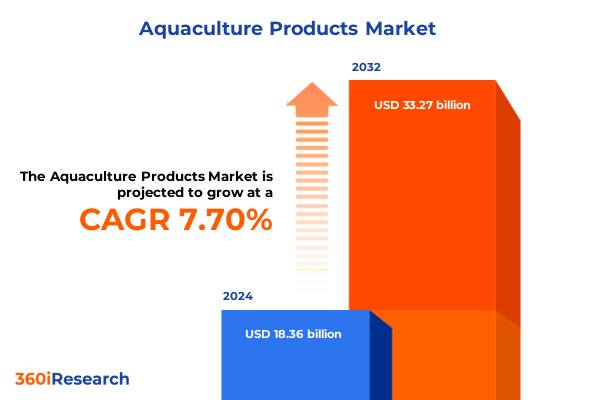

The Aquaculture Products Market size was estimated at USD 19.73 billion in 2025 and expected to reach USD 21.20 billion in 2026, at a CAGR of 7.75% to reach USD 33.27 billion by 2032.

Charting the Rise of Sustainable Aquaculture: An Introduction to Shifting Dynamics, Innovations, and Growth Drivers in the Global Seafood Farming Sector

Aquaculture has rapidly transitioned from a niche sector into a strategic component of global food security and resource management. Rising consumption of seafood, driven by increasing health consciousness and shifting dietary preferences, has underscored the limitations of wild-catch fisheries and highlighted the urgency of scaling sustainable farming practices. This executive summary explores the multifaceted drivers, contemporary challenges, and emergent opportunities that define the modern aquaculture landscape.

Against a backdrop of mounting pressures on marine ecosystems, farmed species offer a reliable avenue to meet protein demands while mitigating the degradation of natural habitats. Concurrent advancements in breeding programs, feed formulations, and environmental monitoring have collectively enhanced productivity, resilience, and ecological compatibility. Moreover, strategic policy initiatives and public-private collaborations are accelerating the transition toward more integrated, efficient, and traceable systems.

This overview sets the stage for a deeper exploration of transformational trends, regulatory influences, segmentation insights, regional dynamics, and actionable recommendations. Stakeholders-from investors and technology providers to governmental bodies and processing enterprises-will find a structured pathway through which to interpret complex data, anticipate market shifts, and position themselves at the forefront of sustainable aquaculture innovation.

Uncovering Major Transformative Shifts Reshaping Aquaculture with Technology, Policy Changes, and Consumer Preferences Driving Industry Evolution

The aquaculture industry is being reshaped by a convergence of technological breakthroughs, evolving regulatory frameworks, and dynamic consumer behaviors. Precision feeding systems and automated monitoring platforms are now commonplace, enabling farmers to optimize growth rates while minimizing resource waste. Simultaneously, the adoption of recirculating aquaculture systems has expanded beyond pilot projects, offering closed-loop solutions that dramatically reduce environmental footprints and facilitate year-round production.

In parallel, regulatory bodies have begun to streamline permitting processes for offshore aquaculture, recognizing the potential to diversify production zones and alleviate coastal congestion. These policy shifts, coupled with growing momentum behind the Blue Economy, are unlocking new investment corridors and incentivizing innovation hubs. At the same time, consumer demand for transparent supply chains and eco-certified products is compelling operators to adopt blockchain-enabled traceability and third-party sustainability certifications.

Furthermore, the intersection of climate resilience and aquaculture has given rise to adaptive breeding programs targeting disease resistance and thermal tolerance. Industry alliances are forming to share best practices and drive collective research agendas, ensuring that the sector evolves in harmony with environmental stewardship. These transformative shifts are not isolated; rather, they represent a cohesive movement toward a future in which aquaculture underpins food security, ecological balance, and economic prosperity.

Analyzing the Cumulative Impact of United States Tariffs in 2025 on Seafood Trade Flows, Domestic Farming Viability, and Global Supply Chain Adjustments

Throughout 2025, United States trade policies have imposed significant tariffs on a variety of seafood imports, influencing both domestic market dynamics and global supply chains. Notably, a 25 percent tariff on key seafood imports from Canada and Mexico has been enacted, with analogous measures anticipated for certain European origins. At the same time, a 170 percent levy on Chinese tilapia fillets has effectively all but eliminated this low-cost source from U.S. retail channels. These cumulative measures have disrupted established trade routes and prompted producers to reassess sourcing strategies to maintain margin integrity and market endurance.

The broader implications extend beyond raw trade flows; consumer prices have adjusted upward, and retail stocking models are evolving to reflect higher procurement costs. Domestic farmers, particularly in shrimp and tilapia production, have experienced partial relief from foreign competition, yet they also face increased input expenses for feed and infrastructure as global market imbalances feed through into cost structures. In parallel, U.S. shrimpers have observed a temporary boost in landed volumes, though analysts caution that sustained profitability will depend on addressing underlying challenges such as aging processing facilities and climate-related stock variability.

Looking ahead, supply chain realignments may spur renewed investments in domestic hatcheries and processing assets, while international exporters recalibrate their market focus toward regions with fewer trade barriers. However, the industry must remain vigilant; further retaliatory measures or extensions of non-tariff barriers could engender volatility and erode consumer confidence. In this complex trade environment, agility and strategic foresight are essential for stakeholders seeking to transform challenges into long-term competitive advantages.

Key Segmentation Insights Revealing How Species, Culture Systems, Environments, Applications, and Product Forms Define Diverse Aquaculture Market Niches

When segmenting the aquaculture market by species, it is examined across crustaceans such as crabs, lobsters, prawns, and shrimp, alongside finfish categories including carp, catfish, salmon, tilapia, and trout, further complemented by mollusks like clams, mussels, oysters, and scallops, as well as seaweed varieties encompassing brown, green, and red types. Each species presents distinct growth cycles, feed conversion ratios, and market positioning, driving tailored production strategies and differentiated supply chain architectures.

In addressing culture systems, operators deploy approaches ranging from open-water cage culture to flow-through systems and pond culture, while advanced recirculating systems provide highly controlled environments. The choice of farming environment-spanning brackish water, freshwater, and marine ecosystems-introduces regulatory considerations, site feasibility studies, and biosecurity protocols that become integral to risk management. Across applications, aquaculture outputs serve animal feed industries, fulfill human consumption demands, and feed into pharmaceutical and nutraceutical formulations, underscoring the sector’s versatility.

Product form-canned, dried, fresh, or frozen-further refines market segmentation by aligning processing technologies with distribution channels, logistical constraints, and consumer convenience preferences. Businesses leverage these segmentation pillars to pinpoint target cohorts, optimize value creation, and drive resource allocation. By synthesizing insights across species, systems, environments, applications, and product forms, stakeholders can uncover niche opportunities, anticipate shifting demand patterns, and architect resilient operational footprints that align with sustainability and profitability agendas.

This comprehensive research report categorizes the Aquaculture Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Species

- Culture System

- Farming Environment

- End User

- Distribution Channel

Key Regional Insights Highlighting Unique Growth Drivers, Regulatory Frameworks, and Market Dynamics across Americas, EMEA, and Asia-Pacific Aquaculture Sectors

Regional variances in aquaculture not only reflect ecological conditions but also the contours of local policy frameworks and consumer behaviors. In the Americas, operators balance large-scale intensive production along the Gulf Coast with artisanal coastal farming in Latin America, navigating a mosaic of federal regulations and export incentives. Market participants in Brazil, Chile, and Ecuador are forging new export corridors, while North American players invest in state-level infrastructure upgrades and public-private partnerships to expand processing capacity and cold-chain logistics.

In Europe, Middle East & Africa, the interplay between stringent environmental directives and nascent growth zones creates a dual narrative. Scandinavian and Mediterranean nations lead with sustainable offshore salmon farming, leveraging advanced technology to meet rigorous EU standards. Meanwhile, emerging markets in North Africa and the Gulf are exploring inland pond culture and recirculating systems to address freshwater scarcity and bolster food security. Across this region, collaborative research networks and harmonized certification schemes are pivotal in scaling responsible aquaculture practices.

Within Asia-Pacific, the sector is characterized by a rich tapestry of traditional coastal farms and high-intensity industrial parks, particularly in Southeast Asia and Oceania. Nations such as China, Vietnam, and Indonesia dominate shrimp and tilapia output, while Australia and New Zealand emphasize premium-value species and eco-certified production. The region’s diverse climatic zones and vast coastlines support a broad spectrum of species cultivation, though pressures on marine ecosystems have prompted a surge in regulatory oversight and community engagement initiatives.

This comprehensive research report examines key regions that drive the evolution of the Aquaculture Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Aquaculture Enterprises and Innovators Shaping Competitive Landscapes through Strategic Partnerships, Advanced Technologies, and Sustainability Initiatives

Leading aquaculture enterprises are leveraging strategic partnerships, capital investments, and technological integrations to secure competitive advantage. Biotechnology firms specializing in genetic optimization collaborate closely with hatcheries to accelerate selective breeding programs, enabling higher yields and disease resilience. At the same time, feed manufacturers innovate with alternative protein sources, such as insect meal and single-cell organisms, reducing reliance on marine fishmeal and supporting circular economy objectives.

Global and regional producers alike are forming consortiums to share best practices and co-invest in infrastructure, including onshore processing facilities and cold-chain networks. Some operators are expanding into value-added segments, offering ready-to-cook products and tailored formulations for specialized culinary applications. Meanwhile, companies active in offshore and inland recirculating systems are forging alliances with engineering firms to optimize water treatment technologies and energy efficiency, underlining a commitment to both operational excellence and environmental stewardship.

Collectively, these corporate maneuvers reveal a sector in which collaboration, innovation, and sustainability converge to define market leadership. As competitive landscapes evolve, agile firms that embrace integrated approaches-spanning genetics, nutrition, digitalization, and responsible sourcing-will be best positioned to capture emerging opportunities and navigate regulatory complexities with confidence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aquaculture Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aanderaa by Xylem, Inc.

- Adisseo

- AGK Kronawitter GmbH

- Applied UV

- Aqua Logic

- Aquaculture Equipment Ltd

- Aquarius Systems

- Aquatic Equipment and Design, Inc.

- BAADER

- FEEDING SYSTEMS, S.L

- Foshan Miaofei Aquarium Equipment

- Guangzhou Zhonghang Environmental Tech

- Innovasea

- Jiangsu G & G Netting

- KAPP ehf

- LINN Gerätebau GmbH

- Marel

- Norfab Equipment Ltd

- Pentair Aquatic Eco‑Systems

- Shenyang Aerti Tech Co., Ltd.

- Sino‑Aqua Corporation

- Tele Net

- Weda AB

- Zhongshan Ewater Aquaculture Equipment

Actionable Recommendations Empowering Industry Leaders to Capitalize on Emerging Opportunities, Enhance Sustainability, and Optimize Value Chains in Aquaculture

Industry leaders must prioritize integrated sustainability strategies that balance production growth with ecological protection. By adopting comprehensive water management protocols and investing in renewable energy solutions, companies can reduce operational risks while enhancing brand value among environmentally conscious consumers. Furthermore, forging partnerships with academic institutions for collaborative research accelerates access to breakthrough technologies in broodstock development and disease mitigation.

To capitalize on shifting consumer preferences, stakeholders should expand traceability frameworks and align with certification bodies to validate product provenance. Transparent communication across the supply chain-leveraging blockchain, QR codes, and digital platforms-builds trust and supports premium pricing strategies. Simultaneously, diversifying production portfolios across species and systems can mitigate exposure to localized climate events and market volatility.

Finally, fostering talent development and community engagement ensures the long-term viability of aquaculture initiatives. Training programs for farmers, technicians, and supply chain participants promote best practices, while stakeholder dialogues with regulatory agencies can streamline permitting processes and reduce time-to-market. By transforming these recommendations into strategic roadmaps, industry leaders will be equipped to navigate uncertainty, drive sustainable growth, and secure their position in a rapidly evolving marketplace.

Rigorous Research Methodology Detailing Systematic Data Collection, Validation Techniques, and Analytical Frameworks Underpinning Aquaculture Market Intelligence

This market analysis is grounded in a rigorous research methodology combining primary and secondary sources to deliver robust insights. Primary research included in-depth interviews with aquaculture producers, feed manufacturers, technology providers, and regulatory stakeholders, enabling firsthand perspectives on operational challenges and innovation trajectories. These interviews were complemented by engagement with academic experts and trade associations to validate emerging trends and technological breakthroughs.

Secondary research encompassed a comprehensive review of industry reports, peer-reviewed journals, policy documents, and financial disclosures from leading companies. Regulatory databases were consulted to map permitting frameworks and environmental standards across key geographies. Data triangulation techniques were applied to cross-verify findings and ensure consistency between diverse information streams.

Analytical frameworks employed include SWOT assessments to evaluate competitive positioning, PESTLE analyses to contextualize policy and macroeconomic influences, and segmentation matrices to identify high-potential niches. Quantitative data were subjected to statistical validation methods to confirm reliability, while qualitative insights were synthesized through thematic coding. This structured approach delivers granular intelligence and strategic clarity for stakeholders navigating the aquaculture landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aquaculture Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aquaculture Products Market, by Product Type

- Aquaculture Products Market, by Species

- Aquaculture Products Market, by Culture System

- Aquaculture Products Market, by Farming Environment

- Aquaculture Products Market, by End User

- Aquaculture Products Market, by Distribution Channel

- Aquaculture Products Market, by Region

- Aquaculture Products Market, by Group

- Aquaculture Products Market, by Country

- United States Aquaculture Products Market

- China Aquaculture Products Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Critical Findings and Strategic Imperatives for Navigating the Evolving Aquaculture Landscape with Confidence

The aquaculture sector stands at a pivotal juncture, propelled by technological strides, policy reforms, and evolving consumer expectations. Critical findings reveal that advancements in system design and genetic optimization are unlocking new efficiencies, while regulatory realignments are reshaping trade dynamics and investment priorities. Segmentation insights underscore the importance of species diversity, culture system customization, and market channel differentiation in driving both resilience and profitability.

Regional analysis highlights a decentralized industry architecture, with unique growth drivers in the Americas, EMEA, and Asia-Pacific regions that demand tailored strategies. Leading companies demonstrate that collaboration, vertical integration, and sustainable innovation are central to maintaining competitive advantage in a complex global market. Actionable recommendations emphasize the need for integrated sustainability frameworks, enhanced traceability mechanisms, and strategic talent development to ensure long-term viability.

Synthesizing these imperatives, stakeholders are advised to embrace agile approaches that align production capabilities with market demands and environmental stewardship goals. By leveraging data-driven decision-making and fostering cross-sector partnerships, industry participants can navigate regulatory uncertainties, optimize resource utilization, and seize emerging opportunities. The collective journey toward a more sustainable and efficient aquaculture future is underway, and informed leadership will be the distinguishing factor in realizing its full potential.

Unlock Comprehensive Aquaculture Market Insights and Drive Strategic Growth Today by Connecting with Ketan Rohom for In-Depth Research and Expert Guidance

Interested parties seeking to unlock the full potential of the aquaculture market are invited to connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He stands ready to guide you through the comprehensive market intelligence report, addressing your specific needs and strategic objectives. Ketan combines in-depth industry knowledge with a consultative approach to ensure that every insight resonates with your business priorities and long-term vision.

By engaging with Ketan, you will gain privileged access to granular data, tailored analysis, and expert interpretations that go beyond surface-level summaries. His expertise facilitates a seamless purchasing process, providing clarity on subscription options, customized deliverables, and value-added services designed to support your decision-making. Reach out to leverage his insights and acquire the definitive resource on aquaculture market trends, competitive landscapes, and transformative opportunities.

- How big is the Aquaculture Products Market?

- What is the Aquaculture Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?