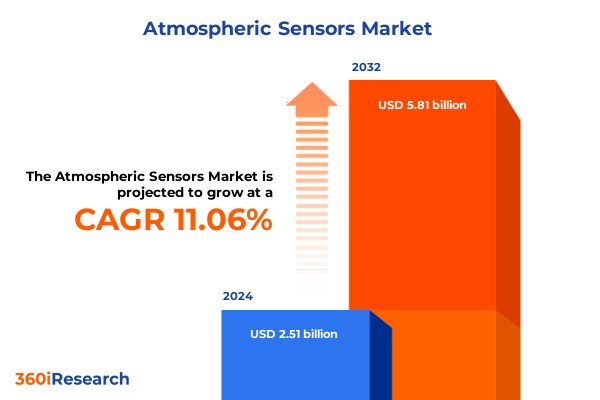

The Atmospheric Sensors Market size was estimated at USD 2.79 billion in 2025 and expected to reach USD 3.07 billion in 2026, at a CAGR of 11.04% to reach USD 5.81 billion by 2032.

Establishing the Strategic Foundation for Atmospheric Sensor Market Overview and the Imperative of Enhanced Environmental Monitoring Capabilities

Atmospheric sensor technologies have emerged as critical enablers in the pursuit of real-time environmental intelligence. By providing continuous, high-fidelity data on gas concentrations, particulate matter, humidity, temperature, pressure, and volatile organic compounds, these devices allow stakeholders to safeguard public health, optimize industrial processes, and ensure regulatory compliance. Over the past decade, dramatic advancements in sensor miniaturization, connectivity protocols, and data analytics frameworks have elevated atmospheric monitoring from isolated point measurements to integrated, networked systems that underpin smart city infrastructures, autonomous platforms, and environmental research initiatives.

This executive summary distills the most salient developments shaping the atmospheric sensor landscape, examining transformative technological shifts, the ramifications of recent United States tariff policies, granular segmentation insights, and differentiated regional dynamics. It also highlights the strategic movements of leading solution providers and offers concrete recommendations for organizational leaders seeking to navigate complexity and capitalize on emergent opportunities. The following sections articulate a comprehensive perspective on market segmentation by sensor type, technology basis, application domains, end users, and installation modalities, as well as the rigor underpinning the underlying analysis.

Through a blend of primary interviews, secondary research, and cross-sector validation, the analysis sheds light on competitive positioning, investment priorities, and risk factors inherent to regulatory shifts and evolving international trade landscapes. Stakeholders will find this compilation instrumental in aligning supply chain configurations, product roadmaps, and research agendas with rapidly emerging environmental monitoring imperatives.

Unveiling Pivotal Technological and Regulatory Shifts Redefining Atmospheric Sensor Deployment and Elevating Data-Driven Environmental Resilience

The atmospheric sensor ecosystem is undergoing a technological renaissance driven by the convergence of miniaturized hardware, advanced materials science, and digital transformation. Microelectromechanical systems leveraging novel nanomaterials now deliver unprecedented sensitivity for trace gas analysis, while integrated connectivity modules enable seamless data transmission via emerging IoT protocols. In addition, the incorporation of edge-computing architectures and artificial intelligence algorithms has transformed raw sensor readings into predictive insights, facilitating proactive maintenance and dynamic control of environmental hazards.

Concurrently, regulatory landscapes across major jurisdictions have tightened air quality standards, compelling industries to deploy more robust and accurate monitoring solutions. Stricter emission thresholds, expanded reporting requirements, and incentives for greenhouse gas reduction are spurring investment in next-generation sensors capable of multi-parameter detection. Moreover, the growing emphasis on carbon footprint verification and sustainable infrastructure planning is elevating the role of atmospheric sensing in corporate environmental, social, and governance agendas. Together, these technological and regulatory drivers are catalyzing a paradigm shift in how organizations design, deploy, and leverage atmospheric monitoring networks to achieve resilient and compliant operations.

Examining the Far-Reaching Consequences of 2025 United States Tariff Policies on Atmospheric Sensor Supply Chains and Operational Cost Structures

In early 2025, the United States implemented a comprehensive tariff regime targeting imported atmospheric sensor components, notably semiconductor wafers, MEMS chips, and specialized optical filters. These measures were introduced as part of broader trade policies aimed at strengthening domestic manufacturing and reducing reliance on single-source suppliers. As a result, sensor integrators encountered increased input costs and navigated complex customs procedures, prompting rapid reassessment of global sourcing strategies.

The cumulative impact extended beyond cost inflation. Many organizations pivoted toward nearshoring and the development of regional supply ecosystems to mitigate exposure to tariff volatility. This shift fostered the emergence of localized component manufacturers, driving faster innovation cycles and improved supply chain resilience. However, it also introduced transitional challenges, including longer lead times and the need for qualification of alternative parts. In response, leading sensor vendors accelerated efforts to redesign modules for compatibility with domestically produced components and entered strategic partnerships with regional foundries. These adaptations underscore the requirement for agile procurement frameworks capable of navigating an evolving tariff landscape while sustaining product performance and reliability.

Illuminating Core Segmentation Dimensions Revealing Key Insights Based on Sensor Type Technology Application End User and Installation Modalities

Based on sensor type, the ecosystem encompasses gas sensors-further categorized into catalytic gas detectors, electrochemical gas sensors, and infrared gas sensors-alongside humidity sensors, particulate matter sensors such as gravimetric particle monitors and laser scattering particle counters, pressure sensors, temperature sensors including resistance temperature detectors, thermistors, and thermocouples, and volatile organic compound sensors. Insight reveals that gas detection modules dominate early adoption in industrial safety, while compact particulate matter counters have gained traction in urban air-quality networks due to their balance of accuracy and cost efficiency. Meanwhile, advancements in nanostructured materials have driven breakthroughs in humidity and VOC sensor performance, enabling broader deployment across residential and commercial compliance applications.

From a technology perspective, electrochemical sensors maintain leadership in toxic gas quantification, whereas metal oxide semiconductor platforms are favored for their robustness in variable environmental conditions. Optical sensors and photoionization detector units are increasingly integrated into networked platforms for rapid environmental scanning, and thermal conductivity detectors offer precision in specialized process-control contexts. On the application front, aerospace implementations demand extreme miniaturization and stringent certification, automotive integrations emphasize real-time diagnostics and system interoperability, environmental monitoring networks prioritize long-term stability, HVAC systems rely on low-powered, maintenance-free modules, and industrial safety operations require fail-safe redundancy. Within end-user categories, commercial and governmental entities focus on regulatory compliance, while industrial and residential stakeholders balance performance with installation and maintenance costs. Across installation types, fixed nodes underpin smart-grid analytics and infrastructure monitoring, whereas portable instruments deliver on-the-spot diagnostics for field engineers and emergency responders.

This comprehensive research report categorizes the Atmospheric Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Type

- Technology

- Installation Type

- Application

- End User

Dissecting Regional Dynamics of the Atmospheric Sensor Ecosystem Across Americas Europe Middle East Africa and Asia-Pacific Market Advancements

In the Americas, momentum is concentrated in North America, where stringent EPA guidelines and municipal smart-city initiatives drive investment in comprehensive monitoring networks. Major metropolitan areas have rolled out sensor-enabled street-level air-quality stations, while industrial zones prioritize continuous emissions monitoring to adhere to tightening environmental legislation. Canada’s emphasis on clean-tech innovation has also accelerated pilot projects in remote locations, leveraging satellite-linked sensor arrays to track cross-border pollutant flows.

Within Europe, Middle East, and Africa, the European Union’s evolving air quality directive and corporate sustainability mandates have catalyzed widespread sensor network deployments. Companies across the region are integrating atmospheric data into digital twins for urban planning and process-optimization use cases. Meanwhile, in the Middle East, rapid infrastructure growth and heightened concerns over particulate blow-in have elevated demand for robust, high-range dust and gas detection solutions. In Africa, nascent regulatory frameworks have prompted collaborative projects among governmental bodies, NGOs, and private entities to deliver air-quality monitoring in urban centers.

The Asia-Pacific region exhibits dynamic growth driven by megacity pollution challenges in China and India, where government measures to curb smog and industrial emissions have triggered large-scale sensor rollouts. Japan and South Korea focus on ultra-low-power modules within consumer appliances, while Australia’s mining and agricultural sectors deploy atmospheric sensors for workplace safety and remote environmental monitoring. Together, these regional dynamics underscore the necessity for tailored deployment strategies that align with diverse regulatory, infrastructural, and application-specific requirements.

This comprehensive research report examines key regions that drive the evolution of the Atmospheric Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unraveling Competitive Positioning and Strategic Initiatives of Leading Entities Shaping the Future of Atmospheric Sensor Innovation

Leading players have pursued distinct strategic initiatives to reinforce their competitive posture in the atmospheric sensor domain. One global conglomerate expanded its portfolio by introducing connectivity-enabled air quality modules that integrate seamlessly with cloud-based analytics platforms, enabling real-time insights and predictive alerts. A specialized semiconductor manufacturer invested in next-generation MEMS fabrication lines to deliver ultra-compact gas and particulate matter sensors tailored for mobile devices.

Regional manufacturers have differentiated by focusing on bespoke solutions for specific verticals, such as ports and refineries, embedding advanced optical sensors within existing industrial control systems. Collaboration between prominent sensor suppliers and major industrial automation firms has accelerated the integration of gas detection modules into programmable logic controller architectures, streamlining deployment and maintenance. Meanwhile, a Europe-based innovator announced a partnership with an AI analytics provider to enhance anomaly detection in multi-parameter sensor streams, reducing false alarms and driving operational efficiency. Across the landscape, mergers and acquisitions have targeted companies with specialized materials expertise or niche application know-how, illustrating a sector in consolidation as well as rapid technological evolution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Atmospheric Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aclima, Inc.

- Aeroqual Limited

- Alphasense Ltd.

- Amphenol Corporation

- ams-OSRAM AG

- Bosch Sensortec GmbH

- Campbell Scientific, Inc.

- Figaro Engineering Inc.

- General Electric Company

- Honeywell International Inc.

- Met One Instruments, Inc.

- OMRON Corporation

- Plume Labs SAS

- Sensirion AG Switzerland

- Siemens AG

- Sierra Nevada Corporation

- Texas Instruments Incorporated

- Thermo Fisher Scientific Inc.

- Vaisala Oyj

Empowering Industry Leaders with Actionable Recommendations to Navigate Technological Complexity Regulatory Challenges and Market Evolution Trajectories

Industry leaders must adopt a proactive approach to supply chain resilience by diversifying component sources across multiple geographies and qualifying alternative suppliers for critical subassemblies. Investing in modular platform architectures can accelerate time to market and facilitate seamless integration of emerging sensor technologies. Engaging early with regulatory bodies and standards organizations will help anticipate compliance requirements and influence the development of pragmatic certification frameworks.

In tandem, organizations should reinforce data analytics capabilities by incorporating edge-AI modules within sensor nodes to execute localized processing and reduce bandwidth demands. Prioritizing interoperability through open protocol support will enable scalable network architectures and foster ecosystem partnerships. To capitalize on regional growth opportunities, companies should establish local service teams and pilot projects that demonstrate value to end users. Finally, cultivating collaborations with academic institutions and industry consortia can accelerate innovation cycles and de-risk R&D investments in next-generation sensing materials and methodologies.

Detailing Rigorous Research Methodology Ensuring Comprehensive Data Integrity Multi-Source Verification and Analytical Robustness in Sensor Market Studies

This analysis combines extensive secondary research with rigorous primary data collection to ensure accuracy, relevance, and analytical depth. Secondary sources include peer-reviewed journals, technical white papers, patent filings, and regulatory documentation. These inputs established a foundational understanding of technological principles, materials science advancements, and policy frameworks.

Primary research efforts involved structured interviews with C-level executives, R&D directors, and procurement managers across sensor manufacturers, system integrators, and end-user organizations. In addition, field surveys captured operational feedback from environmental agencies and industrial safety teams. All quantitative and qualitative data underwent triangulation to validate consistency and resolve discrepancies. A multi-layer review process, encompassing expert panels and methodological audits, assured fidelity at each stage of analysis.

Segmentation schemas were defined along five critical dimensions: sensor type, enabling technology, application sector, end-user category, and installation modality. Regional assessments covered the Americas, Europe Middle East and Africa, and Asia-Pacific territories. Findings were synthesized through bespoke analytical models that emphasize cross-reference validation rather than reliance on singular data streams. This robust approach underpins the credibility of insights and supports strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Atmospheric Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Atmospheric Sensors Market, by Sensor Type

- Atmospheric Sensors Market, by Technology

- Atmospheric Sensors Market, by Installation Type

- Atmospheric Sensors Market, by Application

- Atmospheric Sensors Market, by End User

- Atmospheric Sensors Market, by Region

- Atmospheric Sensors Market, by Group

- Atmospheric Sensors Market, by Country

- United States Atmospheric Sensors Market

- China Atmospheric Sensors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Synthesis Highlighting Critical Takeaways Strategic Implications and Future Trajectories in the Atmospheric Sensor Domain

This comprehensive synthesis underscores the profound transformation of the atmospheric sensor landscape. Technological breakthroughs in miniaturization, connectivity, and analytics are converging with evolving regulatory mandates to reshape deployment strategies across all end-use environments. The effects of recent tariff policies have accelerated supply chain realignments and driven regional manufacturing initiatives, while segmentation insights reveal differentiated demands by sensor type, technology basis, application domain, end user, and installation modality.

Regional dynamics highlight disparate growth trajectories and compliance pressures in the Americas, Europe Middle East and Africa, and Asia-Pacific, emphasizing the necessity for tailored market approaches. Competitive analysis shows that leading entities are leveraging strategic partnerships, technological acquisitions, and platform expansions to secure advantaged positions. The actionable recommendations provided offer a clear roadmap for practitioners to mitigate risks, align innovation efforts, and capture emerging opportunities.

As the atmospheric sensor domain continues to advance, organizations that integrate agile sourcing strategies, robust data architectures, and collaborative ecosystems will be best positioned to maintain leadership. This synthesis equips decision-makers with a holistic perspective to inform strategic planning and execute initiatives that address both current compliance requirements and future environmental monitoring imperatives.

Driving Immediate Engagement and Personalized Consultations with Associate Director Sales Marketing to Secure Essential Atmospheric Sensor Market Intelligence

We invite you to engage directly with Ketan Rohom, Associate Director of Sales and Marketing, to explore how this in-depth atmospheric sensor market report can empower your strategic planning and operational decisions. Ketan’s expertise will help tailor insights to your specific organizational objectives, whether you seek deeper segmentation analyses, bespoke regional assessments, or targeted technology evaluations. Reach out today to schedule a personalized consultation and unlock the full potential of this intelligence for your next-generation environmental monitoring initiatives.

- How big is the Atmospheric Sensors Market?

- What is the Atmospheric Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?