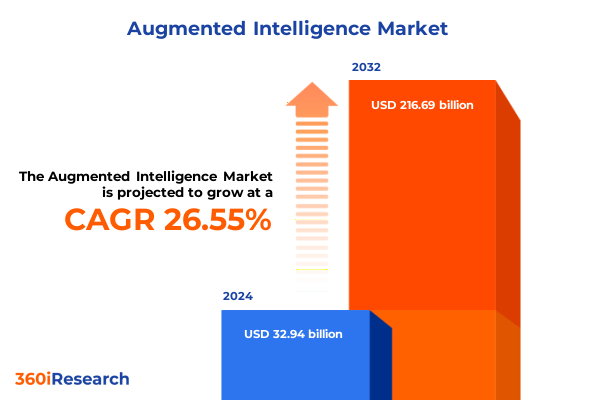

The Augmented Intelligence Market size was estimated at USD 41.21 billion in 2025 and expected to reach USD 51.76 billion in 2026, at a CAGR of 26.75% to reach USD 216.69 billion by 2032.

Unveiling the Strategic Imperatives of Augmented Intelligence Adoption in Rapidly Evolving Business Environments and Competitive Markets

Augmented intelligence has emerged as a strategic imperative for organizations seeking to enhance decision-making capabilities and maintain a competitive edge in rapidly evolving markets. By augmenting human cognition with sophisticated algorithms, real-time analytics, and adaptive learning systems, businesses can foster innovation across operations, customer engagement, and product development. This introduction lays the foundation for understanding how augmented intelligence transcends traditional automation by establishing a collaborative interplay between human expertise and machine precision, ultimately unlocking new pathways for value creation.

The convergence of advanced machine learning models, vast datasets, and scalable computing architectures has propelled augmented intelligence solutions from experimental deployments to mission-critical applications. As enterprises navigate volatile economic and geopolitical landscapes, the capacity to synthesize insights from disparate data sources and adapt to emerging trends becomes indispensable. With this context in mind, the following sections delve into transformative industry shifts, regulatory headwinds, nuanced segmentation perspectives, and strategic recommendations that will inform your roadmap for deploying augmented intelligence effectively.

Identifying the Critical Technological and Market Shifts Driving Augmented Intelligence Evolution and Disruption Across Industries

Innovation cycles are accelerating at an unprecedented pace, driven by breakthroughs in neural network architectures, edge computing, and natural language interfaces. Organizations are witnessing a paradigm shift as legacy data warehouses give way to distributed data fabrics, enabling real-time analytics at the point of need. Consequently, augmented intelligence platforms are being designed with modular architectures that seamlessly integrate cloud, edge, and on-premises environments to ensure low latency and data sovereignty compliance.

In parallel, rising demand for explainable AI frameworks is reshaping vendor roadmaps, as stakeholders require transparent algorithms that can articulate decision rationales. Regulatory bodies and industry consortiums are establishing guidelines to enforce model auditability and data privacy protections, thereby influencing the design of middleware and platform software components. Moreover, the growing emphasis on sustainability is prompting hardware providers to innovate energy-efficient processors and sensor arrays, reducing power consumption without compromising computational throughput. These combined forces are catalyzing a new era of collaborative intelligence solutions tailored to diverse industry requirements.

Assessing the Cumulative Effects of United States 2025 Tariff Adjustments on Augmented Intelligence Supply Chains and Costs

In 2025, incremental tariff adjustments introduced by the United States have reverberated across global supply chains, affecting the cost structure of processors, sensors, and storage devices that underpin hardware components of augmented intelligence systems. As import duties on key semiconductor inputs increased, original equipment manufacturers experienced material cost inflation that was partially offset by strategic sourcing agreements and regional manufacturing investments. However, smaller vendors faced tighter margins and longer lead times, compelling them to evaluate alternative suppliers in nearshoring markets.

Simultaneously, tariff-driven price fluctuations influenced the services segment, particularly managed monitoring services that rely on proprietary hardware for remote diagnostics. Professional integration services encountered elevated travel and logistics costs, which in turn extended project timelines and increased total cost of ownership for end users. In response, many enterprises accelerated adoption of virtualization and containerization strategies to decouple software deployments from hardware constraints. Additionally, software providers intensified partnerships with local distributors to mitigate exchange rate volatility, ensuring continuity of licensing agreements and maintenance contracts despite shifting tariff regimes.

Deriving Deep Insights from Comprehensive Component, Deployment, Enterprise Size, Industry Vertical and Application Segmentation Analyses

Analyzing the market through a component lens reveals that hardware investments are increasingly concentrated on specialized processors optimized for machine learning inference, as well as next-generation sensors capable of real-time environmental monitoring. Within managed services, organizations are prioritizing support offerings that deliver proactive anomaly detection while professional services engagements are focusing on system integration and custom algorithm development. On the software front, demand for natural language processing engines has surged, complemented by integration middleware designed to streamline data flows between legacy enterprise resource planning platforms and cloud-native analytics systems. Data management platforms are concurrently evolving to handle complex data governance frameworks and cross-domain interoperability requirements.

Deployment preferences indicate a clear shift toward hybrid architectures, balancing the agility of cloud-based AI development platforms with the security assurances of on-premises environments. Large enterprises are leading hybrid adoption to maintain regulatory compliance, while small and medium-sized organizations are gravitating toward fully managed cloud models to minimize capital expenditures. Industry verticals such as manufacturing and telecom are investing heavily in predictive maintenance and network optimization applications, whereas financial services and retail sectors are concentrating on fraud detection and customer relationship management solutions. These diverse use cases underscore the importance of a segmented approach that aligns solution portfolios with specific enterprise profiles and operational objectives.

This comprehensive research report categorizes the Augmented Intelligence market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Organization Size

- End User

Revealing Regional Dynamics and Growth Propulsion Patterns for Augmented Intelligence Adoption Across Core Global Markets

Regional dynamics continue to shape the trajectory of augmented intelligence adoption, with the Americas driving innovation through extensive R&D funding and a strong ecosystem of technology incubators. The United States leads in enterprise AI investments, while Canada’s emphasis on data privacy has fostered a growing market for secure analytics platforms. In Latin America, cost sensitivity is encouraging adoption of managed AI services, particularly in retail and consumer goods sectors where agile customer engagement solutions are in high demand.

Europe, the Middle East, and Africa present a complex regulatory mosaic that influences deployment strategies. The European Union’s unified regulations on data protection and artificial intelligence ethics are catalyzing demand for explainable AI tools, especially in BFSI and government applications. In the Middle East, defense modernization programs are accelerating investments in computer vision and autonomous systems, while parts of Africa are leveraging cloud-based AI to enhance healthcare diagnostics and agricultural monitoring.

Asia-Pacific remains a hotbed of innovation, driven by national AI strategies in China, Japan, and South Korea. Rapid digital transformation initiatives in India’s IT services industry are integrating augmented intelligence into customer support and supply chain planning. Southeast Asian economies are experiencing rising adoption in smart city projects, leveraging integrated sensor networks and edge AI to optimize energy and traffic management.

This comprehensive research report examines key regions that drive the evolution of the Augmented Intelligence market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Standout Industry Players Shaping the Augmented Intelligence Ecosystem Through Innovation Partnerships and Strategic Expansions

Leading technology companies are strategically aligning their product portfolios to capture emerging opportunities within the augmented intelligence landscape. Several incumbents have established dedicated AI research labs to accelerate advancements in deep learning model efficiency and multimodal data fusion. Through a combination of in-house innovation and targeted acquisitions, these players are expanding their middleware and development platform offerings, enabling enterprises to deploy tailored solutions with minimal integration overhead.

Collaborative ecosystem models have become increasingly prevalent, as hardware providers partner with software vendors and consulting firms to deliver end-to-end solutions. These alliances facilitate seamless interoperability across processors, sensors, algorithm libraries, and user interfaces, while also spreading risk and sharing intellectual property benefits. Strategic partnerships with regional system integrators are helping multinational corporations navigate local compliance requirements and rapidly scale proof-of-concept deployments.

Investment patterns also highlight a growing emphasis on open standards and developer communities. By sponsoring open-source projects and contributing to industry consortia, major players aim to foster broader adoption of their middleware and platform software. These community-driven initiatives not only accelerate feature enhancements but also provide a pipeline of skilled engineers familiar with proprietary toolsets, thereby reducing the time to market for advanced AI applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Augmented Intelligence market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Binah.ai Ltd.

- Cosmo Tech SAS

- Dataiku Inc.

- DataRobot, Inc.

- EazyML

- EPAM Systems, Inc.

- Google LLC by Alphabet Inc.

- International Business Machines Corporation

- Jumio Corporation

- Lucidworks, Inc.

- Microsoft Corporation

- MICROSTRATEGY INCORPORATED

- Pecan AI Ltd.

- Pryon Inc.

- QlikTech International AB

- Salesforce.com, Inc.

- Samsung Electronics Co., Ltd.

- SAP SE

- SAS Institute Inc.

- Sisense Ltd.

- TIBCO by Cloud Software Group, Inc.

Providing Actionable Strategic Recommendations for Business Leaders to Accelerate Augmented Intelligence Integration and Value Realization

Industry leaders should prioritize establishing a robust data governance framework as the foundation for any augmented intelligence initiative. This includes defining clear ownership models, ensuring data quality standards, and implementing security controls that comply with evolving privacy regulations. By doing so, organizations can mitigate risks associated with data breaches or algorithmic bias and build stakeholder trust in AI-driven outcomes.

To accelerate momentum, executives are advised to adopt an incremental pilot approach that targets high-impact use cases. Focusing initial efforts on areas such as predictive maintenance or fraud detection enables rapid demonstration of value, which in turn fosters internal sponsorship and budget allocation for broader rollouts. Additionally, cultivating cross-functional teams that blend data scientists, business analysts, and domain experts helps bridge the gap between technical capabilities and real-world challenges.

Finally, forging strategic partnerships with leading solution providers and academic institutions can expedite access to cutting-edge research and specialized talent pools. Organizations that embed continuous learning curricula and agile delivery methodologies into their transformation roadmaps are better positioned to adapt to emerging innovations and maintain a competitive advantage in the evolving augmented intelligence market.

Detailing Robust Research Methodology Combining Primary Expert Interviews and Secondary Data Triangulation for Rigorous Market Insights

The research methodology underpinning this report combines rigorous primary research with comprehensive secondary data analysis to ensure depth and reliability. Primary inputs were collected through structured interviews with senior executives across a representative sample of industries, including manufacturing, financial services, and telecommunications. These discussions provided firsthand perspectives on strategic priorities, operational challenges, and investment criteria related to augmented intelligence deployments.

Secondary data collection encompassed extensive review of technology whitepapers, industry journals, and publicly available regulatory documents. Vendor case studies and project briefs were analyzed to identify emerging technology trends, partnership models, and go-to-market strategies. In addition, proprietary data repositories were leveraged to validate anecdotal insights against historical adoption patterns and market dynamics.

To triangulate findings and mitigate potential biases, multiple data sources were cross-referenced, and key assumptions were stress-tested through scenario analysis. Finally, internal workshops with domain experts and advisory board reviews ensured that the synthesized insights align with actual marketplace developments and future trajectory expectations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Augmented Intelligence market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Augmented Intelligence Market, by Component

- Augmented Intelligence Market, by Technology

- Augmented Intelligence Market, by Organization Size

- Augmented Intelligence Market, by End User

- Augmented Intelligence Market, by Region

- Augmented Intelligence Market, by Group

- Augmented Intelligence Market, by Country

- United States Augmented Intelligence Market

- China Augmented Intelligence Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Highlight the Strategic Imperatives and Future Trajectories of Augmented Intelligence Market Adoption

The convergence of advanced hardware architectures, explainable AI frameworks, and hybrid deployment models underscores a transformative moment for augmented intelligence. Organizations that adeptly navigate evolving tariff landscapes and regulatory demands will emerge as frontrunners in applying AI-augmented decision engines to complex business challenges. Segmented use-case strategies, tailored to component and deployment preferences, are key to unlocking maximum return on investment.

Regional disparities in regulatory regimes and infrastructure readiness demand flexible market-entry approaches that accommodate local compliance requirements and operational constraints. Moreover, strategic collaborations across hardware, software, and services ecosystems are proving essential for delivering seamless, scalable solutions. Forward-looking enterprises are those that embed continuous learning and agile governance models into their AI roadmaps, ensuring resilience in the face of ongoing technological and geopolitical shifts.

In summary, the augmented intelligence market is poised for sustained growth, driven by strategic leadership, informed decision-making, and an unwavering commitment to innovation. Organizations that act decisively on these insights will solidify their competitive positioning and unlock new avenues for value creation amid an increasingly data-centric world.

Engage with Ketan Rohom to Unlock Comprehensive Augmented Intelligence Market Intelligence and Drive Strategic Business Decisions

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to gain unparalleled access to a comprehensive report delivering actionable insights for your strategic initiatives. This curated research offers an in-depth exploration of critical market drivers, regional dynamics, segmentation nuances, and regulatory considerations shaping the future of augmented intelligence adoption. By engaging directly with Ketan, you will receive personalized guidance on leveraging these insights to strengthen competitive positioning, optimize investment decisions, and accelerate innovation roadmaps. Reach out to secure your copy of this definitive market intelligence and embark on a transformative journey toward data-driven growth.

- How big is the Augmented Intelligence Market?

- What is the Augmented Intelligence Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?