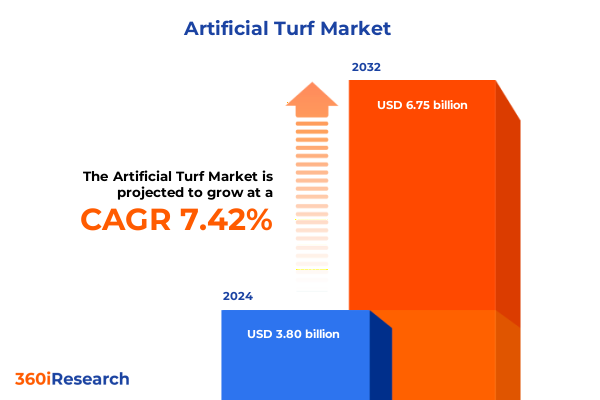

The Artificial Turf Market size was estimated at USD 4.05 billion in 2025 and expected to reach USD 4.31 billion in 2026, at a CAGR of 7.56% to reach USD 6.75 billion by 2032.

Artificial Turf Market Overview Exploring Key Drivers and Innovations Propelling Sustainable Adoption in Sports Venues, Landscaping, and Event Installations

The artificial turf sector has undergone a profound evolution, transitioning from a niche innovation into a mainstream choice for sports facilities, residential gardens, and high-profile event spaces. This transformation is driven by a convergence of performance expectations, environmental considerations, and cost efficiencies. In recent years, advancements in polymer science and fiber extrusion techniques have elevated the durability and realism of synthetic surfaces, narrowing the performance gap with natural grass. Meanwhile, growing pressures on water resources and rising maintenance expenses have positioned artificial turf as a sustainable alternative for both municipal planners and private homeowners.

Against this backdrop, market dynamics are shaped by the interplay between technological breakthroughs and regulatory directives. Stringent water usage restrictions in arid regions amplify the appeal of low-maintenance synthetic surfaces, while end users increasingly demand solutions that balance playability with ecological stewardship. As a result, manufacturers are investing heavily in R&D to develop next-generation turf that offers superior UV stability, reduced surface temperature, and enhanced recyclability. These core drivers underscore a robust growth trajectory across multiple end-use segments, signaling a pivotal moment for stakeholders to align strategic priorities with evolving industry imperatives.

Emerging Technological, Environmental, and Social Dynamics Reshaping the Artificial Turf Landscape with Breakthrough Materials and Performance Standards

Innovations in fiber technology have been at the heart of a recent paradigm shift, as manufacturers introduce multi-filament polyethylene and nylon blends that deliver unprecedented wear resistance without compromising on softness. Concurrently, an intensified focus on environmental impact has accelerated the transition from traditional crumb rubber infill toward organic and silica-based options. These infill materials not only address health and ecological concerns but also contribute to more consistent ball roll and reduced oxidation under ultraviolet exposure.

Moreover, advanced performance standards set forth by international sports federations have compelled producers to enhance shock absorption, energy restitution, and traction profiles. This regulatory impetus, paired with consumer expectations for premium aesthetics, underscores the importance of quality assurance protocols and certification programs. As a result, the artificial turf industry is witnessing greater transparency in lab testing and third-party validation, fostering trust among architects, facility managers, and event planners.

Finally, shifting social attitudes toward urban green spaces and outdoor recreation have opened avenues for portable installation solutions, enabling temporary event applications and rapid deployment for pop-up venues. Accompanied by digital monitoring technologies that track moisture levels and surface temperature, these capabilities underscore a broader trend toward intelligent infrastructure. In essence, these transformative forces are redefining the artificial turf landscape and setting new benchmarks for performance and sustainability.

Assessing the Far-Reaching Consequences of the 2025 United States Tariff Adjustments on Raw Materials Supply Chains Cost Structures and Competitive Positioning

In early 2025, new tariff measures imposed by the United States government targeted key polymer imports, notably polyethylene and polypropylene, in an effort to bolster domestic manufacturing. These adjustments have introduced a fresh layer of complexity to supply chain operations, as U.S. turf producers confront higher costs for raw materials and heightened competition from international players seeking to retain market share. The tariffs have been particularly disruptive for companies reliant on seamless cross-border logistics, prompting a strategic reevaluation of procurement strategies.

Consequently, manufacturers are experiencing pressure on their cost structures, with a cascading impact on pricing strategies for end users. Some firms have absorbed a portion of the tariff-driven expenses to maintain price competitiveness, while others have passed costs through, leading to increased project budgets for sports facilities and landscaping contractors. Meanwhile, the uneven application of these duties has created arbitrage opportunities, prompting savvy buyers to source materials from non-tariffed regions, at times offsetting part of the financial burden.

To mitigate these headwinds, industry leaders are exploring nearshoring initiatives, forging deeper partnerships with North American resin producers, and investing in vertical integration to secure stable feedstock supplies. In parallel, long-term contracts and hedging instruments are being leveraged to manage commodity price volatility. These strategic responses not only safeguard margins but also reinforce supply chain resilience, ensuring that stakeholders can navigate the evolving tariff landscape with greater confidence.

Deep Dive into Artificial Turf Market Segmentation Reveals Opportunities Based on Fiber Materials Infill Options Installation Modes and Application Verticals

A thorough understanding of the artificial turf sector requires a nuanced examination of fiber material distinctions. Nylon variants, prized for exceptional tensile strength, are increasingly specified for high-impact sports arenas where durability is imperative. Polyethylene blends, valued for their balance of resilience and cost efficiency, dominate general-purpose applications. Meanwhile, polypropylene fibers offer a budget-friendly entry point for residential and temporary use scenarios, albeit with a trade-off in long-term UV resistance.

Infill material selection has likewise emerged as a critical determinant of overall system performance. Traditional crumb rubber, once ubiquitous for its shock-absorbing properties, faces scrutiny due to environmental and health debates. This has catalyzed the adoption of organic infills-comprising cork and coconut husks-that deliver a cooler playing surface with lower particle migration. Silica sand remains a stalwart choice, offering consistent density and behavior under varied climatic conditions.

Installation mode further differentiates market offerings, with permanent systems anchored by engineered padding layers attracting facility owners seeking longevity. Conversely, portable turf configurations provide rapid deployment and removal capabilities, ideal for temporary events or multi-function venues requiring surface versatility.

Application segments reveal expansive use cases. Event planners deploy modular turf solutions for exhibitions and concerts, while landscaping projects leverage synthetic grass for commercial plazas, municipal parks, and private residences. Sports installations extend across baseball diamonds, football fields, golf courses, rugby pitches, and soccer arenas, each demanding distinct pile heights, infill blends, and drainage systems.

End users span commercial property management, educational institutions, municipal authorities, and homeowners, each influenced by budget constraints, aesthetic preferences, and maintenance requirements. Distribution channels encompass direct sales relationships with local installers, partnerships with distributors for broader reach, E-commerce platforms facilitating quick turnaround, and retail outlets catering to small-scale buyers.

This comprehensive research report categorizes the Artificial Turf market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fiber Material

- Infill Material

- Installation Mode

- Application

- End User

- Distribution Channel

Regional Dynamics Reveal Growth Patterns Shaped by Infrastructure Investment Consumer Trends and Regulatory Environments in Americas, EMEA, and Asia-Pacific

In the Americas, sustained infrastructure investment and a steady pipeline of stadium renovations have reinforced demand for high-performance synthetic surfaces. Drought-induced restrictions in regions such as California and the Southwest have accelerated the replacement of natural grass, while corporate landscaping projects along commercial corridors continue to favor water-saving turf solutions. This confluence of regulatory pressures and budgetary planning underscores a robust appetite for turnkey installation packages that bundle product and maintenance services.

Across Europe, the Middle East, and Africa, stringent environmental mandates and growing awareness of lifecycle impacts are driving procurement decisions. European Union initiatives to reduce water consumption and microplastics runoff have led facility managers to seek certified environmental product declarations. In the Middle East, vast stadium construction projects and luxury residential developments showcase premium turf installations engineered to maintain consistency under extreme heat. At the same time, select African nations are piloting municipal green-space programs that leverage synthetic turf for community sports and recreation.

Asia-Pacific markets exhibit dynamic growth fueled by rapid urbanization and landmark event hosting. Countries experiencing surges in population density are prioritizing multi-use recreational spaces, while governments leverage turf systems to meet ambitious sustainability commitments. Major city authorities in Australia and Japan, for instance, have integrated smart irrigation and surface monitoring technologies into large-scale park refurbishments. Similarly, event organizers in India and China are embracing portable installations to accommodate cultural festivals and regional sports tournaments, highlighting the region’s appetite for versatile and resilient turf solutions.

This comprehensive research report examines key regions that drive the evolution of the Artificial Turf market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Highlights Strategic Initiatives Product Innovations and Collaborative Partnerships Among Leading Artificial Turf Manufacturers

Leading the competitive charge, FieldTurf continues to leverage its pioneering turf technology, securing high-profile partnerships with global sports federations and major league franchises. The company’s emphasis on green credentials and cradle-to-cradle design has elevated its profile among sustainability-minded buyers. Meanwhile, Shaw Sports Turf distinguishes itself through a diversified product portfolio, incorporating antimicrobial coatings and novel fiber cross-sections to enhance user comfort and safety.

TenCate Grass has emerged as a key innovator in infill development, harnessing proprietary polymer blends and bio-based additives to reduce surface temperatures and enhance shock absorption. Its alliances with research institutions underscore a commitment to performance science. AstroTurf, a legacy brand with deep roots in collegiate athletics, has revitalized its market presence through targeted investments in European and Asian manufacturing hubs, reducing lead times and transportation emissions.

Rising challengers are carving niches with tailored solutions for residential landscaping and small-scale sports facilities, emphasizing ease of installation and minimal maintenance. Collaborations between synthetic turf producers and landscape architects are yielding bespoke designs that blur the line between natural and artificial aesthetics. Partnerships with digital platform providers have also created value-added service models, offering remote condition monitoring and predictive maintenance scheduling.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Turf market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Act Global Corporation

- AVG

- Beaulieu International Group NV

- Bellinturf Artificial Turf Co., Ltd.

- CCGrass

- CityGreenturf Sports Industry Co., Ltd.

- Domo Sports Grass NV

- Evergreen Synthetic Turf, LLC

- Forest Group Co., Ltd.

- Global Syn-Turf Corporation

- Greenfields BV

- Limonta Sport SpA

- Namgrass NV

- Shaw Industries Group, Inc.

- SIS Pitches Ltd.

- Sunligrass Artificial Turf Carpet Co., Ltd.

- Systurf

- Taishan Sports Industry Group Co., Ltd.

- Tarkett SA

- TenCate Grass

- TigerTurf New Zealand Ltd.

- UBU Sports Systems LLC

- Vivaturf Sports Industry Co., Ltd.

- Wicker (Kunshan) Sports Products Co., Ltd.

Strategic Roadmap for Industry Leaders to Capitalize on Innovation Sustainability and Operational Efficiency in the Fast-Evolving Artificial Turf Sector

Industry leaders poised for success will prioritize continued investment in next-generation fiber and infill combinations that address both performance benchmarks and environmental expectations. By directing R&D efforts toward recyclable polymer matrices and non-toxic infill alternatives, companies can align their offerings with increasingly stringent regulatory standards and consumer sustainability goals.

Equally crucial is the diversification of supply chains to insulate operations from tariff-driven cost fluctuations. Establishing strategic partnerships with regional resin producers and logistics providers will enable more predictable procurement pipelines and foster closer collaboration on material innovation. Moreover, integrating IoT-enabled sensors and monitoring platforms into turf systems can create new revenue streams through condition-based service agreements, while also delivering real-time data on usage patterns and surface health.

To distinguish themselves, businesses should embrace circularity initiatives, developing end-of-life programs that recover and repurpose fiber waste. Engaging with certification bodies to secure eco-labels and performance seals will further differentiate products in a crowded marketplace. Finally, cultivating strategic alliances with event organizers, landscape architects, and facility management firms can amplify market reach and reinforce brand credibility.

Rigorous Multi-Source Research Methodology Underpinning the Comprehensive Artificial Turf Market Analysis Incorporating Qualitative and Quantitative Techniques

This analysis draws upon a multi-faceted research framework that merges primary and secondary methodologies. In the primary phase, in-depth interviews were conducted with C-level executives, product engineers, and installation specialists representing turf producers, infill compounders, and facility operators. These conversations yielded qualitative insights into emerging trends, regulatory impacts, and customer pain points.

Complementing these interviews, structured surveys captured preferences and procurement behaviors across end-user groups, encompassing sports franchises, landscaping firms, event managers, and municipal planners. Secondary research involved the review of technical journals, government policy documents, patent filings, and sustainability reports to validate material innovations and environmental credentials. Data triangulation techniques were applied to reconcile any discrepancies between sources, ensuring robustness of findings.

Quantitative analysis leveraged historical shipment data, import-export records, and tariff schedules to map cost dynamics and competitive shifts. Market mapping exercises delineated distribution footprints, while SWOT and PESTLE frameworks illuminated strategic risks and growth levers. Rigorous quality assurance protocols, including peer review by industry experts, underpin the credibility of this comprehensive artificial turf market report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Turf market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Turf Market, by Fiber Material

- Artificial Turf Market, by Infill Material

- Artificial Turf Market, by Installation Mode

- Artificial Turf Market, by Application

- Artificial Turf Market, by End User

- Artificial Turf Market, by Distribution Channel

- Artificial Turf Market, by Region

- Artificial Turf Market, by Group

- Artificial Turf Market, by Country

- United States Artificial Turf Market

- China Artificial Turf Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Underscores the Imperative of Innovation Sustainability and Market Segmentation for Future-Proofing Artificial Turf Solutions

The artificial turf industry stands at a nexus of technological advancement and environmental stewardship. Innovations in fiber composition and sustainable infill alternatives are enabling products that meet rigorous performance criteria while reducing ecological footprints. Concurrently, shifts in installation practices and digital integration underscore a drive toward smarter, more versatile surface solutions.

Amid these developments, the 2025 tariff landscape has revealed the imperative of supply chain agility. Organizations that proactively diversify sourcing channels and deepen collaborations with raw material suppliers are better positioned to maintain competitive cost structures. Moreover, segmentation insights highlight the importance of tailoring offerings to the distinct requirements of sports, landscaping, and event applications.

Regional market dynamics further affirm that success depends on a nuanced appreciation of regulatory regimes and end-user expectations across Americas, EMEA, and Asia-Pacific territories. In this context, a strategic emphasis on recyclable materials, performance certification, and integrated service models will differentiate industry leaders. As the sector continues to mature, stakeholders who can harmonize innovation, sustainability, and operational efficiency will secure a lasting advantage in the dynamic artificial turf market.

Engage with Ketan Rohom to Unlock In-Depth Artificial Turf Market Insights and Custom Solutions through Acquisition of the Comprehensive Research Report

To explore the full depth of insights and strategic analysis presented in this comprehensive artificial turf market report, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored solutions that address your organization’s unique challenges and growth objectives. Reach out to schedule a personalized consultation and secure access to the detailed findings that can drive your competitive advantage. Transform your decision-making process by acquiring the complete market research report today and stay ahead in the rapidly evolving artificial turf industry

- How big is the Artificial Turf Market?

- What is the Artificial Turf Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?