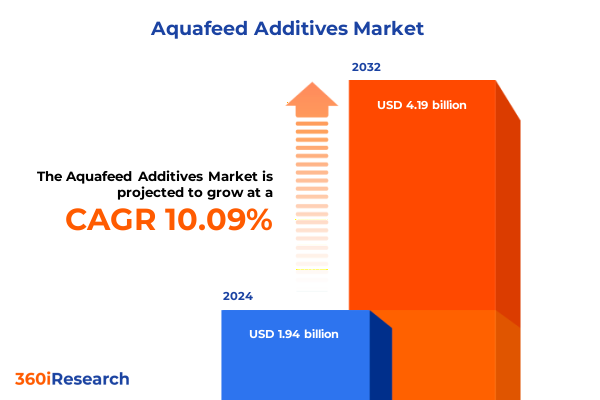

The Aquafeed Additives Market size was estimated at USD 2.10 billion in 2025 and expected to reach USD 2.29 billion in 2026, at a CAGR of 10.31% to reach USD 4.19 billion by 2032.

Strategic Growth and Sustainability: Unveiling Core Drivers, Challenges, and Opportunities Shaping the Future of Aquafeed Additives

The aquaculture sector is now the fastest-growing segment in global food production, driven by rising consumer demand for high-quality seafood and an increasing focus on environmental sustainability. As wild fish stocks face depletion, farmed fish and shellfish have emerged as essential proteins, prompting feed manufacturers to innovate rapidly. Simultaneously, the imperative to reduce reliance on marine-derived ingredients has placed aquafeed additives at the heart of formulation strategies. Beyond substituting fishmeal and fish oil, these additives unlock opportunities to enhance feed conversion ratios and bolster disease resistance in cultured species, redefining how producers approach nutrition and health management in aquatic ecosystems.

Against this backdrop, aquafeed additives have evolved from traditional vitamins and minerals to advanced functional components encompassing probiotics, enzymes, antioxidants, pigments, and immunostimulants. Driven by tighter antibiotic-use regulations and stringent environmental standards, feed formulators are under pressure to strike a balance between cost efficiency and performance. Consequently, precision nutrition-leveraging targeted micronutrients and bioactive compounds-has become the linchpin of sustainable aquaculture. This report provides a comprehensive examination of market drivers, transformative trends, tariff impacts, segmentation nuances, and actionable recommendations, offering an authoritative resource for stakeholders navigating the complex aquafeed additive landscape.

Disruptive Innovations and Evolving Consumer Demands Driving a Paradigm Shift in Aquafeed Additive Technologies and Practices

Innovation in aquafeed additives is accelerating, with sustainability imperatives fueling a shift towards plant-derived and microbial ingredients that reduce environmental footprints. Phytogenics, such as essential oils and botanical extracts, are rapidly replacing synthetic growth promoters as farmers and regulators demand clean-label solutions. At the same time, probiotics and prebiotics are gaining traction, supported by extensive research demonstrating their role in gut health and immunity. The integration of multi-strain microbial blends has shown promise in mitigating pathogen outbreaks, particularly in shrimp and tilapia operations, marking a clear departure from traditional antibiotic reliance.

Concurrently, precision feeding technologies are transforming the way additives are delivered. AI-driven dispensing systems, capable of micro-dosing enzymes and trace minerals, optimize nutrient uptake and minimize waste. Digital platforms now enable real-time monitoring of feed performance, water quality, and animal health, creating a data-rich environment for continuous improvement. Strategic partnerships between biotech firms and feed producers are accelerating innovation, culminating in specialized formulations that target species-specific needs. These converging forces underscore a broader paradigm shift: from generic feed formulations to bespoke, data-driven nutrition solutions that meet both economic and environmental objectives.

Navigating Tariff Turbulence: Assessing How 2025 United States Trade Measures Are Reshaping the Economics of Aquafeed Additives

In 2025, the United States continued to leverage Section 301 trade measures as a strategic tool. Among targeted agricultural lines, fishmeal and whey for feed use benefited from exclusion extensions through February 28, 2025. These extensions were critical in maintaining supply chain stability for feed manufacturers reliant on imported inputs, yet they also underscored the ongoing uncertainty in trade policy. With tariff exclusions scheduled to lapse, producers face potential cost increases that could ripple through formulation strategies and erode margins.

Beyond feed ingredients, broader tariff policy shifts have introduced additional complexity. Imposed reciprocal tariffs on Canadian seafood products and proposed maritime fees on Chinese vessel operators threaten to raise transport and logistics expenses. For instance, leading land-based salmon farmer Atlantic Sapphire cautioned that incoming 25 percent tariffs on Canadian feed imports would elevate production costs, prompting reassessments of sourcing strategies and accelerated investment in domestic feed capacity. Collectively, these measures have reshaped the economic calculus for aquafeed additive procurement, compelling industry leaders to explore nearshoring, alternative ingredients, and tariff-mitigation mechanisms to preserve competitiveness.

Decoding Market Dynamics Through Type, Function, Species, and Form: Key Insights into Aquafeed Additive Segmentations Driving Growth

Market segmentation provides critical clarity, illuminating distinct value pools and performance objectives. Type-based segmentation highlights how amino acids such as lysine, methionine, and threonine anchor protein synthesis, while enzymes like lipase, phytase, and protease unlock bound nutrients in plant-based formulations. Minerals including iron, selenium, and zinc underpin metabolic and antioxidant functions, and pigments drive consumer-driven quality enhancements, particularly in salmon and shrimp markets. Vitamins, from B complex to vitamin E, deliver physiological support under stress conditions, exemplifying the multifaceted roles of additive subclasses in optimally aligned diets.

Function-based segmentation further contextualizes additive utility. Disease resistance solutions, spanning anti-inflammatory compounds to pathogen control agents, address biosecurity challenges in intensive systems. Feed efficiency enhancers improve conversion ratios, while growth performance additives target weight gain optimization. Health promotion categories, encompassing gut health and immune support, reflect a holistic approach to animal welfare, and strictly nutritional additives ensure baseline requirements are met. This layered framework enables feed formulators to precisely tailor diets to species, lifecycle stages, and environmental stressors, maximizing both productivity and resilience.

This comprehensive research report categorizes the Aquafeed Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Additive Type

- Species

- Source

- Physical Form

- End Use Sector

- Distribution Channel

Geographic Footprints and Strategic Trends: Unpacking Regional Drivers and Nuances Across Americas, EMEA, and Asia-Pacific Aquafeed Markets

Regional variations shape the demand profile for aquafeed additives, driven by species composition, regulatory environments, and production intensity. In the Americas, strong shrimp aquaculture activity in Latin America has spurred uptake of functional blends-such as Nutreco’s Protec®-that enhance Vibrio resistance, especially in Ecuador and Brazil. The United States, with its emphasis on technology adoption, is witnessing expanded use of precision-dosed additives, supporting both freshwater and marine species operations.

Over in Europe, Middle East, and Africa, regulatory scrutiny on antibiotic use has accelerated the adoption of natural immunostimulants and probiotics. Germany’s focus on premium trout and carp production has catalyzed demand for organics-based prebiotics and carotenoid pigments, aligning with consumer preference for traceable, non-GMO products. Meanwhile, emerging markets in the Middle East are investing in fortified feeds to meet ambitious food security goals and climate resilience targets.

This comprehensive research report examines key regions that drive the evolution of the Aquafeed Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape and Strategic Positioning: Profiling Leading Players and Their Innovations in the Aquafeed Additives Arena

The competitive landscape is characterized by established chemical and ingredient conglomerates alongside agile biotech pioneers. Cargill has advanced its sustainable aquaculture portfolio through initiatives like the IntelliBond Aqua trace mineral range and partnerships with Innovafeed to introduce insect meal as a novel protein source and supported fishery improvement projects in Chile and Oman Ò15 May 2025Ó. Evonik’s GutPlus® Aqua probiotic and enzyme formulation has gained traction among trout and tilapia farmers, driving significant sales growth in European markets. DSM has similarly expanded its antibiotic-free gut health solutions for catfish and tilapia, reinforcing its position in functional additive innovations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aquafeed Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADDCON GmbH

- Adisseo France SAS

- Aker BioMarine ASA

- Aller Aqua A/S

- Alltech, Inc.

- Archer Daniels Midland Company

- Avanti Feeds Limited

- BASF SE

- BENEO GmbH

- BioMar Group A/S

- Biorigin

- Calanus AS

- Camlin Fine Sciences Ltd.

- Cargill, Incorporated

- Cermaq Group AS

- Delacon Biotechnik GmbH

- Devenish Nutrition Limited

- Diana S.A.S.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Growel Feeds Private Limited

- INVE Aquaculture NV

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Lallemand Inc.

- Norel S.A.

- Nouryon B.V.

- Novus International, Inc.

- Nutreco N.V.

- Olmix Group

- Phibro Animal Health Corporation

- Ridley Corporation Limited

- Royal De Heus Animal Nutrition B.V.

- Thai Union Group Public Company Limited

Strategic Imperatives for Industry Leaders: Actionable Recommendations to Capitalize on Emerging Opportunities in Aquafeed Additives

Industry leaders should prioritize investments in precision nutrition platforms that integrate AI-driven dosing with robust data analytics to deliver real-time performance feedback. Embracing sustainable ingredient substitutes-such as insect meals, algal proteins, and phytogenic extracts-will mitigate raw material volatility and satisfy tightening regulatory standards. Strategic collaborations between feed producers, biotech firms, and academic institutions can accelerate product development cycles and improve market responsiveness. Furthermore, proactive trade risk management-leveraging tariff exclusion requests, nearshoring partnerships, and ingredient diversification-will become essential to stabilizing input costs. Ultimately, by aligning innovation roadmaps with consumer demand for transparency and clean-label credentials, companies can secure competitive advantage and foster long-term growth.

Robust Research Framework and Analytical Approaches: Unveiling Methodology Behind Comprehensive Aquafeed Additives Market Intelligence

This research was conducted through a multi-stage methodology combining comprehensive secondary research, primary stakeholder interviews, and granular data analysis. Initially, industry publications, government databases, and academic journals were reviewed to chart historical trends and regulatory developments. These insights informed the design of primary consultations with feed formulators, aquaculture producers, and technology providers, ensuring real-world context and emerging perspectives.

Quantitative models were then developed to evaluate tariff scenarios, segmentation breakdowns, and competitive positioning. Data triangulation validated key findings, while expert roundtables refined strategic recommendations. This robust framework enables a thorough and impartial assessment of the aquafeed additive landscape, offering actionable intelligence grounded in empirical evidence and stakeholder priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aquafeed Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aquafeed Additives Market, by Additive Type

- Aquafeed Additives Market, by Species

- Aquafeed Additives Market, by Source

- Aquafeed Additives Market, by Physical Form

- Aquafeed Additives Market, by End Use Sector

- Aquafeed Additives Market, by Distribution Channel

- Aquafeed Additives Market, by Region

- Aquafeed Additives Market, by Group

- Aquafeed Additives Market, by Country

- United States Aquafeed Additives Market

- China Aquafeed Additives Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3180 ]

Integrating Insights for Future Readiness: Summarizing Critical Takeaways to Guide Strategic Decision-Making in Aquafeed Additives

The aquafeed additives sector stands at a pivotal juncture, where sustainability, regulatory compliance, and technological advancement converge to redefine nutrition strategies in aquaculture. Core trends-ranging from the rise of probiotics and phytogenics to precision dosing and evolving tariff environments-underscore the need for agility and innovation. Segmentation analysis reveals distinct growth drivers across type, function, species, and form, while regional insights highlight varied adoption patterns shaped by local production dynamics.

Moving forward, companies that blend scientific rigor with strategic foresight will unlock new value in feed formulations, meeting both productivity targets and environmental imperatives. By leveraging advanced analytics, fostering collaborative ecosystems, and proactively managing trade risks, stakeholders can chart a course toward resilient, sustainable growth in the complex and rapidly evolving aquafeed additive arena.

Engage with Associate Director Ketan Rohom to Acquire In-Depth Aquafeed Additives Market Intelligence and Drive Strategic Growth

To drive forward strategic initiatives and capitalize on the detailed insights provided in this comprehensive report, we invite leaders and decision-makers to engage directly with our Associate Director of Sales & Marketing, Ketan Rohom. Drawing on a deep understanding of aquafeed additive dynamics, Ketan can provide tailored guidance on applying these findings to your organization’s unique objectives and challenges.

By partnering with Ketan, you will gain streamlined access to our full suite of market intelligence, including granular data and expert analysis that equips you to navigate emerging opportunities, optimize supply chains, and anticipate regulatory shifts. Whether you require customized briefings, licensing arrangements, or integrated advisory services, Ketan stands ready to ensure you extract maximum value from this research.

Accelerate your strategic planning and investment decisions by reaching out to Ketan Rohom today. Harness the power of advanced aquafeed additive insights to bolster competitiveness, foster innovation, and secure your position at the forefront of aquaculture nutrition.

- How big is the Aquafeed Additives Market?

- What is the Aquafeed Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?