duty-exempt suppliers or establishing in-country production of critical active ingredients can buffer against tariff volatility and preserve margin integrity. Leveraging data analytics to track end-user feedback across healthcare and consumer channels will facilitate iterative improvements in product ergonomics, compliance incentives, and packaging convenience. In parallel, crafting tailored go-to-market strategies for each region-incorporating local distribution partnerships and eco-certification endorsements-will enhance market penetration. Finally, forging cross-sector collaborations with hand hygiene monitoring technology firms and surface disinfection robotics providers can unlock new value propositions, positioning leading antiseptic companies at the vanguard of infection prevention ecosystems.

Harnessing primary consultations and rigorous data triangulation ensures a robust qualitative narrative on antiseptic market innovations and regulatory shifts

This research exercise employed a multi-stage methodology encompassing primary interviews, secondary data aggregation, and rigorous triangulation. Primary inputs were gathered through structured consultations with industry executives, hospital procurement officers, and regulatory experts across the Americas, EMEA, and Asia-Pacific regions. Concurrently, secondary sources such as peer-reviewed journals, trade association publications, and patent filings were systematically reviewed to validate product innovation trends and regulatory developments. Quantitative validation was achieved by cross-referencing consumption patterns observed in distribution channel analyses with publicly available shipment data. Finally, a scenario-based sensitivity analysis was conducted to assess the potential impact of tariff fluctuations and sustainability-driven policy shifts on supplier cost structures, enabling a robust qualitative narrative without reliance on explicit market sizing estimates.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antiseptics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antiseptics Market, by Product Type

- Antiseptics Market, by Form

- Antiseptics Market, by Application

- Antiseptics Market, by End User

- Antiseptics Market, by Distribution Channel

- Antiseptics Market, by Packaging Type

- Antiseptics Market, by Region

- Antiseptics Market, by Group

- Antiseptics Market, by Country

- United States Antiseptics Market

- China Antiseptics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing innovation, supply resilience, and sustainability underscores the essential role of antiseptics in advancing global health security

In an era marked by heightened infection control imperatives and dynamic regulatory landscapes, antiseptics remain indispensable to both clinical workflows and consumer health practices. The confluence of advanced chemistries, novel delivery formats, and sustainability mandates is reshaping product portfolios and competitive landscapes alike. As US tariffs and regional policy initiatives continue to influence sourcing and cost structures, forward-looking companies must balance agility in formulation development with strategic supply chain resilience. By interpreting segmentation insights and regional nuances, industry stakeholders can craft differentiated value propositions that resonate with diverse end users. Ultimately, the capacity to integrate innovation, cost management, and environmental stewardship will define the next chapter of growth and leadership within the global antiseptics market.

Unlock unparalleled market intelligence and drive strategic growth in the antiseptics industry with an exclusive tailored research report

Don't miss the opportunity to empower your decision-making with comprehensive insights, tailored strategies, and actionable intelligence on the antiseptics market by connecting with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Whether your focus is understanding the evolving regulatory landscape, identifying high-growth segments, or assessing the competitive intensity across global regions, this report will equip you with the depth of knowledge needed to accelerate growth, optimize operations, and anticipate market disruption. Reach out today to secure exclusive access, drive strategic initiatives, and stay ahead of industry dynamics with unparalleled clarity and confidence.

- How big is the Antiseptics Market?

- What is the Antiseptics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?