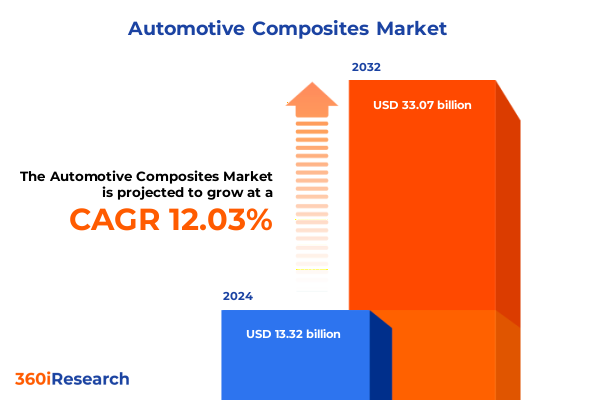

The Automotive Composites Market size was estimated at USD 14.86 billion in 2025 and expected to reach USD 16.57 billion in 2026, at a CAGR of 12.10% to reach USD 33.07 billion by 2032.

Pioneering the Automotive Composites Revolution: How Advanced Materials and Engineering Are Shaping the New Era of Lightweight Mobility

The automotive industry is undergoing a fundamental paradigm shift as manufacturers increasingly turn to composite materials to drive lightweighting, performance enhancements, and sustainability imperatives. Innovations in aramid, carbon, and glass fiber composites have introduced new design freedoms, enabling the creation of complex geometries that were previously unattainable with traditional metals. This shift is particularly pronounced in the context of electric and autonomous vehicles, where reducing structural weight translates directly into extended driving ranges and improved energy efficiency. As regulatory pressure mounts on greenhouse gas emissions, the strategic adoption of composites emerges as a key enabler for compliance as well as for driving competitive differentiation.

Automotive designers and engineers are now collaborating closely with material scientists to develop high-strength, impact-resistant components that meet rigorous crashworthiness standards while shedding unnecessary mass. This convergence of multidisciplinary expertise underscores the value proposition of composites: their high strength-to-weight ratios, fatigue resistance, and potential for integrated functionalities such as vibration damping and thermal management are unmatched by conventional alternatives. Consequently, leading automakers are forging partnerships with advanced materials providers to co-develop bespoke composite solutions that align with specific vehicle architectures and performance targets.

In parallel, manufacturing processes are evolving to support the large-scale integration of composite parts across multiple vehicle platforms. Innovations in automated fiber placement and high-speed resin transfer molding are driving down cycle times and per-unit costs, making composites more accessible beyond niche applications. These advances not only streamline production but also enhance reproducibility and quality control, paving the way for composites to transition from premium segments into mass-market adoption.

As 2025 unfolds, the accelerating momentum behind automotive composites signals that stakeholders who fail to embrace these advanced materials risk falling behind in a marketplace increasingly defined by lightweighting demands, climate commitments, and technological convergence. Strategically harnessing the full potential of composite technologies will be essential to unlocking new performance frontiers, optimizing total cost of ownership, and securing a leadership position in the next era of mobility.

Unprecedented Technological and Regulatory Shifts Are Catalyzing Transformative Change in the Automotive Composites Ecosystem Worldwide

The automotive composites landscape is experiencing a wave of transformative shifts driven by breakthroughs in material science, process engineering, and regulatory imperatives. Advanced precursor materials and novel fiber architectures are enhancing the mechanical properties of carbon and aramid composites, enabling higher stiffness and damage tolerance. Concurrently, high-performance thermoplastic resins are gaining traction, offering faster cycle times, recyclability advantages, and simplified repair processes compared to traditional thermosets. These material innovations are redefining the value chain, compelling suppliers and OEMs to adapt their R&D roadmaps and production strategies.

On the manufacturing front, digitalization and automation are converging with artificial intelligence–driven process controls to optimize fiber placement, resin infusion, and curing protocols. Predictive analytics are now being employed to forecast part performance, reduce scrap rates, and minimize energy consumption. Additive manufacturing techniques are also emerging as complementary approaches, allowing for on-demand production of complex composite prototypes and low-volume specialized parts, thus accelerating design validation cycles and reducing time to market.

Regulatory landscapes around the globe are reinforcing the momentum toward composites, with emissions reduction targets and fuel economy standards creating a strong incentive to adopt lightweight materials. Environmental mandates are also propelling the development of greener composites, characterized by bio-based resins, recyclable fiber matrices, and closed-loop manufacturing systems. This sustainability drive is becoming a competitive differentiator, as consumers and fleets prioritize eco-friendly vehicles, and OEMs integrate circular economy principles into their supply chains.

In tandem, electrification and autonomous driving advancements are imposing stringent new requirements on component integration, sensor compatibility, and thermal management. Composite materials are uniquely positioned to address these challenges through multifunctional designs that integrate structural support with cable channels, sensor housings, and thermal insulation layers. The cumulative effect of these technological, regulatory, and market forces is reshaping the competitive landscape, encouraging stakeholders to realign strategies, forge new partnerships, and scale capabilities to harness the transformative potential of automotive composites.

Assessing the Cumulative Impact of Recent United States Tariffs on Automotive Composite Materials Supply Chains, Costs and Manufacturing Dynamics in 2025

In early 2025, the United States imposed revised tariff measures on select imported composite materials in response to trade imbalances and domestic industry protection mandates. These measures affected a broad range of fibers and prepregs sourced primarily from key global suppliers, prompting immediate repercussions across automotive OEM supply chains. Amid rising raw material costs, manufacturers have been compelled to reevaluate sourcing strategies, explore alternative suppliers, and accelerate localization efforts to mitigate cost pressures and ensure uninterrupted production flows.

The heightened tariff environment has driven many automakers and tier-one suppliers to form joint ventures with domestic composite producers, thereby enhancing local capacity while sharing financial and technical risks. These alliances are not only reshaping supply networks but also fostering technology transfer and skill development within the domestic workforce. In parallel, sourcing teams are intensifying efforts to qualify lower-cost regional fiber producers in Asia-Pacific and Latin America, creating competitive bidding scenarios and diversifying risk exposure.

Despite these mitigation strategies, increased input costs have inevitably been partly passed down the value chain, impacting component manufacturers and, ultimately, vehicle assembly operations. Some stakeholders have responded by redesigning parts to minimize material usage, introducing hybrid metal-composite architectures, or leveraging computational simulations to optimize fiber orientation and resin selection for improved cost-to-performance ratios. Such design optimizations have unlocked incremental weight savings and cost efficiencies that partially offset tariff-induced price hikes.

Looking forward, the cumulative impact of the 2025 tariffs underscores the importance of agile supply chain models, robust risk management frameworks, and proactive engagement with policy makers. As the U.S. automotive sector advances toward electrification and stricter fuel economy targets, the ability to secure stable supplies of high-performance composite materials at competitive prices will be critical. Stakeholders who invest in flexible sourcing networks, local capacity expansions, and collaborative R&D initiatives will be best positioned to navigate tariff volatility and achieve resilient growth.

Illuminating Core Segmentation Insights Across Material Types, Manufacturing Processes, Applications, and End Use Categories in Automotive Composites

Segmenting the automotive composites market by material type reveals a diverse landscape where each fiber class carries unique performance and cost attributes. Aramid fiber composites are prized for their exceptional impact resistance and thermal stability, making them ideal for safety-critical applications and protective structures. Carbon fiber composites deliver unrivaled stiffness-to-weight ratios and fatigue endurance, driving their adoption in high-performance and electric vehicle platforms. Glass fiber composites offer a balance of low cost and reliable mechanical properties, sustaining their prevalence in entry-level and mid-range models. Hybrid composites blend multiple fiber types to achieve optimized mechanical and thermal behaviors, leveraging synergies to meet tailored design requirements.

When examined through the lens of manufacturing processes, distinct advantages and considerations emerge. Compression molding stands out for its suitability in high-throughput production of complex body panels and structural components, benefiting from rapid cycle times and consistent part quality. Filament winding is favored for cylindrical parts such as drive shafts and pressure vessels, offering precise fiber orientation and continuous fiber reinforcement. Hand lay-up retains its relevance for low-volume, intricate geometries, particularly during prototyping and specialty build phases, though it faces scalability limitations. Pultrusion yields constant cross-section profiles with exceptional fiber alignment, commonly used in reinforcing beams and reinforcements. Resin transfer molding enables the production of large, intricately shaped components with high fiber volume fractions and minimal scrap levels.

In terms of application, body panels account for a growing share of composite usage as OEMs strive to reduce overall vehicle mass. Chassis components benefit from composites’ high rigidity and fatigue resistance, translating into improved handling dynamics and ride comfort. Interior elements such as door modules and instrument panels are increasingly designed with composites to integrate aesthetic finishes and structural supports in a single molding operation. Structural components encompass load-bearing elements including pillars and beams, where composites enhance crash performance while minimizing weight. Under-the-hood components leverage composites’ thermal insulation and chemical resistance, contributing to engine compartment lightweighting and thermal management.

Exploring end use categories highlights the distinct drivers and adoption patterns across market segments. Commercial vehicles leverage composites to reduce curb weight, improve payload capacity, and optimize fuel efficiency, while meeting rigorous duty cycle requirements. Electric vehicles present the fastest growth trajectory for advanced composites, as weight savings directly correlate with range extension and energy efficiency. Passenger cars across various segments are adopting composites for both aesthetic and performance applications, balancing cost imperatives with consumer demand for enhanced ride quality, safety, and fuel economy. These segmentation insights collectively underscore the multifaceted nature of the automotive composites market and the importance of aligning material and process selections with specific application and end use needs.

This comprehensive research report categorizes the Automotive Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Manufacturing Process

- Application

- End Use

Exploring Critical Regional Dynamics and Opportunities in the Americas, Europe Middle East Africa, and Asia Pacific for Automotive Composite Markets

Across the Americas, North America remains a pivotal hub for automotive composites innovation, fueled by deep ties between leading OEMs and advanced materials suppliers. Clusters in the United States are driving breakthroughs in carbon fiber precursors and thermoplastic resin chemistries, while Mexico’s assembly plants are integrating cost-efficient glass fiber composites into high-volume production lines. Latin American markets are also gaining momentum, as local manufacturers seek to upgrade passenger and commercial vehicle fleets with lightweight components that enhance fuel efficiency and reduce emissions.

In Europe, stringent regulatory frameworks targeting carbon footprints and end-of-life recyclability have propelled widespread adoption of composites in vehicle platforms. Germany and Italy continue to lead in advanced process technologies such as automated fiber placement and high-pressure resin transfer molding, supported by robust research consortia and government funding. In the Middle East, emerging infrastructure investments and growing aspirations for electric and hybrid mobility are attracting pilot projects focused on composite body structures and energy-absorbing crash elements. These regional dynamics underscore the importance of regulatory alignment and collaborative innovation in driving composites adoption.

Asia-Pacific stands at the forefront of large-scale composites production, with China rapidly expanding domestic fiber and prepreg capacities to support both local and export demand. Japan’s composites industry continues to push the boundaries of high-modulus carbon and specialized thermoset chemistries, while South Korea is integrating composites into next-generation electric vehicles through partnerships between global OEMs and local suppliers. In India, an accelerating shift toward emission norms and safety standards is catalyzing investments in composites manufacturing, particularly for commercial vehicle applications where weight reductions yield significant operating cost benefits.

These regional insights highlight distinct growth trajectories, regulatory environments, and innovation ecosystems across the globe. Understanding the nuanced drivers in each geography is essential for stakeholders seeking to optimize market entry strategies, align product development roadmaps, and forge strategic alliances that leverage regional strengths and mitigate local challenges.

This comprehensive research report examines key regions that drive the evolution of the Automotive Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Profiles, Collaborations, and Competitive Dynamics Among Leading Players Innovating in the Automotive Composites Industry Landscape

Key industry participants are intensifying their efforts to secure leadership positions through strategic investments in capacity expansions, technological collaborations, and vertical integrations. Large multinational composites manufacturers are forming joint ventures with automotive OEMs to co-develop application-specific solutions, thereby aligning material innovations directly with vehicle design roadmaps. Such partnerships enable the rapid scaling of novel composites into high-volume production environments and facilitate shared risk management across the value chain.

Specialized fiber producers are also investing heavily in next-generation precursor materials to improve the cost-efficiency of carbon fiber manufacturing. By refining polymer chemistry and enhancing fiber spinning technologies, these companies aim to reduce energy consumption during the carbonization process while increasing fiber yield per ton of precursor. This focus on sustainable supply chains is further amplified by collaborations with recycling firms to close the loop on composite waste, converting scrap into reclaimed fibers for secondary applications.

On the process equipment side, leading suppliers of automated fiber placement systems and high-pressure resin transfer molding platforms are expanding their footprints to service emerging composite hubs in Asia-Pacific and the Americas. Advanced robotics, coupled with artificial intelligence–driven quality control systems, are being deployed to ensure precise fiber lay-up and optimal resin infusion, reducing cycle times and scrap rates. This automation trend is empowering composites manufacturers to meet the dual demands of high throughput and stringent quality requirements.

Tier-one automotive suppliers are likewise forging alliances with material innovators to integrate composite solutions into complete vehicular subsystems, ranging from structural crash boxes to fully composite-enclosed battery packs. By taking ownership of the material design, part manufacturing, and subassembly integration, these suppliers are positioning themselves as single-source providers, streamlining complex supply chains and offering OEMs turnkey solutions that accelerate time to market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGY Holding Company

- BAM Composites

- CIE India Limited

- Cytec Solvay Group

- DowAksa Composites

- Formaplex Corporate LLC

- Gurit Holding AG

- Hexcel Corporation

- IDI Composites International, Inc.

- Johns Manville Corporation

- Jushi Group Co., Ltd.

- Kautex Textron GmbH & Co. KG

- Mitsubishi Chemical Holdings Corporation

- Muhr und Bender KG

- Owens Corning Corporation

- Plasan Carbon Composites Ltd.

- Revchem Composites

- Röchling SE & Co. KG

- SGL Carbon SE

- Solvay S.A.

- Teijin Limited

- Ten Cate N.V.

- Toho Tenax Co., Ltd.

- Toray Industries, Inc.

- UFP Technologies, Inc.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Address Challenges in Automotive Composites

To capitalize on emerging growth prospects and navigate evolving market complexities, industry leaders should pursue a dual strategy of innovation and supply chain resilience. Investing in domestic and regional composites manufacturing capacity will mitigate exposure to import tariffs and logistical disruptions, while fostering closer collaboration with OEM engineering teams. Such local footprint expansions should be accompanied by shared R&D programs that align material development with vehicle platform requirements, ensuring seamless integration and rapid validation.

Advancing hybrid composite formulations and multifunctional component designs can unlock additional performance gains and cost efficiencies. By leveraging computational simulation tools, engineering teams can optimize fiber architectures and resin systems for targeted applications, reducing material consumption without compromising structural integrity. Concurrently, partnerships with technology providers specializing in automated fiber placement and resin infusion robotics will drive production scalability and quality consistency, key factors in mass-market penetration.

Sustainability must be embedded across the value chain through closed-loop recycling initiatives, bio-based resin adoption, and energy-efficient manufacturing processes. Companies should engage with policy makers to shape favorable regulations for composite waste management, while collaborating with recycling innovators to commercialize reclaimed fiber applications. These efforts will not only align with corporate environmental goals but also respond to growing consumer and regulatory demands for circular economy solutions.

Finally, building robust talent pipelines and upskilling existing workforces in digital manufacturing and advanced materials engineering is critical. Cross-functional training programs, in partnership with academic institutions and vocational centers, will ensure that the industry has the necessary expertise to deploy and sustain next-generation composite technologies. By prioritizing innovation, sustainability, and workforce development in equal measure, automotive composites stakeholders can secure long-term competitive advantages and drive value across the mobility ecosystem.

Rigorous Research Methodology Combining Primary Interviews and Secondary Data Analysis to Deliver Comprehensive Automotive Composites Market Insights

This study is grounded in a rigorous multi-stage research methodology that integrates primary and secondary data sources to deliver robust, actionable insights. Primary research was conducted through structured interviews and in-depth discussions with senior executives, material scientists, and engineering leads at automotive OEMs, tier-one suppliers, and specialized composite manufacturers. These engagements provided firsthand perspectives on innovation roadmaps, technology adoption hurdles, and strategic priorities across diverse global regions.

Secondary research encompassed a comprehensive review of industry publications, technical white papers, patents, and regulatory filings. Leading journals in materials science, transportation engineering, and polymer chemistry were analyzed to track emerging resin formulations, fiber precursor advancements, and manufacturing process optimizations. Trade associations, government reports, and sustainability disclosures were also examined to map the evolving policy landscapes and environmental directives influencing composites adoption.

Quantitative data was triangulated through input-output analyses, supplier shipment data, and vehicle production statistics to validate trends and corroborate qualitative insights. Advanced data modeling techniques were employed to assess cross-segment interactions, such as the interplay between material types and manufacturing processes, ensuring a holistic understanding of market dynamics. The research approach emphasized transparency and verification, with every data point traced back to primary interview transcripts or reputable secondary sources.

To ensure methodological rigor and minimize bias, this report underwent multiple rounds of peer review by industry experts in materials engineering and automotive manufacturing. Feedback loops were established to refine assumptions, validate emerging findings, and ensure that the final analysis accurately reflects the current state of the automotive composites ecosystem. This systematic, layered approach underpins the credibility and relevance of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Composites Market, by Material Type

- Automotive Composites Market, by Manufacturing Process

- Automotive Composites Market, by Application

- Automotive Composites Market, by End Use

- Automotive Composites Market, by Region

- Automotive Composites Market, by Group

- Automotive Composites Market, by Country

- United States Automotive Composites Market

- China Automotive Composites Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Insights to Empower Strategic Decision Making in Automotive Composites as Global Mobility Transitions Accelerate

The synthesis of this analysis underscores the transformative potential of advanced composites in driving the next wave of automotive innovation. By leveraging high-performance materials, automakers can achieve significant weight reductions that directly enhance energy efficiency, safety performance, and overall vehicle dynamics. The confluence of materials advancements, manufacturing breakthroughs, and supportive regulatory frameworks is creating a fertile environment for the widespread adoption of composite solutions across a spectrum of vehicle architectures.

Strategic alignment between material suppliers, process equipment providers, and OEMs has emerged as a critical success factor. Collaborative models that integrate R&D efforts and production capabilities enable rapid scaling of novel composites into production programs. At the same time, agile supply chain structures and on-shoring initiatives are essential to mitigate external shocks, such as tariff fluctuations and logistics bottlenecks, while preserving cost competitiveness.

Regional dynamics remain highly differentiated, with each geography presenting unique drivers and challenges. Stakeholders must tailor market entry and expansion strategies to align with local regulatory regimes, consumer preferences, and infrastructure readiness. Investing in regional innovation hubs and fostering government partnerships will be key to unlocking new growth corridors and ensuring that composite technologies remain at the forefront of mobility advancements.

Ultimately, the stakeholders who embrace a holistic approach-balancing material innovation, process optimization, sustainability imperatives, and workforce capabilities-will secure a competitive edge. As the mobility landscape continues to evolve, the strategic deployment of composites will not only redefine vehicle performance but also catalyze broader shifts toward cleaner, smarter, and more personalized transportation solutions.

Unlock Comprehensive Automotive Composites Market Intelligence by Engaging Directly with Ketan Rohom to Secure Your Informed Competitive Advantage Today

If you are poised to navigate the rapidly evolving landscape of automotive composites with precision and foresight, secure direct access to this comprehensive market report today. Engage with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore tailored purchasing options, request a personalized briefing, or learn how this in-depth analysis can empower your strategic initiatives. Unlock the critical insights you need to outperform competitors and capitalize on emerging opportunities by connecting with our sales leadership and taking the first step toward a future of informed, data-driven decision making in automotive materials innovations

- How big is the Automotive Composites Market?

- What is the Automotive Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?