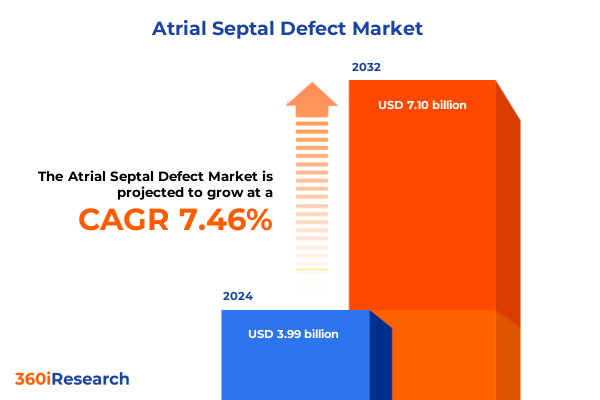

The Atrial Septal Defect Market size was estimated at USD 4.27 billion in 2025 and expected to reach USD 4.58 billion in 2026, at a CAGR of 7.53% to reach USD 7.10 billion by 2032.

Understanding Atrial Septal Defect Dynamics with a Comprehensive Overview of Clinical Perspectives Patient Care Pathways and Therapeutic Challenges

Atrial septal defect represents one of the most prevalent congenital heart anomalies encountered in clinical practice, characterized by an opening in the atrial septum that permits abnormal blood flow between the left and right atria. From asymptomatic cases detected incidentally during routine imaging to patients presenting with exercise intolerance and right ventricular volume overload, the clinical spectrum is remarkably diverse. As such, the diagnostic journey often involves echocardiography, cardiac magnetic resonance imaging, and in select scenarios, transesophageal evaluation to delineate defect morphology and hemodynamic impact. Furthermore, parallel advancements in genetic profiling and fetal imaging have broadened our understanding of disease etiology and early detection, underscoring the critical need for a unified, multidisciplinary approach to patient management.

In recent years, the convergence of interventional cardiology and minimally invasive device innovation has transformed the therapeutic paradigm. Transitioning from open-heart surgical repair to catheter-based closure techniques, clinicians now benefit from enhanced procedural precision, reduced hospital stays, and accelerated patient recovery. Simultaneously, evolving regulatory frameworks and reimbursement policies are reshaping clinical adoption pathways. Consequently, stakeholders across the continuum-from device manufacturers and distributorship networks to cardiac centers and ambulatory surgical providers-are navigating a landscape rich with opportunity as well as complexity. This report delivers a foundational overview that illuminates both the clinical imperatives and operational considerations central to advancing atrial septal defect treatment strategies in modern healthcare systems.

How Innovative Technologies and Changing Clinical Practices Are Redefining the Diagnosis and Treatment Paradigm for Atrial Septal Defect in Modern Healthcare Systems

The atrial septal defect ecosystem is undergoing a profound transformation as emerging technologies and shifting clinical protocols converge to redefine standard care practices. Over the past five years, three-dimensional intracardiac imaging and real-time electrophysiological mapping have elevated diagnostic accuracy, enabling clinicians to tailor intervention strategies to individual septal anatomies. Moreover, the increasing integration of device-agnostic software platforms has facilitated seamless interoperability between imaging modalities and catheterization lab equipment, thereby accelerating procedural workflows and reducing fluoroscopy exposure.

In parallel, the patient journey itself has evolved. Enhanced preoperative screening protocols, supported by telehealth-enabled follow-up pathways, have improved longitudinal monitoring of device integrity and patient functional status. Furthermore, reimbursement reforms have incentivized higher-value care models, encouraging providers to adopt minimally invasive closure technologies. Consequently, the clinical ecosystem is witnessing a shift from reactive interventions toward proactive disease management frameworks. Together, these transformative shifts are establishing a new paradigm for atrial septal defect care that prioritizes precision medicine, patient-centric service delivery, and sustainable operational efficiencies.

Examining the Cumulative Effect of 2025 United States Tariffs on the Global Atrial Septal Defect Device Supply Chain and Cost Structures Across Healthcare Providers

The ripple effects of the 2025 tariff adjustments instituted by the United States have been particularly pronounced for the supply chain supporting atrial septal defect devices. As import duties on select medical device components increased, manufacturers faced elevated material costs that, in turn, influenced pricing negotiations with healthcare providers. Subsequently, device developers pursued strategic sourcing initiatives, relocating certain manufacturing processes to domestic facilities or leveraging preferential trade agreements to mitigate cost pressures.

In addition, distributors recalibrated inventory management strategies to balance the heightened procurement expenses with evolving clinical demand. Some global suppliers established consignment programs and localized warehousing hubs to preserve access continuity across cardiac centers and ambulatory surgical facilities. Meanwhile, downstream stakeholders encountered new contractual frameworks outlining cost-sharing arrangements tied to device utilization rates. Consequently, the cumulative impact of these tariff measures has reshaped stakeholder alliances and prompted an industry-wide reassessment of supply chain resilience and strategic positioning within the atrial septal defect space.

Unveiling Critical Segmentation Insights to Navigate Atrial Septal Defect Treatment Modalities Patient Cohorts Healthcare Settings Distribution Channels and Device Innovations

A nuanced understanding of the atrial septal defect ecosystem demands an appreciation for how clinical subtypes, patient demographics, care settings, distribution pathways, therapeutic modalities, and device architectures intersect to influence the treatment landscape. Drawing upon clinical defect classification, the spectrum encompasses coronary sinus, primum, secundum, and sinus venosus variants, each presenting unique anatomical considerations that dictate procedural approaches. Furthermore, age stratification plays a critical role, with adult patients navigating distinct comorbid profiles compared to pediatric populations, which include adolescent, infant, and neonatal cohorts requiring tailored perioperative protocols.

Transitioning to care delivery environments, closure interventions transpire across ambulatory surgical centers, cardiac centers-encompassing both general clinics and specialist hospitals-and inpatient hospitals, whether private or public. Distribution channel strategies further augment this framework, ranging from direct manufacturer partnerships to international and national distributor networks, each with its own logistical nuances. In step with delivery mechanisms, treatment pathways diverge into medical management through pharmacotherapy, minimally invasive techniques including catheter ablation and device closure, and surgical repair options spanning open-heart and robotic procedures. Finally, device typology itself bifurcates into occluders, differentiated by self-centring and non self-centring designs, and patch materials such as autologous pericardial and Dacron compositions, underscoring the breadth of innovation shaping therapeutic options.

Collectively, these segmentation insights illuminate the complexity of patient journeys and highlight the strategic imperatives for stakeholders seeking to align product portfolios and service models with evolving clinical and operational requirements.

This comprehensive research report categorizes the Atrial Septal Defect market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Treatment Type

- Age Group

- End User

- Defect Type

Regional Landscape of Atrial Septal Defect Care Comparative Clinical Adoption Reimbursement Trends and Innovation Ecosystems in the Americas Europe Middle East & Africa and Asia-Pacific

The regional landscape for atrial septal defect care reveals distinct patterns in clinical adoption, reimbursement frameworks, and innovation ecosystems. In the Americas, robust private payer models and investment in advanced catheterization laboratory infrastructure have accelerated uptake of minimally invasive closure techniques. This environment fosters collaborative research initiatives between academic medical centers and device manufacturers, driving iterative enhancements in device design and procedural efficacy.

Conversely, the Europe Middle East & Africa region presents a heterogeneous tapestry of healthcare delivery systems, where public reimbursement mechanisms coexist alongside private specialty centers. Variation in regulatory pathways and price controls influences time to market for novel closure devices, yet ongoing harmonization efforts under transcontinental alliances are streamlining approval processes. In addition, regional centers of excellence in cardiac surgery are integrating hybrid approaches that combine surgical and percutaneous therapies to address complex septal anatomies.

Meanwhile, Asia-Pacific embodies a rapidly expanding market characterized by rising healthcare expenditure and increasing prevalence of congenital heart disease detection programs. Governments are prioritizing infrastructure upgrades and capacity-building in both urban and tier-two cities, enabling broader access to device closure options. Moreover, partnerships between global manufacturers and local distribution networks are enhancing supply reliability and fostering technology transfer initiatives that support regional device production capabilities. Together, these regional dynamics underscore the importance of tailored market engagement strategies and adaptive go-to-market frameworks across diverse healthcare environments.

This comprehensive research report examines key regions that drive the evolution of the Atrial Septal Defect market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Companies Shaping Atrial Septal Defect Therapeutics and Diagnostics Through Strategic Collaborations Technology Advancements and Clinical Pipeline Developments

Leading organizations in the atrial septal defect arena are distinguishing themselves through strategic alliances, clinical trial leadership, and product portfolio diversification. Major device innovators have established co-development partnerships with academic institutions to refine occluder geometries and patch materials, enhancing biocompatibility and long-term durability. Simultaneously, several key players are capitalizing on in-house research capabilities to advance next-generation imaging-guided delivery systems that promise greater precision and reduced procedural times.

In addition, industry stakeholders are forging distribution partnerships to extend market reach across emerging geographies, particularly within rapidly evolving Asia-Pacific healthcare markets. These collaborations are complemented by robust post-market surveillance programs, enabling real-world data collection and iterative product optimization. At the same time, specialty cardiac centers and hospitals are differentiating their service offerings by integrating multidisciplinary heart teams, combining interventional cardiology, cardiac surgery, and pediatric expertise to address increasingly complex defect presentations. Collectively, these company-level initiatives are shaping a competitive landscape defined by technological leadership, clinical differentiation, and strategic agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Atrial Septal Defect market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Arjo AB

- ASAHI INTECC CO., LTD.

- Asklepion Pharmaceuticals, LLC

- atHeart Medical AG

- AtriCure, Inc

- B. Braun Medical Inc.

- Becton, Dickinson and Company

- Bio‑tronik SE & Co. KG

- Boston Scientific Corporation

- Carag AG

- Cardia, Inc.

- Coherex Medical, Inc.

- Cook Medical, Inc

- Edwards Lifesciences

- GE HealthCare Technologies, Inc.

- Heart Medical Europe BV

- Johnson & Johnson Services, Inc.

- Kaneka Corporation

- Keystone Heart Ltd.

- Koninklijke Philips N.V.

- Lepu Medical Technology (Beijing) Co., Ltd

- Lifetech Scientific

- Medtronic PLC

- Microport Scientific Corporation

- Occlutech GmbH

- Osypka AG

- PFM Medical (Nit‑Occlud ASD‑R)

- Shanghai Shape Memory Alloy Co., Ltd.

- Siemens AG

- St. Jude Medical LLC

- Starway Medical Technology, Inc.

- Stryker Corporation

- Terumo Corporation

- Transcatheter Technologies GmbH

- Vascular Innovations

- Venus Medtech Hangzhou Inc

- Visionary Medtech Solutions

- W. L. Gore & Associates, Inc.

- Weigao Meidcal international Co., Ltd

Actionable Recommendations for Industry Leaders to Optimize Atrial Septal Defect Diagnosis Streamline Device Integration and Enhance Patient Outcomes Through Strategic Partnerships

To capitalize on evolving clinical and commercial opportunities, industry leaders should prioritize an integrated approach that accelerates device innovation while ensuring seamless stakeholder alignment across the care continuum. First, establishing cross-functional consortiums that bring together device engineers, interventional cardiologists, and reimbursement specialists can expedite the translation of design innovations into commercially viable product offerings. Moreover, investing in real-world evidence generation through registry partnerships and post-market studies will strengthen value propositions when engaging with payers and regulatory bodies.

In addition, optimizing supply chain resilience remains critical amidst ongoing tariff and geopolitical uncertainties. Consequently, exploring dual-sourcing strategies and localized manufacturing options can mitigate disruption risks. Furthermore, cultivating direct relationships with ambulatory and inpatient care providers through targeted education and training programs will enhance device adoption rates by equipping clinicians with hands-on procedural expertise. Finally, forging collaborative agreements with academic centers and policy stakeholders to inform value-based care models will align incentives across the ecosystem, driving improved patient outcomes and long-term adoption of advanced atrial septal defect solutions.

Transparent Overview of the Rigorous Research Methodology Employed in Analyzing Atrial Septal Defect Market Dynamics and Evidentiary Clinical Data Aggregation Processes

The research underpinning this analysis leverages a multi-phased methodology designed to ensure depth, rigor, and objectivity. Initially, a comprehensive literature review was conducted, encompassing peer-reviewed journals, clinical trial registries, regulatory filings, and conference proceedings to map the current state of atrial septal defect diagnosis and intervention strategies. Concurrently, structured interviews were carried out with leading electrophysiologists, cardiothoracic surgeons, and health economics experts to capture firsthand insights into clinical practice variations and reimbursement landscapes.

Subsequently, a targeted database of device approvals, patent filings, and company disclosures was synthesized to identify emerging technology trends and pipeline developments. Regional stakeholder consultations provided granular perspectives on distribution dynamics and policy environments. Finally, cross-validation of secondary data through primary outreach to hospital procurement teams and distributor networks ensured the integrity of supply chain and adoption-related findings. Throughout this process, adherence to ethical research standards and data privacy regulations was maintained, guaranteeing that the conclusions drawn offer a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Atrial Septal Defect market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Atrial Septal Defect Market, by Product Type

- Atrial Septal Defect Market, by Treatment Type

- Atrial Septal Defect Market, by Age Group

- Atrial Septal Defect Market, by End User

- Atrial Septal Defect Market, by Defect Type

- Atrial Septal Defect Market, by Region

- Atrial Septal Defect Market, by Group

- Atrial Septal Defect Market, by Country

- United States Atrial Septal Defect Market

- China Atrial Septal Defect Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Perspectives on Atrial Septal Defect Market Dynamics Emphasizing Future Research Directions Sustainable Care Models and Collaborative Innovation Pathways

In summary, the atrial septal defect therapeutic landscape is characterized by rapid technological advancements, shifting care delivery models, and the imperative for resilient supply chains. The convergence of precision imaging, minimally invasive delivery systems, and value-based care frameworks is redefining patient pathways and strengthening stakeholder alignment. Furthermore, regional variations in reimbursement and regulatory processes underscore the necessity of tailored engagement strategies across the Americas, Europe Middle East & Africa, and Asia-Pacific.

Moving forward, enduring success will hinge on collaborative innovation, underpinned by robust real-world evidence and dynamic cost-management practices. Companies that adeptly navigate segmentation complexities-ranging from defect subtype nuances to age-specific treatment protocols and diversified distribution channels-will be well positioned to capture emerging opportunities. Ultimately, sustained patient-centric advancements in atrial septal defect management will require collective dedication from device engineers, clinical specialists, policymakers, and distribution partners working in concert to deliver safer, more effective, and accessible solutions.

Take the Next Step in Advancing Atrial Septal Defect Care by Engaging with Ketan Rohom to Access the Comprehensive Market Research Report Today

To explore the full breadth of insights on the atrial septal defect landscape and equip your organization with strategic intelligence, reach out directly to Ketan Rohom. As Associate Director, Sales & Marketing, Ketan can guide you through the report’s detailed analyses, customized data offerings, and value-added consulting options. Engaging with him ensures that you obtain actionable, data-driven recommendations tailored to your specific clinical, operational, and market-entry objectives. Elevate your decision-making process and secure a competitive advantage in the atrial septal defect space by partnering with an expert who understands your unique needs and can provide real-time support for procurement and implementation.

- How big is the Atrial Septal Defect Market?

- What is the Atrial Septal Defect Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?