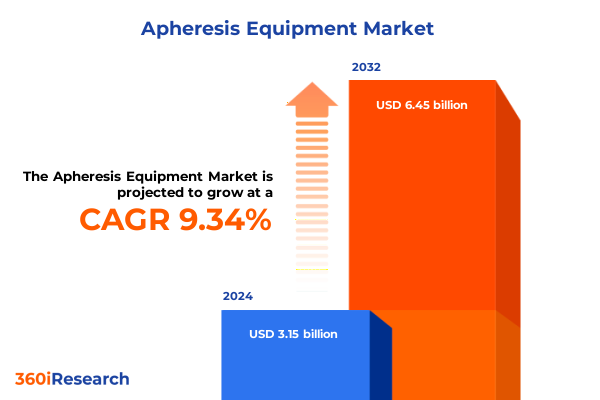

The Apheresis Equipment Market size was estimated at USD 3.45 billion in 2025 and expected to reach USD 3.78 billion in 2026, at a CAGR of 9.33% to reach USD 6.45 billion by 2032.

Exploring the Evolution and Vital Role of Apheresis Equipment in Enabling Therapeutic Interventions, Diagnostic Insights and Advanced Cellular Therapies

Apheresis has emerged as a cornerstone technology in modern healthcare by enabling precise separation of blood components to meet diverse therapeutic and diagnostic needs. At its core, the process involves drawing blood from a donor or patient, isolating targeted elements-such as plasma, platelets, stem cells, or lymphocytes-and safely returning the remaining components to circulation. This extracorporeal therapy leverages centrifugal force or membrane filtration to achieve high purity and yield of specific blood fractions, reducing reliance on whole blood transfusions and enhancing treatment outcomes. The evolution of such equipment has been driven by growing clinical demands, spanning from routine plasma donation to cutting-edge applications in cellular immunotherapies and regenerative medicine.

In recent years, the role of apheresis equipment has expanded beyond traditional blood centers to encompass specialty clinics and research institutes focused on personalized medicine. Therapeutic apheresis addresses complex autoimmune and hematological disorders by selectively removing pathological blood components, while diagnostic apheresis underpins advanced cellular research, such as preparing mononuclear cells for gene therapy vectors. Concurrently, the surge in demand for plasma-derived immunoglobulins and clotting factors has underscored the need for reliable plasma separation systems. As global healthcare systems intensify efforts to streamline supply chains and innovate patient care models, apheresis technology stands at the nexus of safety, efficiency, and clinical innovation.

Unprecedented Technological Disruptions and Regulatory Advances Shaping the Future of Apheresis Equipment and Procedures

The landscape of apheresis equipment is undergoing unprecedented transformation as new technologies and regulatory frameworks converge to redefine standards of care. Fully automated whole blood processing platforms now enable blood centers to harvest both plasma and platelets from a single donation cycle, significantly reducing donor time and operational complexity. Parallel advancements in membrane-based plasmapheresis have introduced saline-optional protocols, offering flexibility and improved patient comfort. Additionally, integrated pathogen reduction systems that combine separation and inactivation steps have gained traction in response to stringent safety guidelines, ensuring robust defense against transfusion-transmitted infections.

Beyond hardware innovation, digital integration has become a hallmark of next-generation apheresis solutions. Real-time analytics and AI-driven maintenance algorithms optimize device uptime and performance, while cloud-enabled data management frameworks facilitate regulatory compliance and remote monitoring. On the regulatory front, recent FDA clearances of software enhancements and new disposables reflect a growing emphasis on single-use kits to mitigate cross-contamination risks. These transformative shifts not only elevate process efficiency but also lay the foundation for decentralized and point-of-care apheresis models, enabling more agile responses to emerging therapeutic requirements.

Assessing the Compounded Effects of 2025 United States Tariff Measures on Apheresis Equipment Supply Chains, Costs and Adoption Dynamics

The cumulative impact of United States tariff measures introduced in 2025 has reverberated across the apheresis equipment ecosystem, amplifying cost pressures and disrupting established supply chains. Broad reciprocal tariffs imposed on imports-excluding select pharmaceutical products-have led to increased component and raw material costs, especially for high-precision parts manufactured overseas. Steel and aluminum derivative tariffs enacted in March further elevated prices for centrifuge bowls and structural components, prompting manufacturers to reassess sourcing strategies. In parallel, expedited tariff hikes targeting specific manufacturing geographies have driven urgency in localized production, with several OEMs accelerating plans to establish U.S.-based assembly lines to shield operations from unpredictable trade policy fluctuations.

Consequently, procurement cycles within blood centers and hospital networks have lengthened as budget committees navigate the balance between fiscal constraints and patient care imperatives. The higher upfront price of new systems has shifted purchasing decisions in favor of upgradeable modular platforms that promise longer lifecycles. In this environment, distributors and service providers are increasingly structuring flexible leasing and trade-in programs to mitigate capital expenditure hurdles. Ultimately, while these tariff developments have introduced near-term headwinds, they have also catalyzed a strategic pivot toward regional supply resilience and cost-effective equipment utilization models.

Revealing Strategic Opportunities Through In-Depth Segmentation Analysis of Product Types, Applications, End Users, Technologies and Patient Demographics

A detailed segmentation analysis of the apheresis equipment market reveals nuanced opportunities aligned with product, application, end user, technology, and patient demographics. Examining product types shows that cell separator systems are driving the segment’s growth, fueled by rising adoption of CAR-T cell therapies and expanded stem cell transplantation programs, while accessory kits continue to innovate through enhanced biocompatible materials and closed-loop tubing designs. Pathogen inactivation systems are experiencing increased uptake as blood establishments prioritize integrated safety protocols, and plasma separation platforms benefit from optimized membrane technologies enabling higher throughput in single-donor and pooled donation settings.

Exploring applications underscores that cell collection remains paramount, with dedicated protocols for CAR-T and hematopoietic stem cell harvesting reshaping therapeutic landscapes. Meanwhile, plasma donation protocols are evolving to balance single-donor yields with source plasma processing efficiencies. In research contexts, versatile systems support diverse investigative workflows, from immunology studies to regenerative medicine. On the end-user spectrum, blood centers retain a core role in large-scale collection, whereas hospitals-both general and specialty-are integrating therapeutic apheresis services for autoimmune and neurological indications. Research institutes, spanning academic and commercial laboratories, leverage high-precision equipment for assay development and cell product generation. Technologically, centrifugal platforms with full and semi-automation options cater to high-volume needs, while membrane-based continuous flow and batch systems offer adaptability for smaller volume and pediatric procedures. Lastly, the market’s response to patient type segmentation highlights differentiated operational protocols and kit configurations tailored for adult and pediatric populations, ensuring safety and efficacy across age groups.

This comprehensive research report categorizes the Apheresis Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Patient Type

- Application

- End User

Uncovering Regional Market Nuances Across the Americas, Europe Middle East & Africa, and Asia-Pacific for Apheresis Equipment Deployment and Growth

Regional insights into the apheresis equipment market uncover distinct dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, mature healthcare infrastructure and a high concentration of blood centers accelerate uptake of advanced automation and integrated pathogen reduction solutions. Robust reimbursement frameworks supported by private and public payers enable capital-intensive upgrades, while strategic partnerships with domestic manufacturers mitigate the impact of trade policy fluctuations. North America’s leadership in cell therapy clinical trials further fuels demand for specialized cell separation systems.

In Europe Middle East & Africa, diverse healthcare landscapes manifest in varied adoption patterns. Western European markets emphasize compliance with stringent EU regulations, driving demand for disposable kits and validated processes. Meanwhile, emerging markets in the Middle East and Africa focus on building foundational blood banking capabilities, prioritizing cost-effective membrane systems that support high-volume plasma donations. Collaborative initiatives between regional health authorities and international NGOs are enhancing supply chain stability and training programs, laying the groundwork for broader therapeutic apheresis services.

Asia-Pacific presents one of the fastest-growing markets for apheresis equipment, propelled by expanding public health investments and rising prevalence of autoimmune and hematological disorders. China and India, in particular, are scaling domestic production of consumables and core components to meet surging local demand, often in collaboration with multinational OEMs. Regulatory harmonization efforts across the region are streamlining device approvals, while growing awareness of plasma-derived therapies and cell-based treatments underpins long-term growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Apheresis Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Dynamics and Strategic Initiatives of Leading Global Apheresis Equipment Providers in a Rapidly Evolving Market Environment

The competitive landscape in apheresis equipment is characterized by established medical device powerhouses alongside agile niche innovators. Leading firms are investing heavily in R&D to differentiate through automation, data analytics, and enhanced disposables. Strategic alliances and M&A activity are shaping new synergies, particularly in combining cell separation expertise with pathogen reduction technologies. Companies with robust global distribution networks and localized manufacturing footprints are outperforming peers by delivering faster lead times and superior service support.

At the forefront of innovation, some organizations are piloting microfluidic and sorbent-based separation techniques to address emerging indications and point-of-care applications. Others are forging partnerships with digital health providers to integrate predictive maintenance and usage analytics into their platforms, unlocking operational efficiencies for end users. Across the board, participants are also emphasizing sustainability in kit design and packaging, responding to growing environmental and regulatory expectations. As the market evolves, competitive success hinges on the ability to marry technical differentiation with scalable production and responsive customer engagement models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Apheresis Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aikang Diagnostics Co., Ltd.

- Asahi Kasei Kuraray Medical CoLtd.

- BBraun Melsungen AG

- Bioelettronica S.r.l.

- Cerus Corporation

- Charles River Laboratories International, Inc.

- Cytosorbents Corporation

- Delcon S.r.l.

- Ekso Bionics Holdings Inc.

- Fenwal by Carrier Global Corporation

- Fresenius Kabi AG

- Haemonetics Corporation

- Isto Biologics

- JMS North America Corporation

- Kaneka Corporation

- LMB Technologie GmbH

- Maco Pharma SAS

- Mallinckrodt Pharmaceuticals Ireland Limited

- MEDICA S.P.A.

- Medicap Clinic GmbH

- Miltenyi Biotec B.V. & Co. KG

- Nikkiso Europe GmbH

- SB-Kawasumi Laboratories, Inc.

- Terumo BCT Inc

Actionable Strategic Imperatives for Industry Leaders to Navigate Disruption, Drive Innovation and Maximize Value in the Apheresis Equipment Sector

To navigate the evolving apheresis equipment landscape, industry leaders should prioritize a multi-pronged approach that balances innovation with operational resilience. Investing in modular automation platforms will enable rapid adaptation to shifting application portfolios, from CAR-T cell collection to pediatric plasmapheresis. Concurrently, expanding regional assembly and logistical capacities can buffer against tariff anomalies and supply chain disruptions, ensuring uninterrupted service delivery.

Further, forging collaborative relationships with regulatory agencies will accelerate clearance pathways for next-generation systems, particularly those integrating pathogen reduction and digital monitoring. Strengthening aftermarket service offerings through predictive analytics and remote diagnostics can drive higher utilization rates and deepen customer loyalty. Finally, dedicating resources to eco-friendly consumable designs and circular economy practices will differentiate brands in markets increasingly attentive to sustainability. By adopting these strategic imperatives, organizations can not only mitigate immediate headwinds but also position themselves as preferred partners in the future of apheresis-enabled therapies.

Rigorous Multi-Method Research Framework Combining Primary Interviews, Secondary Data, and Regulatory Analysis to Ensure Comprehensive Apheresis Equipment Market Insights

This report’s findings emerged from a comprehensive research methodology that combined primary stakeholder interviews with rigorous secondary data analysis and regulatory review. We engaged with senior executives at leading equipment manufacturers, laboratory directors at blood centers, and procurement leaders in hospital networks to gain firsthand perspectives on market drivers, technology adoption, and investment priorities. These qualitative insights were augmented by analysis of publicly available regulatory filings, FDA clearance databases, and technical literature to ensure factual accuracy and depth.

Secondary research encompassed a systematic review of industry publications, peer-reviewed journals, and white papers to map historical trends and technological evolution. We also monitored relevant trade policy announcements and tariff classifications to assess the impact of recent U.S. measures. Synthesis of these diverse inputs was conducted through triangulation techniques to validate key conclusions and minimize bias. Together, this multi-method framework delivers a robust and balanced view of the global apheresis equipment landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Apheresis Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Apheresis Equipment Market, by Product Type

- Apheresis Equipment Market, by Technology

- Apheresis Equipment Market, by Patient Type

- Apheresis Equipment Market, by Application

- Apheresis Equipment Market, by End User

- Apheresis Equipment Market, by Region

- Apheresis Equipment Market, by Group

- Apheresis Equipment Market, by Country

- United States Apheresis Equipment Market

- China Apheresis Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Consolidating Key Insights and Strategic Outlook on Apheresis Equipment to Empower Informed Decisions Amidst Industry Transformation

In summary, apheresis equipment stands at a pivotal juncture where technological breakthroughs, evolving application paradigms, and geopolitical factors converge to reshape the sector’s future. Automation and digital integration are accelerating operational efficiencies, while the push for enhanced safety through pathogen reduction is redefining product standards. Tariff developments in 2025 have introduced short-term cost challenges, yet they have also catalyzed a strategic shift toward nearshoring and resilient supply chains. Segmentation analysis underscores diverse growth pockets-from advanced cell collection workflows to pediatric membrane-based systems-and regional insights reveal tailored pathways for market penetration across the Americas, EMEA, and Asia-Pacific.

Looking ahead, companies that align innovation strategies with actionable insights and agile manufacturing models will lead the next wave of adoption. By leveraging the comprehensive findings and recommendations delineated in this report, decision-makers can confidently navigate the complexities of the apheresis equipment landscape, ensuring both sustained growth and improved patient outcomes.

Immediate Engagement Opportunity: Connect with Ketan Rohom to Unlock Tailored Research Insights and Secure Your Competitive Advantage with a Detailed Report

To explore tailored insights and strategic guidance that align with your specific business objectives, seize this opportunity to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in apheresis equipment market dynamics will help you leverage critical findings for maximum impact. Schedule a personalized discussion and gain access to a detailed report that will empower your organization to outpace competitors and capitalize on emerging opportunities in this rapidly evolving sector.

- How big is the Apheresis Equipment Market?

- What is the Apheresis Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?