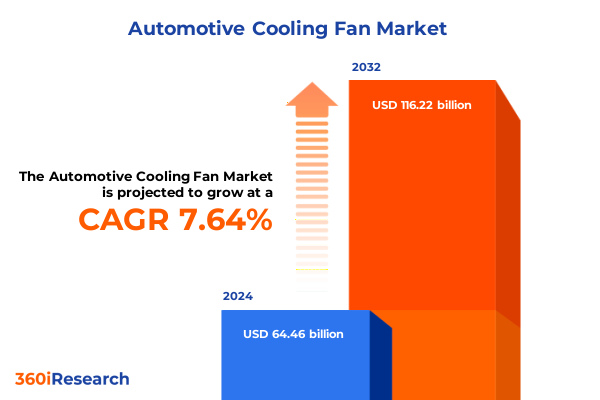

The Automotive Cooling Fan Market size was estimated at USD 69.19 billion in 2025 and expected to reach USD 74.28 billion in 2026, at a CAGR of 7.68% to reach USD 116.22 billion by 2032.

Discover the foundational context and significance of automotive cooling fan technologies shaping performance, efficiency, and reliability across emerging vehicle platforms

The automotive cooling fan market sits at the crossroads of performance, safety, and environmental stewardship, serving as a critical enabler for thermal management in internal combustion, hybrid, and electric vehicles alike. Understanding the intricate dynamics of airflow, thermal dissipation, and system integration is paramount for OEMs, Tier-1 suppliers, and component manufacturers seeking to elevate powertrain efficiency and occupant comfort. Against a backdrop of evolving propulsion architectures, regulatory mandates on fuel economy, and escalating consumer expectations for reliability, this introduction lays the groundwork for a nuanced exploration of industry developments.

The transformative potential of cooling fan innovations extends beyond conventional engine applications to encompass battery packs and HVAC units in electrified platforms. As automakers pursue weight reduction, noise abatement, and cost optimization, design imperatives around blade geometry, motor actuation, and control electronics have converged to redefine best practices. This section frames the critical context, spotlighting the convergence of materials science, system architecture, and regulatory pressures that collectively shape the competitive landscape of cooling fan technologies.

Examine pivotal transformative shifts redefining design, materials, and integration of automotive cooling fans within evolving propulsion and environmental standards

The past several years have witnessed a paradigm shift in how automotive cooling fans are conceptualized and integrated, driven by breakthroughs in electric motor design and adaptive thermal management algorithms. Traditional mechanical fan assemblies are giving way to high-efficiency electric alternatives that deliver precise airflow control, reduced parasitic drag, and seamless integration with vehicle electronics. These technological advances have been propelled by investments in brushless DC motors, sensor fusion, and advanced control software, enabling fans to operate across multiple speed profiles and thermal scenarios with minimal energy expenditure.

Concurrently, materials innovation has introduced composite and plastic blade constructions that balance structural rigidity with weight savings, while novel coatings and surface treatments enhance airflow dynamics and corrosion resistance. The proliferation of electrified powertrains has further underscored the importance of battery cooling fans, catalyzing the adoption of axial and centrifugal flow configurations tailored to pouch, prismatic, and cylindrical cell arrays. Together, these transformative shifts herald a new era of modular, scalable thermal solutions that align with the stringent environmental and performance benchmarks of modern vehicles.

Analyze the cumulative impact of recent United States tariff implementations in 2025 on global supply chains, component sourcing, and cost structures for cooling fans

In 2025, the United States implemented targeted tariffs on key electronic components and raw materials integral to cooling fan assemblies, including precision motors, aluminum alloys, and specialized plastics. These measures, aimed at balancing trade deficits and protecting domestic manufacturing, have reverberated across global supply chains, prompting suppliers to reevaluate sourcing strategies and negotiate new partnerships. The introduction of a 15 percent duty on imported motor cores and a 10 percent surcharge on aluminum extrusions has compressed margins for manufacturers reliant on offshore production hubs.

As a result, tier-1 suppliers have accelerated efforts to localize component fabrication, forging alliances with domestic foundries and motor winding facilities. While this transition mitigates long-term geopolitical risk, it introduces near-term challenges in capacity ramp-up, quality assurance, and cost competitiveness. Furthermore, the increased logistical complexity has necessitated advanced inventory planning and dynamic procurement models, ensuring that thermal management subassemblies maintain availability without incurring debilitating lead-time penalties. Ultimately, the cumulative impact of these tariffs underscores the strategic imperative for supply chain resilience and agile sourcing in the automotive cooling fan sector.

Unveil critical segmentation insights that elucidate market nuances across cooling system types, flow configurations, material compositions, vehicle classes, and applications

A nuanced understanding of the automotive cooling fan market emerges by examining its key segmentation dimensions across system type, flow architecture, material composition, vehicle application, and end-use scenarios. Based on cooling system type, the industry bifurcates into electric fans-driven by brushless DC or AC motors with sophisticated variable-speed controls-and legacy mechanical fans that rely on belt-driven couplings to the engine. This distinction carries significant implications for energy efficiency and integration complexity, particularly in hybrid and battery electric vehicles.

Turning to fan flow type, axial flow configurations provide streamlined airflow through condenser and radiator arrays, whereas centrifugal flow designs generate higher static pressure suited to confined packaging spaces within battery modules. Blade material selection further refines performance attributes: aluminum blades deliver high thermal conductivity and stiffness, composite variants optimize vibration dampening, and plastic designs offer cost advantage and corrosion immunity. Considering vehicle type segmentation, commercial vehicle cooling demands prioritize robust duty cycles and thermal stability under heavy loads, whereas passenger vehicle systems emphasize noise reduction and seamless cabin comfort.

Based on application, engine cooling fans continue to dominate traditional internal combustion platforms, but battery cooling fans have surged in relevance for thermal management of electric powertrains, while HVAC fans ensure passenger cabin climate control across all vehicle segments. Each of these intersecting dimensions paints a comprehensive picture of market drivers, technological trade-offs, and strategic investment priorities that decision-makers must navigate to align product roadmaps with end-user requirements.

This comprehensive research report categorizes the Automotive Cooling Fan market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cooling System Type

- Fan Flow Type

- Blade Material

- Vehicle Type

- Application

Explore regionally differentiated trends and drivers influencing demand for cooling fans across the Americas, EMEA, and Asia-Pacific within varied automotive landscapes

Regional landscapes exert distinct influences on cooling fan design, regulation, and supply chain architecture, shaping where innovation and production capacity concentrate. In the Americas, stringent environmental regulations and a strong push toward vehicle electrification have heightened demand for high-efficiency electric fans and advanced materials. OEMs in North America are championing modular thermal management platforms that can seamlessly adapt to both battery and engine cooling roles, fostering closer integration among powertrain, chassis, and body electronics teams.

Across Europe, Middle East & Africa, evolving emissions standards and a fast-track electrification roadmap have spurred investments in sophisticated control algorithms and lightweight composite structures. European suppliers leverage deep expertise in precision engineering and materials science to deliver fans that meet exacting noise, vibration, and harshness targets, while regional clusters in Germany and France serve as hubs for R&D collaboration. In the Asia-Pacific, varied market maturities-from highly developed markets in Japan and South Korea to burgeoning automotive hubs in Southeast Asia-drive a dual focus on scalable production and cost efficiency. Here, manufacturers balance high-volume output with rapid adoption of battery cooling solutions, benefiting from proximity to electric vehicle component ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Automotive Cooling Fan market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlight key competitive intelligence and strategic positioning of leading and emerging companies shaping the future trajectory of automotive cooling fan innovations

The competitive environment in automotive cooling fans features a blend of established powertrain suppliers, specialized motor manufacturers, and nimble start-ups introducing disruptive technologies. Legacy players with diversified portfolios, including engine thermal modules and HVAC units, leverage their scale to invest in next-generation electric fan systems and digital control solutions. Meanwhile, motor specialists that historically served industrial applications have redirected their expertise toward automotive brushless DC fans, offering compact, high-torque units optimized for hybrid and electric drivetrains.

Strategic partnerships and joint ventures have emerged as a common approach to accelerate development cycles and broaden technology portfolios. Component manufacturers are aligning with software firms to integrate predictive maintenance algorithms and IoT connectivity, enabling real-time monitoring of fan health and performance. At the same time, new entrants focusing on additive manufacturing and advanced composite blades are carving out niche opportunities by addressing weight reduction and rapid prototyping needs. Together, these varied competitive forces drive continuous innovation, compelling industry leaders to balance core competencies in thermal dynamics, electric motor engineering, and system integration to sustain market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Cooling Fan market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Behr Hella Service GmbH

- BorgWarner Inc.

- Delta Electronics, Inc.

- DENSO Corporation

- Flexxaire Inc.

- Glasgow Radiator Co., Inc.

- Hanon Systems Canada Inc.

- Horton Holding Inc.

- KL Cooling Systems LLC

- Lee Coolants & Systems LLC

- MAHLE GmbH

- Meiban Engineering Ltd.

- Mitsubishi Electric Corporation

- Modine Manufacturing Company

- Nidec Corporation

- Nissens A/S

- Panasonic Holdings Corporation

- Sanden Corporation

- SPAL S.p.A.

- Thermo King Corporation

- USUI Co., Ltd.

- Valeo SA

- Valeo Thermal Systems UK Limited

- ZF Friedrichshafen AG

Provide actionable recommendations empowering industry leaders to optimize design, supply chain resilience, regulatory compliance, and strategic partnerships in cooling fan development

Industry stakeholders should prioritize the development of modular fan platforms capable of supporting both engine and battery cooling roles to maximize return on investment across diverse powertrain architectures. By standardizing interface protocols and adopting scalable motor control software, suppliers can reduce engineering redundancy while accelerating time to market. Simultaneously, integrating predictive analytics and remote diagnostics into fan assemblies will differentiate offerings by minimizing unplanned downtime and enabling proactive maintenance scheduling.

To fortify supply chain resilience against geopolitical disruptions and tariffs, executives are advised to cultivate a dual-sourcing strategy for critical components such as motor windings and alloy materials. Establishing strategic partnerships with regional foundries and motor producers will ensure capacity flexibility, while leveraging digital procurement tools can optimize inventory levels and mitigate cost volatility. Furthermore, aligning product roadmaps with emerging regulatory frameworks-particularly those governing noise emissions and energy efficiency-will position organizations to capture first-mover advantages and secure long-term OEM contracts.

Detail the rigorous research methodology employed to ensure comprehensive and unbiased analysis of market dynamics, data validation, and expert insights

This analysis draws upon a multi-tiered research framework combining primary interviews with senior engineering and procurement executives from major OEMs and tier-1 suppliers, alongside secondary data gleaned from trade journals, technical white papers, and regulatory filings. Data triangulation was achieved by cross-referencing insights from material science publications, patent databases, and conference proceedings specializing in thermal management and electric motor technologies.

An expert panel comprising thermal engineers, automotive systems architects, and supply chain strategists validated key findings and provided scenario-based foresight on tariff impacts and material innovations. Quantitative data points were refined through iterative consultations, ensuring both methodological rigor and practical relevance. Supplementing these efforts, advanced analytics tools were employed to map supply chain networks and model regional production capacities. This robust approach underpins the unbiased intelligence and strategic foresight presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Cooling Fan market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Cooling Fan Market, by Cooling System Type

- Automotive Cooling Fan Market, by Fan Flow Type

- Automotive Cooling Fan Market, by Blade Material

- Automotive Cooling Fan Market, by Vehicle Type

- Automotive Cooling Fan Market, by Application

- Automotive Cooling Fan Market, by Region

- Automotive Cooling Fan Market, by Group

- Automotive Cooling Fan Market, by Country

- United States Automotive Cooling Fan Market

- China Automotive Cooling Fan Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Conclude with an integrated synthesis of critical market trends, strategic implications, and foundational takeaways for stakeholders in automotive cooling solutions

The automotive cooling fan market is being reshaped by the confluence of electrification, materials innovation, and evolving trade policies. Electric fan technologies are steadily usurping mechanical systems, owing to their superior energy efficiency and adaptability across multiple cooling domains. At the same time, emerging blade materials and additive manufacturing techniques are redefining performance benchmarks related to weight, noise, and thermal conductivity.

Trade policy developments, notably the 2025 U.S. tariffs on key components, have spotlighted the imperative for localized production and supply chain diversification. Strategic recommendations converge on the need for modular architectures, digital integration, and resilient sourcing strategies. Collectively, these insights chart a clear course for stakeholders aiming to harness technological advances, mitigate external risks, and capture long-term value in an increasingly competitive thermal management landscape.

Initiate collaboration with Ketan Rohom to unlock tailored market intelligence and drive strategic investments in automotive cooling fan technologies

Engaging with a seasoned expert can accelerate strategic initiatives and provide unparalleled insights into the automotive cooling fan ecosystem. To acquire comprehensive analyses, patented research methodologies, and tailor-made recommendations, reach out to Ketan Rohom, Associate Director, Sales & Marketing, who stands ready to guide procurement teams, product strategists, and engineering leadership through the complexities of market decision-making.

By establishing a direct line of communication, stakeholders can secure access to detailed data appendices, executive-level briefings, and ongoing advisory support to ensure that critical investments in cooling fan technologies drive sustainable competitive advantage. Connect with Ketan Rohom to arrange consultations, custom research add-ons, and secure early access to forthcoming intelligence releases.

- How big is the Automotive Cooling Fan Market?

- What is the Automotive Cooling Fan Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?