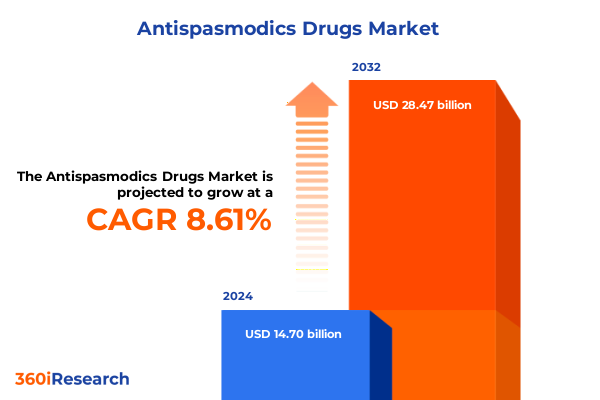

The Antispasmodics Drugs Market size was estimated at USD 13.23 billion in 2025 and expected to reach USD 14.56 billion in 2026, at a CAGR of 10.66% to reach USD 26.89 billion by 2032.

Unveiling the Critical Role of Antispasmodic Drugs in Mitigating Smooth Muscle Disorders and Alleviating Patient Burden Across Clinical Practice Settings Worldwide

The class of therapeutic agents known as antispasmodic drugs plays a pivotal role in alleviating smooth muscle hyperactivity and its associated symptoms across a spectrum of clinical indications. Targeting conditions that range from irritable bowel syndrome and dysmenorrhea to urinary bladder spasticity, these agents act through distinct pharmacological pathways to reduce involuntary contractions and restore patient comfort. Historically, the market for antispasmodics has been driven by growing global incidence of gastrointestinal, gynecological, and urinary disorders, while evolving treatment paradigms have underscored the importance of options that balance efficacy with tolerability. Against this backdrop, stakeholders are seeking a nuanced understanding of the forces reshaping demand, product innovation, and distribution strategies in order to sustain therapeutic and commercial momentum.

As health systems worldwide contend with aging populations, increasing chronic disease burdens, and rising patient expectations, the imperative for targeted smooth muscle relaxants continues to intensify. In parallel, the pharmaceutical landscape has witnessed a proliferation of novel formulations-ranging from advanced oral solid dosage forms to minimally invasive injectable preparations-that enhance bioavailability and patient adherence. Moreover, the integration of digital health platforms has opened avenues for real-time monitoring of symptom control and medication compliance, reinforcing the value proposition of antispasmodic therapies. By synthesizing macroeconomic drivers with clinical trends, this executive summary sets the stage for a comprehensive analysis of market transformations, policy impacts, and strategic imperatives guiding the future of antispasmodic drug development and commercialization.

Exploring Groundbreaking Transformations Reshaping Antispasmodic Drug Development Through Innovation, Regulatory Evolution, and Patient-Centric Solutions

Over the past decade, the antispasmodic treatment landscape has undergone fundamental shifts catalyzed by technological advancement, evolving regulatory expectations, and the emergence of patient-centric care models. Notably, pharmaceutical developers have prioritized the innovation of targeted delivery systems that improve pharmacokinetic profiles and minimize systemic exposure. The advent of soft gel capsule technologies and transdermal patch formats has complemented traditional tablet and injection options, offering clinicians greater flexibility to tailor therapies to individual patient needs. Furthermore, breakthrough research into novel mechanism-of-action compounds-such as highly selective calcium channel inhibitors and next-generation GABA agonists-has reinvigorated the pipeline, posing a challenge to established anticholinergic benchmarks.

In addition to formulation breakthroughs, regulatory agencies have heightened focus on post-marketing safety surveillance, prompting manufacturers to invest in robust real-world evidence generation. This emphasis on longitudinal outcome tracking has led to partnerships between pharmaceutical companies and digital health providers, creating integrated treatment ecosystems that enhance adherence insights while facilitating pharmacovigilance. Concurrently, the rising prevalence of telemedicine and remote patient monitoring has encouraged stakeholders to embed connectivity features in drug delivery devices, enabling dose reminders and symptom reporting via mobile applications. As a result, value-based care initiatives that reward measurable therapeutic benefits are beginning to prioritize antispasmodic regimens that demonstrate both symptomatic relief and quantifiable improvements in quality of life.

Analyzing the Comprehensive Impact of Recent U.S. Tariff Adjustments on Antispasmodic Drug Supply Chains, Manufacturing Costs, and Market Accessibility in 2025

In early 2025, the United States implemented a revised tariff framework that significantly affected the importation of key active pharmaceutical ingredients and excipients used in antispasmodic drug manufacturing. These adjustments, driven by broader trade policy shifts, introduced tariff increases of up to 10% on components sourced from primary API‐producing regions. The immediate repercussions were felt in manufacturing cost structures, with drug producers facing incremental overhead that has been partially absorbed through operational efficiencies but has nonetheless exerted pressure on profit margins.

Moreover, the tariff realignment has compelled several organizations to reassess their supply chain architectures, prompting a strategic pivot toward alternative sourcing from tariff-exempt suppliers in Latin America and Southeast Asia. While this diversification strategy mitigates exposure to U.S. import duties, it has introduced challenges related to supplier qualification timelines, quality assurance audits, and logistical complexities. Some market participants have responded by accelerating efforts to establish nearshore manufacturing capabilities, positioning production closer to end markets to circumvent tariff barriers and reduce lead times. Collectively, these adaptations underscore the resilience of antispasmodic drug supply chains, while highlighting the importance of agile procurement and manufacturing strategies in navigating evolving trade landscapes.

Deriving In-Depth Insight from Multi-Dimensional Segmentation to Reveal Hidden Patterns Influencing Antispasmodic Drug Utilization and Adoption

A multidimensional segmentation approach reveals nuanced insights into where and how antispasmodic therapies are most effectively deployed, providing guidance for prioritizing development and marketing efforts. When viewed through the lens of formulation, hard shell capsules and coated tablets continue to account for a substantial portion of prescriptions, driven by their ease of manufacturing, stable pharmacokinetics, and established physician familiarity. However, the expansion of soft gel technology and uncoated tablet subtypes is steadily reshaping prescribing preferences, particularly for patients with dysphagia or high dosing requirements. Intramuscular injections remain a critical option in acute care settings, while subcutaneous formats are gaining traction as self-administered alternatives for chronic management.

Route of administration further delineates patterns of adoption; oral formulations dominate outpatient settings due to convenience, whereas parenteral delivery-especially intramuscular injections-serves inpatient and acute intervention scenarios. Topical modalities, including creams and gels, are increasingly utilized for localized smooth muscle relief, particularly in gynecological applications, with patch technologies emerging as a potential avenue for sustained, controlled drug release. Mechanism-based segmentation illuminates the shifting favor toward non-anticholinergic pathways, as safety concerns over anticholinergic load have prompted prescribers to consider calcium channel blockers and GABA-mediated compounds. In parallel, distribution channel analysis highlights the sustained influence of hospital pharmacies in driving demand for injectable formulations, while retail and online pharmacy channels facilitate greater accessibility for chronic indications. Application-driven segmentation underscores irritable bowel syndrome as the largest single driver of antispasmodic utilization, though growing awareness of endometriosis management and overactive bladder treatment is expanding prospects in gynecological and urinary disorder categories. Finally, end-user segmentation underscores that hospitals, particularly specialty clinics, remain key customers for high-touch injectable therapies, whereas smaller clinics are increasingly leveraging oral and topical options for outpatient care.

This comprehensive research report categorizes the Antispasmodics Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Formulation

- Route

- Mechanism

- Distribution Channel

- Application

- End User

Unearthing Regional Disparities and Growth Drivers in Antispasmodic Drug Uptake Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional landscape analysis highlights divergent growth dynamics across the Americas, Europe Middle East Africa, and Asia Pacific, driven by local disease prevalence, regulatory frameworks, and healthcare infrastructure. In the Americas, robust healthcare reimbursement models in the United States and Canada have facilitated widespread patient access to branded antispasmodic therapies. Strong collaborations between payers and pharmaceutical providers have resulted in innovative patient assistance programs that reduce out‐of‐pocket costs for individuals with chronic gastrointestinal and urinary conditions. Conversely, Latin American markets exhibit a growing propensity for generic antispasmodic formulations, propelled by cost containment imperatives and the expanding reach of retail pharmacy networks.

Within Europe Middle East Africa, regulatory heterogeneity presents both challenges and opportunities. The European Union’s centralized approval pathways afford streamlined market entry for novel antispasmodic agents, while individual member states maintain diverse reimbursement criteria that can elongate launch timelines. In the Gulf Cooperation Council region, burgeoning government investment in healthcare infrastructure is improving hospital capacities, fueling demand for injectable and advanced formulation options. Africa remains largely underpenetrated, yet targeted initiatives to address gastrointestinal disorders in aging populations are gradually increasing adoption rates.

Asia Pacific markets are characterized by a dual trend of rapid urbanization and rising healthcare expenditure that is catalyzing the uptake of both branded and biosimilar antispasmodic products. In markets such as China, India, and Southeast Asia, expanding clinic networks and growing per-capita income levels are fostering a shift toward higher-value oral and injectable therapies. Government initiatives to modernize primary care facilities and integrate chronic disease management protocols are further reinforcing demand, positioning the region as a future growth engine for antispasmodic drug manufacturers.

This comprehensive research report examines key regions that drive the evolution of the Antispasmodics Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players to Highlight Competitive Strategies, Innovative Portfolios, Partnerships, and Emerging Opportunities in the Antispasmodic Landscape

The competitive landscape is dominated by a handful of multinational pharmaceutical companies that leverage extensive R&D capabilities, global manufacturing footprints, and established sales channels. These leading players maintain diversified antispasmodic portfolios encompassing anticholinergic tablets, calcium channel-modulating injectables, and advanced topical formulations. Strategic collaborations with biotechnology firms have bolstered the pipeline, particularly in areas such as receptor-selective GABA agonists and novel drug-device combination products. Moreover, targeted acquisitions of niche specialty companies have enabled large-cap organizations to expand their presence in high-growth segments such as dysmenorrhea and overactive bladder.

Smaller, agile innovators are differentiating through a focus on proprietary delivery technologies and companion digital health solutions. By forging partnerships with medical device manufacturers and telehealth providers, these companies are enhancing real-world data capture and driving adherence through interactive mobile platforms. In addition, contract development and manufacturing organizations have emerged as pivotal enablers, offering end-to-end services that accelerate time to market for emerging antispasmodic candidates. Taken together, these dynamics underscore a competitive environment where pipeline differentiation, integrated service offerings, and strategic alliances are essential to securing endpoint access and sustaining revenue growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antispasmodics Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Almirall, S.A.

- Boehringer Ingelheim International GmbH

- Dr. Reddy's Laboratories Limited

- Glenmark Pharmaceuticals Limited

- Pfizer Inc.

- Sandoz International GmbH

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Outlining Strategic Recommendations for Industry Leaders to Navigate Competitive Pressures, Regulatory Complexities, and Emerging Opportunities in Antispasmodic Market

To thrive in an increasingly complex antispasmodic market, industry leaders should prioritize investments in high-value formulation innovations and strengthen supply chain resilience to mitigate exposure to external policy shifts. Expanding capabilities in transdermal and subcutaneous delivery systems can unlock new patient segments seeking improved adherence and convenient self-administration. Simultaneously, establishing strategic sourcing agreements with alternative API suppliers and nearshore manufacturing partners will safeguard production continuity and cost efficiency in the face of tariff uncertainties.

Further, integrating digital health solutions with antispasmodic offerings can deliver differentiated patient experiences and generate real-world evidence to support value-based contracting. Collaborations with telemedicine platforms and remote monitoring providers should be pursued to create seamless follow-up protocols that drive adherence and enable data-driven treatment optimization. Engaging proactively with payers and regulatory authorities to demonstrate pharmacoeconomic benefits will accelerate formulary inclusion and reimbursement approvals. Finally, focusing R&D efforts on non-anticholinergic mechanisms and exploring combination therapies with complementary agents can address unmet needs while diversifying revenue streams.

Detailing Rigorous Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Expert Validation to Ensure Comprehensive Market Insights

This report synthesizes findings derived from an integrated research framework combining both primary and secondary methodologies to ensure the highest level of analytical rigor. Primary insights were captured through in-depth interviews with key opinion leaders, including gastroenterologists, urologists, pharmacologists, and healthcare payers, as well as dialogues with leading pharmaceutical executives. These interactions provided real-world perspectives on prescribing behaviors, patient adherence challenges, and perceived unmet needs.

Secondary research encompassed a comprehensive review of peer-reviewed journals, clinical trial registries, regulatory filings, patent databases, and publicly available corporate disclosures. Quantitative data points were validated through cross-reference with proprietary subscription databases and trade association reports. Triangulation of quantitative and qualitative inputs ensured that market dynamics were accurately characterized, with deviations reconciled through follow-up consultations. All findings were subjected to expert validation panels to confirm relevance, completeness, and methodological soundness, reinforcing confidence in the strategic recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antispasmodics Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antispasmodics Drugs Market, by Formulation

- Antispasmodics Drugs Market, by Route

- Antispasmodics Drugs Market, by Mechanism

- Antispasmodics Drugs Market, by Distribution Channel

- Antispasmodics Drugs Market, by Application

- Antispasmodics Drugs Market, by End User

- Antispasmodics Drugs Market, by Region

- Antispasmodics Drugs Market, by Group

- Antispasmodics Drugs Market, by Country

- United States Antispasmodics Drugs Market

- China Antispasmodics Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings to Reinforce Understanding of Market Dynamics, Strategic Imperatives, and Future Directions for Antispasmodic Drug Stakeholders

In summary, the antispasmodic drug sector exhibits robust potential as it contends with shifting patient demographics, evolving clinical practice guidelines, and emergent regulatory policies. Growth is underpinned by innovative formulation technologies that enhance patient experience and by a widening spectrum of mechanism-based therapies that address safety concerns associated with traditional anticholinergics. Nevertheless, external headwinds such as increased manufacturing costs driven by U.S. tariff recalibrations necessitate agile supply chain strategies and diversified sourcing.

Segmentation analysis highlights critical opportunities across oral, injectable, and topical modalities, with emerging preference for targeted delivery systems and non-anticholinergic compounds. Regional insights reveal that the Americas lead in access and reimbursement sophistication, while Europe Middle East Africa and Asia Pacific present distinct pathways for market entry through regulatory alignment and infrastructure development. Competitive dynamics underscore the importance of strategic alliances, digital health integration, and portfolio differentiation. Collectively, these findings lay the foundation for informed decision-making and strategic planning, equipping stakeholders with the clarity needed to capitalize on future growth trajectories.

Inviting Stakeholders to Engage with Ketan Rohom for Tailored Guidance and Exclusive Access to Comprehensive Antispasmodic Drug Market Research Insights

We invite stakeholders interested in harnessing the full potential of the antispasmodic drug market to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings deep expertise in therapeutic market dynamics and can provide tailored guidance on how this comprehensive report aligns with your strategic objectives. By engaging with Ketan, you will gain exclusive access to in-depth analyses, proprietary data insights, and customized advisory support designed to drive informed decision-making and competitive advantage. To explore pricing options, request a sample chapter, or schedule a confidential consultation on market entry strategies and portfolio optimization, please reach out to Ketan. Your next pivotal step in capitalizing on emerging antispasmodic opportunities begins with this dialogue, ensuring you have the clarity and confidence to move forward.

- How big is the Antispasmodics Drugs Market?

- What is the Antispasmodics Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?