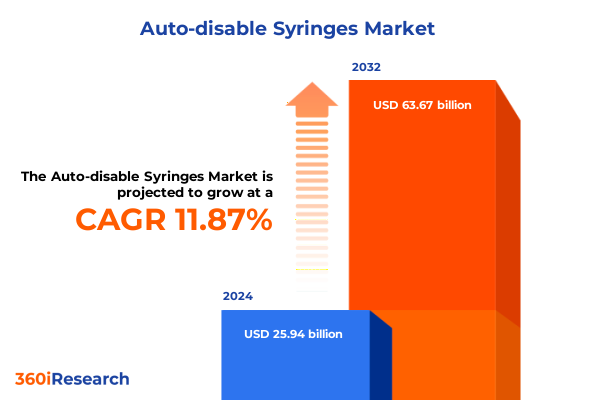

The Auto-disable Syringes Market size was estimated at USD 28.97 billion in 2025 and expected to reach USD 32.36 billion in 2026, at a CAGR of 11.90% to reach USD 63.67 billion by 2032.

Setting the Stage for Transformative Shifts in Auto-Disable Syringe Adoption Driven by Safety Innovations, Regulatory Momentum, and Healthcare Modernization

The global emphasis on healthcare safety has never been more acute, with injection-related infections representing a critical area of concern for public health authorities and care providers. Auto-disable syringes, designed to prevent syringe reuse and thereby minimize cross-contamination, are increasingly recognized as essential tools in the ongoing effort to reduce needlestick injuries and transmission of bloodborne pathogens. As regulatory bodies reinforce stringent standards and healthcare facilities adopt more rigorous safety protocols, the role of these specialized syringes is expanding beyond immunization programs to encompass a broad spectrum of clinical applications. Healthcare professionals and procurement teams alike are seeking solutions that offer both reliability and ease of integration into existing workflows.

In parallel with growing safety imperatives, the market landscape for auto-disable syringes is being reshaped by technological enhancements and evolving policy directives. Innovations that simplify activation mechanisms and improve user compliance are emerging as differentiating factors among suppliers. At the same time, a wave of legislative mandates aimed at phasing out conventional reusable devices underscores a strategic pivot toward single-use safety technologies across public and private healthcare sectors. This introduction sets the scene for a comprehensive examination of the drivers, challenges, and opportunities influencing the auto-disable syringe market today, framing the subsequent analysis of regulatory shifts, tariff impacts, segmentation dynamics, regional variations, and competitive positioning.

Emerging Advances in Injection Safety and Policy Realignment Propelling a Fundamental Evolution in Auto-Disable Syringe Manufacturing and Adoption Practices

A convergence of innovation and policy has sparked a profound transformation in the auto-disable syringe market over recent years. Breakthroughs in active mechanism design have yielded devices that automatically retract needles upon use, reducing the margin for user error and further enhancing point-of-care safety. Likewise, advances in passive systems that rely on built-in locking elements have expanded choices for facilities with varying operational needs. These technological strides are complemented by tighter regulatory oversight; health authorities have introduced updated guidance that prioritizes design validation and systematic post-market surveillance. As a result, suppliers are investing heavily in research and development to meet higher performance benchmarks and secure faster regulatory approvals.

Moreover, novel collaborations between medical device manufacturers and digital health firms are giving rise to “smart” syringes capable of pairing with barcode scanning and electronic health record systems. This trend toward connectivity supports broader initiatives in supply chain traceability and vaccine administration tracking. Concurrently, public-private partnerships are channeling funds into educational programs, ensuring that frontline healthcare workers are trained to utilize these new devices effectively. Together, these transformative shifts are setting a new standard for injection safety, forging stronger alignment between technology, regulation, and clinical practice.

Evaluating the Impact of United States Tariff Changes in 2025 on Supply Chains, Cost Structures and Competitive Dynamics in Auto-Disable Syringe Sector

The implementation of revised tariff schedules by the United States in early 2025 has introduced a series of challenges and strategic considerations for industry participants. Increased duties on key polymer and glass components essential to syringe production have elevated input costs for domestic manufacturers reliant on imports. In response, many suppliers have initiated efforts to diversify procurement sources, exploring partnerships with regional producers in the Americas to mitigate exposure to fluctuating duty rates. This trend is fostering a more intricate network of cross-border supply agreements as manufacturers adapt their sourcing strategies to maintain margin stability.

Simultaneously, the cost pressures induced by these tariff adjustments are prompting companies to reevaluate their operational footprints. Some leading manufacturers have accelerated plans to expand in North America, investing in local manufacturing capacity to reduce dependency on imports and sidestep punitive duties. Others are negotiating long-term contracts that lock in raw material pricing and secure predictable delivery timelines. While short-term price adjustments have been necessary to absorb incremental tariff costs, forward-looking organizations are leveraging this period of disruption to strengthen domestic value chains and bolster resilience against future trade policy shifts.

Decoding Market Segmentation Patterns Across Product Types, Materials, Applications, End Users, and Distribution Channels to Reveal Strategic Growth Pathways

An in-depth exploration of market segmentation reveals differentiated demand patterns across multiple dimensions. By product type, manufacturers offering active auto-disable syringes with spring-loaded or retraction-based mechanisms are capturing attention from high-volume immunization programs, while passive auto-disable syringes continue to meet the needs of routine clinical procedures where simplicity and cost-effectiveness are paramount. Material composition also plays a pivotal role: glass-based syringes are favored in applications requiring chemical inertness and high-precision dosing, whereas plastic variants deliver advantages in lightweight handling and manufacturing scalability.

Applications further diversify the landscape, with blood collection and sample injection representing established use cases in pathology labs, and insulin delivery driving growth within diabetic care settings. The vaccination segment commands particular focus, where adult vaccination campaigns, childhood immunization schedules, and travel vaccination programs present unique requirements in terms of volume, dosing accuracy, and cold-chain integration. From the end user perspective, ambulatory surgical centers and outpatient clinics prioritize ease of stock management and device safety, while home healthcare providers seek user-friendly designs that support self-administration and reduce risk. Within the hospital environment, government-run institutions often adhere to government procurement frameworks that emphasize cost containment, whereas private hospitals may adopt premium syringe models that align with patient safety branding. Finally, distribution channels span hospital pharmacies that require just-in-time delivery capabilities, medical distributors offering bundled supply solutions, online pharmacies catering to end-user convenience, and retail pharmacy locations serving both over-the-counter and prescription-based demands. Together, these segmentation insights illuminate pathways for targeted product development and strategic market targeting.

This comprehensive research report categorizes the Auto-disable Syringes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Application

- End User

- Distribution Channel

Uncovering Regional Variations in Auto-Disable Syringe Adoption Across the Americas, Europe Middle East & Africa, and Asia Pacific to Inform Market Strategies

Regional analysis underscores stark contrasts in adoption rates, regulatory environments, and procurement dynamics. Across the Americas, particularly within the United States and Canada, market expansion is driven by federal and state mandates on injury prevention, bolstered by incentive programs that reward adoption of single-use safety devices. Health systems in these nations emphasize rigorous supplier qualification processes and negotiated volume contracts, creating a competitive landscape where innovation and cost efficiency coexist.

In Europe, Middle East & Africa, diverse regulatory frameworks and varying healthcare infrastructures shape heterogeneous demand. Western European markets exhibit advanced integration of auto-disable technology within national immunization schedules, while select markets in the Middle East are actively modernizing hospital safety protocols. In parts of Africa, donor-funded immunization initiatives are catalyzing volume purchases, although logistics challenges persist in remote regions. Meanwhile, the Asia-Pacific region is characterized by dynamic growth propelled by government-led mass vaccination drives and rising chronic disease management needs. Emerging economies in Southeast Asia and South Asia are incentivizing local production facilities to enhance self-sufficiency, while developed markets in East Asia emphasize product quality and compliance with stringent safety certifications. These regional insights highlight the importance of tailored engagement strategies and supply chain configurations that accommodate distinct regulatory and market maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Auto-disable Syringes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Manufacturers Shaping the Auto-Disable Syringe Market Through Technological Advancements and Strategic Partnerships

Leading players in the auto-disable syringe arena are distinguished by their commitment to technological leadership and collaborative ecosystems. Global medical device manufacturers have reinforced their portfolios with next-generation safety syringes featuring advanced locking mechanisms and compatibility with electronic data capture systems. At the same time, smaller specialized firms are leveraging focused expertise in polymer chemistry and precision engineering to introduce disruptive injection solutions that address unmet clinical requirements. Strategic alliances between manufacturers and contract packaging organizations are streamlining production scalability, while partnerships with logistics providers are enhancing cold-chain distribution capabilities for temperature-sensitive applications such as vaccine delivery.

Moreover, acquisitions and joint ventures are actively reshaping the competitive landscape. Established corporations are acquiring startups with niche innovation capabilities to accelerate their product roadmaps, while mid-size firms are collaborating with regional distributors to penetrate underserved markets. This mosaic of M&A activity and partnership development underlines the industry’s recognition that integrated value chains-from component sourcing through post-market surveillance-are essential for maintaining quality standards, navigating complex regulatory environments, and delivering compelling value propositions to end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Auto-disable Syringes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AccuPoint by AdvaCare Pharma

- Al Shifa Medical Products Co.

- Apple Syringe

- Becton Dickinson & Company

- Duopross Meditech Corp.

- Hindustan Syringes & Medical Devices Ltd

- Merck KGaA

- PT Oneject Indonesia

- Retractable Technologies, Inc.

- Sanavita Pharmaceuticals GmbH

- Shandong Zhushi Pharmaceutical Group Co.,Ltd.

- Shanghai Kohope Medical Devices Co., Ltd.

- Shenzhen Medis Medical

- Terumo Corporation

Crafting Targeted Strategies for Industry Leaders to Accelerate Adoption, Optimize Supply Chains, and Leverage Innovation for Growth in Injection Safety

To capitalize on the burgeoning opportunity in auto-disable syringes, industry leaders should pursue a multipronged approach that balances innovation with operational resilience. First, elevating investment in R&D focused on user-centric design enhancements and smart integration will drive differentiation and support premium positioning. Next, building redundancies in supply chains-such as developing regional manufacturing hubs and forging multi-supplier agreements-will safeguard against trade policy fluctuations and logistical disruptions. Additionally, proactive engagement with regulatory agencies through early dialogue and collaborative pilot programs can streamline approval pathways and foster goodwill.

Equally important is the cultivation of targeted outreach initiatives that educate healthcare professionals on best practices for device utilization, thereby accelerating adoption rates and ensuring clinical efficacy. Finally, leveraging digital platforms to capture real-time usage data and feedback will inform continuous improvement cycles and enable evidence-based value propositions for payers and procurement partners. By implementing these strategies in concert, organizations can not only fortify their market positions but also contribute meaningfully to the global imperative of enhanced injection safety.

Detailing the Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Qualitative Insights to Ensure Robust Market Intelligence

This study synthesizes insights derived from a comprehensive research framework that integrates both primary and secondary methodologies. Primary research encompassed structured interviews with key stakeholders, including manufacturing executives, distribution channel managers, healthcare procurement leaders, and clinical end users in hospitals and home care environments. These discussions were designed to uncover firsthand perspectives on device performance criteria, purchasing drivers, and emerging technology requirements.

Complementing these qualitative insights, an extensive secondary data collection process was undertaken, leveraging regulatory filings, patent databases, clinical guidelines issued by health authorities, and industry white papers to construct a robust context for market dynamics. Data triangulation techniques were applied to validate findings across sources and ensure consistency. Additionally, a series of expert panel reviews was conducted to refine interpretation of trends and test strategic hypotheses. This rigorous methodology underpins the reliability of the conclusions presented herein and supports actionable intelligence for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Auto-disable Syringes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Auto-disable Syringes Market, by Product Type

- Auto-disable Syringes Market, by Material

- Auto-disable Syringes Market, by Application

- Auto-disable Syringes Market, by End User

- Auto-disable Syringes Market, by Distribution Channel

- Auto-disable Syringes Market, by Region

- Auto-disable Syringes Market, by Group

- Auto-disable Syringes Market, by Country

- United States Auto-disable Syringes Market

- China Auto-disable Syringes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Consolidating Key Findings to Highlight the Strategic Imperatives and Future Trajectories for Stakeholders Engaged in the Auto-Disable Syringe Ecosystem

Drawing together the findings of this analysis, it is clear that auto-disable syringes are positioned at the nexus of safety innovation and healthcare policy reform. The expansion of advanced mechanism designs, combined with sweeping regulatory support and reshaped supply chains, has created a fertile environment for market evolution. Segmentation insights reveal differentiated opportunities across product types, materials, applications, end users, and channels, while regional dynamics underscore the need for nuanced go-to-market strategies tailored to local requirements.

Industry participants that align technological innovation with resilient operational frameworks, proactive regulatory engagement, and targeted education initiatives are best positioned to lead. As the imperative for safe injection practices intensifies worldwide, stakeholders who apply the strategic imperatives identified in this report can drive meaningful improvements in patient outcomes and operational efficiencies. The trajectory of the auto-disable syringe market will continue to be shaped by collaborative partnerships and the ability to anticipate shifts in policy and clinical practice.

Encouraging Decision Makers to Engage with Ketan Rohom for Tailored Consultation and Secure Comprehensive Market Research on Auto-Disable Syringes

We encourage forward-thinking decision makers and industry champions seeking to reinforce safety protocols to engage directly with Ketan Rohom at 360iResearch. By connecting with Ketan Rohom, you gain personalized consultation that aligns with your unique challenges, whether optimizing procurement strategies or evaluating emerging injection technologies. This collaborative engagement ensures you receive comprehensive market research tailored to your organization’s goals, empowering you to stay ahead of regulatory changes and competitive pressures. Reach out today to secure the insights and support necessary for informed decision making and strengthened market positioning without delay

- How big is the Auto-disable Syringes Market?

- What is the Auto-disable Syringes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?