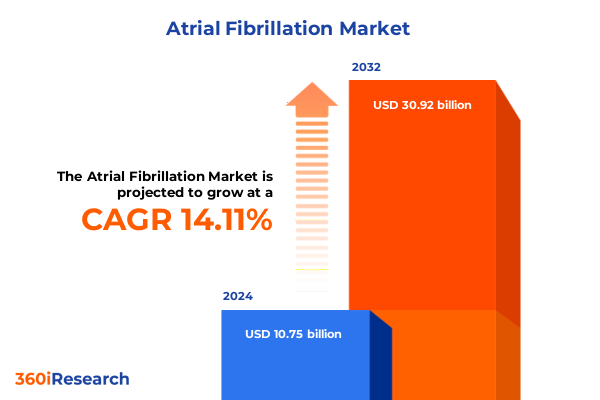

The Atrial Fibrillation Market size was estimated at USD 12.26 billion in 2025 and expected to reach USD 13.89 billion in 2026, at a CAGR of 14.12% to reach USD 30.92 billion by 2032.

Positioning the Atrial Fibrillation Landscape for Strategic Insights into Evolving Treatment Modalities and Regulatory Advancements

Atrial fibrillation represents the most prevalent sustained cardiac arrhythmia in clinical practice, imposing a significant health burden worldwide. In the United States, its estimated prevalence was 5.2 million in 2010 and is projected to climb to 12.1 million by 2030, driven largely by demographic shifts and an aging population. Beyond mere rhythm irregularities, atrial fibrillation markedly elevates the risk of stroke, heart failure, and mortality, underscoring the urgency for precise diagnostic and therapeutic approaches.

This chronic condition is associated with substantial morbidity, including a 2.4-fold increased risk of ischemic stroke and a 5-fold rise in heart failure incidence, as well as heightened rates of cognitive decline and peripheral vascular events. Moreover, lifetime risk estimates approach 30% to 40% among White individuals and remain significant across all racial and ethnic groups, reflecting a pervasive public health challenge that transcends demographic boundaries.

In response to this growing clinical demand, treatment paradigms have evolved rapidly. Recent guidelines from leading professional societies emphasize multifaceted management strategies, integrating early lifestyle modifications, precision pharmacotherapy, and advanced procedural interventions such as catheter ablation. These recommendations highlight an individualized care model that leverages emerging technologies to optimize outcomes, establishing the foundation for this comprehensive market analysis.

Revolutionary Advances in Diagnostic Technologies Mapping Systems and Minimally Invasive Modalities Redefining Patient-Centric Atrial Fibrillation Management

The atrial fibrillation landscape has undergone a renaissance of innovation, fueled by breakthroughs in diagnostic and therapeutic technologies. Wearable devices with integrated photoplethysmography sensors now enable continuous rhythm surveillance outside of traditional clinical settings, facilitating earlier detection of asymptomatic episodes and promoting timely intervention. Notably, consumer-grade wearables have demonstrated promising sensitivity for atrial fibrillation screening in large-scale cohorts, reshaping screening paradigms and patient engagement strategies.

Simultaneously, the procedural arena has witnessed the rise of pulsed field ablation systems, which offer selective myocardial tissue targeting while sparing adjacent structures. Early trial data indicate safety and efficacy profiles comparable to traditional thermal ablation, with reduced risk of collateral injury. These systems, exemplified by FDA-approved PFA platforms, are catalyzing operator interest and redefining electrophysiology workflows by shortening procedure times and enhancing lesion durability.

Advancements in three-dimensional electro-anatomical mapping and real-time imaging integration have further elevated procedural precision. Enhanced mapping systems now support high-resolution substrate characterization and automated lesion set generation, empowering electrophysiologists to tailor ablation strategies to individual patient anatomy. As a result, treatment success rates have improved while procedural complications have declined, driving increased adoption across diverse care settings.

Assessing How the 2025 Wave of U.S. Trade Tariffs on Medical Equipment Has Reshaped Device Accessibility Efficiency and Supply Chain Resilience

In April 2025, the U.S. implemented a 10% baseline tariff on most imported goods, encompassing critical healthcare components from active pharmaceutical ingredients to specialized medical devices. This measure, aimed at incentivizing domestic production, has increased costs for arrhythmia management tools and therapeutics, compelling providers to reevaluate procurement strategies and supply chain configurations. Electrophysiology laboratories, reliant on imported catheters and mapping systems, have felt the impact acutely, prompting negotiations for long-term contracts to mitigate tariff exposure.

Beyond the global tariff, additional duties of up to 25% have been imposed on medical devices originating from Canada and Mexico, while certain high-volume consumables, including syringes and diagnostic kits, face levies of 50% under Section 301 provisions. Hospitals report these increased supply costs have strained operating budgets, leading to deferred capital investments in new electrophysiology infrastructure and heightening interest in domestically produced alternatives.

Although a recent U.S. court decision temporarily blocked portions of the proposed tariff schedule, uncertainty persists. Manufacturers estimate potential import duties up to 145% on select device components if litigation fails to resolve by year-end. Consequently, industry stakeholders are intensifying efforts to diversify supplier networks, invest in on-shore manufacturing partnerships, and engage policymakers to secure critical exemptions for life-saving medical technologies.

In-Depth Examination of Market Segmentation Highlighting How Treatment Types Device Modalities Clinical Indications End Users and Channels Drive Strategic Decisions

Analysis of atrial fibrillation market segmentation reveals that interventional procedures and pharmacological agents coexist as complementary pillars of care, with catheter ablation capturing significant attention for its curative potential. Within the nonpharmacological domain, advances in device closure and surgical ablation address complex atrial substrate, yet catheter-based approaches remain the clinical mainstay. Conversely, pharmacotherapy continues to evolve, as novel anticoagulants challenge traditional vitamin K antagonists and targeted antiarrhythmics refine rate- and rhythm-control paradigms.

Device type segmentation underscores the predominance of ablation catheters, driven by the integration of pulsed field and radiofrequency energy delivery systems. Complementary technologies, such as mapping and cryoablation platforms, enhance procedural versatility and operator confidence. Indication-based analysis differentiates paroxysmal atrial fibrillation as the initial focus for interventional strategies, while persistent and permanent forms demand more complex lesion sets and hybrid approaches spanning device closure and medical management.

End users range from hospitals, which maintain comprehensive electrophysiology suites, to ambulatory surgical centers whose streamlined protocols and same-day discharge models offer cost efficiencies. Distribution channels mirror these trends, as hospital pharmacies secure high-volume product flows and specialty online pharmacies emerge to serve decentralized care pathways. Age segmentation highlights the concentration of cases among patients over 61, yet growing detection in the 41-to-60 cohort signals an evolving demographic profile that shapes preventive and therapeutic investments.

This comprehensive research report categorizes the Atrial Fibrillation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Device Type

- Indication

- Age Group

- End User

Regional Dynamics Uncovered Revealing How The Americas Europe Middle East Africa and Asia Pacific Are Shaping Atrial Fibrillation Treatment Trajectories

Regional analysis of the atrial fibrillation landscape showcases distinct growth trajectories and market drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, mature healthcare infrastructure, expansive insurance coverage, and robust electrophysiology program penetration underpin sustained demand for advanced ablation and monitoring technologies. This environment also fosters a competitive vendor landscape, accelerating innovation and enhancing procedural efficiency.

Within Europe, the Middle East, and Africa, heterogeneous reimbursement mechanisms and variable regulatory frameworks create both opportunities and challenges. Western European markets demonstrate strong adoption of minimally invasive therapies, while certain Middle Eastern nations channel investment into specialized cardiac centers. Nonetheless, supply chain complexities and pricing pressures in emerging economies require strategic alliances and tailored market access initiatives to optimize product launch and uptake.

Asia-Pacific represents the highest growth potential, driven by aging populations, expanding central hospital networks, and government incentives for cardiovascular disease management. Nations such as Japan, South Korea, and Australia lead the region in procedural volumes, while China and India rapidly build capacity through hospital partnerships and training programs. These dynamics position Asia-Pacific as a focal point for device manufacturers seeking new revenue streams and long-term strategic alignment.

This comprehensive research report examines key regions that drive the evolution of the Atrial Fibrillation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Exploration of Key Industry Players Showcasing FDA Approvals Strategic Collaborations Product Innovations and Market Positioning Dynamics in 2025

The competitive landscape is anchored by major electrophysiology and medical device companies that continuously refine product portfolios and pursue strategic collaborations. Boston Scientific, leveraging its FARAPULSE pulsed field ablation system and the Watchman left atrial appendage closure device, has experienced strong procedural uptake and recently revised its earnings outlook upward in response to sustained demand. Its focus on integrated systems reflects a broader market shift toward bundled solutions.

Medtronic remains a key innovator with the PulseSelect pulsed field ablation platform, which holds FDA approval for both paroxysmal and persistent atrial fibrillation. The system’s safety profile and ease of use have positioned it as a preferred choice among electrophysiologists seeking streamlined workflows and reproducible lesion sets. Ongoing clinical evaluations continue to inform its expansion into first-line therapy applications.

Johnson & Johnson MedTech rounds out the leading triad with its VARIPULSE platform, uniquely integrated with a 3D mapping system to enable zero-fluoro procedural protocols. Endorsed by positive registries and FDA approval for paroxysmal cases, this system underscores the company’s commitment to reducing procedural risk and enhancing procedural efficiencies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Atrial Fibrillation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Acutus Medical, Inc.

- AliveCor, Inc.

- AtriCure, Inc.

- Biosense Webster, Inc.

- BIOTRONIK SE & Co. KG

- Boston Scientific Corporation

- CardioFocus, Inc.

- CathRx Ltd.

- Imricor Medical Systems, Inc.

- iRhythm Technologies, Inc.

- Johnson & Johnson Services, Inc.

- Kardium Inc.

- Koninklijke Philips N.V.

- Lepu Medical Technology (Beijing) Co., Ltd.

- Medtronic plc

- MicroPort Scientific Corporation

- Siemens Healthineers AG

- Stereotaxis, Inc.

- Volta Medical Ltd.

Strategic Roadmap Outlining Actionable Recommendations for Industry Leaders to Enhance Competitiveness Adapt to Trade Pressures Innovate Treatment Offerings and Expand Outreach

To navigate evolving tariff environments and ensure uninterrupted access to essential devices, organizations should establish diversified procurement strategies. Engaging multiple suppliers across geographies, negotiating long-term contracts, and exploring domestic manufacturing partnerships can buffer against sudden cost escalations and regulatory shifts. Active policy advocacy for critical medical device exemptions will further stabilize supply chains and preserve affordability.

In parallel, stakeholders must accelerate investment in digital health and remote monitoring platforms. Integrating wearable sensors with telemedicine services not only enhances early detection of atrial fibrillation but also supports chronic disease management and patient engagement. Cross-functional collaboration between cardiology, information technology, and data analytics teams is essential to implement scalable solutions that meet regulatory and privacy standards.

Finally, industry leaders should expand access by leveraging ambulatory surgical centers for appropriate electrophysiology procedures. Collaborating with payers to secure reimbursement pathways, implementing robust safety protocols, and aligning with professional society guidelines will facilitate the transition from traditional hospital settings. This approach can reduce procedural backlogs, lower costs, and improve patient satisfaction, reinforcing a more resilient care continuum.

Comprehensive Research Approach Illustrating Primary and Secondary Methodologies Data Sources Validation Techniques and Analytical Frameworks Underpinning This Atrial Fibrillation Study

This analysis synthesizes insights derived from a comprehensive research framework combining primary and secondary methodologies. Secondary research encompassed peer-reviewed literature, regulatory filings, and clinical guidelines from key professional bodies, ensuring a robust understanding of prevalence, treatment modalities, and technology adoption trends. Industry news, financial disclosures, and patent databases further informed the competitive and regional landscapes.

Primary research included expert interviews with electrophysiologists, device manufacturers, and policy advisors to validate market dynamics and identify emergent challenges. Surveys of hospital procurement teams and ambulatory surgical center administrators supplemented quantitative data, offering real-world perspectives on tariff impacts, adoption barriers, and care model innovation. A structured triangulation process cross-checked these qualitative insights against market intelligence and publicly available datasets.

Analytical techniques incorporated scenario planning to assess tariff fluctuation risks, as well as segmentation modeling to delineate treatment type, device category, indication, end user, distribution channel, and age group variations. Regional forecasting relied on demographic and healthcare expenditure projections, while competitive benchmarking employed SWOT analysis to evaluate strategic positioning. Rigorous data validation and peer review ensured the accuracy and reliability of all findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Atrial Fibrillation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Atrial Fibrillation Market, by Treatment Type

- Atrial Fibrillation Market, by Device Type

- Atrial Fibrillation Market, by Indication

- Atrial Fibrillation Market, by Age Group

- Atrial Fibrillation Market, by End User

- Atrial Fibrillation Market, by Region

- Atrial Fibrillation Market, by Group

- Atrial Fibrillation Market, by Country

- United States Atrial Fibrillation Market

- China Atrial Fibrillation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Forward-Looking Synthesis Summarizing Core Insights Emphasizing Integrated Care Approaches Emerging Technologies and Collaborative Strategies to Address Atrial Fibrillation Burden

The atrial fibrillation domain stands at the intersection of technological innovation, regulatory evolution, and shifting market forces. As demographic trends drive rising prevalence, the integration of pulsed field ablation, advanced mapping, and digital monitoring offers unprecedented opportunities to improve patient outcomes while optimizing resource utilization. Simultaneously, tariff pressures and supply chain volatility underscore the importance of resilient procurement strategies and domestic manufacturing collaborations.

Segmentation insights reveal that treatment type, device modality, and care setting choices have profound strategic implications, influencing both clinical efficacy and financial performance. The ascent of ambulatory surgical centers highlights a paradigm shift toward decentralized care models, complemented by evolving distribution channels that cater to diversified patient needs across age cohorts and geographic regions.

Looking forward, success will demand agile organizations capable of aligning R&D investments with shifting regulatory landscapes, forging partnerships across the value chain, and championing policies that safeguard access to life-saving technologies. Embracing these imperatives will empower stakeholders to deliver scalable, patient-centric solutions and solidify their competitive advantage in a rapidly evolving atrial fibrillation market.

Engage with Ketan Rohom for Tailored Guidance on Acquiring the Definitive Atrial Fibrillation Market Analysis Report and Driving Your Strategic Initiatives in This Evolving Field

To explore how this comprehensive analysis can inform your organization’s strategic direction, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan will provide you access to customized insights and premium report packages tailored to your specific objectives. Collaborate directly to discuss bespoke data requirements, gain early access to proprietary modeling, and secure strategic guidance aligned with your growth initiatives.

Take advantage of this opportunity to leverage in-depth intelligence on treatment modalities, regulatory developments, tariff impacts, and innovative device technologies. Ketan’s expertise in market dynamics and consultative approach ensures your team receives actionable recommendations that drive sustainable success. Whether you seek a high-level briefing or a deep dive into regional and segment-level nuances, Ketan can facilitate seamless access to the full report and ancillary data tools.

Connect with Ketan to arrange a personalized demonstration, request sample chapters, or inquire about licensing options. Embark on a data-driven journey to optimize your market entry strategies, align product development with emerging trends, and fortify your competitive position in the atrial fibrillation landscape with confidence.

- How big is the Atrial Fibrillation Market?

- What is the Atrial Fibrillation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?