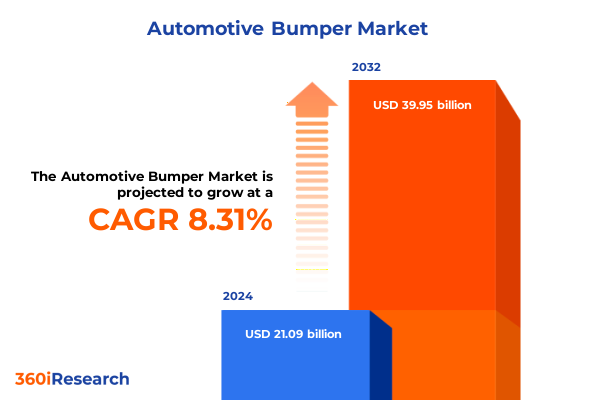

The Automotive Bumper Market size was estimated at USD 22.66 billion in 2025 and expected to reach USD 24.36 billion in 2026, at a CAGR of 8.43% to reach USD 39.95 billion by 2032.

Pioneering a Forward-Looking Exploration of Next-Generation Automotive Bumper Innovations Amidst Evolving Consumer Expectations and Regulatory Advances

In an era of rapid automotive innovation and intensifying regulatory scrutiny, the bumper has evolved from a simple protective accessory into a sophisticated system integral to vehicle safety, aerodynamics, and design appeal. This report opens a window into that evolution, detailing the multifaceted drivers shaping bumper development-from advancements in lightweight materials and advanced driver assistance systems (ADAS) integration to the growing emphasis on sustainability in component manufacturing.

Our analysis begins by weaving together the strands of technological progress and market forces that are redefining how bumpers are conceived, engineered, and commercialized. It offers executives and decision-makers an essential orientation, establishing the context for understanding the interplay between emerging mobility trends-such as electric and autonomous vehicles-and long-standing performance requirements around impact resistance, pedestrian safety, and cosmetic durability.

By setting clear objectives for each subsequent section, this introduction lays the groundwork for a rigorous exploration of material innovations, shifting supply chain paradigms, and key regulatory milestones. In doing so, it ensures that stakeholders can navigate complexity with confidence and seize opportunities in a market poised for transformative growth.

Unveiling the Major Technological, Material, and Manufacturing Transformations Reshaping the Automotive Bumper Landscape in an Era of Electric Mobility and Sustainability Imperatives

The automotive bumper landscape is undergoing sweeping transformations driven by the convergence of lightweighting imperatives, digital manufacturing breakthroughs, and a relentless push toward electrification. Traditional metal-based designs are gradually giving way to composite solutions that combine carbon fiber and fiber reinforced plastic matrices, delivering superior strength-to-weight ratios and enabling new levels of design flexibility.

Simultaneously, the proliferation of electric and autonomous vehicle platforms is reshaping performance criteria. Bumpers must now accommodate sensors and radar arrays without compromising crashworthiness, necessitating a fusion of engineering disciplines that spans materials science, electronics integration, and computational modeling. Additive manufacturing techniques are accelerating prototyping cycles, empowering OEMs and suppliers to iterate bumper geometries in silico before committing to high-volume tooling.

Moreover, environmental sustainability has moved to the forefront. Recyclable thermoplastics such as polypropylene and polyurethane blends are being engineered to meet stringent end-of-life directives, while steel and aluminum variants are increasingly sourced from closed-loop recycling streams. These transformative shifts are setting new benchmarks for cost efficiency, product differentiation, and regulatory compliance, ultimately delineating the next frontier of bumper innovation.

Analyzing the Comprehensive Cumulative Effects of 2025 United States Tariff Policies on Automotive Bumper Supply Chains and Competitive Strategies

In early 2025, the United States introduced revised import duties targeting critical raw materials and finished automotive components, including bumpers. These adjustments have intensified cost pressures across global supply chains by imposing an incremental levy on steel and aluminum inputs as well as on composite materials sourced from key trading partners. Many OEMs and Tier 1 suppliers have responded by reevaluating their sourcing footprints and accelerating nearshoring initiatives to shield production volumes from fluctuating duty structures.

Beyond cost considerations, the tariffs have prompted a strategic shift in supplier relationships. Manufacturers are deepening collaborations with regional material producers to ensure compliance and minimize volatility. Concurrently, some industry participants are absorbing a portion of the tariff impact through price renegotiations, while others are leveraging product redesigns to reduce dependency on high-tariff materials. This adaptive approach has reinforced resilience but also underscored the importance of agility in procurement and design.

Looking ahead, the cumulative impact of these tariff measures is catalyzing a broader realignment of manufacturing networks, with an eye toward diversification and risk mitigation. Suppliers that can demonstrate localized value creation and regulatory agility will be best positioned to thrive in a tariff-aware marketplace.

Delivering Deep Insights into Automotive Bumper Market Segmentation by Material, Distribution, Installation, Application, and Vehicle Type Drivers

A holistic understanding of the bumper market emerges when examining the interplay of multiple segmentation dimensions, each revealing unique value pools and innovation pathways. From a material perspective, carbon fiber composites and fiber reinforced plastics are unlocking premium product tiers, while cast and rolled aluminum variants offer an optimal balance of weight reduction and impact performance. Within the plastic domain, acrylonitrile butadiene styrene provides cost-effective structural support, whereas polypropylene and thermoplastic polyurethane blends enable precise styling and energy absorption. Carbon steel continues to serve as a mainstay for durability, complemented by high-strength steel grades that enhance deformation control during collisions.

Channel dynamics present another layer of complexity. Offline distribution remains vital for establishing close OEM-supplier partnerships and ensuring just-in-time delivery, whereas online platforms are emerging as agile conduits for aftermarket sales and small-batch specialty orders. Original equipment installations drive the forefront of design integration, yet the replacement segment commands significant volume by catering to collision repair networks and retrofit upgrades. Meanwhile, bumper applications bifurcate into front and rear systems, each subject to distinct regulatory standards and consumer expectations regarding shape, sensor integration, and impact tolerance. Vehicle type segmentation further diversifies the landscape, as heavy commercial vehicles demand reinforced structures for load handling, light commercial vehicles seek cost efficiencies, and passenger cars prioritize aesthetic seamlessness and pedestrian safety features.

By weaving these segmentation insights together, stakeholders can pinpoint strategic investments, align product roadmaps with end-user needs, and uncover cross-segment synergies that drive competitive differentiation.

This comprehensive research report categorizes the Automotive Bumper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Installation

- Vehicle Type

- Distribution Channel

- Application

Examining Key Regional Dynamics Influencing Automotive Bumper Markets Across the Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional dynamics are shaping divergent trajectories for bumper market growth, rooted in distinct regulatory environments, production hubs, and consumer preferences. In the Americas, stringent safety mandates in the United States and Canada are driving demand for advanced impact mitigation technologies, while pronounced logistical challenges in Brazil and Mexico have elevated the importance of local sourcing and regional supply chain hubs.

Across Europe, Middle East, and Africa, evolving pedestrian safety regulations and carbon reduction targets have spurred investments in recyclable materials and cleaner manufacturing processes. Germany and France remain epicenters of premium metal bumper fabrication, whereas rapid automotive electrification in the Gulf Cooperation Council is fostering partnerships between local assemblers and global composite specialists.

The Asia-Pacific region exhibits the fastest pace of production expansion. China’s integrated automotive clusters are pioneering scale efficiencies for both electric and combustion platforms, while India’s emerging OEM base is leveraging low-cost plastic and steel bumper solutions tailored for domestic fleets. Meanwhile, Japan and South Korea continue to spearhead lightweight aluminum applications and robotic assembly systems that set benchmarks for precision and cycle time reductions.

Such regional nuances underscore the need for bespoke go-to-market strategies. Manufacturers that calibrate their R&D priorities, sourcing approaches, and compliance frameworks to the specific contours of each geography will secure the greatest competitive advantage.

This comprehensive research report examines key regions that drive the evolution of the Automotive Bumper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Moves and Collaborative Innovations of Leading Automotive Bumper Manufacturers and Tier Suppliers Worldwide

The competitive landscape is characterized by a constellation of global OEMs and specialized tier suppliers, each vying to capture value through distinct innovation and partnership models. Leading players have fortified their positions by cultivating collaborative ecosystems that span material scientists, automation engineers, and aftermarket distributors. Strategic acquisitions of small-scale composite innovators have enabled rapid entry into high-margin segments, while joint ventures with regional steel mills and aluminum casters underpin secure raw material access.

Moreover, certain manufacturers are differentiating through proprietary sensor integration platforms, embedding radar-compatible interfaces within bumper subsystems. Others are pioneering closed-loop recycling programs, reclaiming material streams to lower carbon footprints and enhance brand value among sustainability-focused consumers. In parallel, digital twin and simulation capabilities are being adopted by key suppliers to accelerate crash testing cycles, reduce prototyping costs, and optimize geometric performance under diverse collision scenarios.

As competition intensifies, market leaders are also extending their reach into the aftermarket replacement segment, establishing e-commerce capabilities and leveraging connected vehicle data to anticipate repair demand. Those who successfully align technological leadership with agile distribution models will define the next chapter of bumper market success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Bumper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AD Plastik d.d.

- Flex-N-Gate Corporation

- Forvia SE

- Hendrickson Bumper and Trim, Inc.

- Holi Industries Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Jiangnan Mould & Plastic Technology Co., Ltd.

- KIRCHHOFF Automotive GmbH

- Magna International Inc.

- Montaplast GmbH

- Motherson Sumi Systems Limited

- NTF Group S.p.A.

- Plasman Group Inc.

- Plastic Omnium S.A.

- Samvardhana Motherson International Limited

- SMP Deutschland GmbH

- Toyoda Gosei Co., Ltd.

- Valeo S.A.

- Yanfeng Automotive Trim Systems Co., Ltd.

Empowering Industry Leaders with Actionable Strategies to Navigate Market Disruptions and Capitalize on Emerging Opportunities in Bumper Innovation

Industry participants must adopt a multifaceted strategy to thrive amid evolving material mandates, tariff pressures, and regional growth imbalances. Foremost, accelerating investment in next-generation composite and high-strength alloy research will secure differentiation in weight-sensitive and safety-critical applications. Pairing this with digital manufacturing technologies-such as additive prototyping and robotic assembly-can compress development cycles and unlock mass customization opportunities.

Simultaneously, firms should deepen engagement with regional material partners to mitigate tariff-induced cost volatility and reinforce supply chain resilience. Establishing dual-source agreements for critical feedstocks will create buffers against geopolitical disruption and erratic commodity pricing. At the same time, forging alliances with EV and ADAS platform developers will position bumper suppliers at the forefront of sensor-embedded system integration.

To capture aftermarket potential, building intuitive online sales channels and predictive maintenance services will drive customer retention and aftermarket revenue growth. Equally important is embedding circular economy principles into product design-choosing recyclable polymers and modular assemblies that facilitate disassembly and part reuse. By executing these actionable initiatives, organizations can convert market disruptions into strategic advantages and chart a sustainable path for future expansion.

Detailing the Rigorous Research Methodology Employed to Ensure Accurate Data Collection, Analysis, and Insights in Automotive Bumper Studies

This research harnesses a structured methodology that integrates primary stakeholder interviews, exhaustive secondary literature reviews, and rigorous data triangulation to ensure the highest degree of accuracy and relevance. Interviews with engineering heads, procurement directors, and aftermarket distribution executives provided firsthand perspectives on material preferences, regulatory adaptation, and channel evolution.

Complementing these insights, secondary research encompassed review of public filings, OEM technical papers, industry journals, and compliance documentation from major safety agencies. Quantitative data was validated against historical shipment records, customs databases, and financial disclosures to align qualitative findings with verifiable market behaviors. A multi-layered segmentation framework was then applied, dissecting the market by material, distribution channel, installation type, application, and vehicle classification to uncover granular growth pockets and risk factors.

Finally, a cross-functional analysis was performed to map tariff impacts, regional dynamics, and competitive strategies into an integrated model. This holistic approach not only underscores the robustness of the findings but also provides a transparent roadmap for stakeholders to replicate or refine the research process in future iterations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Bumper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Bumper Market, by Material Type

- Automotive Bumper Market, by Installation

- Automotive Bumper Market, by Vehicle Type

- Automotive Bumper Market, by Distribution Channel

- Automotive Bumper Market, by Application

- Automotive Bumper Market, by Region

- Automotive Bumper Market, by Group

- Automotive Bumper Market, by Country

- United States Automotive Bumper Market

- China Automotive Bumper Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Critical Insights and Strategic Imperatives to Guide Stakeholder Decision-Making in the Evolving Automotive Bumper Ecosystem

The evolution of the automotive bumper market is driven by an intricate tapestry of technological breakthroughs, regulatory imperatives, and shifting global trade policies. Key takeaways highlight a clear move toward lightweight materials-particularly carbon fiber composites and high-strength alloys-coupled with integrated electronic functionalities that support advancing safety systems. The imposition of 2025 US tariffs has accelerated supplier diversification and nearshoring trends, revealing both vulnerabilities and resilience pathways within traditional supply chains.

Segmentation analysis reinforces the importance of a tailored approach: material innovations must align with front and rear bumper performance requirements and variable demands across heavy commercial, light commercial, and passenger vehicle segments. Regional priorities further accentuate this need, as North American safety regulations, EMEA sustainability targets, and Asia-Pacific manufacturing scale each drive distinct strategic imperatives.

As leading companies refine their portfolios through vertical integration, digitalization, and circular economy practices, the competitive landscape will favor those who can seamlessly marry cost efficiency with advanced functionality. Going forward, stakeholders should remain vigilant to emerging disruptors and adapt resource allocations to capitalize on the most promising growth vectors within this dynamically changing ecosystem.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Automotive Bumper Market Intelligence and Secure Your Customized Research Report Today

To gain an in-depth understanding of automotive bumper market dynamics and capitalize on emerging trends, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Through a personalized consultation, he will guide you through key findings, offer tailored insights aligned with your strategic goals, and demonstrate how exclusive intelligence can accelerate your decision-making.

By engaging with this dedicated expert, you will uncover hidden opportunities within material innovations, regional growth pockets, and tariff-driven supply chain pivots. He will outline customized service offerings that align with your product roadmap, competitive positioning, and sustainability ambitions.

Don’t miss the chance to transform your market approach with data-driven recommendations and bespoke analysis. Arrange a strategic briefing today and secure priority access to the comprehensive automotive bumper market research report. Propel your organization ahead of rivals by leveraging the actionable expertise available through Ketan Rohom’s guidance.

- How big is the Automotive Bumper Market?

- What is the Automotive Bumper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?