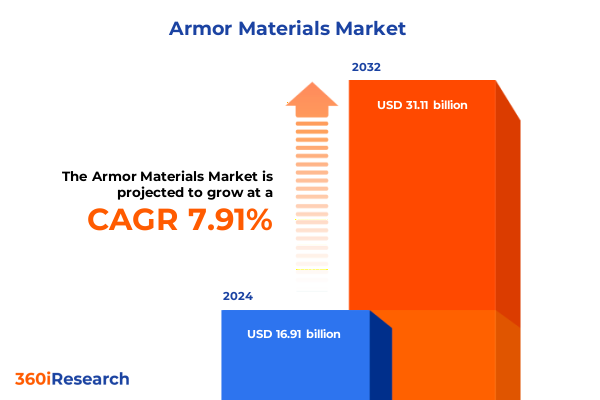

The Armor Materials Market size was estimated at USD 18.22 billion in 2025 and expected to reach USD 19.65 billion in 2026, at a CAGR of 7.93% to reach USD 31.11 billion by 2032.

Exploring the Evolution of Armor Materials as Strategic Enablers in Modern Defense and Security Applications for Critical Protection

The landscape of armor materials is witnessing a profound transformation as advancements in material science intersect with evolving defense and security requirements. High-performance ceramics, advanced composites, metallic alloys, and cutting-edge polymers are each playing a pivotal role in delivering optimized protection solutions for military, law enforcement, and specialized commercial applications. Driven by the need for lighter, stronger, and more adaptable protective systems, stakeholders across the value chain are investing heavily in innovation, from laboratory-scale research to full-scale production.

These materials serve as the critical backbone for personal body armor, vehicle protection systems, naval vessel fortifications, and aerospace shielding, underscoring their strategic importance. Governmental procurement cycles, geopolitical tensions, and rising threats of asymmetric warfare have further intensified the demand for superior protective solutions. As a result, the armor materials sector has become a focal point of defense budget allocations, collaborative research initiatives, and public–private partnerships that seek to maintain technological superiority on the modern battlefield.

How Groundbreaking Technological Innovations and Strategic Initiatives Are Reshaping the Armor Materials Industry for Enhanced Protection

In recent years, additive manufacturing has emerged as a disruptive force in the production of armor components, enabling the fabrication of complex geometries and seamless structures that were previously unattainable with conventional methods. By leveraging techniques such as powder bed fusion and directed energy deposition, manufacturers can now produce jointless hulls for combat vehicles-thereby eliminating weak points that historically resulted from welding-and significantly enhancing blast resistance and overall survivability on the field. Concurrently, the integration of modular composite systems, exemplified by the AMAP family, combines nano-ceramic inserts with modern steel alloys to create customizable protection packages that can be tailored to specific threat profiles and platform constraints.

Beyond manufacturing innovations, the armor materials domain is being reshaped by breakthroughs in nanotechnology and AI-driven design optimization. Ultra-high-temperature ceramics synthesized through reactive post-processing demonstrate enhanced fracture toughness and thermal resilience, making them ideal for extreme-environment applications such as hypersonic vehicle shielding. At the same time, machine learning algorithms are accelerating material discovery by predicting optimal composite formulations and processing parameters, reducing development timelines and enabling rapid iteration cycles. The convergence of these trends is setting a new standard for protective performance, weight reduction, and lifecycle management across the armor materials spectrum.

Assessing the Broad Economic and Supply Chain Ramifications of the 2025 U.S. Tariff Expansions on Steel and Aluminum for Armor Material Production

On February 10, 2025, presidential proclamations under Section 232 of the Trade Expansion Act were issued, expanding existing steel and aluminum tariffs to a global 25 percent rate and terminating all country exemptions and product exclusion processes for derivative articles, effective March 12, 2025. The metal tariffs originally imposed in 2018 have thus been reinforced and broadened, subjecting an array of steel and aluminum inputs-including high-hardness alloys and specialty sheets used in armor fabrication-to higher duties. This policy shift signals a heightened focus on domestic production and national security considerations.

The cumulative impact on the armor materials sector has been significant. Production costs for metallic armors have risen, encouraging manufacturers to source raw inputs from domestic mills or partner with integrated U.S. smelters. At the same time, the strengthened tariffs have spurred investment in alternative materials, such as advanced ceramics and polymeric solutions, to partly offset cost pressures. International suppliers have also realigned their distribution networks, with many forging joint ventures within North America to maintain market access and manage duty burdens. Overall, the 2025 tariff measures have precipitated a strategic recalibration of supply chains and product portfolios across the armor materials value chain.

Uncovering Segmented Market Dynamics Across Diverse Armor Material Categories Applications End Users and Protection Performance Levels

Analyses that segment the armor materials market by material type reveal that ceramic armor continues to lead in environments demanding high hardness and thermal stability, with silicon carbide and boron carbide compositions favored for their cost-to-performance balance. Composite armor, particularly aramid and carbon fiber-based systems, has seen accelerated adoption for lightweight applications in personal and aerial platforms, benefitting from the inherent flexibility and energy-absorbing characteristics of these fiber reinforcements. Metallic armor remains indispensable for vehicle and naval applications, where aluminum and high-hardness steel alloys provide a reliable combination of rigidity and cost efficiency, while emerging titanium alloys are capturing interest for next-generation platforms. In parallel, polymer armors, including thermoplastic polyurethanes and ultra-high molecular weight polyethylenes, are carving out niches in specialized personal protection systems due to their excellent ballistic performance relative to weight.

When framed by application, the market for armor materials spans aerospace shielding for aircraft fuselages and rotorcraft panels, naval fortifications for ship and submarine hulls, personal body armor in the form of helmets, shields, and vests, as well as vehicle armor for personnel carriers and main battle tanks. This multiplicity of applications underscores the necessity to align material selection, processing techniques, and assembly methods to the unique threat scenarios and operational parameters of each end-use environment. Further segmentation by end user highlights diverse procurement channels: commercial entities supplying civilian protection services, law enforcement agencies securing urban environments, and military organizations prioritizing large-scale defense procurements. Lastly, protection level classifications-ranging from Level I to Level IV-serve as the benchmark for performance testing and certification, guiding material system design and ensuring compliance with standardized ballistic and blast resistance protocols.

This comprehensive research report categorizes the Armor Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Protection Level

- Application

Delineating Regional Powerhouses and Emerging Hotspots That Drive Demand and Innovation in the Global Armor Materials Market

The Americas region remains the powerhouse of armor materials production, underpinned by robust domestic steel and aluminum industries and bolstered by significant defense budget allocations for land and air platforms. The reinstated 25 percent tariffs on steel and aluminum have further driven localization efforts, prompting major armor manufacturers to expand fabrication facilities in the United States and Canada to mitigate import costs. Complementary public–private partnerships have focused on scaling production of advanced ceramics and polymer-based solutions, with government incentives supporting the establishment of critical material processing capabilities domestically.

In Europe, the Middle East, and Africa, established defense players are pursuing modular composite systems to modernize legacy fleets, while emerging economies in the Middle East are investing heavily in naval and armored vehicle upgrades to address regional security dynamics. Concurrently, Asia-Pacific markets-spanning China, India, South Korea, and Australia-are experiencing rapid expansion of indigenous armor material production, driven by heightened geopolitical tensions and the strategic imperative to reduce reliance on external suppliers. These regional trends collectively emphasize the strategic localization of supply chains and the pursuit of self-sufficiency in advanced protective materials.

This comprehensive research report examines key regions that drive the evolution of the Armor Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Strategic Alliances and Competitive Movements Shaping the Armor Materials Sector’s Competitive Landscape

Key industry players are differentiating themselves through strategic mergers, acquisitions, and technology partnerships that broaden their material portfolios and geographic reach. Global defense primes have integrated specialized material science firms to secure advanced ceramic and composite capabilities in-house, while chemical and polymer giants have established dedicated business units focused on high-performance armor substrates. Collaboration between OEMs and material suppliers is becoming more prevalent, with joint development agreements facilitating rapid prototyping and qualification of next-generation protection systems.

These competitive dynamics are further shaped by investments in additive manufacturing platforms and digital design tools, enabling companies to deliver bespoke armor solutions with accelerated lead times. New entrants are leveraging niche innovations-such as nanostructured coatings and hybrid fiber matrices-to carve out specialized market segments. Alliances between traditional defense contractors and innovative material startups are setting the stage for disruptive offerings that promise to enhance survivability across air, land, and sea domains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Armor Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ATI, Inc.

- Avient Corporation

- CeramTec GmbH

- DuPont de Nemours, Inc.

- Freudenberg SE

- Hexcel Corporation

- Honeywell International Inc.

- Mitsubishi Chemical Holdings Corporation

- MKU Limited

- Point Blank Enterprises, Inc.

- Royal DSM N.V.

- SGL Carbon SE

- SSAB AB

- Teijin Limited

- Toray Industries, Inc.

Strategic Imperatives and Forward-Looking Measures for Industry Leaders to Capitalize on Shifting Dynamics in Armor Materials

To navigate the complex dynamics of the armor materials industry, leaders should prioritize investments in next-generation production technologies that enable customization and rapid iteration, such as additive manufacturing and automation-enabled finishing processes. Cultivating resilient supply chains through diversified sourcing strategies and partnerships with domestic raw material producers will mitigate exposure to geopolitical trade fluctuations and tariff volatility. Additionally, fostering collaborative R&D ecosystems-bringing together material scientists, data analysts, and end users-can accelerate the translation of laboratory breakthroughs into field-ready systems.

Adopting sustainable material approaches, including recycling of composite layups and reclamation of metallic armor scrap, will align with evolving environmental regulations and reduce lifespan costs. Finally, leveraging digital twins and predictive maintenance frameworks can enhance system readiness and inform continuous performance improvements, delivering both operational and economic value.

Elucidating the Robust Multi-Source Data Collection and Analytical Framework Underpinning the Comprehensive Armor Materials Industry Study

This comprehensive study draws on a rigorous methodology that integrates secondary research from peer-reviewed journals, technical white papers, and government publications with primary insights gathered through structured interviews with material scientists, defense procurement officials, and manufacturing executives. Data triangulation was employed to validate qualitative inputs against industry databases, trade statistics, and patent filings, ensuring a high degree of reliability.

Quantitative analyses of production capacity, material properties, and regional trade flows were complemented by scenario planning workshops and expert panel reviews to capture emerging trends and potential inflection points. The resulting framework offers a holistic view of the armor materials ecosystem, aligning market drivers, technological trajectories, and policy landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Armor Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Armor Materials Market, by Material Type

- Armor Materials Market, by Protection Level

- Armor Materials Market, by Application

- Armor Materials Market, by Region

- Armor Materials Market, by Group

- Armor Materials Market, by Country

- United States Armor Materials Market

- China Armor Materials Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings and Anticipating Future Trajectories in the Evolving Domain of Armor Materials for Strategic Advantage

Through an integrated examination of technological advances, trade policy shifts, segmentation dynamics, and regional developments, this report underscores the critical juncture at which the armor materials sector stands. The reinforcement of tariffs has reshaped supply chains, catalyzing domestic production and incentivizing material innovation. Simultaneously, additive manufacturing, advanced composites, and AI-driven design methodologies are converging to redefine protective performance benchmarks across applications.

As stakeholders prepare for the next wave of strategic requirements-from hypersonic vehicle shielding to seamless combat hulls-the insights outlined herein provide a roadmap for navigating complexity and securing material superiority. By aligning strategic investments with emerging opportunities, organizations can bolster resilience, drive differentiation, and maintain technological leadership in a competitive global landscape.

Engage Directly with Ketan Rohom to Unlock Exclusive Insights and Secure Your Access to the Full Armor Materials Market Research Report

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to gain a personalized briefing on the comprehensive analysis and uncover how these insights can directly support your strategic objectives in armor materials. Reach out to Ketan to explore tailored options for obtaining the full market research report, including custom data modules and in-depth briefings. Engaging with Ketan will provide direct access to expert guidance on leveraging the report’s findings to fortify your decision-making process and drive sustainable competitive advantage in the rapidly evolving armor materials sector.

- How big is the Armor Materials Market?

- What is the Armor Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?