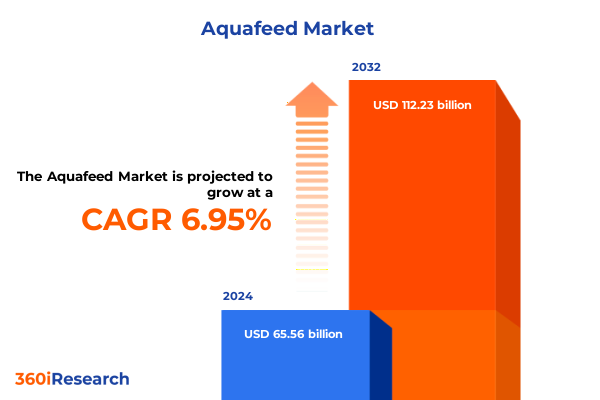

The Aquafeed Market size was estimated at USD 69.68 billion in 2025 and expected to reach USD 74.20 billion in 2026, at a CAGR of 7.04% to reach USD 112.23 billion by 2032.

Charting the Course for a Sustainable and Resilient Aquafeed Industry Amidst Emerging Global Demands and Regulatory Challenges

Aquafeed lies at the heart of a dynamic aquaculture ecosystem that is grappling with mounting environmental, economic, and regulatory pressures. As wild fish stocks face overfishing constraints and global seafood demand continues to escalate, stakeholders across the value chain are seeking more sustainable, nutrient-dense, and economically viable feed solutions. This paradigm shift is catalyzing intensive research into both novel and traditional feed ingredients, while simultaneously driving innovations in feed manufacturing, delivery systems, and nutritional formulations. Furthermore, heightened consumer awareness regarding seafood sourcing and environmental stewardship has elevated the need for transparent supply chains and responsible production practices.

Against this backdrop, the introduction of precision feeding technologies, advanced analytical tools, and digital monitoring platforms has empowered producers to optimize feed conversion ratios and reduce waste. The interplay between sustainability and profitability has never been more pronounced, compelling feed manufacturers, farm operators, and investors to re-evaluate longstanding production models. As a result, collaboration between public agencies, research institutions, ingredient suppliers, and aquafeed producers has intensified, laying the groundwork for an integrated approach to feed innovation and ecosystem stewardship. By exploring these interconnected trends, this analysis establishes a comprehensive foundation for understanding the contemporary aquafeed landscape and its future trajectory.

Unveiling the Transformative Shifts Redefining Aquafeed Production Through Innovation and Sustainability Paradigms

The aquafeed sector is undergoing profound transformation driven by breakthroughs in alternative ingredient sourcing, digitalization, and regulatory alignment. In recent years, insect-derived meals, algae-based proteins, and single-cell organisms have transitioned from experimental to commercial-scale applications, offering nutrient profiles that rival traditional fishmeal while reducing reliance on wild-caught resources. Additionally, plant-based proteins fortified with essential amino acids and micronutrients have gained traction, responding to supply volatility in marine-derived inputs.

Simultaneously, digital tools are revolutionizing feed management through real-time monitoring of fish behavior and environmental conditions. Advanced computer vision systems and AI-driven feeding algorithms enable farms to tailor feeding regimes with unprecedented precision, thereby lowering feed waste and minimizing ecological impacts. Regulatory frameworks are also evolving, with several key markets instituting certification schemes that mandate sustainable sourcing and traceability, further incentivizing innovation across the value chain.

Moreover, emerging circular economy strategies-such as repurposing agro-industrial by-products into feed substrates-are bridging the gap between waste reduction and cost efficiency. These cyclical models not only align with global sustainability goals but also enhance the socioeconomic viability of smallholder and large-scale operations alike. Taken together, these transformative shifts underscore a collective industry commitment to forging resilient, resource-efficient aquafeed paradigms.

Examining the Cumulative Impact of Recent United States Tariff Measures on Aquafeed Ingredient Supply Chains and Costs

In 2025, United States tariff measures have created significant ripple effects across aquafeed ingredient supply chains. The imposition of a 10 percent duty on nearly all seafood products, coupled with a 30 percent surcharge on imports from China, has elevated costs for feed components that rely on marine-derived inputs and processing equipment. These levies have not only strained importers of fishmeal and fish oil but have also triggered broader trade policy recalibrations among key supplying nations.

To alleviate some of this burden, strategic tariff exclusions-such as the extension of Section 301 exemptions for fishmeal used in feed-have provided temporary relief, underscoring the tension between protectionist impulses and industry sustainability needs. Nevertheless, the overall escalation in trade barriers has compelled feed producers to diversify sourcing strategies, pivoting toward alternative protein streams and seeking domestic partnerships to secure supply continuity.

Over the long term, these cumulative tariff effects have prompted a reevaluation of cost structures, inventory management, and logistical planning within the aquafeed sector. Industry stakeholders are now exploring localized ingredient production facilities, investing in vertical integration, and engaging in collaborative advocacy to harmonize trade policy with the imperatives of a burgeoning sustainable seafood market.

Exploring Segmentation Insights to Illuminate Species, Ingredients, Forms, Channels and End User Dynamics Shaping Aquafeed

A nuanced understanding of market segmentation is vital for tailoring feed solutions that meet the diverse nutritional needs of cultivated species. For crustaceans-including crab, prawn, and shrimp-formulations emphasize high-quality protein sources and lipid profiles conducive to robust shell formation and immunocompetence, while finfish diets cater to both freshwater varieties like carp, catfish, and tilapia and marine species such as salmon, sea bass, and sea bream. Mollusk nutrition, focused on clams, mussels, and oysters, integrates specific carbohydrate and mineral blends to support shell growth and filter-feeding physiology.

Equally critical is the selection of ingredient types. Carbohydrate inputs, derived from materials like corn starch and rice bran, serve as cost-effective energy sources, whereas lipid ingredients sourced from fish oil and vegetable oil supply essential fatty acids. Protein ingredients range from traditional fish meal and soybean meal to emerging options such as pea protein and corn gluten meal, each calibrated to meet species-specific amino acid requirements.

The physical form of feed-whether crumbles, extruded pellets, gel, pelleted feed, or powder-directly influences feeding behavior, pellet stability, and water quality. Moreover, the choice of distribution channel, be it direct sales, distributor networks, or online platforms (including B2B and B2C portals), affects delivery timelines and service levels. Finally, end-user profiles-from commercial fish, mollusk, and shrimp farms to hatcheries and home aquariums-determine batch sizes, formulation complexity, and service expectations, highlighting the need for a versatile, customer-centric approach to product development.

This comprehensive research report categorizes the Aquafeed market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Feed Type

- Ingredient Type

- Source Type

- Species Type

- Aquaculture System

- Farming Environment

- Feed Formulation

- End User

- Sales Channel

Key Regional Perspectives Revealing How Americas Europe Middle East Africa and Asia-Pacific Influence Aquafeed Development

Regional dynamics exert a profound influence on feed formulation, sourcing strategies, and market access. In the Americas, robust aquaculture sectors in the United States, Brazil, and Chile benefit from well-developed supply chains and favorable climate conditions for shrimp and salmon production. This region also continues to innovate with precision feeding technologies and traceability initiatives that cater to discerning North American and European consumers.

Meanwhile, Europe, Middle East and Africa present a mosaic of regulatory environments and market maturities. Western European producers emphasize stringent eco-certification standards and reduced antibiotic use, whereas emerging markets in the Middle East and North Africa are investing in hatchery development and partnerships to expand local production capacity. Across sub-Saharan Africa, smallholder and community-driven aquaculture ventures are gradually adopting low-cost, locally sourced feed ingredients to foster food security and rural livelihoods.

Asia-Pacific remains the dominant force in aquaculture, led by China, India, Vietnam, and Indonesia. Here, high production volumes, combined with rich biodiversity, create unparalleled demand for nutritionally balanced feed. Companies are deploying large-scale extrusion plants, exploring novel inland and marine feed ingredients, and collaborating with research institutions to support sustainable intensification while minimizing environmental footprints.

This comprehensive research report examines key regions that drive the evolution of the Aquafeed market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Dynamics and Innovative Strategies of Leading Aquafeed Companies Driving Market Evolution

Leading aquafeed companies are driving innovation through strategic investments, partnerships, and operational realignment. For instance, one multinational agribusiness recently announced the closure of two feed mills in Vietnam as part of a global restructuring effort designed to enhance supply chain efficiency and concentrate resources on core markets. Simultaneously, this company has extended its long-term alliance with an insect protein specialist to scale the use of black soldier fly meal, underscoring a commitment to reducing reliance on marine-derived proteins and curbing greenhouse gas emissions.

Another prominent feed supplier has established a North American Insect Innovation Centre to accelerate local production and commercialization of insect-based ingredients, reflecting the sector’s pivot toward circular economy models and renewable resource utilization. In parallel, a leading European nutrition provider has harnessed advanced digital platforms to share real-time production data with customers, enabling dynamic feed recommendations that optimize growth performance and operational costs.

Furthermore, commitments to responsible sourcing are evident in the rapid adoption of sustainability certifications, with one global feed producer securing the Aquaculture Stewardship Council’s Feed Standard across multiple facilities to meet evolving customer and regulatory requirements. Product innovation continues apace, as evidenced by the introduction of precision formulation concepts designed to align amino acid profiles with species-specific dietary demands, thereby enhancing feed conversion efficiency and environmental outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aquafeed market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aller Aqua A/S

- Archer Daniels Midland Company

- Avanti Feeds Limited

- BENEO

- Bern Aqua NV

- BioMar Group

- Biostadt India Limited

- Cargill, Incorporated

- Charoen Pokphand Foods PLC

- CPF Worldwide

- Godrej Agrovet Limited

- Growel

- Growel Feeds Pvt. Ltd.

- Happy Feeds

- Kemin Industries, Inc.

- Nutreco

- Pro Indo Aqua Fish Feed

- Purina Animal Nutrition LLC

- Ridley Corporation

- Skretting

- Skretting

- Symrise

- The Scoular Company

- Wilbur-Ellis Company

- Zeigler Bros., Inc.

Crafting Actionable Strategic Recommendations to Empower Industry Leaders in Navigating the Evolving Aquafeed Landscape

Industry leaders can strengthen market positioning by embracing integrated strategies that align sustainability goals with operational excellence. First, investment in alternative protein research should be prioritized, with a focus on scalable insect and algae platforms. Collaborative pilot programs can validate nutrient bioavailability and cost-performance metrics, while joint ventures with local producers will secure feedstock supply chains.

Second, digital transformation of feed management offers immediate returns through waste reduction and growth optimization. Deploying AI-driven feeding algorithms and real-time monitoring systems will foster predictive feeding models that adapt to environmental fluctuations and individual farm conditions. In this regard, forming strategic alliances with technology providers will ensure seamless integration and ongoing technical support.

Third, proactive engagement with policymakers is essential to shape trade and environmental regulations that support industry resilience. By contributing data-driven insights to tariff exclusion negotiations and sustainability certification frameworks, companies can influence policy outcomes and mitigate regulatory risks.

Lastly, customer-centric service models should be refined through targeted segmentation strategies that address the unique needs of commercial farms, hatcheries, and retail aquarium segments. Tailored feed formulations, coupled with advisory services and training programs, will cultivate long-term partnerships and bolster brand loyalty in an increasingly competitive marketplace.

Outlining Rigorous Research Methodology Combining Multidisciplinary Approaches and Data Collection for Aquafeed Analysis

This analysis synthesizes a multi-tiered research methodology that integrates quantitative data, qualitative insights, and expert consultation. Primary research involved structured interviews with aquafeed producers, ingredient suppliers, feed trials specialists, and regulatory authorities across key markets to capture firsthand perspectives on innovation drivers and operational challenges. These dialogues informed the thematic framework for subsequent inquiries.

Secondary research encompassed an extensive review of peer-reviewed literature, industry publications, and government reports, including data on dietary requirements for species, feed conversion trends, and regulatory developments. Statistical databases from reputable institutions were consulted to validate macro-environmental trends, ensuring a robust contextual understanding.

Triangulation techniques were applied to reconcile findings across data sources, enhancing the reliability of insights and recommendations. In addition, case studies of leading feed manufacturers provided illustrative benchmarks for best practices in ingredient diversification, process optimization, and digital integration. Ethical considerations, such as ensuring data confidentiality and avoiding conflicts of interest, were rigorously upheld throughout the research process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aquafeed market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aquafeed Market, by Feed Type

- Aquafeed Market, by Ingredient Type

- Aquafeed Market, by Source Type

- Aquafeed Market, by Species Type

- Aquafeed Market, by Aquaculture System

- Aquafeed Market, by Farming Environment

- Aquafeed Market, by Feed Formulation

- Aquafeed Market, by End User

- Aquafeed Market, by Sales Channel

- Aquafeed Market, by Region

- Aquafeed Market, by Group

- Aquafeed Market, by Country

- United States Aquafeed Market

- China Aquafeed Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2226 ]

Concluding Reflections on the Critical Role of Aquafeed in Sustainable Aquaculture Growth and Future Industry Priorities

In conclusion, aquafeed is a pivotal nexus for the sustainable growth of global aquaculture. The convergence of ingredient innovation, digital transformation, and evolving trade policies underscores the urgency of an integrated approach to feed development. By harnessing alternative proteins, optimizing feed delivery systems, and proactively navigating regulatory landscapes, stakeholders can drive both environmental stewardship and economic resilience.

The cumulative impact of tariff measures in 2025 highlights the importance of diversified sourcing strategies and collaborative advocacy to secure stable supply chains. Segmentation analysis reveals tailored opportunities to optimize nutrition for specific species, while regional insights underscore the varied dynamics across the Americas, Europe Middle East & Africa, and the Asia-Pacific.

As leading companies continue to pioneer new formulations and digital solutions, the sector stands at the threshold of a transformative era. Success will be defined by the ability to adapt, innovate, and align shared objectives toward a more efficient, transparent, and sustainable aquaculture future.

Engage with Ketan Rohom to Acquire In-Depth Market Research Insights and Drive Strategic Decision Making in Aquafeed

Ready to transform the way you approach strategic decision-making in the aquafeed sector? Ketan Rohom, Associate Director of Sales & Marketing, extends an exclusive invitation to industry leaders, innovators, and decision-makers to explore a deeply researched, forward-looking market intelligence report that uncovers critical insights, competitive dynamics, and actionable recommendations. By engaging directly with Ketan, you will gain personalized guidance on how to harness the latest trends-from sustainability-driven ingredient sourcing to digital precision feeding strategies-to drive innovation and strengthen your competitive advantage. This tailored consultation will ensure you have the clarity and confidence to navigate evolving trade policies, optimize supply chain resilience, and capitalize on emerging regional growth opportunities. Don’t miss the chance to equip your organization with the comprehensive knowledge and strategic foresight needed to excel in the rapidly advancing aquafeed landscape. Contact Ketan Rohom today to schedule a dedicated briefing and take the first step towards securing your leadership position in this essential sector.

- How big is the Aquafeed Market?

- What is the Aquafeed Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?