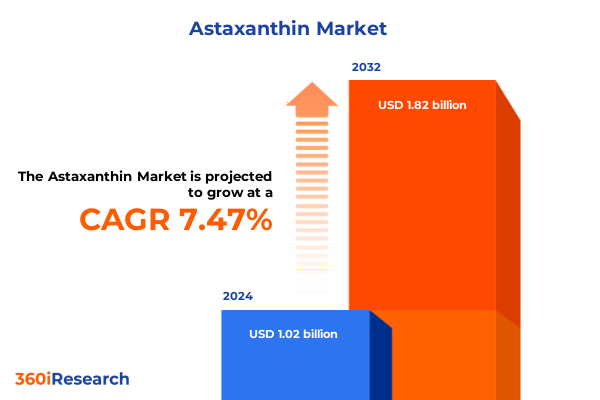

The Astaxanthin Market size was estimated at USD 1.09 billion in 2025 and expected to reach USD 1.16 billion in 2026, at a CAGR of 7.66% to reach USD 1.82 billion by 2032.

Unveiling the Rising Tide of Astaxanthin: Examining Its Antioxidant Powerhouse Role, Innovative Applications, and Industry Growth Drivers

Astaxanthin, a naturally occurring carotenoid pigment recognized for its extraordinary antioxidant capacity, has been at the forefront of research within health and wellness circles. Recent product launches highlight its expanding relevance across sectors: in October 2024, Algatechnologies introduced a microencapsulated beverage-grade ingredient optimized for dairy and drinks, reflecting a strategic pivot toward enhanced consumer experiences in functional foods and nutrient-rich beverages. At the same time, BGG’s 2023 completion of a photobioreactor farm expansion not only doubled capacity for its AstaZine natural line but underscored the industry’s shift toward vertically integrated production models to meet surging global demand.

This confluence of technological innovation and rising health consciousness has propelled astaxanthin beyond its traditional use in aquaculture pigmentation into nutraceuticals, cosmetics, and pharmaceuticals. Consumers are increasingly seeking natural solutions that deliver clinically validated benefits such as cellular protection and skin health support, prompting brands to invest in advanced extraction and formulation techniques. As a result, the astaxanthin landscape is rapidly evolving, characterized by dynamic collaborations, facility expansions, and product diversification that will be further explored in the following executive summary report.

How Breakthrough Biological Processes and Sustainable Innovations Are Transforming the Global Astaxanthin Landscape with Next-Level Efficiency

The astaxanthin industry has witnessed significant transformations driven by breakthroughs in cultivation and formulation technologies. For example, closed-system tubular photobioreactors have emerged as a scalable solution for microalgae cultivation, enabling companies like BGG to double production capacity and reduce environmental footprints simultaneously. Complementing these upstream improvements, formulation advances such as patented microencapsulation techniques have enhanced bioavailability and stability, exemplified by Algatechnologies’ 2024 launch of encapsulated powders tailored for beverage matrices.

In parallel, sustainability has risen to the forefront of strategic priorities. Firms are integrating renewable energy and water-recycling systems into their operations, while certification frameworks are creating transparency around organic and eco-friendly sourcing. This trend is not only reshaping production methodologies but also redefining competitive advantage, as brands that can demonstrate verifiable environmental stewardship gain traction among increasingly eco-conscious consumers.

Assessing the Cumulative Impact of New United States Tariffs on Astaxanthin Supply Chains, Cost Structures, and Ingredient Sourcing Strategies Through 2025

The introduction of new U.S. tariff structures in 2025 has created a complex web of duties impacting astaxanthin supply chains. A universal 10% tariff applied broadly to imports effective April 5, 2025, while reciprocal tariffs ranging from 11% to 50% were set to follow before a 90-day extension suspended most higher rates, excluding China. As a result, Chinese-derived synthetic carotenoids now face a stacked rate approaching 145%, combining the base tariff with existing Section 301 duties, while other global suppliers operate within the 10% window for the interim period.

These elevated cost structures are prompting manufacturers to reevaluate sourcing strategies. Companies reliant on Chinese chemical synthesis for cost-effective astaxanthin are experiencing margin compression and exploring domestic fermentation routes or natural extraction partnerships to mitigate tariff exposure. At the same time, ingredient suppliers that source via aquafeed intermediaries, such as krill and shrimp, must navigate additional marine import duties and logistics constraints. The cumulative effect is reshaping cost models across nutraceutical, feed, and cosmetic value chains, compelling stakeholders to balance tariff burdens with supply reliability.

Deciphering the Complex Segmentation of the Astaxanthin Landscape: From Source Origins and Production Methods to Formulations and Distribution Channels

A nuanced segmentation analysis of the astaxanthin market reveals distinct pathways for product development and commercialization. When examining the primary source categories, natural astaxanthin-derived from microalgae strains like Haematococcus pluvialis, as well as seafood byproducts such as krill and shrimp-coexists with synthetic variants manufactured via petrochemical synthesis. Each origin story influences cost, sustainability credentials, and regulatory scrutiny. Likewise, formulation options range from liquid suspensions and powdered concentrates to softgel encapsulations, with each form factor catering to specific use cases and consumer preferences.

Delving deeper, production methods further differentiate market players. Chemical synthesis offers predictable output and scalability but often falls short on environmental metrics, driving interest in fermentation technologies that blend microbial engineering with renewable feedstocks. Natural extraction, by contrast, appeals to clean-label trends and can leverage co-location advantages near algae farms or marine biomass sources. Across applications, astaxanthin’s versatility shines: it enhances pigmentation in aquaculture and pet nutrition, serves as an active anti-aging ingredient in creams, lotions, and serums, enriches functional foods from bakery goods to beverages, and fortifies pharmaceuticals and dietary supplements packaged as capsules, powders, or tablets. Distribution dynamics also reflect evolving consumer behaviors-traditional brick-and-mortar channels remain vital for certain segments, while online platforms are accelerating direct-to-consumer engagement and demand forecasting accuracy.

This comprehensive research report categorizes the Astaxanthin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sources

- Formulation

- Production Method

- Application

- Distribution Channel

Unpacking Regional Dynamics: Key Drivers and Opportunities for Astaxanthin Adoption Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping astaxanthin’s global trajectory. In the Americas, North America leads adoption driven by robust nutraceutical and cosmetics sectors. Here, companies benefit from domestic cultivation initiatives and partnerships, while online penetration accelerates consumer access to premium formulations. Notably, U.S. astaxanthin revenue is projected to outpace other markets by 2030, reinforcing its status as a strategic hub for innovation and regulatory alignment.

Across Europe, Middle East, and Africa, established chemical and biotech clusters in Germany and the Nordics are investing heavily in sustainable extraction and purification technologies. BASF’s 2025 expansion of its German facility exemplifies the region’s commitment to high-purity synthetic beadlets for aquaculture applications, balanced by growing demand for certified natural extracts in skincare formulations. Strategic trade partnerships are also evolving in response to the broader tariff environment, prompting regional alliances and localized production to shield against cross-border cost pressures.

In Asia-Pacific, the market is experiencing the fastest growth globally, driven by a combination of rising health awareness and rapidly expanding aquaculture industries. The Asia-Pacific region accounted for over a quarter of global revenue in 2024, with India and South Korea registering double-digit growth rates. Here, large-scale algae farms in China and emerging production hubs in Southeast Asia are positioning the region as both a manufacturing powerhouse and a pivotal end-consumer market for nutraceutical, food & beverage, and cosmetic segments.

This comprehensive research report examines key regions that drive the evolution of the Astaxanthin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategies of Leading Astaxanthin Companies: Innovation Pathways, Sustainability Commitments, and Market Positioning Tactics

Leading companies are redefining the contours of the astaxanthin market through strategic investments in production scale, R&D collaborations, and sustainability mandates. Beijing Gingko Group (BGG) has staked its claim as the world’s largest natural astaxanthin producer by commissioning a second photobioreactor facility, achieving an annual capacity of 7.5 metric tons of pure compound and reinforcing its end-to-end supply chain control. Meanwhile, Algatechnologies’ closed tubular photobioreactor operations showcase how renewable energy integration and water recycling can align operational efficiency with environmental stewardship, capturing premium valuation among eco-conscious buyers.

On the synthetic front, BASF has leveraged its petrochemical expertise to secure a dominant position in aquafeed applications, producing over 850 metric tons annually with a patented beadlet technology that minimizes pigment leaching. DSM Nutritional Products similarly combines fermentation and synthetic pathways to deliver CAROPHYLL® solutions under a carbon-neutral roadmap, demonstrating the strategic value of diversified manufacturing approaches. In parallel, Cardax and Parry Nutraceuticals are carving niches through clinically validated formulations and customizable beadlet options tailored for high-dose therapeutic applications and beverage formats, respectively.

Across this competitive landscape, smaller innovators and contract manufacturers are also gaining prominence by offering specialized extraction services and white-label formulation support. Their agility in navigating tariff complexities and adapting to segmented consumer demands underscores the importance of flexible business models and strategic alliances in sustaining long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Astaxanthin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Algatech Ltd.

- ASTAMAZ NZ LTD.

- AstaReal Co., Ltd.

- BASF SE

- Beijing Gingko Group

- Cardax, Inc.

- Cyanotech Corporation

- Divi’s Laboratories Ltd.

- DSM-Firmenich AG

- ENEOS Techno Materials Corporation

- FENCHEM

- Fuji Chemical Industries Co., Ltd.

- Lycored Corp.

- Merck KGaA

- MicroActiveingredients

- Nutrex Hawaii Inc.

- Piveg, Inc.

- Solabia Nutrition

- Sun Chlorella Corporation

Actionable Strategic Recommendations for Astaxanthin Industry Leaders to Navigate Supply Challenges, Maximize Segment Opportunities, and Drive Sustainable Growth

To thrive amid evolving market forces, industry leaders should prioritize integrating tariff-resilient supply strategies by diversifying raw material sourcing and establishing localized production hubs. Developing fermentation-based production lines and securing long-term algae biomass agreements can buffer against import duties and supply disruptions, while co-investing in shared processing assets can reduce per-unit extraction costs. Moreover, embedding sustainability metrics into every stage of the value chain-supported by third-party certifications-will resonate with regulatory bodies and discerning consumers alike.

Product innovation should focus on expanding high-margin formulations, such as vegetarian softgels and cold-water dispersible beadlets, to capture segments with premium willingness-to-pay. Collaborations with research institutions and cosmetic brands can accelerate proof-of-concept studies, unlocking new skincare and pharmaceutical indications. Concurrently, digital commercialization strategies that leverage direct-to-consumer platforms will enable more precise demand sensing and accelerate go-to-market cycles. Finally, proactive engagement with trade associations and policymakers is essential to anticipate regulatory changes, shape tariff exemptions, and advocate for ingredient-specific treatments under evolving U.S. trade policies.

Robust Research Methodology Overview: Data Sources, Analytical Frameworks, and Quality Assurance Processes Underpinning the Astaxanthin Market Analysis

This report synthesizes insights derived from a rigorous multi-stage research methodology. Initially, an extensive review of public filings, industry press releases, and tariff documentation was conducted to map current production capacities, technological advancements, and regulatory shifts. Quantitative data on regional demand patterns and company performance were validated through sector-specific databases and triangulated against stakeholder interviews, including executives from leading algae cultivators and formulation partners.

Subsequently, segmentation frameworks were applied to delineate product categories, application verticals, and distribution channels, ensuring a structured lens for trend analysis. Impact assessments of 2025 U.S. tariffs were modeled using customs duty schedules and trade flow data to quantify cost implications across source and form factors. Throughout the research process, quality assurance protocols-including data consistency checks, peer reviews, and continuous updates from real-time news feeds-ensured the accuracy and relevance of findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Astaxanthin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Astaxanthin Market, by Sources

- Astaxanthin Market, by Formulation

- Astaxanthin Market, by Production Method

- Astaxanthin Market, by Application

- Astaxanthin Market, by Distribution Channel

- Astaxanthin Market, by Region

- Astaxanthin Market, by Group

- Astaxanthin Market, by Country

- United States Astaxanthin Market

- China Astaxanthin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Insights on Astaxanthin’s Evolution: Synthesizing Key Findings and Implications for Stakeholders Across Health, Nutrition, and Industrial Applications

The astaxanthin industry stands at an inflection point where scientific innovation, sustainability imperatives, and geopolitical considerations converge. Breakthroughs in cultivation techniques, formulation science, and certification pathways are enabling producers to meet diverse consumer demands across nutrition, cosmetics, and pharmaceuticals. However, rising tariff barriers and supply chain volatility underscore the necessity for agile sourcing and strategic risk mitigation.

As regional markets continue to diverge in growth rates and regulatory environments, stakeholders must adopt nuanced strategies that align product portfolios with local demand drivers while leveraging global networks for scale. By embracing collaborative R&D, prioritizing environmental stewardship, and maintaining open dialogue with policymakers, companies can harness astaxanthin’s full potential as a multi-industry powerhouse. Ultimately, success will hinge on balancing innovation with resilience to navigate an increasingly complex market landscape.

Secure Your Comprehensive Astaxanthin Market Report Today by Contacting Ketan Rohom for Tailored Insights and Partnership Opportunities

Take the next step in capitalizing on the immense growth potential of the astaxanthin industry by investing in a comprehensive market research report tailored to your strategic needs. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure unparalleled access to proprietary insights, granular competitive intelligence, and actionable regional analyses. Whether you aim to optimize your supply chain, refine product development, or expand into emerging markets, our report will equip you with the data-driven clarity required to outpace competitors. Reach out today to arrange a consultation, request a customized proposal, and ensure your organization is positioned to lead in the evolving astaxanthin landscape.

- How big is the Astaxanthin Market?

- What is the Astaxanthin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?