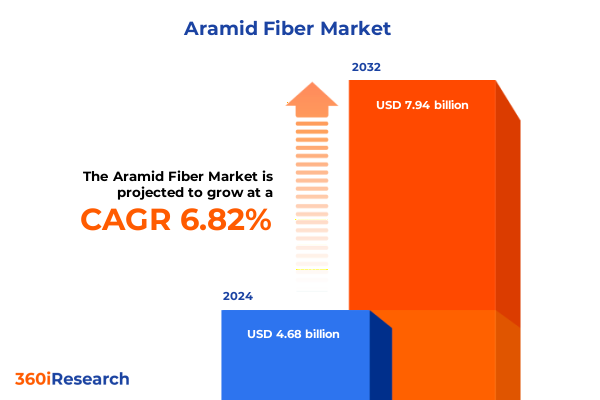

The Aramid Fiber Market size was estimated at USD 4.98 billion in 2025 and expected to reach USD 5.30 billion in 2026, at a CAGR of 6.89% to reach USD 7.94 billion by 2032.

Unveiling the Critical Role and Unparalleled Performance of Aramid Fiber in Modern Industries with Emphasis on Strength and Versatility

Aramid fiber has emerged as a cornerstone material in modern engineering, valued for its exceptional tensile strength, thermal stability, and lightweight characteristics. Since its inception, aramid has evolved from a niche specialty product into a critical enabler for applications demanding uncompromising performance. As industries pursue greater fuel efficiency, enhanced safety standards, and innovative protective solutions, the role of aramid fiber continues to expand, driving deeper integration across aerospace, automotive, defense, and industrial end uses.

In the broader context of material innovation, aramid distinguishes itself through a unique molecular structure that translates to high modulus values while resisting heat and abrasion. These properties have made it a preferred choice in airframes, high-performance sporting goods, and protective clothing, among others. The sustained demand is underpinned by stringent regulatory requirements and the relentless pursuit of lightweight composites that do not sacrifice mechanical resilience.

Looking ahead, the strategic significance of aramid fiber is set to grow as manufacturers and end users collaborate on next-generation composites. Innovations in processing techniques and fiber architectures are unlocking new performance thresholds. Consequently, stakeholders are increasingly focused on harnessing these capabilities to secure competitive advantage and meet evolving market demands.

Exploring Revolutionary Technological Advances and Sustainable Innovations Reshaping the Aramid Fiber Market Landscape Across Key Applications Worldwide

The aramid fiber market is undergoing a period of rapid transformation driven by technological breakthroughs and a heightened focus on sustainability. Advances in nanostructuring methods, for instance, have enabled the production of ultrafine filaments with enhanced interfacial bonding in composite matrices. These improvements are catalyzing broader adoption in sectors that require lightweight yet durable materials, such as next-generation airframes and electric vehicle components.

Simultaneously, research into bio-based precursors and closed-loop recycling processes is reshaping the sustainability profile of aramid production. Companies are piloting solvent recovery systems within both dry spinning and wet spinning processes to reduce environmental impact, while exploring alternative feedstocks that align with circular economy principles. These initiatives are gaining traction among environmentally conscious end users who prioritize lifecycle assessments in procurement decisions.

Moreover, the convergence of digital manufacturing and real-time quality monitoring systems is enhancing production consistency and throughput. By integrating advanced sensor networks and artificial intelligence-driven analytics, producers can detect defects at an early stage, optimize fiber orientation in fabrics and pulp, and achieve tighter tolerances. These cumulative advancements are redefining cost structures and opening new opportunities for customized aramid solutions across diverse application segments.

Assessing the Far-Reaching Implications of 2025 United States Tariff Policies on Trade Dynamics and Supply Chain Resilience in Aramid Fiber

The imposition of United States tariffs in early 2025 has significantly altered trade flows and cost dynamics within the global aramid fiber supply chain. Increasing duties on primary imports have prompted manufacturers to reassess sourcing strategies, leading to a notable shift toward domestic and nearshore suppliers. While this realignment has introduced redundancies into certain logistics networks, it has also stimulated investments in North American production capacity to mitigate exposure to cross-border duty increases.

End users have responded by reconfiguring their inventory management practices and emphasizing supplier diversity. Companies reliant on specialized para-aramid variants such as Kevlar and Twaron have begun qualifying alternate providers across Europe and Asia-Pacific to safeguard continuity. In parallel, higher landed costs for imported meta-aramid fibers are driving efforts to optimize fiber utilization and pursue application-specific formulations that maximize performance while minimizing material waste.

Longer term, these tariff-induced tensions are catalyzing collaborative engagement between producers and downstream fabricators. Joint R&D programs are focusing on cost-effective processing improvements to offset duty impacts without compromising product specifications. The result is a more resilient supply ecosystem that balances tariff exposure, fosters localized production, and encourages synergies across the value chain.

Deriving In-Depth Segmentation Insights Revealing Application-Specific, Industry-Oriented, and Product-Level Opportunities Within the Aramid Fiber Market

When the aramid fiber market is analyzed by application, aerospace & defense emerges as a cornerstone, with its subdivisions of airframes, defense equipment, and engine components playing pivotal roles in driving adoption. The demand for enhanced ballistic protection, combined with performance imperatives in extreme environments, underscores the critical importance of aramid in these high-requirement segments. Conversely, within automotive & transportation, commercial vehicles, motorsport, and passenger vehicles each leverage aramid’s high strength-to-weight ratio to improve fuel economy and occupant safety, prompting design teams to integrate filament and fabric forms into crash structures and brake systems.

From an industrial & electrical perspective, belts & hoses, cables & wires, and protective components have demonstrated consistent uptake due to aramid’s superior thermal and chemical resistance. These attributes ensure reliability under prolonged exposure to high torque and corrosive conditions. In protective clothing applications, firefighter gear, industrial protective clothing, and military protective equipment benefit from para-aramid’s flame resistance and meta-aramid’s thermal stability, providing critical life-saving performance for first responders and defense personnel.

Further segmentation by end use industry reveals parallel trends. In aerospace, aramid continues to underpin composite innovations, while automotive & transportation segments prioritize lightweighting. Defense & security mandates elevate performance criteria in both personal protective equipment and equipment shielding. Electronics & electrical applications leverage aramid pulp in insulating layers for cables. Industrial equipment sectors, meanwhile, apply staple fiber blends to reinforce seals and gaskets.

Diving deeper by type, meta-aramid fibers are predominantly selected for high-temperature resistance, while para-aramid variants deliver unmatched tensile strength. Fabric and filament forms dominate established product portfolios, yet pulp and staple fiber are gaining traction for specialty uses. Manufacturing processes-dry spinning versus wet spinning-directly influence fiber morphology and end-use performance. As for proprietary products, leading brands such as Kevlar, Technora, and Twaron each hold distinct value propositions, shaping competitive positioning based on application requirements and supply chain compatibility.

This comprehensive research report categorizes the Aramid Fiber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Type

- Form

- Manufacturing Process

- Application

- End Use Industry

Dissecting Regional Dynamics Highlighting Growth Drivers and Challenges Across Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional dynamics in the aramid fiber landscape present a tapestry of distinct growth drivers and challenges. In the Americas, robust aerospace programs and a burgeoning electric vehicle market are accelerating demand for high-performance fibers. Investments in reshoring critical material production have strengthened North American supply chains, although Latin American markets display varied maturity levels, influenced by local manufacturing capabilities and import regulations.

Within the Europe, Middle East & Africa region, stringent regulatory frameworks governing environmental compliance and product certification have elevated quality benchmarks. European defense modernization initiatives and infrastructure renewals in the Middle East are creating pockets of heightened demand. Meanwhile, Africa’s nascent industrialization offers long-term potential, contingent on the development of reliable logistics and raw material access.

Asia-Pacific remains the fastest growing regional segment, driven by large-scale composite manufacturing hubs in China, Japan, and South Korea. These economies benefit from integrated supply ecosystems, from precursor production through advanced textile processing. India and Southeast Asia are emerging as important markets for protective clothing and electrical insulation applications, fueled by government initiatives in public safety and energy infrastructure expansion.

Collectively, these regional narratives illustrate how geopolitical considerations, regulatory landscapes, and end-use investment cycles converge to shape aramid fiber adoption across global markets.

This comprehensive research report examines key regions that drive the evolution of the Aramid Fiber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Aramid Fiber Manufacturers and Strategic Collaborations That Define Market Competition and Innovation Trajectories

The competitive landscape of the aramid fiber market is influenced by a handful of established manufacturers and a growing cadre of emerging players. Industry stalwart DuPont retains a commanding presence through continuous innovation in para-aramid offerings, complemented by strategic partnerships aimed at sustainable production. Teijin has simultaneously expanded its meta-aramid portfolio, focusing on applications requiring high thermal endurance, while pursuing joint development agreements to co-create next-generation composites.

Kolon Industries brings differentiated capabilities in filament spinning and advanced textile integration, leveraging its strong base in Asia-Pacific to meet fast-evolving regional demand. Hyosung has directed investments toward vertically integrated production, enhancing feedstock control and process efficiency in both wet and dry spinning lines. Niche specialists such as TeXtreme have carved out leadership in high-performance fabric architectures, collaborating closely with end users in motorsport and aerospace to refine fiber orientation techniques.

Collectively, these companies are deploying strategies that blend capacity expansions, collaborative research endeavors, and end-use customization to solidify market positions. Differentiation through proprietary brand products, sustainability credentials, and value-added technical services is becoming increasingly critical as competition intensifies and end users seek tailored solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aramid Fiber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- China National Bluestar (Group) Co., Ltd.

- DuPont de Nemours, Inc.

- Huvis Corporation

- Hyosung Corporation

- Kermel S.A.

- Kolon Industries, Inc.

- Kordsa Global

- SABIC

- SRO Aramid

- Taekwang Industrial Co., Ltd.

- Teijin Limited

- Toray Industries, Inc.

- Toyobo Co., Ltd.

- X-FIPER New Material Co., Ltd.

- Yantai Tayho Advanced Materials Co., Ltd.

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends, Mitigate Risks, and Drive Sustainable Growth in the Aramid Fiber Sector

Industry leaders must prioritize targeted investment in research and development to maintain a competitive edge in the aramid fiber sector. Allocating resources toward novel precursor chemistries and advanced spinning techniques will enable the creation of fibers with bespoke property arrays, positioning organizations to capture emerging opportunities. Concurrently, diversifying supply chains across multiple geographies can mitigate tariff exposure and geopolitical risks, ensuring continuity of supply even amid trade policy fluctuations.

Sustainability initiatives warrant immediate attention, with companies encouraged to implement solvent recovery systems and explore bio-derived feedstocks. These measures not only reduce environmental impact but also align with the procurement criteria of major end users in defense and aerospace. Strengthening partnerships across the value chain-spanning fiber producers, composite fabricators, and OEM integrators-will facilitate joint problem solving and accelerate time-to-market for innovative applications.

Moreover, deploying digital manufacturing platforms and artificial intelligence-driven quality controls can optimize production yields and minimize waste. By coupling real-time analytics with process automation, manufacturers can improve consistency, reduce operational costs, and deliver higher-value fiber solutions. Finally, maintaining active engagement with regulatory bodies and industry consortia will ensure that evolving standards and safety requirements are met proactively, thereby safeguarding market access and bolstering customer confidence.

Outlining Rigorous Research Methodologies and Data Validation Techniques That Ensure Unbiased, Comprehensive Insights Into the Aramid Fiber Market

The research methodology underpinning this analysis rests on a rigorous combination of primary and secondary data collection, designed to deliver comprehensive and objective insights. In the primary phase, in-depth interviews were conducted with key stakeholders across the value chain, including fiber producers, composite fabricators, OEM engineers, and technical directors. These conversations provided granular perspective on application-specific requirements, supply chain dynamics, and technological roadmaps.

Secondary research encompassed a thorough review of technical journals, patent filings, industry white papers, and regulatory documentation. This work was complemented by analysis of publicly available company disclosures and sustainability reports to triangulate data on production capacities, process advancements, and strategic partnerships. Data validation protocols were applied throughout, leveraging cross-referencing techniques to ensure consistency between disparate information sources.

Quantitative and qualitative inputs were synthesized using data triangulation methods, which facilitated the identification of emerging themes and potential inflection points. Quality controls included peer review by subject matter experts and iterative feedback loops with senior analysts. The resulting framework delivers an unbiased, 360-degree view of the aramid fiber market, enabling decision makers to act with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aramid Fiber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aramid Fiber Market, by Product

- Aramid Fiber Market, by Type

- Aramid Fiber Market, by Form

- Aramid Fiber Market, by Manufacturing Process

- Aramid Fiber Market, by Application

- Aramid Fiber Market, by End Use Industry

- Aramid Fiber Market, by Region

- Aramid Fiber Market, by Group

- Aramid Fiber Market, by Country

- United States Aramid Fiber Market

- China Aramid Fiber Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Strategic Perspectives to Illuminate the Future Trajectory of the Global Aramid Fiber Industry and Stakeholder Opportunities

This analysis has illuminated the multifaceted dynamics shaping the aramid fiber market, from transformative technological advances and sustainable manufacturing initiatives to the ripple effects of recent tariff policies. Segment-level insights reveal how application, end use industry, product type, form, and manufacturing process converge to create distinct value propositions. Regional assessments underscore the importance of localized production capabilities and regulatory environments, while competitive profiling highlights the strategic levers deployed by leading manufacturers.

Moving forward, stakeholders equipped with these insights will be better positioned to navigate complexity and capitalize on high-growth opportunities. Emphasis on collaborative innovation, supply chain resilience, and environmental stewardship will differentiate market leaders in an industry that prizes performance and reliability. Ultimately, the future trajectory of aramid fiber adoption will hinge on the ability of producers and end users to co-create solutions that address stringent safety, weight, and sustainability requirements.

By synthesizing core findings and strategic perspectives, this analysis offers a clear roadmap for leveraging aramid fiber’s unparalleled attributes to drive competitive advantage and long-term success.

Empowering Decision Makers to Secure Comprehensive Aramid Fiber Market Intelligence: Connect with Ketan Rohom for Detailed Research Access

We invite decision makers and technical leaders seeking unparalleled clarity on aramid fiber dynamics to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with Ketan, you will gain tailored guidance on navigating the intricacies of application-specific demand patterns, regional growth differentials, and the competitive positioning of leading manufacturers. This direct collaboration ensures that your organization can leverage our in-depth qualitative analysis to inform strategic investments, product development roadmaps, and supply chain optimization. Reach out today to access the full report and equip your team with robust, actionable insights that will empower confident decision making in an increasingly complex marketplace

- How big is the Aramid Fiber Market?

- What is the Aramid Fiber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?