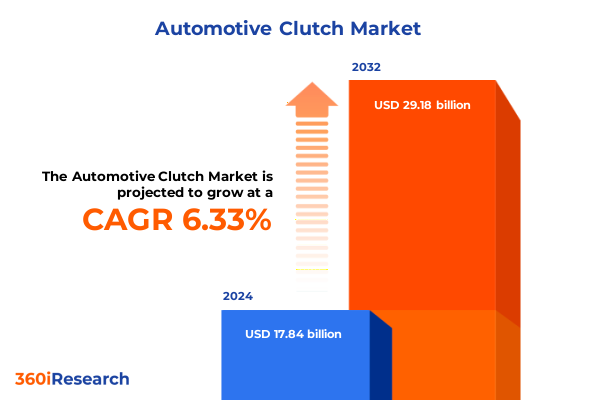

The Automotive Clutch Market size was estimated at USD 18.92 billion in 2025 and expected to reach USD 20.08 billion in 2026, at a CAGR of 6.38% to reach USD 29.18 billion by 2032.

Introduction to the Critical Role of Clutch Systems in Modern Powertrains and Their Evolution Amidst Electrification and Global Market Dynamics

The evolution of clutch systems remains a cornerstone of mechanical powertrain innovation, underpinning both established internal combustion setups and emerging hybrid configurations. By mediating torque transfer between engine and transmission, clutches enable seamless shifting, optimize fuel efficiency, and contribute to overall drivability. In recent years, the sustained relevance of manual transmissions in cost-sensitive markets coexists with growing electrification trends, positioning the clutch not only as a mechanical interface but also as an enabler of advanced hybrid and automated drive systems. The integration of dog clutches and electro-hydraulic actuation modules has demonstrated how traditional designs can adapt to contemporary mobility demands, offering automakers a blend of performance and economy.

Looking beyond component functionality, the clutch market reflects broader segmentation by propulsion architecture, material science, and digital connectivity. As OEMs strive to meet stringent global CO₂ targets, they turn to innovative clutch variants such as electromagnetic disengagement units and multi-plate friction designs optimized for blended torque delivery. These advancements coincide with consumer expectations for dynamic shift quality and predictive maintenance capabilities. Consequently, industry consortia and tier-one suppliers are forging partnerships to accelerate R&D cycles and ensure that clutch solutions remain at the forefront of next-generation powertrain platforms.

Transformative Shifts in Clutch Technology Driven by Electrification, Smart Connectivity, and Advanced Materials Reshaping the Automotive Transmission Landscape

Clutch technology is experiencing a paradigm shift as the transition to electrified drivetrains accelerates. Electromagnetic clutches, once niche in high-precision industrial settings, have been repurposed for hybrid automotive applications to achieve near-instantaneous engagement and enhanced system responsiveness. By replacing mechanical linkages with electronically controlled actuators, these units reduce wear and support regenerative braking integration, a critical factor for mild-hybrid architectures.

Simultaneously, the emergence of smart clutch systems embeds sensors and connectivity modules directly within the clutch housing. This digital infusion enables real-time monitoring of friction disc temperature, engagement cycles, and wear progression. Consequently, predictive maintenance algorithms can forecast replacement intervals, cutting downtime and bolstering fleet uptime in commercial operations. Manufacturers are also leveraging lightweight composite materials to reduce rotating mass, directly contributing to lower fuel consumption and improved acceleration profiles in both passenger and performance vehicle segments.

Moreover, cross-sector collaboration is redefining clutch testing and validation methods. Internet of Things platforms facilitate remote calibration updates and over-the-air diagnostics, allowing OEMs to fine-tune clutch engagement strategies post-launch. As automated and semi-autonomous features become more prevalent, clutch actuation must seamlessly integrate with advanced driver assistance systems, ensuring both safety and comfort. These transformative shifts collectively signal a competitive landscape where mechanical ingenuity, digitalization, and material innovation converge to shape the future of clutch technology.

Cumulative Impact of Sequential 2025 U.S. Metal and Automotive Import Tariffs on Clutch Manufacturing Costs, Supply Chains, and Industry Resilience

The United States’ 2025 tariff landscape has layered multiple levies on both raw materials and finished automotive parts, fundamentally altering clutch manufacturing economics. In February, the restoration of a 25% Section 232 steel tariff, alongside elevated aluminum duties, immediately increased input costs for clutch housings, pressure plates, and flywheel components, constraining margins for suppliers reliant on global steel and aluminum markets.

Subsequently, in March, a 25% duty on imported automobiles and key auto parts came into effect under the same Section 232 authority, extending to clutch release bearings, friction discs, and hydraulic torque converters. This directive compounded material tariffs, potentially subjecting certain parts to cumulative duties in excess of 50% unless producers could certify domestic content under USMCA provisions.

In April, executive relief measures eliminated overlapping duties on steel and auto parts for qualifying U.S. assemblers, while introducing production-based credits to offset future imports. Yet this relief did not apply to Chinese imports, which remain subject to up to 145% in tariffs. Most recently, a Department of Commerce program launched in June enables U.S. manufacturers to submit applications for auto tariff offsets tied to domestic assembly volumes, offering a pathway to mitigate some Section 232 burdens. Collectively, these sequential policy actions have driven a reevaluation of sourcing strategies, encouraged vertical integration, and underscored the need for agile supply chain management to preserve competitiveness in the clutch market.

Key Segmentation Insights Revealing How Diverse Clutch Types, Components, Materials, Vehicle Applications, and Sales Channels Define Market Dynamics

Clutch systems can be categorized by type into centrifugal, cone, diaphragm, electromagnetic, friction, hydraulic, and positive & spline variants, each offering unique engagement characteristics that address specific torque transfer requirements. Within friction clutches, single plate and multi-plate configurations cater to light-duty passenger vehicles and high-performance sports cars respectively, while hydraulic variants incorporate fluid coupling and torque converter subtypes to optimize smoothness in commercial applications.

Components within a clutch assembly span from the release bearing, friction disc, linkage, and pressure plate to release levers and specialized springs that modulate engagement force. Innovators continually refine these parts to improve heat dissipation, reduce hysteresis, and extend service life under demanding operating conditions.

Material choices for friction discs include organic composites, metallic blends, Kevlar reinforcements, and ceramic formulations. Each material category balances cost, wear resistance, and coefficient of friction to meet OEM specifications for fuel efficiency and emissions regulations.

Clutch applicability cuts across commercial vehicles, passenger cars, and two-wheelers. Heavy and light commercial trucks require high-capacity diaphragm or multi-plate solutions, while hatchbacks, sedans, and SUVs prioritize compact single-plate units. Aftermarket and OEM channels further influence distribution strategies, with OEM supply emphasizing integration into original powertrain designs and aftermarket offerings targeting retrofit and upgrade opportunities.

This comprehensive research report categorizes the Automotive Clutch market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Types

- Components

- Clutch Discs Material

- Vehicle Type

- Sales Channel

Key Regional Insights Exploring Distinct Automotive Clutch Market Drivers and Opportunities Across the Americas, EMEA, and Asia-Pacific Powertrain Ecosystems

In the Americas, a robust vehicle fleet aging profile continues to sustain aftermarket clutch demand alongside OEM programs targeting mild-hybrid integration. U.S. light vehicle sales are projected to modestly grow despite tariff-related uncertainties, with fleet electrification initiatives and start-stop system adoption driving interest in electro-mechanical clutch variants.

Europe, the Middle East & Africa present a mixed landscape. Stringent CO₂ emission targets across the European Union are accelerating the uptake of dual-clutch transmissions and 48V e-clutch systems in passenger cars, while legacy diesel platforms in the Middle East and Africa still rely on proven friction and hydraulic solutions for commercial fleets.

Asia-Pacific remains the largest manufacturing hub, fueled by emerging economies such as China and India. Local producers leverage cost efficiencies to supply both domestic OEMs and global export markets, even as policy incentives in China boost EV production and ancillary clutch technologies for hybrid platforms.

Across these regions, distinct regulatory drivers, consumer preferences, and localization strategies dictate the mix of clutch types, with each geography offering both unique challenges and opportunities for suppliers seeking to optimize market penetration.

This comprehensive research report examines key regions that drive the evolution of the Automotive Clutch market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles Highlighting Leading Automotive Clutch Suppliers Innovations, Collaborations, and Competitive Positioning in Transmission Markets

Leading global clutch suppliers are forging strategic alliances and expanding R&D capabilities to address electrification and regulatory pressures. Schaeffler has integrated power electronics into traditional clutch portfolios, exemplifying its push into hybrid and automated manual transmission domains. ZF Friedrichshafen continues to advance multi-plate friction and dual-clutch modules for high-performance applications, leveraging its expertise in lightweight design and thermal management. BorgWarner’s P2 electric drive module, featuring an integrated clutch, underscores the company’s commitment to hybrid driveline architectures that combine mechanical and electrical functions seamlessly. Valeo has focused on start-stop systems and 48V e-clutch actuation platforms, targeting fuel economy regulations in mature markets. Other notable players, including Exedy, GKN Automotive, and Aisin Seiki, are investing in novel friction materials and automated clutch actuation to maintain competitiveness in shifting powertrain ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Clutch market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Apls Automotive Industries Pvt. Ltd.

- BLM Automatic Clutch

- Centerforce Performance Clutch

- DESCH Antriebstechnik GmbH & Co. KG

- Eaton Corporation

- Exedy Corporation

- FCC CLUTCH INDIA PVT. LTD.

- Ford Motor Company

- General Motors Company

- Honda Motor Company, Ltd.

- Hyundai Motor Company

- Kia Motor Corporation

- Logan Clutch Corporation

- Mahindra & Mahindra Limited

- Mod E-Tech Engineering Pvt Ltd.

- MODIMAZ Engineers

- Nissan Motor Co., Ltd.

- NSK Ltd.

- Ogura Industrial Corp.

- Pethe Industrial Marketing Company Pvt. Ltd.

- Schaeffler Group

- The Carlyle Johnson Machine Company, LLC

- Valeo SA

- Yamaha Motor Co., Ltd.

- ZF Friedrichshafen AG

Actionable Recommendations for Industry Leaders to Navigate Technological Disruption, Supply Chain Risks, and Regulatory Shifts in Automotive Clutch Production

Manufacturers should prioritize investment in electromagnetically actuated clutch systems to align with the ongoing shift toward hybrid and fully electric powertrain solutions. This strategic focus will enhance responsiveness and reduce mechanical wear, meeting consumer expectations for seamless power delivery.

Simultaneously, leadership teams must diversify sourcing strategies to mitigate tariff-driven input cost volatility. Establishing regional manufacturing footprints and qualifying alternate steel and aluminum suppliers can minimize exposure to Section 232 duties and safeguard production continuity.

Embracing digitalization through embedded sensor networks and predictive maintenance platforms can yield significant total cost of ownership reductions. Suppliers that offer remote diagnostics and over-the-air calibration capabilities will gain a competitive edge, particularly in commercial fleet markets where uptime is critical.

Finally, collaboration across the supply chain-spanning OEMs, tier-one integrators, and material specialists-will accelerate the development of lightweight composite components and advanced friction formulations. These joint ventures will be pivotal in meeting ever-tightening CO₂ standards and enriching product portfolios with high-margin, differentiated clutch solutions.

Comprehensive Research Methodology Combining Primary Interviews, Segmentation Analysis, and Data Triangulation to Ensure Market Intelligence Accuracy

This research employs a multi-stage methodology combining primary interviews with powertrain engineers, OEM procurement leads, and tier-one supplier executives to capture forward-looking insights. Secondary data was gathered from industry publications, regulatory filings, and technical journals to validate emerging technology trends and policy shifts.

Market segmentation analysis was conducted across clutch types, components, material classes, vehicle platforms, and sales channels to ensure a granular understanding of demand drivers. Data triangulation techniques reconciled inputs from supplier financial reports, trade statistics, and expert forecasts, ensuring robustness and minimizing bias.

Qualitative assessments of company strategies and collaboration models complement quantitative evaluation of supplier capabilities. Where applicable, triangulation of material cost data, tariff schedules, and production volumes provided a comprehensive view of the evolving competitive landscape.

This methodology ensures that the findings and recommendations are grounded in empirical evidence, reflective of current market realities, and adaptable to future technological developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Clutch market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Clutch Market, by Types

- Automotive Clutch Market, by Components

- Automotive Clutch Market, by Clutch Discs Material

- Automotive Clutch Market, by Vehicle Type

- Automotive Clutch Market, by Sales Channel

- Automotive Clutch Market, by Region

- Automotive Clutch Market, by Group

- Automotive Clutch Market, by Country

- United States Automotive Clutch Market

- China Automotive Clutch Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Conclusion Summarizing Critical Automotive Clutch Market Drivers, Technological Pathways, and Strategic Imperatives for Sustained Competitive Advantage

Automotive clutch systems stand at the intersection of mechanical heritage and digital innovation, with friction, hydraulic, electromagnetic, and hybrid variants each playing critical roles across global vehicle segments. The convergence of electrification mandates, material advancements, and tariff-induced supply chain realignments underscores the need for agile strategies that address both immediate cost pressures and long-term sustainability goals.

Technology leaders must sustain momentum in developing smart clutch systems that integrate sensor feedback and over-the-air calibration, while ensuring that mechanical reliability remains uncompromised. Simultaneously, supply chain resilience will hinge on geographic diversification and close collaboration with steel and aluminum suppliers to navigate evolving Section 232 policies.

In this dynamic environment, segmentation insights-from types and components to materials and sales channel strategies-enable targeted portfolio optimization. Regional market nuances further guide localization and product customization efforts, offering pathways to secure competitive advantage.

Ultimately, the ability to harmonize innovation, regulation compliance, and operational efficiency will define success in the automotive clutch domain. Stakeholders who embrace data-driven decision-making and proactive collaboration are best positioned to capture growth opportunities in the next wave of powertrain evolution.

Explore How Ketan Rohom Can Guide Your Team to Leverage In-Depth Automotive Clutch Research Insights and Drive Strategic Decision Making in 2025

If you are ready to elevate your strategic planning with comprehensive insights tailored to the automotive clutch sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide an executive briefing, discuss bespoke research needs, and guide your team through actionable market intelligence. Connect today to secure timely access to detailed analysis that will inform your investment decisions and competitive strategy in the evolving powertrain landscape.

- How big is the Automotive Clutch Market?

- What is the Automotive Clutch Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?