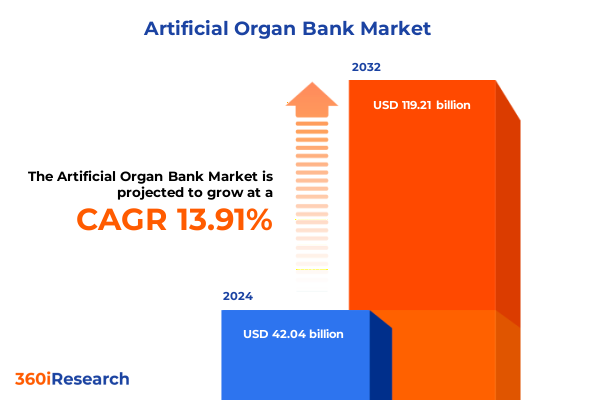

The Artificial Organ Bank Market size was estimated at USD 47.81 billion in 2025 and expected to reach USD 54.37 billion in 2026, at a CAGR of 13.94% to reach USD 119.21 billion by 2032.

Exploring how multidisciplinary innovations in tissue engineering and biofabrication are converging to establish the artificial organ bank ecosystem

The trajectory of regenerative medicine has reached a pivotal juncture as sophisticated tissue engineering converges with unmet clinical demand, giving rise to the artificial organ bank concept. This introduction outlines how cross-disciplinary breakthroughs in cell culture, scaffold design and biofabrication are coalescing into a robust supply chain of functional organ substitutes. Far from a distant aspiration, successful preclinical validations of heart and liver constructs have accelerated collaboration among biotech innovators, research institutes, and healthcare providers to address chronic organ shortages.

Against a backdrop of evolving regulatory frameworks and precision medicine imperatives, this report provides an overview of key technological milestones that underpin the artificial organ bank’s maturity. It highlights the mechanisms by which decellularization techniques preserve native extracellular matrices and how emerging scaffold technologies replicate biomechanical properties with unprecedented fidelity. By illustrating the synergy between advanced materials science and stem-cell biology, this section establishes the foundational context for subsequent analysis of market dynamics, policy impacts, segmentation insights and actionable recommendations critical to stakeholders across the ecosystem.

Analyzing the pivotal technological, investment and collaborative forces redefining the artificial organ bank industry trajectory

The artificial organ bank landscape has undergone transformative shifts driven by both scientific breakthroughs and strategic partnerships. Over the past five years, 3D bioprinting has transitioned from proof-of-concept to scalable manufacturing, enabling extrusion, inkjet and laser-assisted processes to create anatomically precise constructs. Simultaneously, decellularization strategies have evolved to permit high-throughput recovery of native matrices, while scaffold designs leveraging ceramic, natural polymer and synthetic polymer frameworks have become more sophisticated in replicating organ microenvironments.

This transformation is further propelled by growing investment from pharmaceutical and medical device conglomerates seeking to integrate bioprinted tissues into drug testing pipelines, reducing reliance on animal models. Collaboration between universities and private ventures has accelerated translational research, as evidenced by the first human-grade kidney prototype cleared for early clinical evaluation. These shifts underscore a new paradigm in which technology convergence, regulatory alignment and capital influx are reconfiguring the pathways from laboratory innovation to commercial adoption, setting the stage for artificial organ banks to become integral components of global healthcare infrastructure.

Evaluating the aggregate effects of recent U.S. tariff policies on supply chain resilience and cost structures within the artificial organ bank market

In 2025, tariff adjustments in the United States have introduced significant headwinds and opportunities within the artificial organ bank supply chain. Heightened duties on imported biopolymers, composite scaffold materials and specialized reagents have elevated production costs for domestic manufacturers, prompting a strategic re-evaluation of sourcing models. At the same time, incentives in the form of tariff exemptions for cell culture consumables have offered relief to tissue-engineering facilities that rely on raw materials for large-scale manufacturing.

These cumulative policy shifts have also influenced cross-border collaboration, as certain international technology providers have established U.S.-based distribution hubs to mitigate trade friction. Consequently, domestic firms have accelerated vertical integration efforts, investing in local decellularization and scaffold synthesis capabilities. While short-term margin pressures have emerged, the longer-term effect is expected to foster a more resilient, geographically diversified supply network. Stakeholders must therefore navigate this evolving tariff landscape by balancing cost containment measures with investments in regional manufacturing footprints to sustain growth in the artificial organ bank sector.

Unveiling how organ type, bioprinting innovations, material classifications, diverse applications and user profiles shape the artificial organ bank landscape

Dissecting the artificial organ bank landscape through multiple segmentation lenses reveals nuanced growth drivers and competitive dynamics. An organ-centric view highlights varying levels of maturity, with kidney-derived constructs dominating early clinical translation efforts, while pancreatic and intestinal replacements remain in exploratory phases. Technology segmentation underscores the prominence of extrusion bioprinting alongside emerging inkjet and laser-assisted approaches, as scaffold innovation spans ceramic arrays, natural polymers and synthetic constructs to tailor biomechanical performance.

Material-based analysis distinguishes biological substrates, including allogenic and autologous matrices, from synthetic options like composite and polymeric systems, each aligning with distinct regulatory pathways and cost profiles. Application segmentation showcases pharmaceutical testing as an early revenue driver, while transplantation and research applications reflect longer sales cycles offset by higher reimbursement potential. Finally, end-user segmentation differentiates hospitals and organ transplant centers, which demand clinical validation and regulatory compliance, from research institutes focused on exploratory studies. Collectively, these segmentation insights provide a multifaceted understanding of where value is created and how targeted strategies can optimize performance across the organ type, technology, material, application and end-user dimensions.

This comprehensive research report categorizes the Artificial Organ Bank market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Organ Type

- Technology

- Material Type

- Application

- End User

Examining how distinct policy, infrastructure and funding landscapes across global regions influence artificial organ bank adoption and growth

Regional dynamics play a pivotal role in shaping the competitive environment of the artificial organ bank industry. In the Americas, robust clinical infrastructure and favorable reimbursement models have galvanized market entry, accelerating clinical trials and early commercial adoption in both North and Latin America. Europe, the Middle East and Africa benefit from harmonized regulatory frameworks and collaborative research consortia that bridge academia and industry, enabling faster protocol approvals and shared technology platforms.

In contrast, Asia-Pacific regions exhibit a mosaic of growth drivers, where government-backed initiatives in countries such as Japan, South Korea and China prioritize local biomanufacturing capacity and incentivize public-private partnerships. Cost-effective contract research organizations in emerging markets offer scalable validation services, making the region an attractive hub for pilot production runs and early-stage testing. These regional insights illuminate how geographic variances in regulatory policy, funding mechanisms and infrastructure readiness influence strategic priorities for both incumbents and newcomers in the artificial organ bank ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Artificial Organ Bank market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading biotechnology pioneers and life sciences conglomerates shaping standards and driving competitive dynamics within artificial organ banking

Key companies at the forefront of artificial organ banking exemplify a spectrum of strategies, from pure-play biotechnology startups to diversified life sciences conglomerates. Some pioneering firms have concentrated on proprietary 3D bioprinting platforms that integrate extrusion, inkjet and laser-assisted modules, securing strategic partnerships with academic centers to validate vascularized organ constructs. Other organizations have emphasized decellularization expertise, leveraging native extracellular matrices and focusing on scalable purification technologies to supply off-the-shelf scaffolds.

A subset of industry leaders has adopted a platform approach, coupling cell culture automation with scaffold synthesis to offer end-to-end solutions that address regulatory and manufacturing complexities. Meanwhile, forward-looking conglomerates have invested in multi-modal portfolios encompassing both synthetic and biological materials, enabling clients to select optimized formulations for specific therapeutic or testing applications. Through mergers, acquisitions and collaborative alliances, these key players are actively defining standards, setting benchmarks for quality and driving the competitive intensity that will shape the artificial organ bank market’s maturation over the next decade.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Organ Bank market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abiomed, Inc.

- Asahi Kasei Medical Co., Ltd.

- B. Braun Melsungen AG

- Baxter International Inc.

- Berlin Heart GmbH

- BiVACOR Pty Ltd

- Boston Scientific Corporation

- CARMAT SA

- Cochlear Limited

- CryoLife, Inc.

- Edwards Lifesciences Corporation

- Fresenius Medical Care AG & Co. KGaA

- Getinge AB

- Jarvik Heart, Inc.

- LivaNova PLC

- Medtronic plc

- Organovo Holdings, Inc.

- OrganOx Limited

- SynCardia Systems, LLC

- TransMedics, Inc.

- Zimmer Biomet Holdings Inc.

Strategic imperatives for executives to integrate technological innovation, supply chain resilience and regulatory alignment for sustainable leadership

Industry leaders seeking to harness the potential of artificial organ banks should prioritize a multifaceted strategy that balances innovation with operational rigor. Organizations must invest in modular manufacturing platforms capable of integrating emerging bioprinting and scaffold technologies, thereby reducing time-to-market and facilitating rapid iteration. At the same time, establishing strategic alliances with academic research centers and clinical networks will be critical for validating constructs, accelerating regulatory approvals and generating robust safety data.

To mitigate supply chain disruptions driven by tariff fluctuations, executives should explore localizing production of key materials and reagents, while diversifying supplier portfolios to include both incumbent and niche specialized vendors. Furthermore, companies should implement advanced data analytics to monitor process parameters in real time, optimizing yield and ensuring batch-to-batch consistency. By adopting a customer-centric mindset, tailored service offerings for pharmaceutical and clinical end users can enhance value propositions, driving adoption among transplant centers and research institutes. Collectively, these recommendations provide a roadmap to strengthen market positioning, foster sustainable growth and lead the transition from experimental paradigms to fully operational artificial organ banks.

Outlining a rigorous research framework combining primary interviews, literature analysis, quantitative modeling and expert validation to ensure robust findings

The research methodology underpinning this report integrates a rigorous blend of primary and secondary research combined with structured data triangulation. Primary inputs include in-depth interviews with C-level executives, R&D heads and clinical trial investigators, ensuring firsthand insights into technological feasibility and market readiness. Complementing these interviews, a detailed review of peer-reviewed literature, regulatory filings and corporate disclosures provided empirical validation of critical innovations and policy impacts.

Quantitative analyses employed both top-down and bottom-up approaches to cross-verify adoption rates, supply chain costs and segmentation breakdowns, while scenario modeling assessed the implications of tariff changes and regional regulatory shifts. Expert panels comprising material scientists, bioengineers and reimbursement specialists convened to stress-test assumptions, refine market definitions and prioritize actionable insights. This multi-layered methodology ensures that the report’s findings are robust, defensible and aligned with the nuanced realities faced by stakeholders across the artificial organ bank ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Organ Bank market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Organ Bank Market, by Organ Type

- Artificial Organ Bank Market, by Technology

- Artificial Organ Bank Market, by Material Type

- Artificial Organ Bank Market, by Application

- Artificial Organ Bank Market, by End User

- Artificial Organ Bank Market, by Region

- Artificial Organ Bank Market, by Group

- Artificial Organ Bank Market, by Country

- United States Artificial Organ Bank Market

- China Artificial Organ Bank Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing how coordinated advances in technology, policy, manufacturing and partnerships will catalyze the widespread deployment of artificial organ banks

As the artificial organ bank concept transitions from experimental innovation to commercial reality, stakeholders across the ecosystem must align on shared standards, scalable manufacturing practices, and targeted investment priorities. This conclusion synthesizes the core insights revealed in technology convergence, tariff impacts, segmentation nuances, regional dynamics and competitive strategies. It highlights how a harmonized emphasis on regulatory collaboration, local production resilience, and iterative platform development will define the path toward sustainable adoption.

Future success will hinge on the ability of industry participants to transform pilot-scale demonstrations into validated production networks, leveraging advanced analytics and cross-sector partnerships. By maintaining a proactive stance on policy developments and embracing modular infrastructure, organizations can reduce time-to-market and ensure consistent product quality. Ultimately, the maturation of artificial organ banks will depend on coordinated efforts spanning R&D, manufacturing, clinical validation and commercialization-paving the way for a new era in regenerative healthcare that alleviates organ shortages and elevates patient outcomes.

Uncover bespoke insights and strategic guidance by connecting with Ketan Rohom to secure your comprehensive artificial organ bank research tailored to your needs

To explore the full range of insights and strategic imperatives outlined in this report, we invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise in guiding stakeholders through actionable intelligence will ensure you extract maximum value from the data and analysis presented. Reach out to schedule a personalized consultation, request customized data sets, or discuss enterprise licensing options that align with your business objectives. Empower your organization to stay ahead of the competitive curve by partnering with a dedicated industry veteran who can tailor the research to your unique needs and drive transformative growth in the artificial organ bank domain

- How big is the Artificial Organ Bank Market?

- What is the Artificial Organ Bank Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?