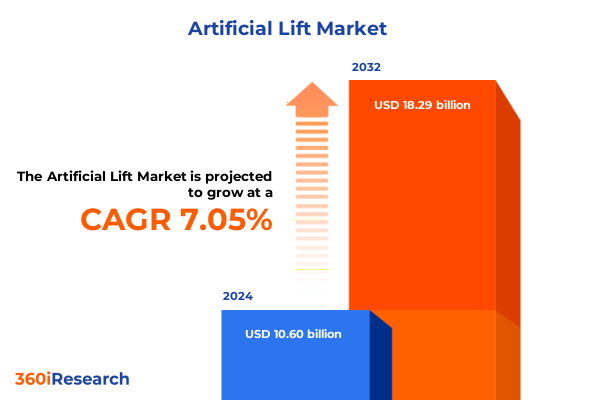

The Artificial Lift Market size was estimated at USD 11.37 billion in 2025 and expected to reach USD 12.09 billion in 2026, at a CAGR of 7.03% to reach USD 18.29 billion by 2032.

Harnessing Advanced Technologies and Sustainability Imperatives to Navigate the Next Phase of Artificial Lift Market Evolution

The artificial lift market stands at a pivotal juncture, driven by growing global energy demand, evolving reservoir complexities, and a heightened focus on operational efficiency. Advanced technologies such as digital monitoring platforms, real-time analytics, and automated optimization solutions are transforming how operators deploy and manage lift systems. In parallel, pressures to reduce carbon emissions and enhance sustainability are prompting innovation in electrified pumping solutions and integrated renewable power options.

As an industry undergoing rapid evolution, artificial lift solutions must address challenges related to aging well infrastructure, remote asset accessibility, and fluctuating commodity prices. Companies that proactively embrace modular designs, predictive maintenance strategies, and data-driven decision-making will secure competitive advantage. Transitioning from traditional fixed-speed and mechanical systems toward digitally connected, intelligent lift architectures underscores the critical role of cross-sector collaboration between oilfield operators, technology developers, and service providers. By understanding emerging trends and applying cutting-edge technologies, stakeholders can optimize well performance and extend producing life while managing costs effectively.

Charting the Industry’s Digital Transformation and Hybrid Deployment Strategies Reshaping Modern Artificial Lift

The global artificial lift landscape has experienced transformative shifts as digitalization and automation redefine operational paradigms. Enhanced connectivity through Internet of Things (IoT) sensors and cloud-based analytics platforms empowers continuous well performance monitoring and predictive diagnostics. Such advancements enable proactive maintenance scheduling, reducing unplanned downtime and extending equipment longevity.

Simultaneously, the adoption of unconventional resource extraction techniques has spurred demand for adaptable lift methods. Hybrid solutions that combine electrical submersible pumps with gas lift or plunger lift technologies offer flexible responses to changing reservoir pressures and production profiles. Moreover, the integration of artificial intelligence (AI) and machine learning algorithms into control systems facilitates autonomous optimization of lift parameters, improving overall recovery rates and lowering energy consumption. These shifts underscore a broader industry trend toward convergence of digital innovation and mechanical reliability.

Navigating Trade Policy Dynamics and Evolving Supply Chain Strategies Amidst Rising Tariffs Impacting Equipment Costs

Cumulative implementation of United States tariffs through 2025 has materially influenced the cost structures and supply chains of artificial lift equipment manufacturers and service providers. Elevated duties on imported steel and aluminum have driven up raw material expenses, prompting a reevaluation of manufacturing footprints and localization strategies. In response, some leading vendors have expanded domestic machining operations and diversified supplier bases to mitigate import cost volatility and safeguard delivery timelines.

Beyond material tariffs, Section 301 measures on specific components originating from select countries have incentivized alternative sourcing of motors, electronics, and control hardware. Operators face higher capital expenditures for equipment retrofits, yet these pressures have also accelerated collaboration with local fabricators and technology innovators. As a result, the industry is witnessing the emergence of more regionally integrated supply chains that balance cost efficiency with resilience against future trade policy fluctuations. Looking ahead, ongoing dialogue between policymakers and industry stakeholders remains critical to ensure tariff frameworks support a competitive domestic manufacturing ecosystem without hindering technological progress.

Delving into Method, Well Type, Drive, Application, and End User Patterns to Reveal How Artificial Lift Preferences Drive Industry Strategy

Evaluating the market through the lens of lift method offers deep insights into performance optimization and technology adoption trends. Electrical submersible pumps dominate installations in mature and high-volume wells, with induction motors currently leading due to proven reliability, while permanent magnet motors are gaining traction for their higher efficiency and reduced energy consumption. Gas lift solutions maintain significant relevance in wells with variable flow regimes, enabling cost-effective production management, whereas hydraulic pumps and jet pumps remain vital for wells with high sand production or irregular pressure profiles. In applications requiring intermittent injection, plunger lift systems deliver dependable operation across low-volume gas and oil wells, and progressive cavity pumps serve viscous fluids where rod pumps face limitations. Rod pumps themselves continue to report extensive usage in conventional vertical wells due to their maturity and broad service network.

Segmentation by well type reveals distinct deployment patterns. Offshore platforms in deepwater environments rely heavily on ESP arrays and hydraulic lift systems to manage extreme pressures, whereas shallow water installations often prefer gas lift for its adaptability. Ultra deepwater projects call for specialized down-hole equipment engineered for high reliability under extreme conditions. Onshore directional and horizontal wells increasingly leverage advanced rod pump designs optimized for lateral trajectories, while vertical wells still favor traditional sucker rod units. Drive type segmentation underscores a clear shift to electric drives, driven by infrastructure upgrades and grid connectivity, though hydraulic and pneumatic drives retain niches in remote or compressed air-supported operations. Application segmentation differentiates between gas well lift solutions, where plunger and rod lift remain prevalent, and oil well methods that lean toward high-capacity ESP and progressive cavity technologies. End user segmentation highlights that exploration and production companies often opt for integrated lift packages offering turnkey performance, whereas service companies prioritize modular systems that facilitate rapid mobilization across diverse well environments.

This comprehensive research report categorizes the Artificial Lift market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Lift Method

- Well Type

- Drive Type

- Application

- End User

Comparative Outlook on Regional Demand Patterns Revealing How Geography Shapes Artificial Lift Investment Priorities

Regional analysis unveils unique dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, a mix of shale production and offshore deepwater activities sustains demand for electrically driven and hybrid artificial lift solutions, paired with a robust service network and growing adoption of digital twin technology for reservoir management. The Europe, Middle East & Africa region exhibits strong uptake in offshore platforms, particularly in the North Sea and Gulf of Mexico corridors, where integrated lift systems and corrosion-resistant materials are paramount due to harsh operating conditions and stringent environmental regulations.

Asia-Pacific stands out as a high-growth arena, driven by rapid onshore development in Southeast Asia, China, and Australia. Operators there are increasingly deploying permanent magnet motor ESPs and advanced plunger lift packages to optimize production in both emerging and mature fields. Infrastructure investments in gas gathering and oil processing facilities further boost demand for specialized lift equipment tailored to local reservoir characteristics. These regional distinctions highlight the necessity for suppliers and service providers to tailor their offerings and strategic partnerships to address unique market demands and regulatory frameworks within each geographic segment.

This comprehensive research report examines key regions that drive the evolution of the Artificial Lift market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Collaborative Innovation and Service Excellence Propel Leading Companies to Redefine Artificial Lift Offerings

The competitive landscape of artificial lift encompasses integrated equipment manufacturers, specialized service providers, and technology innovators. Leading pump producers continuously expand their product portfolios by incorporating digital control modules, energy-efficient motor designs, and advanced sealing technologies. Service companies differentiate through comprehensive field support packages, offering end-to-end performance management, preventative maintenance, and real-time analytics dashboards that empower clients to make data-backed operational decisions.

In parallel, a new cohort of agile technology firms is disrupting traditional models by delivering cloud-native software platforms and remote monitoring solutions that seamlessly integrate with legacy hardware. Partnerships between oilfield service giants and technology startups accelerate the development of next-generation automation features, such as adaptive set-point adjustments and machine learning-driven fault detection. Moreover, several companies are forging alliances with renewable energy providers to pilot solar-powered lift installations, aligning operational efficiency goals with corporate decarbonization targets. This evolving ecosystem underscores the critical role of collaboration and continuous innovation in maintaining competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Lift market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baker Hughes Company

- Borets International Limited

- ChampionX Corporation

- Dover Corporation

- DynaPump Inc.

- Endurance Lift Solutions

- Forum Energy Technologies, Inc.

- General Electric Company

- Halliburton Company

- Kudu Industries Inc.

- Liberty Oilfield Services Inc.

- National Oilwell Varco, Inc.

- Novomet Group

- Oil States International, Inc.

- PCM Artificial Lift Solutions

- Production Lift Companies

- Proserv Group Inc.

- Schlumberger Limited

- Tenaris S.A.

- Weatherford International plc

Accelerating Growth Through Integrated Digitalization, Strategic Sourcing and Sustainable Energy Adoption for Artificial Lift Providers

To thrive amid rapid technological advances and shifting regulatory landscapes, industry leaders should adopt a strategic roadmap focused on digital integration, supply chain resilience, and decarbonization. First, organizations must invest in unified digital platforms that consolidate well data, automate routine diagnostics, and enable remote control of lift parameters. This foundational step not only enhances operational visibility but also lays the groundwork for advanced predictive analytics.

Concurrently, establishing diversified sourcing strategies will mitigate risks associated with localized trade policy changes and raw material cost volatility. Engaging with regional fabricators and cultivating multi-tier supplier relationships ensures timely equipment delivery and strengthens competitive positioning. Lastly, integrating low-carbon power sources and energy-efficient motor options into artificial lift portfolios will prepare companies for increasingly stringent emissions standards and unlocking new segments among environmentally conscious operators. By balancing digital innovation, supply chain optimization, and sustainability initiatives, stakeholders can secure long-term profitability and market leadership.

Leveraging Integrated Primary Interviews, Secondary Publications and Expert Validation to Deliver Rigorous Artificial Lift Market Insights

This study leverages a robust research methodology combining primary and secondary data sources to ensure comprehensive market insights. Primary research includes in-depth interviews with upstream operators, equipment manufacturers, and service providers across multiple regions to capture firsthand perspectives on technology adoption trends and regulatory impacts. These discussions provide qualitative intelligence on strategic priorities, field performance challenges, and future investment plans.

Secondary research encompasses extensive review of industry publications, technical journals, government policy documents, and trade association reports to contextualize primary findings within broader market dynamics. Data triangulation techniques reconcile disparate information streams and validate key thematic findings. Additionally, expert panel consultations and stakeholder workshops supplement insights, offering iterative feedback loops that refine the analysis. This multifaceted approach delivers a balanced, evidence-based understanding of the global artificial lift landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Lift market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Lift Market, by Lift Method

- Artificial Lift Market, by Well Type

- Artificial Lift Market, by Drive Type

- Artificial Lift Market, by Application

- Artificial Lift Market, by End User

- Artificial Lift Market, by Region

- Artificial Lift Market, by Group

- Artificial Lift Market, by Country

- United States Artificial Lift Market

- China Artificial Lift Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Technology, Policy and Regional Dynamics to Illuminate Strategic Pathways for Future Artificial Lift Success

In this dynamic energy environment, artificial lift solutions play a pivotal role in enhancing production efficiency, managing complex reservoirs, and supporting sustainability objectives. Technological breakthroughs in digital connectivity, electrification, and autonomous operations are reshaping established methodologies, while supply chain realignment in response to tariff regimes underscores the need for adaptive strategies. Moreover, differentiated regional demands and the emergence of hybrid lift configurations highlight the importance of segmentation-driven approaches.

As operators and service providers navigate evolving market conditions, collaboration and innovation emerge as key success factors. By embracing digital transformation, diversifying supplier ecosystems, and integrating sustainable energy sources, industry participants can optimize well performance and unlock value across the asset lifecycle. These collective efforts will not only address immediate operational challenges but will also chart the course toward a more efficient, resilient, and environmentally conscious artificial lift sector.

Leverage Personalized Expertise From Our Associate Director to Unlock the Full Strategic Value of the Artificial Lift Market Report

To explore a comprehensive understanding of emerging opportunities and strategic imperatives in the global artificial lift market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with his team ensures tailored insights and precise guidance that align with your organizational objectives and operational priorities. Connect with Ketan today to secure your full report, which provides in-depth qualitative analysis, segmentation intelligence, and actionable strategies essential for navigating dynamic market conditions with confidence.

- How big is the Artificial Lift Market?

- What is the Artificial Lift Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?