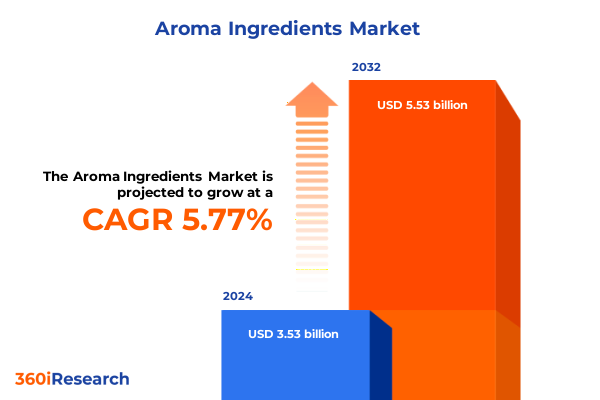

The Aroma Ingredients Market size was estimated at USD 3.72 billion in 2025 and expected to reach USD 3.91 billion in 2026, at a CAGR of 5.84% to reach USD 5.53 billion by 2032.

Setting the Stage for Aroma Ingredient Innovation by Exploring the Dynamics Driving Flavor and Fragrance Raw Materials in a Shifting Global Appetite

In today’s highly competitive landscape, ingredient suppliers must navigate an intricate web of consumer preferences, regulatory demands, and technological advancements to thrive. By exploring the multifaceted world of Aroma Ingredients-from raw materials sourcing through to end-product formulation-organizations can gain the strategic clarity required to drive product innovation and ensure sustainability across their supply chains.

Increasingly, food and beverage, personal care, and fine fragrance manufacturers seek partners who can deliver consistent, high-quality aroma solutions that resonate with evolving taste and ethics-driven values. This executive summary sets the context for understanding the dynamic interplay between natural and synthetic ingredients, the imperative of regulatory compliance, and the transformative trends that are redefining flavor and fragrance creation. It distills the most critical insights needed for executives and decision-makers to stay ahead of market shifts and capitalize on emerging opportunities.

Uncovering the Transformational Drivers Shaping Aroma Ingredients from Sustainability Demands to Digitalization in Flavor and Fragrance Sectors

Over the past decade, aroma ingredients have undergone a fundamental transformation driven by consumer demand for transparency and sustainability. Once dominated by petrochemical-derived compounds, the market is now witnessing accelerated investment in fermentation-based platforms and botanical extractions. This shift reflects a broader pursuit of traceability and clean-label credentials that resonate with environmentally conscious shoppers.

Concurrently, digital tools are reshaping research and development workflows. Advanced analytics, artificial intelligence-driven flavor prediction, and virtual sensory evaluation are enabling quicker iteration cycles and cost efficiency. As a result, suppliers are forging closer collaborations with end-users to co-create formulations that balance sensory appeal with regulatory and cost constraints.

Finally, emerging regulations around volatile organic compounds and allergen labeling are reshaping supply chains. Ingredient developers must adapt their portfolios to comply with stricter standards, while also anticipating future regulatory trajectories. These converging forces are not isolated; rather, they collectively redefine how aroma ingredients are sourced, developed, and commercialized.

Evaluating How Recent United States Tariff Adjustments of 2025 Have Altered Global Sourcing Strategies and Cost Structures for Aroma Components

In 2025, a significant recalibration of United States tariffs on imported aroma precursors has compelled ingredient manufacturers to reevaluate their sourcing and pricing models. Cumulative duties on select botanical extracts and specialty synthetics have increased cost pressures, prompting many suppliers to explore domestic production or near-shoring as viable alternatives.

These tariff adjustments have had a ripple effect across the global supply network. Producers in Europe and Asia have revisited their export strategies, with some opting to absorb a portion of the increased duties to maintain market presence, while others have passed costs onto downstream buyers. Consequently, end-users are negotiating more rigorous supply contracts and considering multi-source strategies to mitigate disruption.

Amid these challenges, the tariff landscape has also spurred innovation. Several domestic players have accelerated investment in fermentation-based synthesis to reduce reliance on tariff-exposed imports. This shift not only addresses cost issues but also aligns with growing demand for sustainable and traceable aroma solutions.

Revealing Critical Insights into Aroma Ingredient Market Segmentation Across Source Origins Forms Channels and Diverse End Use Applications

Aroma ingredient markets can be understood through multiple segmentation lenses that illuminate the nuanced demands across industries. When examining source origin, the market divides into natural and synthetic categories; natural ingredient offerings encompass animal-derived extracts and botanical extractions, while synthetics span fermentation-derived compounds as well as petrochemical-derived molecules.

Form preferences further shape product development, spanning gel, liquid, and solid or powder formats that cater to diverse processing requirements and application needs. Moreover, distribution pathways include offline retail channels alongside online retail environments, where company websites and third-party e-commerce platforms serve as key conduits for ingredient procurement.

Application-specific segmentation reveals the breadth of aroma ingredient use. Fine fragrances remain a primary outlet, while food and beverage applications range from bakery and confectionery to dairy, savory, and beverage sub-categories such as alcoholic products-including beer, spirits, and wine-juices, and both carbonated and non-carbonated soft drinks. In the household products sphere, air fresheners, detergents, and surface cleaners rely on tailored aroma systems, whereas the personal and home care domain bifurcates into home care solutions like air care, laundry, and surface care, and personal care staples including cosmetics, hair care, oral care, and skin care.

This comprehensive research report categorizes the Aroma Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Application

- Distribution Channel

Delving into Regional Variations Shaping Aroma Ingredients Demand and Innovation Dynamics Across the Americas EMEA and Asia Pacific Markets

In the Americas, established supply networks and sophisticated consumer markets sustain steady demand for both traditional botanical extracts and next-generation synthetic analogs. Regulatory oversight and consumer preference for clean-label credentials are driving suppliers to enhance traceability protocols and sustainability certifications, particularly within North American food and beauty segments.

Across Europe, the Middle East, and Africa (EMEA), stringent regulations on allergen disclosure and volatile organic compound emissions are prompting ingredient developers to reformulate legacy offerings. Meanwhile, premiumization trends in Western Europe reinforce the uptake of high-impact botanicals, while emerging economies in the Middle East seek cost-effective synthetic blends that balance performance with regulatory compliance.

In Asia-Pacific, rapid urbanization and escalating disposable incomes are fueling robust growth in fragrance and personal care categories. Local innovation hubs are pioneering novel extraction techniques for indigenous botanical species, and collaborations between international firms and regional players are accelerating product localization. As markets mature, emphasis on digital marketing and direct-to-consumer channels is poised to reshape distribution dynamics.

This comprehensive research report examines key regions that drive the evolution of the Aroma Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves and Portfolio Evolution of Leading Aroma Ingredient Manufacturers Driving Competitive Advantage and Growth Initiatives

Leading aroma ingredient suppliers are increasingly focused on portfolio diversification, merging high-value botanical lines with advanced synthetic analogs to address a broad spectrum of customer needs. Several key players have invested in strategic partnerships with biotechnology firms to scale fermentation-derived platforms, enhancing product consistency while reinforcing sustainability claims.

Mergers and acquisitions have also played a significant role in shaping competitive positioning. By acquiring niche specialty houses, major suppliers have bolstered their capabilities in natural extraction and green chemistry, enabling faster go-to-market timelines. In parallel, investments in digital formulation tools and e-commerce infrastructure have fortified customer engagement, offering tailored technical support and streamlined procurement processes.

Innovation pipelines reveal a growing emphasis on multifunctional aroma systems that deliver both olfactory appeal and performance benefits, such as odor neutralization or sensory modulation. By leveraging data analytics to forecast consumer preferences, companies are refining their R&D roadmaps, ensuring that new offerings align with the evolving demands of fine fragrance, personal care, and household product manufacturers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aroma Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aquila Organics Private Limited

- Aurochemicals

- BASF SE

- Bell Flavors & Fragrances

- Bordas S.A.

- Citrus and Allied Essences Ltd.

- De Monchy Aromatics Ltd

- Eternis Fine Chemicals Limited

- Firmenich SA

- Givaudan SA

- Huabao International Holdings Limited

- International Flavors & Fragrances Inc.

- Kalpsutra chemicals Pvt. Ltd.

- Kao Corporation

- Koninklijke DSM N.V.

- Merck KGaA

- Ogawa & Co., Ltd.

- Privi Speciality Chemicals Limited

- Robinson Brothers Limited

- S H Kelkar and Company Limited

- Solvay S.A.

- Symrise AG

- T. Hasegawa Co., Ltd.

- Takasago International Corporation

- Vigon International, Inc.

- Yin Yang Aroma Chemical Group

- Yinghai (Cangzhou) Aroma Chemical Company Ltd.

Outlining Actionable Strategies for Industry Leaders to Navigate Disruption Harness Emerging Trends and Strengthen Supply Chain Resilience in Aroma Ingredients

To navigate disruptive forces and capitalize on emerging market dynamics, industry leaders should prioritize supply chain diversification by integrating domestic and near-shore production capabilities. This approach mitigates tariff risk and enhances resilience against logistic challenges.

Investing in research partnerships that advance fermentation-derived and botanical extraction technologies can position organizations at the forefront of clean-label innovation. Such collaborations enable rapid iteration of aroma profiles while reinforcing sustainability credentials essential to today’s consumers.

Digital transformation across formulation, procurement, and customer engagement channels offers another avenue for competitive differentiation. By deploying AI-driven flavor mapping and predictive analytics, suppliers can accelerate product development and deliver personalized technical solutions that strengthen client relationships.

Detailing Robust Research Methodology Employed to Ensure Comprehensive Data Quality Triangulation and Insights Validation in Aroma Ingredient Analysis

The analysis underpinning this executive summary draws on a comprehensive methodology integrating secondary data sources, expert interviews, and quantitative validation techniques. Initial market mapping relied on publicly available regulatory filings, trade data, and industry publications to define the scope of aroma ingredient categories.

Subsequently, primary research interviews with key stakeholders-including ingredient producers, formulation experts, and procurement managers-provided qualitative insights into evolving challenges and strategic priorities. Data triangulation techniques were employed to reconcile discrepancy across information sources and ensure the robustness of thematic conclusions.

Finally, rigorous quality control protocols were applied, encompassing cross-verification of product portfolios, patent filings, and sustainability certifications. This layered approach ensures that the insights presented here reflect both current market realities and anticipated strategic inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aroma Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aroma Ingredients Market, by Source

- Aroma Ingredients Market, by Form

- Aroma Ingredients Market, by Application

- Aroma Ingredients Market, by Distribution Channel

- Aroma Ingredients Market, by Region

- Aroma Ingredients Market, by Group

- Aroma Ingredients Market, by Country

- United States Aroma Ingredients Market

- China Aroma Ingredients Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Summarizing Key Takeaways and Strategic Imperatives Highlighting the Future Pathways for Aroma Ingredient Market Stakeholders Amidst Evolving Trends

This executive summary has highlighted the critical trends shaping the aroma ingredients landscape-from the accelerating shift toward sustainable sourcing and digital R&D workflows, to the evolving tariff environment that demands strategic supply chain recalibration. By synthesizing segmentation and regional dynamics, it underscores the importance of agility, innovation, and data-driven decision-making.

As the industry moves forward, stakeholder collaboration across the value chain will be essential to harmonize regulatory compliance with consumer expectations for transparency and performance. Firms that proactively adapt their portfolios, embrace cutting-edge technologies, and strengthen resilience to geopolitical risks will be best positioned to lead.

Ultimately, success in the aroma ingredients sector hinges on a balanced focus: harnessing the science of scent with the art of brand storytelling, all while maintaining the operational flexibility to respond swiftly to market shifts.

Encouraging Decision Makers to Connect with Associate Director Sales Marketing Ketan Rohom for Exclusive Aroma Ingredient Report Acquisition

To explore comprehensive insights tailored to your strategic objectives and unlock the full potential of Aroma Ingredients markets, connect with Associate Director of Sales & Marketing, Ketan Rohom. With deep expertise in flavor and fragrance supply chains, Ketan can provide personalized guidance on harnessing research findings to drive innovation, mitigate risk, and capture emerging growth opportunities. Engage directly to discuss customized licensing options, corporate subscriptions, or bespoke consultative projects that leverage granular data and actionable analysis. Reach out to schedule a consultation and secure the market intelligence that empowers confident decision-making in an increasingly complex global landscape

- How big is the Aroma Ingredients Market?

- What is the Aroma Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?