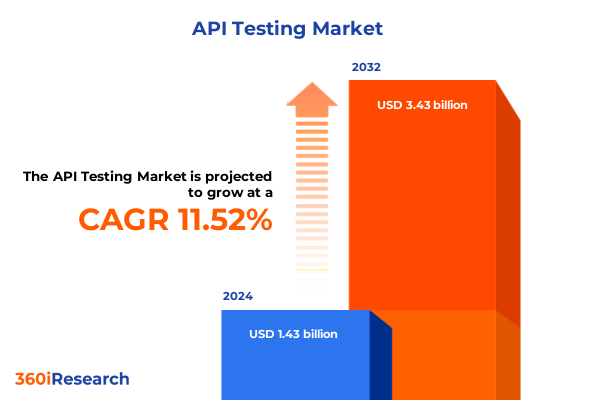

The API Testing Market size was estimated at USD 1.55 billion in 2025 and expected to reach USD 1.69 billion in 2026, at a CAGR of 11.96% to reach USD 3.43 billion by 2032.

Building a Compelling Foundation with an Insightful Introduction That Frames the Market Context and Guides Stakeholders Towards Strategic Considerations

The introduction serves as a critical foundation for understanding the current market environment and establishing the relevance of subsequent insights. It frames the discourse by highlighting the convergence of technological advancements, shifting regulatory landscapes, and evolving consumer expectations that define the modern competitive arena.

As stakeholders seek clarity amid complexity, this section positions the market’s trajectory within the broader economic and policy-driven forces at play. It underscores why an informed perspective is essential for executives and decision-makers who must navigate uncertainties and capitalize on emerging opportunities. Transitioning from this foundational overview, the report then delves into transformative shifts that are reshaping the competitive landscape.

Uncovering the Pivotal Transformative Shifts Shaping the Competitive Landscape and Driving Innovation across Market Verticals and Technology Paradigms

Organizations today are experiencing a wave of transformative shifts that disrupt longstanding paradigms and demand agile responses. Digitalization continues to permeate every industry vertical, forcing traditional models to adapt or risk obsolescence. Artificial intelligence and machine learning have transitioned from experimental technologies to integral components of analytics, control mechanisms, and monitoring solutions, propelling new efficiencies across value chains.

Simultaneously, the regulatory environment-particularly in the United States-has grown more stringent, with stakeholders contending with evolving data privacy, security, and trade policies. This convergence of technological acceleration and policy complexity prompts enterprises to recalibrate their strategies, prioritizing resilience and scalability. Moreover, changing consumer behaviors, driven by heightened expectations for personalized experiences and seamless digital interactions, are compelling providers to rethink product and service delivery. Against this backdrop, understanding these transformative dynamics is crucial for crafting strategies that deliver sustainable growth.

Evaluating the Comprehensive Cumulative Impact of Newly Imposed United States Tariffs in 2025 on Supply Chains Pricing Structures and Trade Dynamics

The implementation of new United States tariffs in 2025 has introduced significant ripple effects across global supply chains, pricing structures, and trade dynamics. Companies that depend on cross-border inputs have encountered rising material costs, prompting renegotiations with suppliers and exploration of alternative sourcing strategies. In turn, these adjustments have affected production timelines and cost management, exerting pressure on margins.

Furthermore, the increased duty burdens have led many organizations to evaluate nearshoring options within the Americas, seeking to mitigate exposure to tariff fluctuations. This strategic recalibration has not only altered logistical footprints but also driven investments in manufacturing capabilities closer to end markets. As pricing structures evolve, customers face higher costs that may influence demand elasticity and buying behavior. Stakeholders must now balance the imperative to maintain competitive pricing against the necessity to preserve profitability. The net result is a market that demands nimble trade strategy execution and robust scenario planning to navigate ongoing tariff uncertainties.

Extracting Key Segmentation Insights to Illuminate How Product Type Application Deployment and Company Size Influence Market Behavior and Adoption Patterns

Segmentation insights reveal how distinct market categories influence adoption patterns and competitive dynamics. When examining the market through the lens of product type-Basic solutions cater to entry-level requirements, while Premium offerings deliver advanced features and differentiated performance; Standard products occupy the middle ground, balancing cost and capability. These delineations drive buyer preferences and shape go-to-market strategies, with providers tailoring value propositions to specific tiered needs.

Exploring application-based segmentation, analytic platforms have emerged as critical enablers of data-driven decision-making, control systems optimize operational flows, and monitoring tools deliver real-time visibility-each use case carries unique requirements and growth trajectories. Industry vertical segmentation further refines the picture: in the BFSI sector, Banking solutions emphasize transaction security and compliance while Insurance services focus on risk assessment and customer engagement. Healthcare adoption spans diagnostics, hospital infrastructure, and pharmaceutical development, each demanding specialized regulatory compliance and performance criteria. IT & Telecom verticals navigate the interplay between service management and network reliability, whereas Retail adoption bifurcates into brick-and-mortar enhancements and online retail optimization. Finally, deployment mode analysis contrasts the flexibility of cloud implementations with the customization of on-premises environments and the hybrid approaches that straddle both worlds. Company size segmentation shows large enterprises investing in comprehensive, integrated suites, with medium and small organizations often favoring modular, cost-effective deployments poised for targeted scale.

This comprehensive research report categorizes the API Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Deployment Mode

- Company Size

- Application

- Industry Vertical

Delivering Comprehensive Regional Insights That Highlight Growth Drivers Challenges and Opportunities across the Americas EMEA and Asia-Pacific Territories

Regional insights underscore divergent growth drivers and market dynamics across geographies. In the Americas, robust infrastructure investments and a mature regulatory framework facilitate rapid digital transformation, underscoring opportunities in advanced analytics and integrated control solutions. Market players leverage proximity to innovation hubs and strong consumer demand to pilot emerging technologies and scale proven offerings.

Meanwhile, Europe, Middle East & Africa exhibits a complex mosaic of regulatory regimes and economic conditions. Enterprises in Western Europe prioritize compliance and data sovereignty, driving investments in secure, localized deployments, whereas emerging markets in the Middle East and Africa focus on foundational infrastructure expansion and cost-effective monitoring capabilities. These disparities necessitate region-specific strategies that account for regulatory heterogeneity and divergent customer maturity levels.

In Asia-Pacific, the landscape is defined by a blend of hyper-competitive digital economies and fast-growing emerging markets. Leading markets invest heavily in AI-driven analytics and smart monitoring, while developing economies pursue digital inclusion and basic service automation. This diversity creates a tiered market structure that demands highly adaptable offerings and flexible deployment models to capture the full spectrum of opportunity.

This comprehensive research report examines key regions that drive the evolution of the API Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Key Company Profiles and Strategic Moves That Define Competitive Positioning Investment Decisions and Partnerships in the Market Landscape

Key company insights reveal strategic maneuvers and competitive positioning that shape market trajectories. Leading incumbents are expanding through targeted acquisitions of niche analytics providers to bolster their platform capabilities, while also forging strategic alliances with cloud infrastructure partners to enhance deployment flexibility. Some mid-sized players differentiate through proprietary control algorithms that cater to specialized industry requirements, emphasizing customization and rapid integration.

At the same time, agile entrants are leveraging open-source frameworks and modular architectures to introduce cost-effective monitoring solutions that appeal to price-sensitive segments. These innovative models are prompting established providers to revisit their product roadmaps and adopt more customer-centric pricing strategies. Additionally, cross-industry collaborations are emerging, as technology firms partner with vertical-specialized consultancies to deliver combined expertise in analytics, control, and monitoring-which accelerates time to value and elevates the standard for end-to-end service delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the API Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A1QA, Inc.

- Accenture plc

- Cigniti Technologies Limited

- Codoid, Inc.

- Global App Testing Ltd.

- iBeta Quality Assurance, Inc.

- QA Mentor, Inc.

- QASource, Inc.

- Qualitest Group

- QualityLogic, Inc.

- ScienceSoft USA Corporation

- TestingXperts, Inc.

- Testlio, Inc.

- Testrig Technologies Pvt. Ltd.

Outlining Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends Enhance Operational Efficiency and Sustainable Market Positioning

Industry leaders are encouraged to prioritize investments in unified platforms that integrate analytics, control, and monitoring capabilities, ensuring a seamless flow of insights across organizational silos. By cultivating strategic partnerships with cloud and edge computing providers, organizations can optimize deployment flexibility and accelerate time to market for new offerings.

Simultaneously, embedding regulatory compliance as an integral design principle will mitigate risks associated with data privacy and evolving trade policies, particularly in jurisdictions affected by new tariff measures. Leaders should also consider piloting nearshoring initiatives within the Americas to diversify supply chain dependencies and reduce exposure to future tariff fluctuations. Finally, establishing a centralized insights hub-combining data from multiple segmentation categories-will equip decision-makers with a 360-degree view necessary for adaptive scenario planning and resilient growth strategies.

Demonstrating Robust Research Methodology That Ensures Data Reliability Analytical Rigor and Coverage across Multiple Segmentation and Regional Perspectives

This research employs a rigorous methodology that blends primary and secondary sources to ensure data reliability and analytical rigor. Primary insights were gathered through structured interviews with domain experts, senior executives, and technology providers, complemented by surveys that captured end-user sentiment and adoption drivers across verticals and company sizes.

Secondary research drew upon reputable industry publications, regulatory filings, and patent databases to validate findings and contextualize market developments. Segmentation parameters were defined through iterative consultations with stakeholders, ensuring that categories such as product type, application, industry vertical, deployment mode, and company size accurately reflect market realities. Regional analyses incorporated macroeconomic indicators, policy reviews, and local market studies to deliver comprehensive coverage across the Americas, EMEA, and Asia-Pacific.

Data synthesis involved cross-verification across all sources, iterative peer reviews, and quality assurance checks to uphold methodological transparency and confidence. This multi-layered approach underpins the robustness of the insights provided and supports informed strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our API Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- API Testing Market, by Product Type

- API Testing Market, by Deployment Mode

- API Testing Market, by Company Size

- API Testing Market, by Application

- API Testing Market, by Industry Vertical

- API Testing Market, by Region

- API Testing Market, by Group

- API Testing Market, by Country

- United States API Testing Market

- China API Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding the Executive Summary by Synthesizing Core Findings Highlighting Critical Takeaways and Setting the Stage for Informed Strategic Decision Making

In conclusion, the market is undergoing rapid transformation driven by technology convergence, regulatory shifts, and evolving consumer behaviors. The newly imposed United States tariffs in 2025 have introduced supply chain complexities and pricing pressures that require agile responses and strategic realignment.

Segmentation insights highlight the nuanced needs of different product tiers, applications, industries, deployment modes, and company sizes, while regional perspectives reveal distinct growth levers and challenges across the Americas, EMEA, and Asia-Pacific. Strategic company movements, from acquisitions to alliances, illustrate the ongoing race to deliver integrated, customer-centric solutions.

Collectively, these findings underscore the imperative for organizations to adopt a holistic strategy-leveraging unified platforms, reinforcing compliance, and diversifying operational footprints-to navigate the evolving landscape and achieve sustainable competitive advantage.

Compelling Next Steps and Personalized Call To Action with Ketan Rohom to Propel Stakeholder Engagement and Drive Acquisition of the Market Research Report

I invite you to take decisive action today by engaging directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure access to this comprehensive market research report and unlock the insights you need to stay ahead in a rapidly evolving environment.

By connecting with Ketan Rohom, you will receive tailored guidance on how to leverage the report’s deep segmentation analyses, regional perspectives, and strategic recommendations to refine your growth strategy and optimize operational performance.

Don’t let opportunity pass you by-reach out to Ketan Rohom now to discuss how this research can empower your decision-making, bolster your competitive positioning, and deliver tangible value for your organization.

- How big is the API Testing Market?

- What is the API Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?