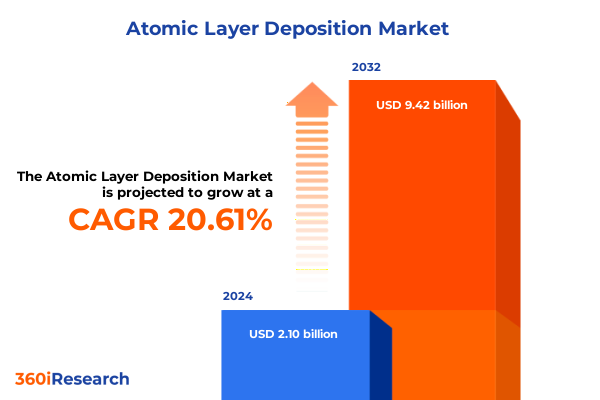

The Atomic Layer Deposition Market size was estimated at USD 5.50 billion in 2025 and expected to reach USD 5.97 billion in 2026, at a CAGR of 9.26% to reach USD 10.22 billion by 2032.

Unveiling the Transformational Power of Atomic Layer Deposition as a Cornerstone Technology Driving Precision, Efficiency, and Innovation Across Emerging High-Tech Sectors

Atomic layer deposition has emerged as a pivotal thin-film growth technique distinguished by its atomic-level precision and unparalleled uniformity, enabling a host of advanced technological innovations across semiconductors, energy storage, and protective coatings. Leveraging sequential, self-limiting surface reactions, this methodology facilitates exact control over film thickness and composition at the angstrom scale. As industries demand increasingly sophisticated material properties and device architectures, atomic layer deposition stands at the forefront of enabling next-generation performance and reliability.

The introduction to this executive summary sets the stage for an in-depth exploration of how atomic layer deposition underpins critical advances in microelectronics miniaturization, high-efficiency photovoltaics, and specialized barrier layers for corrosion resistance. Beyond its technical merits, the technology’s adoption trajectory reflects dynamic market drivers, including shifting supply chain paradigms and evolving regulatory landscapes. In the following sections, we will examine landmark industry transformations, assess policy impacts, delve into multi-faceted segmentation insights, and propose strategic imperatives for stakeholders aiming to harness the full potential of this transformative deposition approach.

Exploring the Groundbreaking Advances and Disruptive Innovations Shaping the Atomic Layer Deposition Landscape in Response to Emerging Industry Demands

Industrial and research communities have witnessed sweeping transformative shifts in the atomic layer deposition landscape, spurred by continuous innovation in equipment design and process chemistries. Recent advances in single-wafer and roll-to-roll systems have accelerated throughput while preserving atomic-level uniformity, effectively bridging the gap between laboratory-scale exploration and high-volume commercial production. These technological leaps have propelled atomic layer deposition beyond traditional semiconductor domains, enabling its integration into flexible electronics, advanced sensors, and emerging energy storage devices.

Concurrently, material diversification has unfolded rapidly, with new precursor chemistries for nitrides, fluorides, and complex oxides enhancing the functional versatility of deposited films. This expansion of material portfolios has catalyzed novel applications, such as ultra-thin barrier layers for perovskite solar cells and conformal coatings tailored for micro-electromechanical sensors. Together, these advancements are reshaping research priorities and influencing capital investments across both established and nascent industries.

Moreover, the landscape is being redefined by a surge in strategic collaborations between equipment vendors, material suppliers, and end-user innovators. As a result, atomic layer deposition has evolved from a niche technique into a mainstream enabler of precision manufacturing, underpinning critical pathways to next-generation device architectures and materials breakthroughs.

Assessing the Compounding Effects of Recent United States Tariffs on Atomic Layer Deposition Equipment Supply Chains and Industry Cost Structures in 2025

In 2025, the cumulative impact of United States tariffs on imported atomic layer deposition equipment has introduced a new layer of complexity to global supply chains, elevating procurement costs and prompting strategic realignment of manufacturing footprints. While the imposition of additional duty rates under trade policy measures aimed at protecting domestic industries was intended to spur onshore innovation, it has concurrently amplified lead times and compelled original equipment manufacturers to reassess their global sourcing strategies.

Industry participants have responded by intensifying dialogues with domestic system integrators to mitigate exposure to tariff-induced cost escalations. At the same time, equipment designers have accelerated the development of modular architectures that can be assembled in multiple regions, thereby enhancing flexibility and resilience. As a result, decision-makers are now weighing the balance between short-term cost implications and the long-term benefits of localized production capabilities.

Despite these headwinds, the redistribution of supply chains has fostered closer collaboration between equipment manufacturers, domestic suppliers, and research institutions. This closer alignment is driving a reconfiguration of innovation ecosystems and accelerating the maturation of homegrown process chemistries. Ultimately, the net effect of these tariff measures is manifesting as both a catalyst for domestic capability building and a challenge to established cost optimization models within the atomic layer deposition industry.

Deriving Strategic Insights Through Multidimensional Segmentation of Equipment, Materials, Applications, and Industry Verticals in Atomic Layer Deposition

A multidimensional segmentation analysis uncovers strategic nuances that are critical for stakeholders seeking to navigate the atomic layer deposition market effectively. When examining equipment type, the interplay between batch systems, roll-to-roll platforms, and single-wafer configurations reflects divergent value propositions: batch setups continue to attract interest for high-volume coating applications, roll-to-roll approaches are gaining traction in flexible electronic substrates, and single-wafer systems remain indispensable for advanced node semiconductor fabrication.

In parallel, material segmentation reveals a dynamic shift toward specialized precursors. Fluorides and nitrides are increasingly employed in niche dielectric barriers, while metals such as copper, platinum, and ruthenium are being harnessed for their unique catalytic and conductivity properties. Oxides continue to underpin many foundational applications, yet the real momentum lies in hybrid material formulations that combine multiple elemental layers to achieve tailored functionalities.

The application spectrum further delineates the technology’s reach, from anti-corrosion and anti-reflective coatings to high-performance displays employing both LCD and OLED architectures. Energy storage domains, spanning battery and supercapacitor enhancements, leverage atomic layer deposition to bolster electrode lifespans and charge efficiencies. Semiconductors, encompassing foundry services, logic device innovation, and memory technologies, depend on atomic layer deposition for critical layer conformality. Biosensors, gas sensors, and MEMS devices demand the ultra-thin, pinhole-free coatings that only atomic layer deposition can deliver, while solar cell advancements across crystalline silicon, perovskite, and thin-film platforms rely on its precision to optimize light absorption and stability.

End-user industry segmentation illuminates additional strategic contours. Aerospace and defense sectors are applying atomic layer deposition to avionics and space systems for enhanced environmental resilience. Automotive manufacturers, both in electric vehicle powertrains and internal combustion engine components, are adopting surface treatments to elevate durability and thermal management. Consumer electronics, telecommunications infrastructure, and wearable device makers prioritize miniaturization and reliability, rendering atomic layer deposition a central enabler. Energy enterprises, spanning storage solutions and power generation assets, seek electrode and grid component improvements, while healthcare innovators exploit biocompatible coatings and sensor enhancements to advance diagnostic and therapeutic tools.

This comprehensive research report categorizes the Atomic Layer Deposition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deposition Process Type

- Equipment Type

- Coating Type

- Film Thickness

- Substrate Type

- Application

- End-User Industry

Decoding Regional Market Dynamics by Examining Drivers, Challenges, and Opportunities Across Americas, Europe Middle East Africa, and Asia-Pacific in ALD Sector

Regional dynamics in the atomic layer deposition sector are shaped by distinct innovation drivers, policy environments, and investment landscapes. In the Americas, a strong push toward semiconductor sovereignty and energy storage leadership has galvanized collaborations between federal research programs and private industry. This has resulted in enhanced domestic capacity for both equipment manufacturing and advanced material synthesis, as stakeholders seek to reduce reliance on external supply chains and secure critical technology assets.

Across Europe, the Middle East, and Africa, regulatory emphasis on sustainability and circular economy principles is steering the development of environmentally responsible precursors and low-energy deposition techniques. The presence of mature industrial clusters, particularly in Western Europe, fosters cross-border partnerships that accelerate process innovation, while emerging hubs in the Middle East are channeling sovereign wealth into next-generation manufacturing facilities. In Africa, nascent research ecosystems are beginning to harness atomic layer deposition for renewable energy and sensor applications tailored to local market needs.

The Asia-Pacific region continues to command the lion’s share of production and research activity, driven by robust semiconductor fabrication capacity and rapidly expanding energy technology deployments. National investments in cutting-edge wafer fabs, coupled with targeted incentives for clean energy initiatives, have spurred equipment demand and process optimization efforts. As a result, Asia-Pacific serves as both a hotbed of technological experimentation and a critical node in global supply chains, reinforcing its position as a bellwether for industry trends.

This comprehensive research report examines key regions that drive the evolution of the Atomic Layer Deposition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Landscapes by Highlighting Leading Atomic Layer Deposition Providers, Their Technological Differentiators, and Strategic Partnerships

The competitive landscape of atomic layer deposition is defined by a handful of companies that combine deep domain expertise with continuous innovation in equipment design and process chemistries. These organizations have differentiated themselves through proprietary precursor development, advanced reactor architectures, and strategic collaborations that extend their technological reach into adjacent application areas.

Leading suppliers are investing heavily in next-generation platforms that deliver higher throughput, lower total cost of ownership, and expanded material compatibility. Partnerships with specialty chemical producers have yielded new precursor families optimized for emerging substrate materials, while alliances with research consortia are accelerating the commercialization of novel deposition processes. In parallel, some firms are integrating digital twins and predictive maintenance tools to enhance operational uptime and reduce end-user barriers to adoption.

Amid these dynamics, select players are pursuing vertical integration strategies, offering bundled solutions that encompass both equipment hardware and consumables, alongside dedicated process support. This holistic approach not only locks in recurring revenue streams but also facilitates faster adoption cycles, as end users can source end-to-end services from a single partner. As the market continues to evolve, companies that can anticipate application-specific requirements and deliver turnkey solutions will be best positioned to capture sustained growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Atomic Layer Deposition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adeka Corporation

- Aixtron SE

- ALD NanoSolutions, Inc.

- Anric Technologies LLC

- Applied Materials, Inc.

- Arradiance, LLC

- ASM International N.V.

- Beneq Oy

- Canon Anvela Corporation

- CVD Equipment Corporation

- Denton Vacuum LLC

- Encapsulix SAS

- Entegris, Inc.

- Eugenus, Inc.

- Forge Nano, Inc.

- Hitachi, Ltd.

- HZO, Inc.

- Kurt J. Lesker Company

- Lam Research Corporation

- Merck KGaA

- NCD Co., Ltd.

- Oxford Instruments PLC

- SENTECH Instruments GmbH

- Sioux Technologies B.V.

- Tokyo Electron Limited

- Veeco Instruments Inc.

Formulating Proactive Strategies and Tactical Roadmaps for Industry Leaders to Capitalize on Atomic Layer Deposition Advancements and Market Opportunities

Industry leaders aiming to harness the full potential of atomic layer deposition should adopt a forward-looking innovation agenda that prioritizes modular equipment architectures, precursor co-development partnerships, and digitalization of process controls. By investing in adaptable reactor designs, organizations can future-proof their capital assets against shifting production requirements and rapidly scale into new application domains.

Moreover, stakeholders should cultivate collaborative ecosystems that bring together equipment vendors, material suppliers, and research institutions, enabling co-creation of solutions that address complex performance specifications. This collaborative approach reduces time to market for novel processes and lowers technical risk by leveraging cross-functional expertise. Concurrently, establishing in-house pilot lines dedicated to testing emerging precursors and substrates can yield critical process insights that inform broader commercial rollouts.

Finally, executives must integrate actionable market intelligence with regulatory and policy foresight, ensuring that strategic roadmaps align with evolving trade environments, sustainability mandates, and localization requirements. By coupling robust scenario planning with agile decision-making frameworks, industry leaders can navigate external uncertainties and convert potential disruptions into competitive advantages.

Outlining Rigorous Research Methodology Combining Primary Expert Consultations and Comprehensive Secondary Analysis to Ensure Robust Atomic Layer Deposition Insights

This analysis integrates a rigorous research framework combining primary expert consultations and extensive secondary literature review. Internal data sources encompass archived patent analyses, corporate white papers, and technical conference proceedings, which were cross-referenced against public filings and trade association reports. To enrich these insights, we conducted in-depth interviews with key executives, process engineers, and materials scientists, thereby capturing real-world perspectives on technology adoption and market dynamics.

Complementing qualitative inputs, the study employed comprehensive segmentation analysis across equipment types, precursor materials, applications, and end-user industries. Regional market assessments were informed by policy documentation, investment portfolios, and infrastructure development plans, while competitive benchmarking drew on corporate disclosures and strategic partnership announcements. Quality checks included data triangulation and sensitivity analyses to ensure the robustness of findings.

Throughout the research process, strict protocols were followed to uphold data integrity, confidentiality, and methodological transparency. Limitations of the study and areas for future investigation are documented separately, providing a roadmap for ongoing research refinement and deeper exploration of emerging atomic layer deposition frontiers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Atomic Layer Deposition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Atomic Layer Deposition Market, by Deposition Process Type

- Atomic Layer Deposition Market, by Equipment Type

- Atomic Layer Deposition Market, by Coating Type

- Atomic Layer Deposition Market, by Film Thickness

- Atomic Layer Deposition Market, by Substrate Type

- Atomic Layer Deposition Market, by Application

- Atomic Layer Deposition Market, by End-User Industry

- Atomic Layer Deposition Market, by Region

- Atomic Layer Deposition Market, by Group

- Atomic Layer Deposition Market, by Country

- United States Atomic Layer Deposition Market

- China Atomic Layer Deposition Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Summarizing Key Findings to Illuminate Future Trajectories and Strategic Imperatives for Atomic Layer Deposition Adoption and Innovation

The convergence of technological advances, evolving policy frameworks, and shifting supply chain paradigms underscores atomic layer deposition’s critical role in modern manufacturing and materials science. From enabling semiconductor miniaturization to bolstering the performance of next-generation energy storage systems, the technique’s atomic-level precision is unlocking pathways to breakthrough innovations.

Key trends highlighted in this summary - including modular equipment architectures, diversified precursor portfolios, and collaborative innovation ecosystems - paint a picture of an industry poised for continued expansion across multiple sectors. Despite headwinds such as tariff-induced cost pressures and regional supply chain realignments, strategic investments and proactive partnerships are mitigating risks and paving the way for sustainable growth.

Ultimately, the ability of organizations to integrate these insights into targeted R&D programs, flexible manufacturing strategies, and informed policy engagements will determine their success in harnessing atomic layer deposition’s full potential. This executive summary serves as a foundational guide for executives and decision-makers seeking to align their strategic imperatives with the evolving contours of this transformative technology.

Seize Cutting-Edge Atomic Layer Deposition Intelligence Today by Connecting with Ketan Rohom to Elevate Your Strategic Decision-Making and Competitive Edge

To secure unparalleled strategic foresight and competitive advantage in the rapidly evolving arena of atomic layer deposition, we encourage you to reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to explore how this comprehensive market research can empower your organization’s growth ambitions. Engaging with Ketan Rohom will enable you to delve deeper into the nuanced insights presented in this report and to tailor findings to your specific business needs, whether your focus is on equipment innovation, material optimization, application development, or regional expansion strategies.

Through a personalized consultation, you will gain clarity on how to navigate the complex interplay of technological drivers, regulatory shifts, and competitive dynamics that define the atomic layer deposition landscape today. By partnering with Ketan Rohom, you will receive guidance on extracting the most actionable takeaways from the report’s multi-dimensional analysis and transforming them into high-impact strategies. Make the strategic choice to elevate your organization’s decision-making framework and future-proof your investments in atomic layer deposition technology by engaging with Ketan Rohom to purchase this essential market research report

- How big is the Atomic Layer Deposition Market?

- What is the Atomic Layer Deposition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?