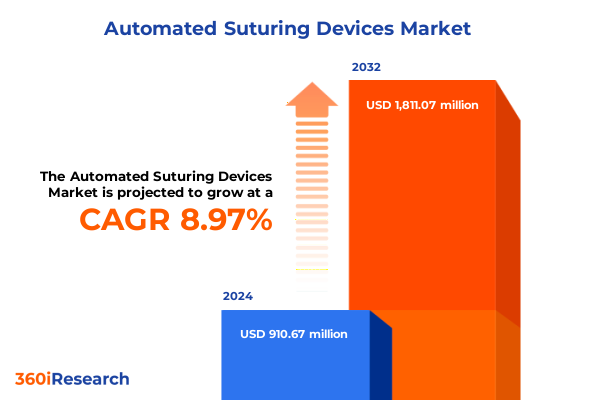

The Automated Suturing Devices Market size was estimated at USD 991.27 million in 2025 and expected to reach USD 1,084.01 million in 2026, at a CAGR of 8.99% to reach USD 1,811.07 million by 2032.

Uncovering the Emerging Significance of the Automated Suturing Devices Market Amidst Evolving Surgical Practices and Innovations

The evolution of surgical practice over the past decade has been propelled by a relentless pursuit of precision, consistency, and efficiency. Robotic-assisted procedures have shifted from niche applications to mainstream adoption across general, gynecological, and colorectal surgeries, marking a pivotal transformation in operating room dynamics. According to a population-based cohort study spanning 2012 to 2018, the use of robotic surgery for general procedures surged from 1.8% to 15.1%, driven by hospitals launching dedicated robotic surgery programs and an industry-wide emphasis on minimally invasive techniques. This rapid uptake underscores the growing imperative for complementary technologies that enhance robotic platforms’ capabilities, particularly in suturing tasks where precision is paramount.

Automated suturing devices have emerged as a critical innovation to address limitations inherent in manual stitching and traditional laparoscopic stitching techniques. Evidence from an ex vivo study demonstrates that an autonomous robotic system equipped with real-time optical coherence tomography guidance can complete 90% of vascular anastomosis sutures without human intervention, achieving outcomes competitive with expert surgeons. Such breakthroughs highlight the potential for these devices to mitigate variability in suture placement, reduce operative times, and enhance patient safety. As digital integration permeates the modern operating suite, automated suturing devices are poised to become indispensable tools that unify advanced imaging, force feedback, and precision robotics to redefine surgical standards.

Mapping the Transformative Shifts Redefining Automated Suturing Devices Through Technological Advancements and Strategic Industry Collaborations

The automated suturing devices landscape is witnessing transformative shifts driven by advances in sensor technology, integration with next-generation robotic platforms, and burgeoning artificial intelligence capabilities. Recent peer-reviewed studies revealed that force feedback systems incorporated into leading surgical robots can reduce tissue forces by up to 43%, enhancing surgeon performance and potentially minimizing inadvertent tissue damage. Concurrently, the first FDA clearance of a fully wristed stapler designed for single-port robotic surgery demonstrates regulatory momentum for devices that grant surgeons greater control and autonomy during key procedural steps.

Looking ahead, the mid-2025 commercial rollout of next-generation robotic systems, featuring ten-thousand-fold increases in computational power and intraoperative data streaming, will catalyze new levels of automation and remote collaboration. These platforms enable real-time force feedback, smart tissue sensing, and integrated analytics that are prerequisites for seamless automated suturing workflows. Moreover, the emergence of competing robotic suites, such as Medtronic’s Hugo platform preparing for FDA submissions, signals intensifying innovation competition that will accelerate feature development, drive cost efficiencies, and expand clinical indications across specialties.

Assessing the Cumulative Impact of the 2025 United States Tariff Measures on the Automated Suturing Devices Supply Chain and Cost Dynamics

The reinstatement and expansion of Section 301 tariffs on medical devices imported from China and other targeted nations has introduced significant headwinds for the automated suturing devices supply chain. GlobalData reports that new tariffs on Class I and II medical devices, including key robotic surgical instruments sourced from China, are expected to intensify cost pressures and elevate supply chain risk, prompting medtech leaders to accelerate diversification and regional manufacturing strategies. Industry associations warn of potential downstream impacts on procedure costs and patient access if reliance on tariff-exposed supply routes persists.

Further amplifying these concerns, financial markets have reacted to announced tariff measures with share price declines among major medical device manufacturers, reflecting investor uncertainty about margin compression and earnings volatility. In response, companies are evaluating targeted re-shoring initiatives, forging partnerships with domestic suppliers, and redesigning component sourcing to mitigate tariff exposure. While these strategies may incur upfront investments and operational complexity, they represent a strategic imperative to sustain supply reliability and preserve competitive positioning in a landscape reshaped by evolving trade policies.

Unveiling Key Segmentation Insights Across Applications End Users Product Types Technologies Materials and Automation Levels in Surgical Suturing

Key segmentation insights reveal that automated suturing device needs and adoption patterns differ substantially across surgical applications. In cardiovascular surgery, high-precision, scale-based suturing requirements drive demand for devices offering submillimeter accuracy and dynamic tissue feedback. Meanwhile, colorectal procedures benefit from compact, flexible devices adaptable to varied access angles and luminal environments. General surgery priorities focus on streamlining suturing workflows to reduce operative time and standardize outcomes, whereas gynecological applications emphasize minimal tissue trauma in confined anatomical spaces. In orthopedic surgery, devices capable of handling tougher tissue matrices and variable bone proximity are critical, reflecting the need for robust mechanical designs.

End users also exhibit divergent requirements: ambulatory surgical centers demand devices that emphasize rapid turnaround, ease of use, and low footprint to support high-volume workflows; hospitals prioritize interoperability with existing robotic systems and compliance with stringent sterilization protocols; specialty clinics seek tailored devices for niche procedures with customizable automation settings. Differentiating between disposable and reusable product types influences cost structures and regulatory considerations, with disposable devices favored for infection control and initial cost minimization, while reusable systems support long-term sustainability goals. Within technological classifications, electrosurgical options-encompassing bipolar and ultrasonic modalities-offer integrated energy delivery for simultaneous cutting and hemostasis, whereas mechanical systems relying on compression clips and stapling mechanisms provide consistent suture placement without thermal effects. Device selection further varies by suture material compatibility, with absorbable options suited for internal tissue integrity and non-absorbable materials required for external closures. Finally, the spectrum of automation levels, from semi-automatic assistance to fully autonomous suturing, aligns with surgeon expertise, procedural complexity, and facility readiness for advanced digital OR integration.

This comprehensive research report categorizes the Automated Suturing Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Suture Material

- Automation Level

- Application

- End User

Analyzing Critical Regional Insights Spanning The Americas Europe Middle East Africa And Asia Pacific Automated Suturing Market Dynamics

Regional dynamics in the automated suturing devices market reflect a complex interplay of clinical demand, regulatory environments, and manufacturing capabilities. In the Americas, healthcare systems are rapidly adopting advanced robotic platforms, driven by procedural efficiency imperatives and favorable reimbursement frameworks. Strong installations of next-generation robots in high-volume surgical centers underscore this region’s leading role in early technology adoption and clinical validation of automated suturing workflows.

Within Europe, Middle East & Africa, stringent regulatory oversight under the European Medical Device Regulation has fostered robust quality standards but can extend time-to-market. Nonetheless, leading academic hospitals and national health services are investing in minimally invasive and robotic-assisted solutions, creating opportunities for devices that deliver demonstrable clinical and economic value. In Asia-Pacific, burgeoning surgical volumes, expanding hospital infrastructure, and government initiatives to bolster local manufacturing are catalyzing growth. Countries such as Japan and South Korea, with established medtech industries, are at the forefront of co-developing devices, while emerging markets in India and Southeast Asia prioritize cost-effective, scalable solutions to meet growing unmet surgical needs.

This comprehensive research report examines key regions that drive the evolution of the Automated Suturing Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining The Strategic Positioning Innovation Focus And Competitive Dynamics Among Leading Automated Suturing Device Manufacturers Worldwide

Leading manufacturers in the automated suturing devices arena are leveraging distinct strategic approaches to secure competitive advantage. Intuitive Surgical, the incumbent market leader, is capitalizing on its broad da Vinci platform installed base by integrating advanced force feedback technology and enabling smart stapler attachments cleared by the FDA for both multiport and single-port systems. This focus on continuous innovation and digital tool integration reinforces surgeon loyalty and creates high barriers to entry.

Medtronic is positioning its Hugo RAS platform to challenge the incumbent through modular design, competitive pricing, and targeted clinical trials in urology and hernia repair, aiming for FDA clearance in early 2025. Ethicon, a subsidiary of Johnson & Johnson, is advancing electromechanical suturing solutions that combine ultrasonic energy delivery with precision robotic guidance, enhancing hemostasis and reducing thermal spread. B. Braun and Teleflex are expanding their presence by partnering with regional distributors to introduce cost-effective semi-automatic suturing devices tailored to emerging markets. Meanwhile, startups with autonomous system prototypes and novel tissue sensing modalities continue to attract venture funding, signaling a vibrant ecosystem poised for consolidation and strategic alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automated Suturing Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- B. Braun Melsungen AG

- Baxter International Inc.

- ConMed Corporation

- DemeTECH Corporation

- Ethicon, Inc.

- Intuitive Surgical, Inc.

- Karl Storz SE & Co. KG

- Medtronic plc

- Mellon Medical B.V.

- Olympus Corporation

- Péters Surgical, Inc.

- Smith & Nephew plc

- Surgical Innovations Ltd

- Sutrue Limited

- TELA Bio, Inc.

- Teleflex Incorporated

- Teleflex, Inc.

- Zimmer Biomet Holdings, Inc.

Delivering Actionable Recommendations To Guide Industry Leaders In Navigating Supply Chain Regulations Technological Advancements And Market Expansion

To navigate the evolving landscape and capitalize on emerging opportunities, industry leaders should prioritize building resilient and diversified supply chains. Establishing strategic partnerships with regional component suppliers and exploring localized manufacturing can mitigate tariff exposure and reduce logistical vulnerabilities, thereby safeguarding margin stability amid shifting trade policies. Furthermore, aligning product development roadmaps with regulatory innovation pathways-such as the FDA’s Real-World Evidence and De Novo frameworks-can accelerate market entry for novel suturing automation features while maintaining compliance.

In parallel, companies must invest in technology integration that enhances surgeon experience and clinical outcomes. Incorporating real-time force feedback, intelligent tissue recognition, and seamless interoperability with digital OR ecosystems will differentiate offerings and drive adoption. Emphasizing scalable training programs and remote proctoring capabilities will lower barriers to surgeon proficiency, expand addressable markets, and maximize installed system utilization. Finally, targeted clinical studies demonstrating time savings, reduced complication rates, and cost-benefit scenarios will be essential to secure favourable reimbursement and solidify the value proposition for automated suturing solutions.

Detailing The Rigorous Research Methodology And Analytical Framework Underpinning The Market Intelligence On Automated Suturing Devices

This analysis is grounded in a rigorous methodology combining multiple layers of primary and secondary research. Extensive interviews with key stakeholders-ranging from C-suite executives at leading medical device companies to clinical users in hospitals and ambulatory surgical centers-provided qualitative insights into adoption drivers, pain points, and unmet needs. Secondary research encompassed a comprehensive review of peer-reviewed literature, regulatory filings, patent databases, and industry reports to map technological trends and benchmark competitive landscapes.

Data triangulation was employed to validate findings; quantitative inputs from surgical registries and public financial disclosures were cross-checked against expert interviews to ensure accuracy. A detailed segmentation framework was applied to analyze market dynamics across application, end-user, product type, technology, suture material, and automation level. Regional assessments incorporated regulatory timelines, reimbursement policies, and manufacturing capacities. Finally, iterative validation sessions with industry advisors and domain experts refined key insights and recommendations, ensuring the relevance and reliability of the strategic guidance presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automated Suturing Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automated Suturing Devices Market, by Product Type

- Automated Suturing Devices Market, by Technology

- Automated Suturing Devices Market, by Suture Material

- Automated Suturing Devices Market, by Automation Level

- Automated Suturing Devices Market, by Application

- Automated Suturing Devices Market, by End User

- Automated Suturing Devices Market, by Region

- Automated Suturing Devices Market, by Group

- Automated Suturing Devices Market, by Country

- United States Automated Suturing Devices Market

- China Automated Suturing Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis Of Critical Findings Reinforcing The Strategic Imperatives And Future Outlook Of The Automated Suturing Devices Landscape

The convergence of robotics, automation, and advanced sensing is redefining the suturing process, offering unprecedented precision and operational efficiency. Critical findings reveal that force feedback and real-time tissue recognition technologies are poised to become benchmarks for device differentiation, while fully autonomous systems demonstrate early promise in preclinical settings. Trade policies enacted in 2025 have underscored the necessity of supply chain resilience, prompting a strategic shift toward localized manufacturing and supplier diversification.

Segmentation insights indicate that varied clinical requirements-from cardiovascular to orthopedic applications-as well as distinct end-user environments in ambulatory centers, hospitals, and specialty clinics warrant tailored device offerings. Regional analyses highlight that the Americas lead in technology adoption, while regulatory and manufacturing dynamics in EMEA and Asia-Pacific present unique growth opportunities. Competitive positioning by incumbents and challengers alike will hinge on innovation speed, strategic partnerships, and compelling clinical evidence. These imperatives form the strategic foundation for organizations aiming to harness the transformative potential of automated suturing devices and secure sustainable competitive advantage in an increasingly digital operating room ecosystem.

Connect Directly With The Associate Director Of Sales And Marketing To Secure Your Automated Suturing Devices Market Research Report Today

To explore the full depth of insights and strategic guidance outlined in this executive summary, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Whether you’re aiming to refine your product roadmap, optimize your supply chain against evolving tariff landscapes, or capitalize on emerging technology integrations, Ketan can provide a personalized overview and access options for the comprehensive market research report. Engage with Ketan to unlock detailed analysis on segmentation, regional dynamics, and competitive positioning, enabling you to make informed decisions with confidence. Take action today by connecting with Ketan to secure your copy of the automated suturing devices market research report and position your organization at the forefront of surgical innovation

- How big is the Automated Suturing Devices Market?

- What is the Automated Suturing Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?