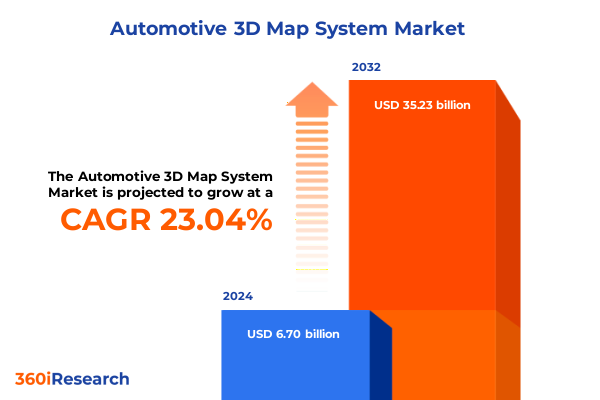

The Automotive 3D Map System Market size was estimated at USD 8.20 billion in 2025 and expected to reach USD 10.03 billion in 2026, at a CAGR of 23.15% to reach USD 35.23 billion by 2032.

Unveiling a New Era of Precision Navigation Through the Advent of Three-Dimensional Digital Cartography in Automotive Ecosystems

The automotive industry is on the cusp of a paradigm shift as three-dimensional mapping technologies emerge as a foundational element in next-generation vehicle systems. Traditional two-dimensional map data is rapidly giving way to immersive, high-fidelity 3D representations that not only chart roadways but also capture elevation, structure, and semantic attributes critical for advanced driver assistance and full autonomy. This transition reflects a growing demand for context-aware navigation, where vehicles can anticipate obstacles, optimize routes in real time, and support complex urban scenarios with unparalleled precision.

In this evolving ecosystem, OEMs, Tier 1 suppliers, and technology providers are forging collaborations to build robust 3D map platforms that integrate sensor fusion, cloud connectivity, and predictive analytics. The convergence of lidar, radar, and computer vision has driven the creation of layered digital twins of actual environments, enabling continuous updates and situational awareness. As a result, vehicles are becoming smarter and more adaptive, leveraging these digital choreographies to enhance safety, efficiency, and user experiences.

Looking ahead, three-dimensional mapping will underpin a spectrum of applications from dynamic route recalculation and real-time hazard alerts to seamless integration with smart city infrastructures. By embracing this next wave of digital cartography, automakers and mobility service providers can deliver transformative value, unlock new revenue streams, and set a new standard for navigation intelligence.

Mapping the Future: How Artificial Intelligence, 5G Connectivity, and Edge Computing Are Revolutionizing Automotive 3D Mapping Technologies

The landscape of automotive 3D mapping is being reshaped by an array of technological forces that converge to deliver unprecedented capabilities. Artificial intelligence and machine learning algorithms have advanced to the point where map updates can be generated and validated in near real time, reducing reliance on manual data curation. Simultaneously, the rollout of 5G networks is unlocking ultra-low-latency communications, enabling vehicles to upload sensor data and download enriched map layers with minimal delay, thus ensuring that drivers and autonomous systems operate on the freshest information available.

At the edge, powerful processors and specialized GPUs are being embedded within vehicles to handle complex rendering tasks that once required centralized cloud servers. This edge computing paradigm minimizes bandwidth usage and safeguards critical decision loops from network interruptions. Furthermore, the integration of vehicle-to-everything (V2X) communications allows cars to share localized observations-such as road hazards or dynamic traffic conditions-with each other and with infrastructure nodes, fostering a collaborative mapping environment where the map evolves in lockstep with real-world changes.

The adoption of digital twin frameworks, fueled by advances in photogrammetry and simultaneous localization and mapping (SLAM), has ushered in a new level of environmental fidelity. These virtual replicas empower simulation-based testing and validation of autonomous functions, accelerating development while reducing physical trial constraints. As these transformative shifts coalesce, the 3D mapping domain is set to underpin a new generation of mobility solutions defined by resilience, scalability, and hyper-contextualized intelligence.

Assessing the Unforeseen Ripple Effects of 2025 United States Tariff Adjustments on the Global Supply Chain of Automotive Three-Dimensional Mapping Solutions

In early 2025, the United States government enacted an across-the-board tariff of 10% on virtually all imports, layering on top of existing duties and targeted measures to fortify domestic manufacturing. Crucially, semiconductor imports now face up to a 50% duty, while electric vehicles are subject to rates as steep as 100%. These elevated tariffs have injected uncertainty into sourcing strategies for hardware components that are essential to 3D mapping systems, including lidar units, high-definition displays, and specialized processors.

Perhaps the most immediate consequence has been felt in the semiconductor realm, where a proposed 25% tariff on certain imported chips threatens to upend cost structures and supply agreements. Automotive designers have responded by exploring partnerships with local fabrication plants and by renegotiating contracts to factor in the additional levies. Given the intricate integration of microcontrollers and custom ASICs in mapping hardware, any price fluctuation can cascade through the value chain, elevating per-unit expenses and complicating procurement cycles.

Beyond semiconductors, strategic electronics such as inertial measurement units and high-precision position sensors have come under scrutiny. White House proposals suggest further levies on sensors and chipsets critical to advanced driver assistance recalibrations and virtual sensor algorithms. Automakers and their suppliers are now bracing for potential tariff hikes that would range from 25% to 50% on these components, prompting contingency planning that includes increased inventory buffers and alternative sourcing from tariff-exempt countries.

The cumulative impact of these tariff measures extends beyond raw cost inflation; lead times have stretched by several weeks, and many OEMs have begun relocating smaller production runs to nearshore facilities. While these strategies may offer relief in the mid term, they introduce complexity into global supply network designs. In the short term, the industry faces a balancing act between absorbing higher import taxes and preserving the pace of innovation required to maintain the competitive edge of automotive 3D mapping solutions.

Differentiating Market Dynamics Through Application, Component, Vehicle Type, Deployment Mode, and End User Perspectives for 3D Automotive Mapping

A deep dive into market segmentation reveals distinct dynamics that shape the trajectory of automotive 3D mapping solutions. Applications span a spectrum from advanced driver assistance systems, which leverage detailed elevation data for precise lane-keeping and collision warning, to fully autonomous driving platforms that rely on richly textured spatial datasets to navigate complex urban environments. In parallel, fleet management services harness real-time route and environmental intelligence to optimize operational efficiency and safety, while infotainment and navigation offerings enrich user experiences through immersive, three-dimensional visualizations and predictive point-of-interest recommendations.

Equally insightful is the breakdown by component type, where hardware remains the backbone of end-to-end mapping systems. High-resolution displays render layered map content, processors perform on-vehicle computations, and sensors capture raw environmental inputs that feed into map-building pipelines. Complementing this are specialized services, including consulting engagements that tailor mapping solutions to specific vehicle architectures, periodic data updates that ensure the map fidelity remains current, and maintenance agreements that guarantee system uptime. Software modules complete the ecosystem, providing map data management platforms for version control, rendering engines for seamless visualization, and visualization tools that enable developers to customize user interfaces.

Vehicle type segmentation underscores divergent priorities between commercial and passenger vehicles. Commercial platforms demand scalability and robustness for continuous operation in logistics and public transportation, whereas passenger vehicles emphasize features that enhance driver experience and safety. The choice between cloud and on-premise deployment further differentiates the offering, as cloud solutions deliver elastic compute resources and global coverage, while on-premise systems appeal to stakeholders seeking complete data sovereignty and minimized latency. Finally, end-user segmentation separates aftermarket channels, which focus on retrofit applications and add-on services, from OEM partnerships that embed mapping capabilities within factory-fitted vehicle architectures.

This comprehensive research report categorizes the Automotive 3D Map System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Vehicle Type

- Deployment Mode

- Application

- End User

Unveiling Diverse Regional Adoption Patterns and Strategic Imperatives Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional landscapes reveal how macroeconomic factors, regulatory environments, and infrastructure maturity shape the adoption of automotive 3D mapping technologies. In the Americas, particularly in the United States and Canada, the rollout of advanced driver assistance mandates and federal incentives for connected vehicle deployments has accelerated investments in high-definition mapping. Strong support from government agencies and collaboration among automotive OEMs and technology startups have fostered a vibrant ecosystem where pilot programs in urban centers inform scalable rollouts nationwide.

Across Europe, the Middle East, and Africa, the emphasis varies by subregion. Western Europe’s stringent safety regulations and progressive smart city initiatives have catalyzed adoption, with several capitals integrating map-based traffic management and emergency response systems. In the Middle East, investments in smart mobility corridors and ambitious urban development projects have provided fertile ground for partnerships between local authorities and global map providers. Meanwhile, in parts of Africa, the challenge of disparate road networks and limited digital infrastructure is being addressed through public-private collaborations that leverage satellite imagery and crowdsourced data to build foundational 3D map layers.

Asia-Pacific stands out for its diversity, with advanced markets like Japan and South Korea driving early deployments of autonomous shuttles and last-mile delivery robots powered by centimeter-level map accuracy. Southeast Asian countries are embracing cloud-based mapping platforms to leapfrog traditional infrastructure gaps, while China’s massive investments in smart highways and vehicle-to-infrastructure trials are pushing the envelope on real-time map updates and predictive analytics. Across all regions, regulatory frameworks, investment incentives, and infrastructure readiness continue to be pivotal in determining the pace at which three-dimensional automotive mapping solutions reach scale.

This comprehensive research report examines key regions that drive the evolution of the Automotive 3D Map System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovative Disruptors Shaping the Competitive Landscape of Automotive 3D Mapping Systems Worldwide

A competitive review of the automotive 3D mapping landscape highlights a mix of established cartography stalwarts, semiconductor and hardware giants, and agile software innovators. Legacy mapping providers have strengthened their portfolios with layered 3D data sets, leveraging decades of geospatial expertise to support both OEM and aftermarket channels. These incumbents benefit from extensive data collection networks and established partnerships with navigation device manufacturers and cloud platform operators.

Simultaneously, semiconductor companies with high-performance GPUs and specialized automotive-grade processors are asserting their influence by enabling on-board rendering and real-time environmental analysis. By bundling hardware acceleration with reference software stacks, these vendors streamline integration for automakers aiming to reduce development cycles. Complementary to this, sensors manufacturers-ranging from lidar innovators to inertial measurement unit specialists-are differentiating through ranges, accuracy levels, and form factor optimization to meet the stringent requirements of 3D mapping accuracy.

On the software front, a wave of startups and established technology firms is delivering modular mapping engines, visualization frameworks, and machine learning toolkits designed for continuous map improvement and anomaly detection. These providers often adopt open APIs and SDKs to foster a developer ecosystem that extends functionality through third-party integrations. Together, this constellation of companies is fostering a rich, interconnected competitive environment where collaborations, strategic alliances, and vertical integrations accelerate the maturation of automotive 3D mapping solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive 3D Map System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- BAE Systems plc

- Continental AG

- DENSO Corporation

- Dynamic Map Platform Co., Ltd.

- Garmin Ltd.

- Google LLC by Alphabet Inc.

- HARMAN International

- HERE Global B.V.

- Intel Corporation

- Mitsubishi Electric Corporation

- NVIDIA Corporation

- Pioneer Corporation

- Robert Bosch GmbH

- TomTom International B.V.

- Valeo SA

- ZF Friedrichshafen AG

Strategic Imperatives and Tactical Measures for Industry Leaders to Capitalize on Emerging Opportunities in Automotive 3D Mapping Technology

To navigate the complexities of the evolving automotive 3D mapping domain, industry leaders should first prioritize the diversification of data sources and supplier networks. By establishing multi-tiered partnerships for sensor procurement and semiconductor fabrication, stakeholders can mitigate the risks associated with tariffs and concentrate on optimizing total cost of ownership rather than relying on singular supply channels. This approach also enables swift reconfiguration of procurement strategies in response to regulatory shifts or technological breakthroughs.

Next, organizations must invest in hybrid deployment architectures that combine the strengths of cloud scalability with the immediacy of edge processing. Embracing containerized map rendering modules and on-vehicle ML inference engines will ensure that mapping services remain resilient under network variability and maintain high performance in mission-critical scenarios. Concurrently, engaging in standardization initiatives and data-sharing consortia will foster interoperability, reduce integration complexity, and drive down development overhead across the ecosystem.

Finally, a robust roadmap for continuous innovation is essential. This entails allocating budget for iterative improvements through agile data refinement cycles, running sandbox environments for scenario-based validation, and leveraging digital twin platforms to accelerate time to market. By aligning R&D investments with clear use cases-whether in commercial fleets, passenger safety enhancements, or new mobility services-leaders can capture first-mover advantages while laying the groundwork for scalable, future-proof mapping architectures.

Delving into Rigorous Multi-Source Research Approaches and Analytical Frameworks That Underpin the Credible Insights in Automotive 3D Mapping Analysis

This analysis draws upon a multi-layered research methodology designed to deliver rigorous, credible insights into the automotive 3D mapping space. Secondary research formed the foundation, leveraging a breadth of publicly available resources such as patent filings, regulatory publications, and vendor press releases to compile an initial data set. This desk research was augmented by a systematic review of industry conferences, white papers, and journal articles to capture the most recent technological advances and deployment case studies.

Primary research efforts included structured interviews with executives from OEMs, Tier 1 suppliers, sensor manufacturers, and mapping software providers. These conversations were conducted under non-disclosure terms to ensure candid perspectives on challenges, strategic roadmaps, and investment priorities. In parallel, a series of expert panels with academics and analysts in the fields of geospatial science, autonomy, and telecom were convened to validate emerging trends and to stress-test hypothesis models.

Finally, data triangulation techniques were employed to reconcile quantitative inputs-such as component cost indices and adoption metrics-with qualitative insights. This iterative validation process, reinforced by scenario analysis and sensitivity testing, underpins the robustness of the conclusions and recommendations presented. Throughout the research, strict adherence to ethical standards and data integrity protocols ensured that confidentiality and accuracy were maintained.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive 3D Map System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive 3D Map System Market, by Component

- Automotive 3D Map System Market, by Vehicle Type

- Automotive 3D Map System Market, by Deployment Mode

- Automotive 3D Map System Market, by Application

- Automotive 3D Map System Market, by End User

- Automotive 3D Map System Market, by Region

- Automotive 3D Map System Market, by Group

- Automotive 3D Map System Market, by Country

- United States Automotive 3D Map System Market

- China Automotive 3D Map System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing the Strategic Transformations and Future Trajectories of the Automotive 3D Mapping Domain for Informed Decision-Making

In summary, three-dimensional mapping stands as a cornerstone of the next mobility revolution, offering precision, context, and adaptability that traditional map formats cannot match. The ongoing convergence of AI, 5G, edge computing, and digital twin frameworks is accelerating the maturity of these systems, enabling richer situational awareness and new service paradigms across both passenger and commercial segments. Navigating this evolution requires a nuanced understanding of application demands, component ecosystems, and deployment preferences.

At the same time, recent tariff measures in the United States have introduced fresh supply chain complexities, underscoring the importance of flexible sourcing strategies and localized production capabilities. Organizations that proactively diversify hardware and semiconductor partnerships, while optimizing hybrid deployment architectures, will be best positioned to offset cost pressures and maintain development velocity.

Regional adoption patterns further highlight that regulatory support, infrastructure investment, and public-private collaboration are pivotal in determining market traction. By aligning innovation roadmaps with regional priorities and by forging strategic alliances across the value chain, stakeholders can unlock significant opportunities in the rapidly expanding landscape of automotive 3D mapping.

Secure Exclusive Access to Cutting-Edge Automotive 3D Mapping Intelligence by Engaging with Ketan Rohom for the Comprehensive Market Research Report

To gain a competitive edge and unlock comprehensive intelligence on the automotive 3D mapping landscape, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to access the complete market research report. Ketan combines deep domain expertise with a consultative approach to ensure that your organization receives tailored insights and actionable data to support strategic decisions. By collaborating with him, you will benefit from a personalized briefing, custom data extracts, and priority support, enabling you to navigate regulatory shifts, technology disruptions, and evolving customer demands with confidence.

Contact Ketan today to secure your exclusive copy of the report and transform your mapping initiatives into market-leading innovations. Empower your teams with the latest analyses, strategic recommendations, and competitive intelligence designed to drive growth and resilience in the rapidly evolving world of automotive 3D mapping.

- How big is the Automotive 3D Map System Market?

- What is the Automotive 3D Map System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?