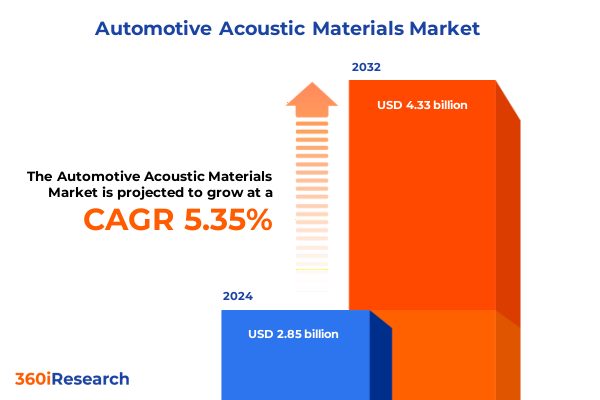

The Automotive Acoustic Materials Market size was estimated at USD 3.01 billion in 2025 and expected to reach USD 3.16 billion in 2026, at a CAGR of 5.34% to reach USD 4.33 billion by 2032.

Elevating Vehicle Acoustics with Advanced Materials to Meet Evolving Passenger Comfort Expectations and Stringent Global Regulatory Demands

Automotive acoustic materials have emerged as pivotal enablers of vehicle refinement, shaping the perception of quality and comfort among drivers and passengers alike. With interior cabin noise reduction advancing beyond mere comfort to embody a brand’s reputation for sophistication, the selection and integration of specialized materials have become core to vehicle development strategies. Manufacturers are no longer content with passive sound dampening; instead, they seek solutions that actively manage noise across multiple domains, including engine bay noise control, undercarriage noise suppression, exhaust system attenuation, and the orchestration of an immersive silence within the passenger compartment.

As the driving experience evolves toward electrification, the acoustic signature of vehicles transforms, demanding novel approaches to noise control. Electric powertrains, while intrinsically quieter at lower speeds, generate unique frequency profiles that require targeted absorption and insulation strategies. At the same time, legislative bodies worldwide continue to tighten regulations on external noise emissions, compelling OEMs and suppliers to innovate rapidly. This convergence of consumer expectations and regulatory imperatives underscores the strategic importance of acoustic materials, positioning them as key differentiators in an increasingly competitive market.

Transformative Developments in Acoustic Material Technologies Shaping the Future of Quieter, More Sustainable, and Cost Efficient Mobility

The landscape of automotive acoustic materials is in the midst of transformative change, driven by breakthroughs in polymer chemistry and fiber engineering. Traditional foams and rubbers are now complemented by lightweight thermoplastic polymers that offer exceptional damping performance at reduced mass. Innovations in nonwoven fabrics marry breathability with sound absorption, while natural fiber composites are gaining traction for their renewable credentials and favorable acoustic properties. These material evolutions not only deliver superior noise attenuation but also align with broader sustainability goals as manufacturers pursue carbon footprint reductions.

Concurrently, the shift to electric vehicles is redefining noise, vibration, and harshness (NVH) benchmarks. With the absence of dominant combustion noise, cabin whisper becomes a central metric of quality, compelling suppliers to refine solutions for road and tire noise control. This dynamic is fostering collaborative partnerships between acoustics specialists and vehicle OEMs, accelerating the adoption of integrated systems that blend insulation, absorption, and barrier layers. In tandem, digital simulation and predictive modeling tools are streamlining material selection and placement, enabling cross-functional teams to optimize acoustic performance early in the design cycle.

Moreover, global regulatory frameworks are catalyzing material innovation. Stricter external noise emission standards in Europe, North America, and Asia-Pacific markets are heightening the focus on exhaust and undercarriage noise control systems. The resulting synergy of consumer demand, regulatory compliance, and rapid technological advancement heralds a new era of acoustic excellence within the automotive sector.

Assessing the Comprehensive Effects of United States Trade Tariffs on Automotive Acoustic Material Supply Chains and Cost Structures into 2025

Throughout 2025, the implementation of United States tariffs on select imported materials has reshaped supply chain dynamics for acoustic components. These trade measures, aimed at balancing domestic manufacturing and strategic resource access, have impacted the cost structures of raw fibers, specialized foams, and thermoplastic polymers critical to noise control applications. Suppliers dependent on cross-border shipments have responded by diversifying procurement strategies, forging partnerships with regional manufacturers to mitigate the effects of duty escalations and logistical complexities.

The cumulative influence of these trade policies extends beyond price adjustments. Companies have intensified efforts to localize production footprints, investing in domestic manufacturing lines that support undercarriage noise control matting and cabin noise insulation. As a result, lead times have shortened and inventory buffers have adjusted to accommodate shifts in material flow. This pivot toward nearshoring not only curbs tariff exposure but also enhances supply chain resilience, providing OEMs with greater certainty amid ongoing geopolitical uncertainty.

In parallel, suppliers are exploring material reformulations to reduce reliance on tariffed inputs without compromising acoustic performance. By substituting certain imported rubber elastomers with locally sourced EPDM or by blending glass and natural fibers with alternative polymer matrices, manufacturers are maintaining sound absorption benchmarks while controlling cost pressures. The collective response to 2025 tariffs underscores the industry’s capacity for adaptive innovation, ensuring that advancements in acoustic materials remain on track even as trade landscapes evolve.

Unveiling Critical Market Segmentation Perspectives across Application Domains Material Types Vehicle Categories End Users and Distribution Channels

A nuanced examination of market segmentation reveals the diverse pathways through which acoustic materials address vehicle NVH challenges. Application segmentation spans cabin noise reduction, where multi-layer insulation packages envelop the passenger space, to engine bay noise control solutions that withstand high temperatures and mechanical stress. Exhaust system noise control integrates robust barrier layers that endure corrosive environments, while undercarriage noise control relies on durable mats designed to survive road debris impacts, illustrating how each application domain demands tailored material attributes.

Material type segmentation underscores the breadth of options available to engineers. Fibers ranging from glass to natural and polyester variants offer customizable stiffness and density profiles, while melamine, polyethylene, and polyurethane foams deliver targeted sound absorption across variable frequency ranges. Rubber categories such as butyl and EPDM excel in vibration dampening, while thermoplastic polymers including polypropylene and PVC contribute lightweight formability and chemical resistance. These distinct material classes enable a layered approach, combining multiple solutions to achieve holistic acoustic performance.

Further market stratification by vehicle type highlights differential priorities. Commercial vehicles, split between heavy and light configurations, emphasize robust undercarriage and engine bay solutions to withstand demanding duty cycles. Electric vehicles, encompassing battery electric and hybrid models, focus on reducing road and wind noise at low speeds to compensate for minimal powertrain sounds. Passenger cars-from compact segments through mid-size to luxury tiers-prioritize interior quietness and comfort refinement, driving the integration of advanced acoustic materials throughout the entire vehicle architecture.

End user segmentation differentiates the aftermarket and original equipment manufacturer channels, with each requiring distinct packaging, certification, and installation guidelines. Distribution channels further vary between traditional dealership networks and digital platforms, reflecting evolving buyer preferences for convenience and customization. Recognizing these segmentation lenses is critical for stakeholders seeking targeted growth strategies and product development roadmaps.

This comprehensive research report categorizes the Automotive Acoustic Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Material Type

- Vehicle Type

- End User

- Distribution Channel

Examining Regional Dynamics Shaping Demand for Acoustic Materials across Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics exert a powerful influence on the evolution of acoustic material demand. In the Americas, a combination of consumer appetite for premium driving experiences and stringent national noise regulations has elevated the adoption of advanced cabin insulation and engine bay noise control products. Manufacturers in North America have doubled down on local production of foams and fiber composites, fostering a resilient supply chain that aligns with trade policy shifts and cost optimization objectives.

Within Europe, Middle East, and Africa, the interplay of diverse regulatory standards and consumer segments drives regional differentiation. Western Europe’s focus on sustainability and weight reduction has spurred interest in bio-based fibers and recyclable thermoplastics, whereas emerging markets in North Africa and the Gulf states prioritize long-term durability under extreme climate conditions. Suppliers have responded with regionally tailored formulations that balance acoustic performance with environmental resilience, establishing strategic partnerships to navigate complex distribution channels.

Asia-Pacific’s vast and heterogenous automotive landscape propels growth in both volume and innovation. High-volume passenger car markets in China and India emphasize cost-effective noise control matting and scalable production methods, while governments in Japan and South Korea champion next-generation materials through research grants and technical collaborations. Southeast Asian nations are rapidly harmonizing import regulations, further incentivizing regional manufacturing hubs. Across Asia-Pacific, the convergence of local expertise and global technology transfer continues to redefine acoustic material offerings.

This comprehensive research report examines key regions that drive the evolution of the Automotive Acoustic Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation Collaboration and Strategic Growth in Automotive Acoustic Materials

Leading material suppliers have harnessed strategic investments in research and development to solidify their positions within the acoustic materials arena. Global conglomerates with expertise in polymer science have expanded their portfolios to include specialized nonwoven barriers, leveraging brand equity to secure partnerships with OEMs focused on premium cabin experiences. Simultaneously, niche innovators have forged alliances with automotive tier suppliers, co-developing lightweight composite panels that integrate sound absorption and structural reinforcement.

Cross-industry collaborations between chemical producers and automotive manufacturers have accelerated the commercialization of novel melamine foam grades and thermoplastic elastomers. These partnerships focus on dual objectives: achieving superior low-frequency attenuation and delivering sustainable lifecycle credentials through recyclable material streams. At the same time, corporate ventures and joint development agreements are enabling the rapid scaling of production capacities in key regional markets, ensuring that emerging applications-such as undercarriage noise control for electric light commercial vehicles-receive timely support.

To maintain a competitive edge, top-tier companies are also embracing digital transformation in their operations. Predictive maintenance of manufacturing equipment, real-time quality monitoring, and artificial intelligence–driven design optimization are becoming standard components of acoustic material production. These capabilities not only enhance product consistency but also shorten time to market, reinforcing the strategic alignment of R&D, supply chain management, and customer engagement functions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Acoustic Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Acoustical Solutions LLC

- Adler Pelzer Group

- Autoneum Holding Ltd.

- BASF SE

- Borgers AG

- Covestro AG

- Dow Inc.

- DuPont de Nemours Inc.

- Faurecia SE

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Illbruck GmbH

- International Automotive Components Group

- Mitsui Chemicals Inc.

- Nitto Denko Corporation

- Pyrotek Inc.

- Saint-Gobain SA

- Silent Running Inc.

- Sound Seal

- Sumitomo Riko Company Limited

- Toyoda Gosei Co. Ltd.

Actionable Strategies to Enhance Competitiveness Sustainability and Efficiency for Industry Leaders in the Automotive Acoustic Materials Sector

Industry leaders aiming to capitalize on acoustic material advancements should prioritize investments in sustainable raw material sourcing and circular economy initiatives. By integrating bio-based fibers and recyclable thermoplastics into core product lines, suppliers can anticipate regulatory mandates and consumer preferences for eco-friendly solutions. Concurrently, establishing modular manufacturing cells dedicated to quick-change tooling will enable rapid adaptation to emerging vehicle architectures, particularly in electric and hybrid segments.

Strengthening collaborative ecosystems with automotive OEMs and tier suppliers is equally critical. Co-development projects that embed acoustic materials into multi-functional vehicle components-combining insulation with structural or thermal properties-can unlock performance synergies and cost efficiencies. Leaders should also cultivate partnerships with research institutes to leverage advanced modeling tools, ensuring that material placement and thicknesses are optimized from the earliest design stages.

Furthermore, enhancing digital capabilities across the value chain will yield measurable benefits in quality assurance and customer responsiveness. Implementing real-time analytics for production monitoring and predictive maintenance can significantly reduce downtime, while tailored digital platforms will streamline aftermarket distribution and customer support. By orchestrating these strategic initiatives, industry leaders can forge robust supply chains, differentiate their offerings, and secure long-term growth in a dynamic market environment.

Elaborating Thorough Research Methodology with Data Triangulation Expert Interviews Rigorous Validation and Quality Assurance Processes

The research methodology underpinning this analysis combined rigorous primary and secondary approaches to ensure reliability and depth. Primary insights were gathered through structured interviews with acoustics engineers, supply chain managers, and regulatory experts across major automotive regions. These conversations provided direct perspectives on material performance criteria, procurement challenges, and emerging application requirements.

Secondary research entailed systematic reviews of technical publications, patent filings, and regulatory frameworks. Databases covering material science breakthroughs, trade policy announcements, and environmental standards were meticulously examined to map the evolving landscape. Data triangulation techniques were employed to reconcile findings across sources, enhancing the robustness of segmentation analyses and regional assessments.

In addition, a continuous validation process was instituted, leveraging pilot workshops and prototype evaluations with select OEM partners. These sessions tested material samples under real-world acoustic conditions, refining performance benchmarks and ensuring that the report’s insights reflect practical applicability. Quality assurance protocols governed each stage of data collection, from interview transcription accuracy to the integrity of secondary information, culminating in a comprehensive methodology designed to deliver actionable, high-fidelity intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Acoustic Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Acoustic Materials Market, by Application

- Automotive Acoustic Materials Market, by Material Type

- Automotive Acoustic Materials Market, by Vehicle Type

- Automotive Acoustic Materials Market, by End User

- Automotive Acoustic Materials Market, by Distribution Channel

- Automotive Acoustic Materials Market, by Region

- Automotive Acoustic Materials Market, by Group

- Automotive Acoustic Materials Market, by Country

- United States Automotive Acoustic Materials Market

- China Automotive Acoustic Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Future Opportunities to Forge Competitive Advantage in the Automotive Acoustic Materials Industry

The trajectory of automotive acoustic materials is defined by an intricate interplay of technological innovation, regulatory pressures, and shifting consumer expectations. The emergence of lightweight polymers, natural fiber composites, and advanced foams underscores the sector’s capacity for material evolution, while the implications of trade policies have reinforced the importance of resilient, localized supply chains. Segmentation insights reveal that customization across application, material, vehicle type, end user, and distribution channel is essential to address the full spectrum of NVH challenges.

As regional dynamics continue to diversify demand profiles-from the Americas’ premium focus to Asia-Pacific’s volume-driven markets-the strategic agility of suppliers will determine their ability to capture growth opportunities. Collaborative models that unite R&D expertise with digital production capabilities are emerging as differentiators, propelling companies that can deliver integrated, sustainable solutions ahead of their peers. Looking ahead, the confluence of electrification, sustainability imperatives, and advanced manufacturing promises to redefine acoustic performance standards, fostering a new era of vehicle refinement.

Engage with Ketan Rohom to Secure Your Comprehensive Automotive Acoustic Materials Market Report Tailored to Your Strategic Objectives

For tailored insights that empower your organization to excel in the rapidly evolving automotive acoustic materials landscape, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing). He will guide you through the comprehensive market research report, highlighting how it aligns with your strategic goals, supply chain requirements, and product development roadmaps. Engage with a specialist who understands the nuances of material innovation, regulatory compliance, and regional market dynamics, ensuring that your investment yields actionable intelligence and a competitive edge. Secure your copy today to harness data-driven recommendations and cutting-edge analysis calibrated to drive growth and efficiency within your operation

- How big is the Automotive Acoustic Materials Market?

- What is the Automotive Acoustic Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?