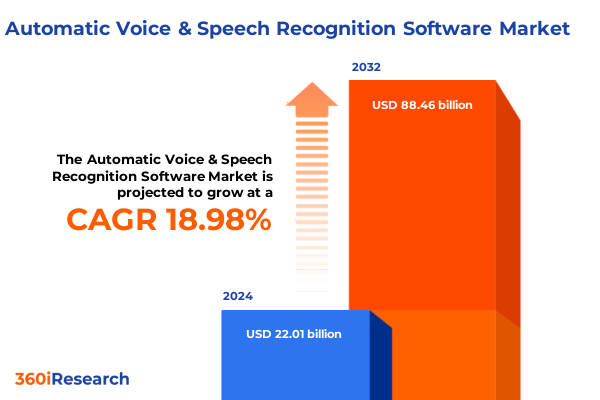

The Automatic Voice & Speech Recognition Software Market size was estimated at USD 26.20 billion in 2025 and expected to reach USD 30.87 billion in 2026, at a CAGR of 18.97% to reach USD 88.46 billion by 2032.

How Advanced Voice and Speech Recognition Solutions Are Revolutionizing Business Processes, Customer Engagement, and Operational Efficiency

The introduction to automatic voice and speech recognition software showcases a technological transformation that bridges human language and digital systems in unprecedented ways. By leveraging deep learning and advanced neural network architectures, modern speech recognition platforms have rapidly progressed from crude phonetic matching to sophisticated end-to-end models that understand context and intent. For instance, transformer-based ASR models have achieved word error rates as low as 2.2% on the LibriSpeech dataset, underscoring the near-human accuracy of these systems in controlled settings. Similarly, innovative approaches that decouple speaker separation from recognition have yielded remarkable multi-talker performance with error rates around 5.1%, even in complex conversational scenarios.

Moreover, enterprises across industries are integrating voice interfaces to streamline operations, enhance customer engagement, and reduce reliance on manual transcription. In sectors ranging from customer service to healthcare and automotive, the adoption of voice-driven applications is reshaping traditional workflows. Contact centers are automating call routing and sentiment analysis, while medical institutions employ speech-to-text solutions for accurate charting and compliance. As organizations seek both efficiency gains and richer user experiences, voice and speech recognition software emerges as a pivotal enabler of digital transformation.

Emerging Transformative Advances in AI Architectures, Self-Supervision, and Edge-First Privacy-Centric Deployments

The landscape of voice and speech recognition is undergoing transformative shifts driven by breakthroughs in machine learning and architectural innovations. Self-supervised learning techniques have unlocked vast potential by enabling models to leverage unlabelled audio, minimizing the dependency on costly annotated datasets. End-to-end transformer models now not only transcribe speech but also extract semantic and contextual insights, paving the way for more natural conversational AI. For example, open-source systems such as Whisper large-v2 have established benchmarks with word error rates near 2.9% across diverse datasets, illustrating the power of scale and pretraining.

In parallel, the convergence of voice AI with edge computing is reshaping deployment strategies and privacy paradigms. Edge-based inference reduces latency and limits the transfer of sensitive audio data to the cloud, aligning with stringent regulations like the EU’s General Data Protection Regulation and California’s Consumer Privacy Act, which classify voice as biometric or personal data and impose strict consent and deletion requirements. As a result, organizations are adopting hybrid architectures that balance centralized model updates with on-device processing to ensure both performance and compliance.

Assessing the Industrywide Consequences of New Section 301 Tariffs on Critical Hardware Components and Deployment Costs

The cumulative impact of United States tariffs implemented in 2025 has introduced new considerations for the voice and speech recognition software ecosystem, particularly in hardware-dependent segments. The USTR’s decision to raise Section 301 duties on imported semiconductors to 50% effective January 1, 2025 has driven up costs for speech processing chips essential to both on-premise servers and edge devices. Simultaneously, tariff increases on polysilicon and solar wafer components to 50% and on tungsten products to 25% further pressure supply chains for cloud datacenter infrastructure powered by renewable energy solutions.

This elevation in input costs has led some enterprises to delay hardware upgrades and expansion plans. A notable contraction in U.S. orders for core capital goods in June reflected a broader hesitancy among businesses to invest under tariff uncertainty, underscoring the tension between policy objectives and operational agility. Moving forward, companies are exploring diversification of component sourcing and increased reliance on software optimization to mitigate the financial impact of elevated duties, ensuring that their voice AI deployments remain cost-effective and scalable.

Deep Dive into Application, Component, Deployment, and End-User Segmentation Uncovering Nuanced Dynamics

Insight into market segmentation reveals a multifaceted structure that informs product development, go-to-market strategies, and user prioritization. By application, speech recognition is deployed in call center automation where natural language understanding drives intelligent routing and analytics, in dictation and transcription across legal, medical, and general domains to accelerate documentation workflows, in virtual assistants offering both personal and customer service support, and in voice biometrics used for speaker identification and verification. Examining each component layer reveals that while hardware underpins performance and latency, software and associated consulting, integration, and support services capture a significant share of value through customization and ongoing optimization.

In terms of deployment modes, the choice between cloud and on-premise implementations-and within cloud, the spectrum from public to private and hybrid environments-shapes data control, scalability, and integration complexity. Lastly, end-user segmentation spans verticals such as automotive and transportation, encompassing in-vehicle voice commands and traffic management systems; BFSI including banking, capital markets, and insurance for fraud detection and customer service; healthcare from hospitals to telehealth for clinical documentation; retail and e-commerce for customer support at scale; and telecom and IT for network management and customer interaction platforms. Understanding these layered segments is critical for tailoring solutions to specific use cases and achieving differentiated market positioning.

This comprehensive research report categorizes the Automatic Voice & Speech Recognition Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Deployment Type

- Function

- Application

- End-User Industry

Regional Adoption Patterns Highlighting North American Cloud Leadership, EMEA Privacy-Driven Growth, and Asia-Pacific Language Innovation

Across the Americas, momentum is driven by early adopters in North America leveraging robust cloud ecosystems and regulatory clarity to pioneer large-scale deployments. Brazil and Mexico are following closely, embracing speech analytics for call center efficiency and multilingual customer support. Transitioning to Europe, Middle East and Africa, digital transformation initiatives in the UK, Germany, and the Nordics prioritize data sovereignty and privacy compliance, spurring demand for private and hybrid cloud offerings. Meanwhile, Gulf Cooperation Council countries focus on government-led smart city programs that integrate voice-enabled traffic management and public safety systems.

Asia-Pacific stands out for its diverse growth trajectories. China’s government mandates AI integration across call centers and public services, while Japan and South Korea emphasize R&D in low-latency edge voice applications. India’s multilingual environment fuels innovation in regional language transcription, creating opportunities for specialized models. Southeast Asian markets are also accelerating adoption, leveraging voice interfaces to overcome literacy barriers and support financial inclusion initiatives.

This comprehensive research report examines key regions that drive the evolution of the Automatic Voice & Speech Recognition Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Dominant Hyperscalers, Specialized Providers, and Integrators Driving Speech Recognition Innovation

Leading the competitive landscape, hyperscale providers continue to advance core speech services. Amazon Transcribe and Microsoft Azure Speech Services both leverage extensive cloud infrastructures to offer scalable streaming and batch transcription with average word error rates in the mid-four percent range for native English speakers. Google’s vector of offerings integrates speech recognition into broader AI stacks for developers, while IBM Watson Speech to Text focuses on enterprise security and integration with analytics platforms. Deepgram’s Nova-3 model has made headlines with its sub-seven percent word error rate for streaming scenarios and specialized variants targeting healthcare with impressive accuracy improvements.

Beyond the cloud giants, niche specialists differentiate through domain expertise and on-device innovation. Sensory delivers low-footprint SDKs for offline applications, Nuance (now under Microsoft) dominates the healthcare transcription segment, and tools like Verint and NICE concentrate on conversational analytics for customer engagement. Service providers and system integrators play a critical role in adapting core engines for industry-specific workflows and ensuring seamless deployment at enterprise scale.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automatic Voice & Speech Recognition Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acapela Group SA

- Amazon.com, Inc.

- Apple Inc.

- Cerence Inc.

- Google LLC

- International Business Machines Corporation

- LumenVox LLC

- Microsoft Corporation

- Nuance Communications, Inc.

- OpenAI, L.L.C.

- ReadSpeaker Holding B.V.

- Sensory, Inc.

- Speechmatics Ltd.

- Verint Systems Inc.

- VoiceBase, Inc.

- VoiceVault Inc.

Strategic Roadmap for Executives to Secure Hybrid Deployments, Demystify Compliance, and Unlock Domain-Tailored Advantages

Industry leaders should prioritize a hybrid-cloud strategy that blends centralized model training with edge-based inference to balance scalability, latency, and compliance requirements. Investing in domain-specific model fine-tuning will enhance accuracy in niche applications such as medical and legal transcription, while partnerships with telecommunication carriers and OEMs can unlock integrated in-vehicle and network management use cases. To mitigate supply chain risks from tariff fluctuations, organizations ought to diversify hardware sourcing, leverage software optimization, and consider geographic embodiment of compute resources closer to end users.

Additionally, embedding privacy-by-design principles will build user trust and simplify compliance across jurisdictions. By implementing granular consent mechanisms, robust anonymization, and clear data retention policies, companies can navigate evolving regulations while maintaining innovation velocity. Finally, fostering an ecosystem of third-party developers through open APIs and SDKs will accelerate solution adoption and create new revenue streams.

Overview of Robust Multi-Stage Research Approach Integrating Data Triangulation and Stakeholder Validation

This research employed a multi-faceted methodology grounded in both secondary and primary intelligence gathering. We began with comprehensive secondary research, examining policy documents, regulatory filings, and publicly available financial and technical publications. Primary insights were obtained through structured interviews with industry stakeholders, including technology providers, system integrators, and end-user organizations, to validate market dynamics, deployment challenges, and investment priorities.

Data triangulation techniques were applied to reconcile differing perspectives and ensure the robustness of findings. Segmentation analyses utilized a bottom-up approach, mapping use-case requirements to solution capabilities and revenue drivers. Our methodology emphasizes transparency and repeatability, with all findings traceable to sourced inputs and validated by expert review, ensuring high confidence in the strategic guidance provided.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automatic Voice & Speech Recognition Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automatic Voice & Speech Recognition Software Market, by Technology

- Automatic Voice & Speech Recognition Software Market, by Deployment Type

- Automatic Voice & Speech Recognition Software Market, by Function

- Automatic Voice & Speech Recognition Software Market, by Application

- Automatic Voice & Speech Recognition Software Market, by End-User Industry

- Automatic Voice & Speech Recognition Software Market, by Region

- Automatic Voice & Speech Recognition Software Market, by Group

- Automatic Voice & Speech Recognition Software Market, by Country

- United States Automatic Voice & Speech Recognition Software Market

- China Automatic Voice & Speech Recognition Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings on Accuracy, Compliance, Deployment Strategies, and Strategic Differentiators

In conclusion, the automatic voice and speech recognition software ecosystem is at an inflection point characterized by unprecedented accuracy gains, robust regulatory frameworks, and evolving deployment architectures. While the adoption of edge-first inference and privacy-centric designs is accelerating across verticals, the impact of trade policies and component cost pressures underscores the need for agile supply chain strategies. Competitive differentiation will hinge on domain-optimized models, seamless integration across cloud-edge environments, and adherence to stringent data governance practices.

As enterprises refine their digital transformation roadmaps, leveraging the insights outlined in this report will be critical to capturing the full value of voice AI technologies. The convergence of advanced AI architectures, strategic partnerships, and regulatory compliance forms the cornerstone of sustainable growth in this dynamic market.

Unlock In-Depth Market Intelligence by Connecting with Ketan Rohom for Your Voice and Speech Recognition Research Needs

To secure comprehensive, strategic insights that will guide your organization’s next steps in the rapidly evolving voice and speech recognition landscape, contact Ketan Rohom, Associate Director of Sales & Marketing, to explore the full scope of our detailed market research report. Ketan can walk you through the methodology, key findings, and tailored opportunities identified for your specific objectives. Engage with an expert who understands both the technological intricacies and market dynamics at play, and gain the intelligence you need to make confident, forward-looking decisions. Reach out today to access the full report and unlock unparalleled clarity on where the voice and speech recognition industry is headed.

- How big is the Automatic Voice & Speech Recognition Software Market?

- What is the Automatic Voice & Speech Recognition Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?