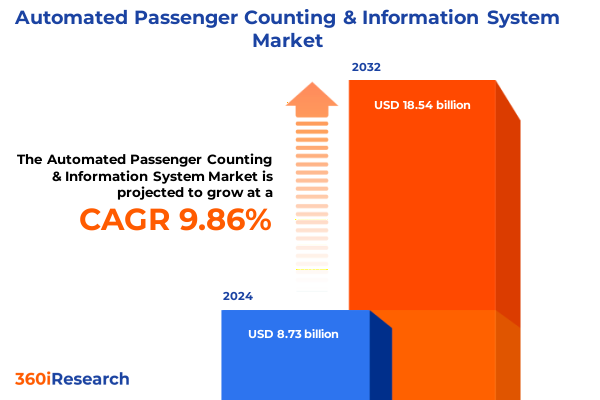

The Automated Passenger Counting & Information System Market size was estimated at USD 9.58 billion in 2025 and expected to reach USD 10.53 billion in 2026, at a CAGR of 10.70% to reach USD 19.54 billion by 2032.

Discover How Automated Passenger Counting and Information Systems Are Revolutionizing Transit Operations and Enhancing Passenger Experiences Worldwide

Public transit agencies around the world are undergoing a technological renaissance driven by the imperative for accurate ridership measurement and real-time service information. Automated passenger counting and information systems have emerged as critical enablers for operators seeking to optimize resource allocation, improve schedule adherence, and enhance overall service reliability. By moving away from manual tallying and static signage, these intelligent systems deliver granular data that empower transit providers to make evidence-based decisions and meet the growing expectations of today’s commuters.

This executive summary offers a concise yet comprehensive overview of the market for automated passenger counting and information systems, outlining the transformative trends reshaping the industry. It highlights the recent policy developments, such as new tariffs that influence supply chains, delves into segmentation and regional dynamics, and showcases the strategic activities of leading technology providers. Furthermore, it distills actionable recommendations for transit authorities and solution suppliers to navigate the dynamic landscape successfully. Through a careful analysis of primary research and secondary data, this summary equips decision-makers with the strategic insights necessary to harness emerging opportunities and mitigate evolving challenges.

Explore the Major Technological and Operational Shifts Driving the Evolution of Automated Passenger Counting and Information Systems in Modern Transit Networks

Over the past few years, the transit sector has witnessed a paradigm shift as operators prioritize intelligent data solutions to address complex challenges in service delivery. The integration of advanced sensor arrays, Internet of Things (IoT) connectivity, and cloud-based analytics has redefined expectations for system accuracy and responsiveness. Real-time monitoring of passenger flows coupled with predictive algorithms now enables proactive adjustments to service frequency and capacity, reducing crowding and improving on-time performance.

Simultaneously, the convergence of automated counting with dynamic passenger information services is creating new channels for real-time communication. Digital displays, mobile applications, and onboard announcements powered by integrated data feeds offer travelers timely insights into arrival times, occupancy levels, and service disruptions. This seamless information ecosystem not only elevates the passenger experience but also fosters greater trust in public transit as a reliable alternative to private vehicles. As these technologies mature, collaborations between system integrators, transit agencies, and technology vendors are accelerating the rollout of pilot deployments into full-scale operational solutions.

Assessing the Broad Effects of New United States Import Tariffs in 2025 on Sensor Supplies Manufacturing and Deployment Strategies in Transit Technologies

In early 2025, the United States implemented revised import tariffs on a range of electronic components and sensors widely used in automated passenger counting and information systems. These measures were enacted to support domestic manufacturing but have had a cumulative impact on procurement strategies within the transit technology market. Suppliers and integrators have reported higher input costs for infrared and ultrasonic sensor modules, onboard processing units, and communication gateways, prompting a reassessment of vendor agreements and project budgets.

The tariff adjustments have also inspired a strategic pivot toward supply chain diversification. Several system manufacturers have intensified partnerships with North American assembly facilities to localize final production and minimize exposure to cross-border levies. At the same time, alternate sourcing has emerged as a viable mitigation strategy, with companies exploring manufacturers in tariff-exempt regions to secure competitive pricing on key hardware components. This shift has underscored the importance of flexibility in component procurement, ensuring uninterrupted project timelines amid evolving trade policies.

Beyond hardware, the tariffs have influenced software licensing and service models. Providers are increasingly packaging maintenance and analytics solutions with onshore support services to offset rising equipment costs. By emphasizing value-added services and subscription-based software deployments, vendors can distribute tariff-related cost increases over multi-year contracts, maintaining budget predictability for transit agencies. Overall, the 2025 tariff environment has catalyzed a more resilient and agile procurement landscape in the automated passenger counting and information system market.

Revealing Market Segmentation Dynamics Across Installation Types Components Technologies Transit Modes Driving Passenger Counting and Information Innovations

A detailed segmentation of the market reveals the diversity of technology, deployment preferences, and service offerings that shape system design and adoption. When considering installation type, transit operators must decide between new system rollouts and retrofits of legacy vehicles and stations, each presenting distinct operational and integration challenges. Turning to component classification, the hardware segment encompasses gateways, onboard processors, and sensor modules, while the services sphere covers installation and ongoing maintenance support. In parallel, software offerings such as cloud analytics, integration platforms, and onboard data processing deliver expanded capabilities for real-time decision-making.

The technological foundation of automated passenger counting spans infrared sensors-active or passive configurations-pressure-sensitive mats, thermal imaging devices, ultrasonic sensors available in fixed or portable formats, and video imaging that can operate in two-dimensional or advanced three-dimensional modes. Each technology choice reflects a balance of accuracy requirements, environmental conditions, and cost considerations. Furthermore, the selection of a transit mode-whether bus, paratransit vehicle, or rail system-dictates specific durability standards, installation constraints, and data integration interfaces. Appreciating how these interrelated segments govern solution design is essential to aligning system capabilities with operational objectives and budget parameters.

This comprehensive research report categorizes the Automated Passenger Counting & Information System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Installation Type

- Technology

- Transit Mode

- Sales Channel

- End User

Examining Key Regional Variations in Automated Passenger Counting and Information Systems Adoption Patterns Across the Americas EMEA and Asia Pacific Markets

Regional dynamics exert a substantial influence on technology adoption patterns and vendor strategies. In the Americas, the focus remains on achieving federal and municipal mandates for ridership reporting while upgrading aging fleets with sophisticated counting and information solutions. Transit authorities in this region prioritize turnkey deployments that integrate seamlessly with existing fare collection and fleet management systems, often leveraging public-private partnerships to fund modernization initiatives.

Across Europe, the Middle East, and Africa, a broad spectrum of economic and regulatory environments shapes market uptake. Western European agencies typically lead with stringent accuracy standards and interoperability requirements, promoting open architecture platforms. In contrast, emerging markets in Eastern Europe and the Middle East are rapidly embracing hybrid deployment models that blend low-cost sensor arrays with cloud-based analytics to accelerate digital transformation. Africa’s growth corridors are increasingly targeted by solution providers offering portable sensor systems that require minimal infrastructure investment.

In the Asia-Pacific region, high urbanization rates and government-driven smart city programs have spurred widespread adoption of advanced passenger counting combined with predictive passenger information services. Markets such as China, Japan, and Australia are at the forefront of integrating these systems into multimodal transport networks, emphasizing system scalability and advanced AI-driven analytics. Meanwhile, Southeast Asian nations are focusing on cost-effective retrofit solutions to upgrade existing buses and rail fleets in order to meet evolving passenger expectations and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Automated Passenger Counting & Information System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategies and Innovations from Leading Players Shaping the Automated Passenger Counting and Information System Landscape with Competitive Edge

Leading technology providers are pursuing differentiated strategies to consolidate their positions in the automated passenger counting and information systems space. One category of established integrators is expanding its portfolio through strategic acquisitions of specialist sensor or analytics firms, enabling a vertically integrated offering that spans hardware production, software development, and service delivery. Another cohort of agile technology startups is capitalizing on narrow niches-such as three-dimensional video imaging or edge-based AI processing-to secure pilot projects with major transit agencies and showcase superior accuracy with minimal infrastructure investment.

Partnership models are also evolving, with hardware manufacturers collaborating closely with cloud service providers and data analytics platforms to present unified solutions. This cooperative approach accelerates time to deployment and simplifies vendor management for transit authorities. Moreover, several leading firms are establishing center-of-excellence programs for predictive maintenance and operations optimization, leveraging machine learning algorithms to forecast service disruptions before they occur. Through these innovation-driven initiatives, key players are shaping the competitive landscape, raising the bar for system performance, data reliability, and overall passenger satisfaction.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Passenger Counting & Information System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstom SA

- BlueSurge Technologies

- Cisco Systems, Inc.

- Clever Devices Ltd

- Cubic Transportation Systems, Inc.

- DILAX Intelcom GmbH

- ETA Transit Systems Inc.

- Eurotech S.p.A.

- GMV Syncromatics Corporation

- HELLA Aglaia Mobile Vision GmbH

- Hitachi Ltd

- Huawei Technologies Co., Ltd.

- Indra Sistemas, S.A.

- Infodev Electronic Designers International Inc.

- INIT SE

- iris-GmbH Infrared & Intelligent Sensors

- Masstrans Technologiies Private Limited

- R-Com Technical Limited

- R2P GmbH

- Retail Sensing Ltd.

- Scheidt & Bachmann GmbH

- Siemens AG

- ST Engineering Ltd.

- Teleste Corporation

- Televic Group NV

- Thales Group

- Trapeze Group Ltd

- Wabtec Corporation

Actionable Recommendations Enabling Industry Leaders to Optimize Investments Enhance Data Integration and Foster Sustainable Growth in Information Systems

Industry leaders should adopt a multi-pronged strategy to remain competitive and deliver measurable value to transit operators. First, it is essential to invest in comprehensive data integration capabilities that seamlessly consolidate passenger counts, vehicle telemetry, and live service information into a unified dashboard. This integration not only enhances operational visibility but also supports advanced analytics that can drive continuous service improvements.

Second, diversifying the supply chain by engaging multiple component suppliers and exploring nearshore assembly partnerships will mitigate future tariff-related risks and strengthen resilience against geopolitical disruptions. Concurrently, firms should develop flexible service models that distribute implementation costs over extended contracts, thereby aligning vendor incentives with long-term performance outcomes.

Third, forging collaborative pilot programs with transit agencies offers a low-risk environment to validate new sensor technologies and data processing techniques. These initiatives facilitate real-world testing and generate crucial case studies that can accelerate broader commercial rollouts. Finally, embedding sustainability principles-such as energy-efficient hardware designs and eco-friendly materials-into product development will resonate with public sector procurement mandates and contribute to more sustainable urban transport ecosystems.

Outlining a Robust Multi Stage Research Methodology Integrating Primary Interviews Secondary Analysis and Data Triangulation for Market Insights

The findings presented in this report are grounded in a rigorous multi-stage research methodology designed to ensure accuracy, depth, and impartiality. The process began with an extensive review of secondary sources, including regulatory filings, industry white papers, and technology vendor documentation, to establish a foundational understanding of market dynamics. This desk research was complemented by in-depth inquirer-led interviews with transit agency procurement officers, system integrators, and technology developers to capture diverse stakeholder perspectives.

Subsequently, a series of vendor briefings was conducted to validate technical specifications, deployment case studies, and support service offerings. Data triangulation techniques were applied to reconcile quantitative insights from supplier databases with qualitative feedback from field deployments. Throughout the research process, strict data governance protocols were maintained to ensure confidentiality and reliability of proprietary information. This layered approach has produced a comprehensive set of insights and recommendations that reflect both strategic trends and operational realities in the automated passenger counting and information system market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Passenger Counting & Information System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Passenger Counting & Information System Market, by Component

- Automated Passenger Counting & Information System Market, by Installation Type

- Automated Passenger Counting & Information System Market, by Technology

- Automated Passenger Counting & Information System Market, by Transit Mode

- Automated Passenger Counting & Information System Market, by Sales Channel

- Automated Passenger Counting & Information System Market, by End User

- Automated Passenger Counting & Information System Market, by Region

- Automated Passenger Counting & Information System Market, by Group

- Automated Passenger Counting & Information System Market, by Country

- United States Automated Passenger Counting & Information System Market

- China Automated Passenger Counting & Information System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Drawing Conclusive Perspectives on the Evolution and Future Potential of Automated Passenger Counting and Information Systems in Transit Ecosystems

The evolution of automated passenger counting and information systems marks a pivotal juncture in the modernization of public transit. As the sector embraces digital transformation, the convergence of sensor accuracy, data analytics, and real-time communication is setting new performance benchmarks. The integration of these technologies empowers operators to deliver more responsive, reliable, and passenger-centric services, while simultaneously unlocking a wealth of operational intelligence that drives continuous improvement.

Looking ahead, the interplay between emerging technologies-such as edge AI processing, advanced three-dimensional imaging, and integrated mobile platforms-will further redefine system capabilities. Transit agencies and technology providers that align strategic investments with evolving policy frameworks and passenger expectations will gain a distinct advantage in the marketplace. By building on the insights and recommendations in this executive summary, stakeholders can navigate the complexities of tariff environments, supply chain dynamics, and regional variations to realize the full potential of automated passenger counting and information systems.

Contact Ketan Rohom Associate Director Sales Marketing to Unlock Comprehensive Automated Passenger Counting and Information System Market Research Insights

For in-depth insights and tailored guidance on leveraging the latest trends in automated passenger counting and information systems, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. His expertise in transit technology strategies will help you secure the right solutions to elevate operational efficiency and enrich passenger experiences. Connect now to discuss how this comprehensive market research can inform your strategic planning and provide the competitive edge your organization needs to thrive in an evolving transit ecosystem.

- How big is the Automated Passenger Counting & Information System Market?

- What is the Automated Passenger Counting & Information System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?