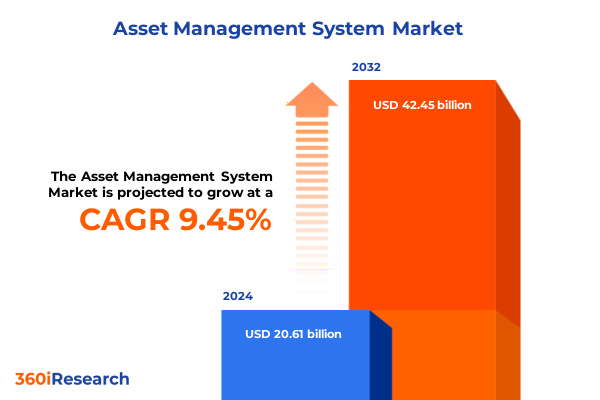

The Asset Management System Market size was estimated at USD 22.47 billion in 2025 and expected to reach USD 24.52 billion in 2026, at a CAGR of 9.50% to reach USD 42.45 billion by 2032.

Unifying Asset Oversight and Embedding Advanced Digital Capabilities to Navigate the Complexity of Modern Enterprise Ecosystems

Forward-looking enterprises are confronting an unprecedented level of complexity as digital transformation reshapes every aspect of asset oversight. Legacy silos between operations and technology are dissolving, and firms that integrate these functions seamlessly are generating what industry leaders describe as “digital alpha,” driving superior growth in assets under management and dramatically reduced operational costs. At the same time, burgeoning data volumes and heightened cybersecurity requirements necessitate a streamlined application landscape, supported by robust architecture and advanced analytics capabilities.

Responding to Technology Convergence, Regulatory Evolution, and Sustainability Imperatives Driving a Transformative Shift in Asset Management

The asset management landscape is experiencing a seismic shift driven by the convergence of artificial intelligence, Internet of Things connectivity, and cloud-native architectures. Organizations are rapidly embedding machine learning models into maintenance and reliability workflows, enabling predictive analytics that preempt equipment failures and optimize performance in real time. Parallel to this, sustainability mandates and regulatory evolution are prompting firms to incorporate environmental impact metrics directly into asset lifecycle decisions, fostering a more responsible, transparent approach to infrastructure management.

Assessing the Broad Economic and Operational Repercussions of Recent US Tariffs through Supply Chain to Technology Cost Pressures

Since the introduction of sweeping 25 percent tariffs on imports from Canada and Mexico in early 2025, supply chains have incurred significant cost pressures that ripple through every tier of technology procurement and deployment. These levies have compounded existing trade tensions, triggering reciprocal tariffs and elevating uncertainty in global logistics, with many firms reporting extended lead times for critical components and elevated inventory carrying costs.

Deconstructing the Multifaceted Asset Management Market by Type, Component, Deployment, Industry Vertical, and Organizational Scale for Precise Insights

Analyzing the market through a multifaceted segmentation lens reveals distinct dynamics across solution types, components, deployment models, industry verticals, and organizational scale. Digital asset management systems are capturing rapid interest among marketing and creative teams, even as enterprise and fixed asset management suites remain core to heavy industries and utilities. From hardware elements-spanning barcode scanners to RFID tags and advanced sensors-to managed and professional services engagements, providers are tailoring offerings to meet discrete operational requirements. Cloud-based platforms continue to challenge on-premise deployments for flexibility and scalability, while end-user industries such as manufacturing, healthcare, and transportation & logistics are at the forefront of adopting these technologies. Across this spectrum, large enterprises command the lion’s share of early investment, but small and medium-sized organizations are emerging as a fast-growing segment, driven by the availability of subscription-based and cloud-native solutions.

This comprehensive research report categorizes the Asset Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Deployment

- End-User Industry

- Organization Size

Characterizing Regional Dynamics across the Americas, EMEA, and Asia-Pacific to Uncover Divergent Growth Drivers and Investment Priorities

Regional growth trajectories diverge significantly across the Americas, EMEA, and Asia-Pacific, shaped by local economic conditions and regulatory frameworks. North America remains a mature market characterized by advanced cloud adoption and AI-powered predictive maintenance investments, underscored by widespread digital twins and IoT deployments. In Europe, Middle East & Africa, stringent sustainability regulations and interoperability standards are driving a surge in integrated asset management solutions, with many firms prioritizing compliance and energy-efficiency modules. Meanwhile, Asia-Pacific is emerging as the fastest-growing frontier, as rapid industrialization and digital infrastructure upgrades accelerate demand for both on-premise and cloud-based asset management platforms.

This comprehensive research report examines key regions that drive the evolution of the Asset Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Competitive Strategies and Innovation Profiles of Leading Vendors Shaping the Asset Management Landscape

Leading vendors are differentiating through a combination of technical prowess, integration ecosystems, and domain-specific innovations. IBM’s Maximo Application Suite has been recognized as a leader in enterprise asset management, achieving top marks for interoperability, development environment, and energy management capabilities according to an independent Green Quadrant evaluation. This strong positioning is reinforced by IBM’s dominant presence among the Global Top 100 enterprises, where it commands over two-thirds of installed deployments. Similarly, SAP and Oracle maintain significant footholds with comprehensive suites that address maintenance, reliability, and fixed asset lifecycle needs; SAP’s flagship solution supports real-time visibility across asset lifecycles in more than 590 organizations globally, while Oracle’s eAM platform underpins operations at over 540 enterprises, offering robust cloud services and consulting integrations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Asset Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- AiREM

- Asset Infinity

- Asset Panda, LLC

- BMC Software, Inc.

- Capgemini Technology Services India Limited

- Ceipal Corp.

- EZ Web Enterprises, Inc.

- Financial Asset Management Systems, Inc.

- Freshworks Inc.

- Hexagon AB

- Hitachi, Ltd.

- Honeywell International Inc.

- Horizon Technologies Ltd.

- International Business Machines Corporation

- Kaizen Software Solutions, LLC.

- Lansweeper

- Microsoft Corporation

- Oracle Corporation

- Ramco Systems Ltd.

- SAP SE

- SapphireIMS by Tecknodreams Software Consulting Pvt. Ltd.

- ServiceNow, Inc.

- SolarWinds Worldwide, LLC.

- Spiceworks Inc. by Ziff Davis company.

- Spine Technologies Pvt. Ltd.

- SysAid Technologies Ltd.

- Wasp Barcode Technologies by Informatics Holdings, Inc.

- Zoho Corporation

Implementing Targeted Strategic Moves to Enhance Resilience, Efficiency, and Innovation across Asset Management Operations

Industry leaders can enhance resilience by prioritizing modular architectures that decouple legacy systems while scaling new AI-driven analytics as discrete microservices. By adopting a two-speed technology approach-aggressively streamlining existing infrastructure and simultaneously investing in next-generation platforms-organizations can shift a greater portion of their technology budgets toward high-impact transformation initiatives. Furthermore, fostering closer collaboration between operations and IT teams, with shared accountability and unified road maps, ensures that digital investments translate directly into measurable improvements in uptime, compliance, and cost efficiency.

Outlining a Rigorous, Data-Driven Research Framework Combining Primary Interviews, Secondary Analysis, and Quantitative Validation

This report’s findings are grounded in a rigorous research framework combining in-depth primary interviews with senior executives and domain experts, extensive secondary research across industry publications and technical white papers, and quantitative data analysis. Structured data triangulation was employed to validate insights, ensuring consistency across varied sources. Market and economic impacts were further corroborated with publicly available trade and tariff data, while technology adoption trends were cross-checked against independent analyst evaluations and vendor disclosures.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Asset Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Asset Management System Market, by Component

- Asset Management System Market, by Application

- Asset Management System Market, by Deployment

- Asset Management System Market, by End-User Industry

- Asset Management System Market, by Organization Size

- Asset Management System Market, by Region

- Asset Management System Market, by Group

- Asset Management System Market, by Country

- United States Asset Management System Market

- China Asset Management System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Imperatives to Highlight Pathways for Sustainable Asset Management Excellence

The asset management sector stands at an inflection point where digital transformation, regulatory change, and geopolitical dynamics intersect. Organizations that embrace integrated platforms, leverage AI and IoT for predictive capabilities, and strategically navigate tariff-driven cost pressures will secure a competitive advantage. By focusing on agile deployment models, regional market nuances, and the strengths of leading vendors, executives can chart a course toward sustainable operational excellence and long-term value creation.

Take the Next Step in Securing Transformative Asset Management Intelligence with a Personalized Consultation to Acquire the Full Report

Ready to translate deep insights into decisive action for your organization’s asset management roadmap? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, for a tailored consultation and discover how to secure the comprehensive research report that will empower your strategic initiatives.

- How big is the Asset Management System Market?

- What is the Asset Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?